Industrial Silica Market Size, Share, and Trends Analysis Report

CAGR :

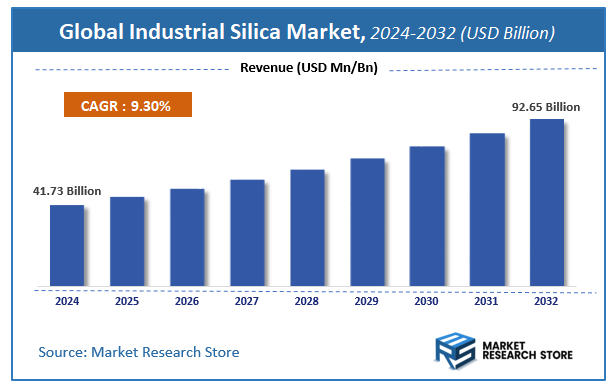

| Market Size 2024 (Base Year) | USD 41.73 Billion |

| Market Size 2032 (Forecast Year) | USD 92.65 Billion |

| CAGR | 9.3% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global industrial silica market, estimating its value at USD 41.73 Billion in 2024, with projections indicating it will reach USD 92.65 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 9.3% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the industrial silica industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Industrial Silica Market: Overview

The growth of the industrial silica market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The industrial silica market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the industrial silica market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product Type, Application, Purity Level, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global industrial silica market is estimated to grow annually at a CAGR of around 9.3% over the forecast period (2025-2032).

- In terms of revenue, the global industrial silica market size was valued at around USD 41.73 Billion in 2024 and is projected to reach USD 92.65 Billion by 2032.

- The market is projected to grow at a significant rate due to rising demand for high-purity silica in electronics, construction, and renewable energy applications.

- Based on the Product Type, the Quartz segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Glass Manufacturing segment is anticipated to command the largest market share.

- In terms of Purity Level, the High Purity segment is projected to lead the global market.

- By End-User, the Construction segment is predicted to dominate the global market.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Industrial Silica Market: Report Scope

This report thoroughly analyzes the industrial silica market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Silica Market |

| Market Size in 2024 | USD 41.73 Billion |

| Market Forecast in 2032 | USD 92.65 Billion |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 240 |

| Key Companies Covered | U.S. Silica Holdings Inc., Sibelco Group, Fairmount Santrol Holdings Inc., Badger Mining Corporation, Emerge Energy Services LP, Minerali Industriali S.r.l., Quarzwerke Group, Preferred Sands LLC, Pioneer Natural Resources Company, Toyota Tsusho Corporation, Covia Holdings Corporation, Adwan Chemical Industries Co. Ltd., Euroquarz GmbH, Delmon Group of Companies, Saudi Emirates Pulverization Industries Company (SEPICO), Sil Industrial Minerals, Short Mountain Silica, AGC Glass Europe, Terengganu Silica Consortium Sdn. Bhd., Unimin Corporation |

| Segments Covered | By Product Type, By Application, By Purity Level, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Silica Market: Dynamics

Key Growth Drivers

The Industrial Silica market is fundamentally driven by robust growth in key end-use industries globally. The booming construction sector, particularly in emerging economies with rapid urbanization and infrastructure development, significantly fuels demand for silica in concrete, mortar, and other building materials. The expanding automotive industry, especially with the rise of electric vehicles (EVs) and the increasing use of precipitated silica in "green tires" for improved fuel efficiency, is another major catalyst. Furthermore, the electronics sector's continuous innovation, with silica being crucial for semiconductors, optical fibers, and display glass, along with the growing demand for specialized glass products, continue to propel market expansion.

Restraints

Despite the strong growth, the Industrial Silica market faces several notable restraints. The significant environmental concerns associated with silica mining, including habitat loss, soil erosion, and the potential for water pollution, lead to stringent environmental regulations and increased operational costs for compliance. The health hazards posed by respirable crystalline silica dust, which can cause silicosis and other respiratory diseases, necessitate costly dust control measures and occupational safety protocols, adding to production expenses. Furthermore, the volatility in raw material prices and potential supply chain disruptions, especially for high-purity grades, can impact manufacturers' profitability and stable production.

Opportunities

The Industrial Silica market presents numerous opportunities driven by ongoing technological advancements and the increasing demand for high-performance and sustainable materials. The development of advanced silica products with enhanced properties, such as high-purity silica for cutting-edge electronics and nanotechnology-based applications (e.g., in advanced batteries and catalysts), offers significant growth avenues. The growing focus on sustainable construction practices and green manufacturing is driving demand for silica in eco-friendly concrete formulations and recycled glass products. Moreover, the expanding use of specialized silica in water treatment and filtration systems, along with its emerging applications in horticulture and agriculture, further diversify market potential beyond traditional segments.

Challenges

The Industrial Silica market grapples with several intricate challenges. A primary concern is navigating the complex and often fragmented regulatory landscape regarding environmental protection and worker safety across different regions, requiring substantial investment in compliance and risk management. The industry faces the continuous challenge of optimizing mining and processing techniques to reduce environmental impact and ensure worker safety while maintaining cost-effectiveness. Furthermore, intense competition among numerous players, coupled with the potential for substitution by alternative materials in certain applications, puts pressure on pricing and necessitates continuous product innovation and differentiation to maintain market share. Ensuring consistent quality and purity for highly specialized applications, such as in semiconductor manufacturing, also remains a critical technical challenge.

Industrial Silica Market: Segmentation Insights

The global industrial silica market is segmented based on Product Type, Application, Purity Level, End-User, and Region. All the segments of the industrial silica market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product Type, the global industrial silica market is divided into Quartz, Tridymite, Cristobalite, Others.

On the basis of Application, the global industrial silica market is bifurcated into Glass Manufacturing, Foundry, Construction, Ceramics & Refractories, Oil & Gas, Others.

In terms of Purity Level, the global industrial silica market is categorized into High Purity, Standard Purity.

Based on End-User, the global industrial silica market is split into Construction, Automotive, Electronics, Chemicals, Others.

Industrial Silica Market: Regional Insights

The industrial silica market is currently dominated by the Asia-Pacific (APAC) region, which accounted for over 55% of global revenue in 2023, driven by rapid industrialization, construction booms, and glass manufacturing demand in China, India, and Southeast Asia. China leads the market as the world’s largest silica producer and consumer, fueled by its solar panel (PV glass), electronics (silicon wafers), and automotive (tire rubber) industries. North America ranks second, with the U.S. focusing on high-purity silica for semiconductors and fracking sand. Europe shows steady demand in Germany and Italy for specialty silica in paints and ceramics. APAC’s dominance is reinforced by government infrastructure projects, low-cost quartz mining, and partnerships with global solar and tech supply chains.

Industrial Silica Market: Competitive Landscape

The industrial silica market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Industrial Silica Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- U.S. Silica Holdings Inc.

- Sibelco Group

- Fairmount Santrol Holdings Inc.

- Badger Mining Corporation

- Emerge Energy Services LP

- Minerali Industriali S.r.l.

- Quarzwerke Group

- Preferred Sands LLC

- Pioneer Natural Resources Company

- Toyota Tsusho Corporation

- Covia Holdings Corporation

- Adwan Chemical Industries Co. Ltd.

- Euroquarz GmbH

- Delmon Group of Companies

- Saudi Emirates Pulverization Industries Company (SEPICO)

- Sil Industrial Minerals

- Short Mountain Silica

- AGC Glass Europe

- Terengganu Silica Consortium Sdn. Bhd.

- Unimin Corporation

The Global Industrial Silica Market is Segmented as Follows:

By Product Type

- Quartz

- Tridymite

- Cristobalite

- Others

By Application

- Glass Manufacturing

- Foundry

- Construction

- Ceramics & Refractories

- Oil & Gas

- Others

By Purity Level

- High Purity

- Standard Purity

By End-User

- Construction

- Automotive

- Electronics

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Industrial Silica Market Share by Type (2020-2026) 1.5.2 Precipitated 1.5.3 Gel 1.5.4 Colloidal 1.5.5 Fumed 1.5.6 Others 1.6 Market by Application 1.6.1 Global Industrial Silica Market Share by Application (2020-2026) 1.6.2 Sodium Silicate 1.6.3 Fiberglass 1.6.4 Cultured Marble 1.6.5 Additive 1.6.6 Reinforcing filler 1.6.7 Foundry work 1.6.8 Ceramic frits & glaze 1.6.9 Oilwell Cement 1.6.10 Glass & Clay Production 1.6.11 Others 1.7 Industrial Silica Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Industrial Silica Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Industrial Silica Market 3.1 Value Chain Status 3.2 Industrial Silica Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Industrial Silica 3.2.3 Labor Cost of Industrial Silica 3.2.3.1 Labor Cost of Industrial Silica Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Sil Industrial Minerals Inc 4.1.1 Sil Industrial Minerals Inc Basic Information 4.1.2 Industrial Silica Product Profiles, Application and Specification 4.1.3 Sil Industrial Minerals Inc Industrial Silica Market Performance (2015-2020) 4.1.4 Sil Industrial Minerals Inc Business Overview 4.2 U.S. SILICA 4.2.1 U.S. SILICA Basic Information 4.2.2 Industrial Silica Product Profiles, Application and Specification 4.2.3 U.S. SILICA Industrial Silica Market Performance (2015-2020) 4.2.4 U.S. SILICA Business Overview 4.3 Silica International Silica Industries 4.3.1 Silica International Silica Industries Basic Information 4.3.2 Industrial Silica Product Profiles, Application and Specification 4.3.3 Silica International Silica Industries Industrial Silica Market Performance (2015-2020) 4.3.4 Silica International Silica Industries Business Overview 4.4 FINETON Industrial Minerals Limited 4.4.1 FINETON Industrial Minerals Limited Basic Information 4.4.2 Industrial Silica Product Profiles, Application and Specification 4.4.3 FINETON Industrial Minerals Limited Industrial Silica Market Performance (2015-2020) 4.4.4 FINETON Industrial Minerals Limited Business Overview 4.5 Al-Rushaid Group 4.5.1 Al-Rushaid Group Basic Information 4.5.2 Industrial Silica Product Profiles, Application and Specification 4.5.3 Al-Rushaid Group Industrial Silica Market Performance (2015-2020) 4.5.4 Al-Rushaid Group Business Overview 4.6 Saudi Emirates Pulverization Industries Company (SEPICO) 4.6.1 Saudi Emirates Pulverization Industries Company (SEPICO) Basic Information 4.6.2 Industrial Silica Product Profiles, Application and Specification 4.6.3 Saudi Emirates Pulverization Industries Company (SEPICO) Industrial Silica Market Performance (2015-2020) 4.6.4 Saudi Emirates Pulverization Industries Company (SEPICO) Business Overview 4.7 AGSCO Corporation 4.7.1 AGSCO Corporation Basic Information 4.7.2 Industrial Silica Product Profiles, Application and Specification 4.7.3 AGSCO Corporation Industrial Silica Market Performance (2015-2020) 4.7.4 AGSCO Corporation Business Overview 4.8 Premier Silica LLC 4.8.1 Premier Silica LLC Basic Information 4.8.2 Industrial Silica Product Profiles, Application and Specification 4.8.3 Premier Silica LLC Industrial Silica Market Performance (2015-2020) 4.8.4 Premier Silica LLC Business Overview 4.9 Delmon Group of Companies 4.9.1 Delmon Group of Companies Basic Information 4.9.2 Industrial Silica Product Profiles, Application and Specification 4.9.3 Delmon Group of Companies Industrial Silica Market Performance (2015-2020) 4.9.4 Delmon Group of Companies Business Overview 5 Global Industrial Silica Market Analysis by Regions 5.1 Global Industrial Silica Sales, Revenue and Market Share by Regions 5.1.1 Global Industrial Silica Sales by Regions (2015-2020) 5.1.2 Global Industrial Silica Revenue by Regions (2015-2020) 5.2 North America Industrial Silica Sales and Growth Rate (2015-2020) 5.3 Europe Industrial Silica Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Industrial Silica Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Industrial Silica Sales and Growth Rate (2015-2020) 5.6 South America Industrial Silica Sales and Growth Rate (2015-2020) 6 North America Industrial Silica Market Analysis by Countries 6.1 North America Industrial Silica Sales, Revenue and Market Share by Countries 6.1.1 North America Industrial Silica Sales by Countries (2015-2020) 6.1.2 North America Industrial Silica Revenue by Countries (2015-2020) 6.1.3 North America Industrial Silica Market Under COVID-19 6.2 United States Industrial Silica Sales and Growth Rate (2015-2020) 6.2.1 United States Industrial Silica Market Under COVID-19 6.3 Canada Industrial Silica Sales and Growth Rate (2015-2020) 6.4 Mexico Industrial Silica Sales and Growth Rate (2015-2020) 7 Europe Industrial Silica Market Analysis by Countries 7.1 Europe Industrial Silica Sales, Revenue and Market Share by Countries 7.1.1 Europe Industrial Silica Sales by Countries (2015-2020) 7.1.2 Europe Industrial Silica Revenue by Countries (2015-2020) 7.1.3 Europe Industrial Silica Market Under COVID-19 7.2 Germany Industrial Silica Sales and Growth Rate (2015-2020) 7.2.1 Germany Industrial Silica Market Under COVID-19 7.3 UK Industrial Silica Sales and Growth Rate (2015-2020) 7.3.1 UK Industrial Silica Market Under COVID-19 7.4 France Industrial Silica Sales and Growth Rate (2015-2020) 7.4.1 France Industrial Silica Market Under COVID-19 7.5 Italy Industrial Silica Sales and Growth Rate (2015-2020) 7.5.1 Italy Industrial Silica Market Under COVID-19 7.6 Spain Industrial Silica Sales and Growth Rate (2015-2020) 7.6.1 Spain Industrial Silica Market Under COVID-19 7.7 Russia Industrial Silica Sales and Growth Rate (2015-2020) 7.7.1 Russia Industrial Silica Market Under COVID-19 8 Asia-Pacific Industrial Silica Market Analysis by Countries 8.1 Asia-Pacific Industrial Silica Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Industrial Silica Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Industrial Silica Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Industrial Silica Market Under COVID-19 8.2 China Industrial Silica Sales and Growth Rate (2015-2020) 8.2.1 China Industrial Silica Market Under COVID-19 8.3 Japan Industrial Silica Sales and Growth Rate (2015-2020) 8.3.1 Japan Industrial Silica Market Under COVID-19 8.4 South Korea Industrial Silica Sales and Growth Rate (2015-2020) 8.4.1 South Korea Industrial Silica Market Under COVID-19 8.5 Australia Industrial Silica Sales and Growth Rate (2015-2020) 8.6 India Industrial Silica Sales and Growth Rate (2015-2020) 8.6.1 India Industrial Silica Market Under COVID-19 8.7 Southeast Asia Industrial Silica Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Industrial Silica Market Under COVID-19 9 Middle East and Africa Industrial Silica Market Analysis by Countries 9.1 Middle East and Africa Industrial Silica Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Industrial Silica Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Industrial Silica Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Industrial Silica Market Under COVID-19 9.2 Saudi Arabia Industrial Silica Sales and Growth Rate (2015-2020) 9.3 UAE Industrial Silica Sales and Growth Rate (2015-2020) 9.4 Egypt Industrial Silica Sales and Growth Rate (2015-2020) 9.5 Nigeria Industrial Silica Sales and Growth Rate (2015-2020) 9.6 South Africa Industrial Silica Sales and Growth Rate (2015-2020) 10 South America Industrial Silica Market Analysis by Countries 10.1 South America Industrial Silica Sales, Revenue and Market Share by Countries 10.1.1 South America Industrial Silica Sales by Countries (2015-2020) 10.1.2 South America Industrial Silica Revenue by Countries (2015-2020) 10.1.3 South America Industrial Silica Market Under COVID-19 10.2 Brazil Industrial Silica Sales and Growth Rate (2015-2020) 10.2.1 Brazil Industrial Silica Market Under COVID-19 10.3 Argentina Industrial Silica Sales and Growth Rate (2015-2020) 10.4 Columbia Industrial Silica Sales and Growth Rate (2015-2020) 10.5 Chile Industrial Silica Sales and Growth Rate (2015-2020) 11 Global Industrial Silica Market Segment by Types 11.1 Global Industrial Silica Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Industrial Silica Sales and Market Share by Types (2015-2020) 11.1.2 Global Industrial Silica Revenue and Market Share by Types (2015-2020) 11.2 Precipitated Sales and Price (2015-2020) 11.3 Gel Sales and Price (2015-2020) 11.4 Colloidal Sales and Price (2015-2020) 11.5 Fumed Sales and Price (2015-2020) 11.6 Others Sales and Price (2015-2020) 12 Global Industrial Silica Market Segment by Applications 12.1 Global Industrial Silica Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Industrial Silica Sales and Market Share by Applications (2015-2020) 12.1.2 Global Industrial Silica Revenue and Market Share by Applications (2015-2020) 12.2 Sodium Silicate Sales, Revenue and Growth Rate (2015-2020) 12.3 Fiberglass Sales, Revenue and Growth Rate (2015-2020) 12.4 Cultured Marble Sales, Revenue and Growth Rate (2015-2020) 12.5 Additive Sales, Revenue and Growth Rate (2015-2020) 12.6 Reinforcing filler Sales, Revenue and Growth Rate (2015-2020) 12.7 Foundry work Sales, Revenue and Growth Rate (2015-2020) 12.8 Ceramic frits & glaze Sales, Revenue and Growth Rate (2015-2020) 12.9 Oilwell Cement Sales, Revenue and Growth Rate (2015-2020) 12.10 Glass & Clay Production Sales, Revenue and Growth Rate (2015-2020) 12.11 Others Sales, Revenue and Growth Rate (2015-2020) 13 Industrial Silica Market Forecast by Regions (2020-2026) 13.1 Global Industrial Silica Sales, Revenue and Growth Rate (2020-2026) 13.2 Industrial Silica Market Forecast by Regions (2020-2026) 13.2.1 North America Industrial Silica Market Forecast (2020-2026) 13.2.2 Europe Industrial Silica Market Forecast (2020-2026) 13.2.3 Asia-Pacific Industrial Silica Market Forecast (2020-2026) 13.2.4 Middle East and Africa Industrial Silica Market Forecast (2020-2026) 13.2.5 South America Industrial Silica Market Forecast (2020-2026) 13.3 Industrial Silica Market Forecast by Types (2020-2026) 13.4 Industrial Silica Market Forecast by Applications (2020-2026) 13.5 Industrial Silica Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Industrial Silica

Request Sample

Industrial Silica