Digital Remittance Market Size, Share, and Trends Analysis Report

CAGR :

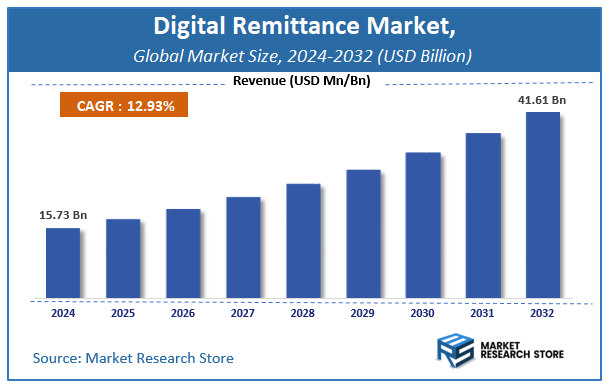

| Market Size 2024 (Base Year) | USD 15.73 Billion |

| Market Size 2032 (Forecast Year) | USD 41.61 Billion |

| CAGR | 12.93% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global digital remittance market, estimating its value at USD 15.73 Billion in 2024, with projections indicating it will reach USD 41.61 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 12.93% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the digital remittance industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Digital Remittance Market: Overview

The growth of the digital remittance market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The digital remittance market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the digital remittance market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Channel, End Use, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global digital remittance market is estimated to grow annually at a CAGR of around 12.93% over the forecast period (2025-2032).

- In terms of revenue, the global digital remittance market size was valued at around USD 15.73 Billion in 2024 and is projected to reach USD 41.61 Billion by 2032.

- The market is projected to grow at a significant rate due to Increasing cross-border transactions, growing adoption of mobile payment solutions, and rising demand for low-cost remittance services are boosting the Digital Remittance market.

- Based on the Type, the Inward Digital Remittanc segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Channel, the Bank segment is anticipated to command the largest market share.

- In terms of End Use, the Migrant Labor Workforc segment is projected to lead the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Digital Remittance Market: Report Scope

This report thoroughly analyzes the digital remittance market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Remittance Market |

| Market Size in 2024 | USD 15.73 Billion |

| Market Forecast in 2032 | USD 41.61 Billion |

| Growth Rate | CAGR of 12.93% |

| Number of Pages | 223 |

| Key Companies Covered | Azimo Limited, Digital Wallet Corporation, InstaReM Pvt. Ltd., MoneyGram, PayPal Holdings Inc, Ria Financial Services Ltd., TransferGo Ltd., TransferWise Ltd., Western Union Holdings Inc, WorldRemit Ltd. |

| Segments Covered | By Type, By Channel, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Remittance Market: Dynamics

Key Growth Drivers :

The digital remittance market is experiencing robust growth driven by the widespread adoption of smartphones and the increasing penetration of the internet, especially in developing nations. This technological shift has empowered a vast, previously unbanked or underbanked population to access financial services through mobile apps and online platforms. The convenience, speed, and cost-effectiveness of digital services compared to traditional, brick-and-mortar money transfer operators are major attractions for migrant workers who need to send money home frequently. Furthermore, globalization and increased international migration are creating a larger pool of potential users. The trend of governments promoting cashless economies and providing regulatory support for digital payments is also a significant catalyst for market expansion.

Restraints :

Despite the market's potential, it faces several significant restraints. A primary challenge is the complex and varied regulatory landscape across different countries. Digital remittance providers must navigate a labyrinth of regulations, including stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which can be costly and time-consuming to implement. Cybersecurity risks and data privacy concerns also remain a major barrier, as consumers are often hesitant to trust platforms with their sensitive financial information. A lack of digital and financial literacy, particularly in rural or less developed regions, can also hinder adoption. Finally, the persistent preference for cash payouts in many recipient countries presents a last-mile problem that digital services must address.

Opportunities :

The digital remittance market is ripe with opportunities for innovation and growth. The ongoing development of new technologies, such as blockchain and cryptocurrencies, offers the potential for faster, more secure, and cheaper cross-border transactions. The rise of business-to-business (B2B) remittances is a significant emerging opportunity, as small and medium-sized enterprises (SMEs) are increasingly using digital platforms to manage international payments. Furthermore, the expansion of services beyond simple money transfers to include features like bill payments, mobile top-ups, and savings accounts can deepen customer engagement and create new revenue streams. Collaborations between traditional financial institutions and agile fintech companies can also leverage the strengths of both to create more comprehensive and seamless services.

Challenges :

The market is confronted by a number of operational and systemic challenges. The intense competition from both traditional banks and a growing number of fintech startups is putting pressure on profit margins and forcing companies to continually innovate. Addressing the "digital divide" is a key challenge, as many potential users in rural or remote areas still lack reliable internet access or the necessary digital skills. Fraudulent activities and scams, which are often difficult to prevent, can erode consumer trust and harm brand reputation. Finally, ensuring interoperability between different payment systems, mobile wallets, and banking networks remains a technical and logistical challenge that is crucial for creating a truly seamless global remittance ecosystem.

Digital Remittance Market: Segmentation Insights

The global digital remittance market is segmented based on Type, Channel, End Use, and Region. All the segments of the digital remittance market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global digital remittance market is divided into Inward Digital Remittanc, Outward Digital Remittance.

On the basis of Channel, the global digital remittance market is bifurcated into Bank, Money Transfer Operator, Online Platform, Other.

In terms of End Use, the global digital remittance market is categorized into Migrant Labor Workforc, Persona, Small Businesse, Others.

Digital Remittance Market: Regional Insights

The Asia-Pacific region is the dominant and fastest-growing market for digital remittances, accounting for the largest transaction volume globally. This dominance is primarily driven by massive, high-frequency migration corridors, such as those between the US and the Philippines, and the Gulf Cooperation Council (GCC) countries and India, Bangladesh, and Pakistan. The region's leadership is fueled by high smartphone penetration, supportive government regulations promoting fintech, and a large unbanked population leapfrogging directly to digital solutions.

While corridors like US-Mexico are significant, the sheer volume, competitive pricing, and rapid adoption of mobile wallets in countries like India and the Philippines solidify Asia-Pacific's position as the central hub of the digital remittance industry.

Digital Remittance Market: Competitive Landscape

The digital remittance market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Digital Remittance Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings Inc

- Ria Financial Services Ltd.

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings Inc

- WorldRemit Ltd.

The Global Digital Remittance Market is Segmented as Follows:

By Type

- Inward Digital Remittanc

- Outward Digital Remittance

By Channel

- Bank

- Money Transfer Operator

- Online Platform

- Other

By End Use

- Migrant Labor Workforc

- Persona

- Small Businesse

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Digital Remittance Market Share by Type (2020-2026) 1.5.2 Inward Digital Remittance 1.5.3 Outward Digital Remittance 1.6 Market by Application 1.6.1 Global Digital Remittance Market Share by Application (2020-2026) 1.6.2 Business 1.6.3 Personal 1.7 Digital Remittance Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Digital Remittance Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Digital Remittance Market 3.1 Value Chain Status 3.2 Digital Remittance Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Digital Remittance 3.2.3 Labor Cost of Digital Remittance 3.2.3.1 Labor Cost of Digital Remittance Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 TNG Limited 4.1.1 TNG Limited Basic Information 4.1.2 Digital Remittance Product Profiles, Application and Specification 4.1.3 TNG Limited Digital Remittance Market Performance (2015-2020) 4.1.4 TNG Limited Business Overview 4.2 Toastme Pte Limited 4.2.1 Toastme Pte Limited Basic Information 4.2.2 Digital Remittance Product Profiles, Application and Specification 4.2.3 Toastme Pte Limited Digital Remittance Market Performance (2015-2020) 4.2.4 Toastme Pte Limited Business Overview 4.3 TransferWise Ltd. 4.3.1 TransferWise Ltd. Basic Information 4.3.2 Digital Remittance Product Profiles, Application and Specification 4.3.3 TransferWise Ltd. Digital Remittance Market Performance (2015-2020) 4.3.4 TransferWise Ltd. Business Overview 4.4 Azimo Limited 4.4.1 Azimo Limited Basic Information 4.4.2 Digital Remittance Product Profiles, Application and Specification 4.4.3 Azimo Limited Digital Remittance Market Performance (2015-2020) 4.4.4 Azimo Limited Business Overview 4.5 WorldRemit Ltd. 4.5.1 WorldRemit Ltd. Basic Information 4.5.2 Digital Remittance Product Profiles, Application and Specification 4.5.3 WorldRemit Ltd. Digital Remittance Market Performance (2015-2020) 4.5.4 WorldRemit Ltd. Business Overview 4.6 The Western Union Company 4.6.1 The Western Union Company Basic Information 4.6.2 Digital Remittance Product Profiles, Application and Specification 4.6.3 The Western Union Company Digital Remittance Market Performance (2015-2020) 4.6.4 The Western Union Company Business Overview 4.7 OrbitRemit Global Money Transfer Limited 4.7.1 OrbitRemit Global Money Transfer Limited Basic Information 4.7.2 Digital Remittance Product Profiles, Application and Specification 4.7.3 OrbitRemit Global Money Transfer Limited Digital Remittance Market Performance (2015-2020) 4.7.4 OrbitRemit Global Money Transfer Limited Business Overview 4.8 InstaReM PTE limited 4.8.1 InstaReM PTE limited Basic Information 4.8.2 Digital Remittance Product Profiles, Application and Specification 4.8.3 InstaReM PTE limited Digital Remittance Market Performance (2015-2020) 4.8.4 InstaReM PTE limited Business Overview 4.9 Ria Financial Services Ltd. 4.9.1 Ria Financial Services Ltd. Basic Information 4.9.2 Digital Remittance Product Profiles, Application and Specification 4.9.3 Ria Financial Services Ltd. Digital Remittance Market Performance (2015-2020) 4.9.4 Ria Financial Services Ltd. Business Overview 4.10 TransferGo Ltd. 4.10.1 TransferGo Ltd. Basic Information 4.10.2 Digital Remittance Product Profiles, Application and Specification 4.10.3 TransferGo Ltd. Digital Remittance Market Performance (2015-2020) 4.10.4 TransferGo Ltd. Business Overview 4.11 PayPal Holdings, Inc. 4.11.1 PayPal Holdings, Inc. Basic Information 4.11.2 Digital Remittance Product Profiles, Application and Specification 4.11.3 PayPal Holdings, Inc. Digital Remittance Market Performance (2015-2020) 4.11.4 PayPal Holdings, Inc. Business Overview 4.12 Remitly, Inc. 4.12.1 Remitly, Inc. Basic Information 4.12.2 Digital Remittance Product Profiles, Application and Specification 4.12.3 Remitly, Inc. Digital Remittance Market Performance (2015-2020) 4.12.4 Remitly, Inc. Business Overview 4.13 Digital Wallet Corporation 4.13.1 Digital Wallet Corporation Basic Information 4.13.2 Digital Remittance Product Profiles, Application and Specification 4.13.3 Digital Wallet Corporation Digital Remittance Market Performance (2015-2020) 4.13.4 Digital Wallet Corporation Business Overview 4.14 coins.ph Pte. Ltd. 4.14.1 coins.ph Pte. Ltd. Basic Information 4.14.2 Digital Remittance Product Profiles, Application and Specification 4.14.3 coins.ph Pte. Ltd. Digital Remittance Market Performance (2015-2020) 4.14.4 coins.ph Pte. Ltd. Business Overview 4.15 MoneyGram International, Inc. 4.15.1 MoneyGram International, Inc. Basic Information 4.15.2 Digital Remittance Product Profiles, Application and Specification 4.15.3 MoneyGram International, Inc. Digital Remittance Market Performance (2015-2020) 4.15.4 MoneyGram International, Inc. Business Overview 5 Global Digital Remittance Market Analysis by Regions 5.1 Global Digital Remittance Sales, Revenue and Market Share by Regions 5.1.1 Global Digital Remittance Sales by Regions (2015-2020) 5.1.2 Global Digital Remittance Revenue by Regions (2015-2020) 5.2 North America Digital Remittance Sales and Growth Rate (2015-2020) 5.3 Europe Digital Remittance Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Digital Remittance Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Digital Remittance Sales and Growth Rate (2015-2020) 5.6 South America Digital Remittance Sales and Growth Rate (2015-2020) 6 North America Digital Remittance Market Analysis by Countries 6.1 North America Digital Remittance Sales, Revenue and Market Share by Countries 6.1.1 North America Digital Remittance Sales by Countries (2015-2020) 6.1.2 North America Digital Remittance Revenue by Countries (2015-2020) 6.1.3 North America Digital Remittance Market Under COVID-19 6.2 United States Digital Remittance Sales and Growth Rate (2015-2020) 6.2.1 United States Digital Remittance Market Under COVID-19 6.3 Canada Digital Remittance Sales and Growth Rate (2015-2020) 6.4 Mexico Digital Remittance Sales and Growth Rate (2015-2020) 7 Europe Digital Remittance Market Analysis by Countries 7.1 Europe Digital Remittance Sales, Revenue and Market Share by Countries 7.1.1 Europe Digital Remittance Sales by Countries (2015-2020) 7.1.2 Europe Digital Remittance Revenue by Countries (2015-2020) 7.1.3 Europe Digital Remittance Market Under COVID-19 7.2 Germany Digital Remittance Sales and Growth Rate (2015-2020) 7.2.1 Germany Digital Remittance Market Under COVID-19 7.3 UK Digital Remittance Sales and Growth Rate (2015-2020) 7.3.1 UK Digital Remittance Market Under COVID-19 7.4 France Digital Remittance Sales and Growth Rate (2015-2020) 7.4.1 France Digital Remittance Market Under COVID-19 7.5 Italy Digital Remittance Sales and Growth Rate (2015-2020) 7.5.1 Italy Digital Remittance Market Under COVID-19 7.6 Spain Digital Remittance Sales and Growth Rate (2015-2020) 7.6.1 Spain Digital Remittance Market Under COVID-19 7.7 Russia Digital Remittance Sales and Growth Rate (2015-2020) 7.7.1 Russia Digital Remittance Market Under COVID-19 8 Asia-Pacific Digital Remittance Market Analysis by Countries 8.1 Asia-Pacific Digital Remittance Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Digital Remittance Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Digital Remittance Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Digital Remittance Market Under COVID-19 8.2 China Digital Remittance Sales and Growth Rate (2015-2020) 8.2.1 China Digital Remittance Market Under COVID-19 8.3 Japan Digital Remittance Sales and Growth Rate (2015-2020) 8.3.1 Japan Digital Remittance Market Under COVID-19 8.4 South Korea Digital Remittance Sales and Growth Rate (2015-2020) 8.4.1 South Korea Digital Remittance Market Under COVID-19 8.5 Australia Digital Remittance Sales and Growth Rate (2015-2020) 8.6 India Digital Remittance Sales and Growth Rate (2015-2020) 8.6.1 India Digital Remittance Market Under COVID-19 8.7 Southeast Asia Digital Remittance Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Digital Remittance Market Under COVID-19 9 Middle East and Africa Digital Remittance Market Analysis by Countries 9.1 Middle East and Africa Digital Remittance Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Digital Remittance Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Digital Remittance Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Digital Remittance Market Under COVID-19 9.2 Saudi Arabia Digital Remittance Sales and Growth Rate (2015-2020) 9.3 UAE Digital Remittance Sales and Growth Rate (2015-2020) 9.4 Egypt Digital Remittance Sales and Growth Rate (2015-2020) 9.5 Nigeria Digital Remittance Sales and Growth Rate (2015-2020) 9.6 South Africa Digital Remittance Sales and Growth Rate (2015-2020) 10 South America Digital Remittance Market Analysis by Countries 10.1 South America Digital Remittance Sales, Revenue and Market Share by Countries 10.1.1 South America Digital Remittance Sales by Countries (2015-2020) 10.1.2 South America Digital Remittance Revenue by Countries (2015-2020) 10.1.3 South America Digital Remittance Market Under COVID-19 10.2 Brazil Digital Remittance Sales and Growth Rate (2015-2020) 10.2.1 Brazil Digital Remittance Market Under COVID-19 10.3 Argentina Digital Remittance Sales and Growth Rate (2015-2020) 10.4 Columbia Digital Remittance Sales and Growth Rate (2015-2020) 10.5 Chile Digital Remittance Sales and Growth Rate (2015-2020) 11 Global Digital Remittance Market Segment by Types 11.1 Global Digital Remittance Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Digital Remittance Sales and Market Share by Types (2015-2020) 11.1.2 Global Digital Remittance Revenue and Market Share by Types (2015-2020) 11.2 Inward Digital Remittance Sales and Price (2015-2020) 11.3 Outward Digital Remittance Sales and Price (2015-2020) 12 Global Digital Remittance Market Segment by Applications 12.1 Global Digital Remittance Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Digital Remittance Sales and Market Share by Applications (2015-2020) 12.1.2 Global Digital Remittance Revenue and Market Share by Applications (2015-2020) 12.2 Business Sales, Revenue and Growth Rate (2015-2020) 12.3 Personal Sales, Revenue and Growth Rate (2015-2020) 13 Digital Remittance Market Forecast by Regions (2020-2026) 13.1 Global Digital Remittance Sales, Revenue and Growth Rate (2020-2026) 13.2 Digital Remittance Market Forecast by Regions (2020-2026) 13.2.1 North America Digital Remittance Market Forecast (2020-2026) 13.2.2 Europe Digital Remittance Market Forecast (2020-2026) 13.2.3 Asia-Pacific Digital Remittance Market Forecast (2020-2026) 13.2.4 Middle East and Africa Digital Remittance Market Forecast (2020-2026) 13.2.5 South America Digital Remittance Market Forecast (2020-2026) 13.3 Digital Remittance Market Forecast by Types (2020-2026) 13.4 Digital Remittance Market Forecast by Applications (2020-2026) 13.5 Digital Remittance Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Digital Remittance

Request Sample

Digital Remittance