Li-ion Battery Market Size, Share, and Trends Analysis Report

CAGR :

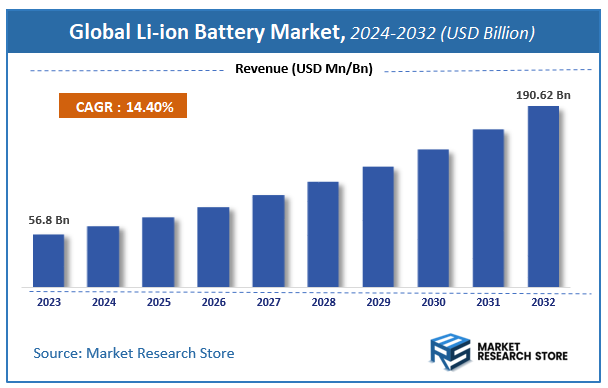

| Market Size 2023 (Base Year) | USD 56.8 Billion |

| Market Size 2032 (Forecast Year) | USD 190.62 Billion |

| CAGR | 14.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Li-ion Battery Market Insights

According to Market Research Store, the global li-ion battery market size was valued at around USD 56.8 billion in 2023 and is estimated to reach USD 190.62 billion by 2032, to register a CAGR of approximately 14.4% in terms of revenue during the forecast period 2024-2032.

The li-ion battery report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Li-ion Battery Market: Overview

The Li-ion Battery for Consumer Electronics Market focuses on lithium-ion batteries as the primary power source for a wide range of consumer electronic devices, including smartphones, laptops, tablets, wearables, and cameras. These batteries are favored for their high energy density, lightweight design, and rechargeable capabilities, which enhance the portability and performance of modern electronic devices.

The market is driven by the increasing adoption of advanced consumer electronics, fueled by technological advancements and rising consumer demand for high-performance, portable devices. Features such as long-lasting battery life, fast-charging capabilities, and improved safety standards have made Li-ion batteries the industry standard for powering electronic devices. The growing penetration of IoT devices and smart gadgets is further boosting demand for compact and efficient Li-ion batteries. Additionally, ongoing innovations, such as solid-state batteries and flexible Li-ion batteries, are opening new possibilities for design and functionality in consumer electronics, ensuring sustained market growth.

Key Highlights

- The li-ion battery market is anticipated to grow at a CAGR of 14.4% during the forecast period.

- The global li-ion battery market was estimated to be worth approximately USD 56.8 billion in 2023 and is projected to reach a value of USD 190.62 billion by 2032.

- The growth of the li-ion battery market is being driven by a surge in demand across various sectors, primarily fueled by the rapid electrification of transportation and the increasing adoption of renewable energy sources.

- Based on the product, the lithium-nickel manganese cobalt oxide battery segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the smartphones segment is projected to swipe the largest market share.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Li-ion Battery Market: Dynamics

Key Growth Drivers

- Electric Vehicle (EV) Revolution: The rapid growth of the electric vehicle market is the single most significant driver. EVs heavily rely on Li-ion batteries for propulsion, and increasing demand for EVs translates directly to increased demand for batteries.

- Renewable Energy Integration: The rise of renewable energy sources like solar and wind power necessitates energy storage solutions. Li-ion batteries play a crucial role in storing excess energy generated during peak production and releasing it during periods of high demand, ensuring grid stability.

- Portable Electronics: The ever-growing demand for smartphones, laptops, tablets, and other portable electronic devices continues to drive significant demand for Li-ion batteries.

- Energy Storage Systems (ESS): Li-ion batteries are essential for grid-scale energy storage, enabling utilities to manage peak demand, improve grid reliability, and integrate renewable energy more effectively.

Restraints

- High Raw Material Costs: The prices of key raw materials like lithium, cobalt, and nickel can fluctuate significantly, impacting battery production costs.

- Supply Chain Constraints: Ensuring a stable and reliable supply chain for critical raw materials is crucial, but geopolitical risks and potential disruptions can pose challenges.

- Safety Concerns: Safety concerns related to fire hazards, thermal runaway, and potential explosions can hinder widespread adoption.

- Environmental Concerns: Concerns about the environmental impact of battery production, including mining, refining, and disposal, need to be addressed.

Opportunities

- Advancements in Battery Chemistry: Research and development of next-generation chemistries like solid-state batteries and lithium-sulfur batteries offer the potential for higher energy density, improved safety, and longer lifespans.

- Recycling and Reuse: Developing efficient battery recycling technologies and exploring second-life applications for retired batteries can reduce waste and improve sustainability.

- Integration with Smart Grids: Integrating Li-ion batteries with smart grid technologies can optimize energy storage and utilization, improving grid efficiency and reliability.

- Expanding into Emerging Markets: Expanding into emerging markets with growing electrification needs and increasing renewable energy penetration can drive significant market growth.

Challenges

- Maintaining Competitive Advantage: Intense competition among battery manufacturers requires continuous innovation and cost optimization to remain competitive.

- Ensuring Safety and Reliability: Ensuring the safety and reliability of Li-ion batteries across various applications is crucial for maintaining consumer trust and market growth.

- Addressing Environmental and Social Concerns: Addressing environmental and social concerns related to battery production and disposal is critical for long-term sustainability.

- Meeting Growing Demand: Meeting the rapidly growing demand for Li-ion batteries while ensuring a stable and sustainable supply chain will be a major challenge.

Li-ion Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Li-ion Battery Market |

| Market Size in 2023 | USD 56.8 Billion |

| Market Forecast in 2032 | USD 190.62 Billion |

| Growth Rate | CAGR of 14.4% |

| Number of Pages | 140 |

| Key Companies Covered | Panasonic, Samsung SDI, LG Chem, Sony Energy Devices, Maxwell Technologies, Toshiba, Saft, BYD Company, Amperex Technology, CATL, Valence Technology, Kolam, Leclanché, Electrovaya, Tianjin Lishen Battery, Shenzhen BAK Battery, AESC |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Li-ion Battery Market: Segmentation Insights

The global li-ion battery market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global li-ion battery market is divided into lithium-nickel manganese cobalt oxide battery, lithium-cobalt oxide battery, lithium-titanate battery, lithium-iron phosphate battery, and lithium-manganese oxide battery.

The Lithium-Nickel Manganese Cobalt Oxide (NMC) Battery segment dominates the market due to its high energy density, excellent performance, and versatility. NMC batteries are extensively used in electric vehicles, power tools, and grid storage systems. The ability to balance energy density, lifespan, and cost makes NMC batteries a leading choice for applications requiring both high performance and efficiency. The ongoing optimization of nickel, manganese, and cobalt ratios aims to enhance their affordability and sustainability, further solidifying their position as a dominant player in the market.

The Lithium-Cobalt Oxide (LCO) Battery segment is a prominent player in the Li-ion Battery Market, known for its high energy density and lightweight design. These batteries are widely used in portable electronics such as smartphones, tablets, and cameras due to their excellent energy-to-weight ratio. The LCO battery's ability to deliver consistent power output makes it ideal for compact devices requiring prolonged operation. However, LCO batteries are less durable under high discharge rates and elevated temperatures, which limits their use in high-performance applications. Despite these challenges, their dominance in the consumer electronics sector ensures their continued significance in the market.

The Lithium-Titanate (LTO) Battery segment is gaining traction due to its exceptional safety, long cycle life, and rapid charging capabilities. LTO batteries are commonly used in electric buses, grid energy storage systems, and industrial applications where durability and reliability are paramount. Unlike other Li-ion chemistries, LTO batteries can operate effectively in extreme temperatures and support high charge-discharge rates, making them suitable for demanding applications. Although their energy density is lower than other battery types, their longevity and safety profile make them an attractive option for specialized markets.

The Lithium-Iron Phosphate (LFP) Battery segment is one of the most rapidly growing segments, driven by its outstanding thermal stability, safety, and cost-effectiveness. LFP batteries are widely utilized in electric vehicles (EVs), energy storage systems, and commercial applications due to their long cycle life and resistance to thermal runaway. Their lower energy density compared to NMC or LCO batteries is offset by their affordability and reliability, making them a preferred choice for applications where safety and longevity are priorities. With advancements in LFP technology, such as improved energy density, their adoption in mainstream EVs and renewable energy projects continues to rise.

The Lithium-Manganese Oxide (LMO) Battery segment is valued for its high thermal stability and fast charging capabilities. These batteries are commonly used in power tools, medical devices, and certain types of electric vehicles, including hybrids. LMO batteries excel in delivering high power output, making them suitable for applications requiring rapid energy delivery. However, their relatively lower energy density and shorter lifespan compared to other chemistries have limited their use in long-range EVs. Despite these limitations, their cost-effectiveness and safety features maintain their relevance in niche markets.

Segmentation Insights by Application

On the basis of Application, the global li-ion battery market is bifurcated into smartphones, laptops, tablets, digital cameras, mp3 players, and others.

The smartphones segment dominates the Li-ion Battery Market, driven by the global proliferation of smartphones and their reliance on lightweight, high-capacity batteries. Lithium-Cobalt Oxide (LCO) batteries are commonly used in this segment due to their high energy density and compact size, which align with the performance and portability demands of modern smartphones. As smartphones evolve with larger screens, faster processors, and advanced features like 5G connectivity, the need for batteries with extended life, rapid charging, and safety features continues to rise. This segment remains the largest consumer of Li-ion batteries, fueled by constant upgrades and the increasing penetration of smartphones in emerging markets.

The laptops segment is a significant contributor to the market, as Li-ion batteries power a wide range of portable computers used in personal and professional settings. Lithium-Nickel Manganese Cobalt Oxide (NMC) and Lithium-Polymer variants dominate this segment due to their balance of energy density, safety, and cycle life. With the growing popularity of ultrabooks and gaming laptops, there is increasing demand for high-performance batteries capable of sustaining heavy workloads and providing extended runtime. Additionally, the rise of remote work and e-learning has further driven the adoption of laptops, boosting the demand for Li-ion batteries in this segment.

The tablets segment leverages Li-ion batteries to support lightweight and portable designs, catering to users who need a balance between smartphones and laptops. Tablets typically utilize Lithium-Cobalt Oxide (LCO) or Lithium-Polymer batteries for their slim profiles and efficient energy delivery. As tablets find applications in both consumer and enterprise settings, including education, healthcare, and field operations, the demand for reliable and long-lasting battery solutions continues to grow. The adoption of 2-in-1 convertible devices further drives the need for high-capacity Li-ion batteries in this segment.

The digital cameras segment benefits from the use of Li-ion batteries due to their ability to deliver high power output in a compact form. Professional cameras and DSLRs, in particular, rely on high-performance batteries to support features like high-speed shooting, image stabilization, and video recording. While the adoption of standalone digital cameras has declined with the rise of smartphones, the professional photography and videography markets ensure sustained demand for advanced Li-ion battery solutions in this niche segment.

The MP3 players segment represents a niche application, as the popularity of standalone music devices has waned in favor of multifunctional smartphones. However, portable audio devices that require compact and lightweight power sources still use Li-ion batteries, particularly Lithium-Polymer variants. The segment's growth is primarily driven by audiophiles and specific consumer groups seeking high-quality, standalone audio experiences.

Li-ion Battery Market: Regional Insights

- Asia-Pacific currently leads the global li-ion battery market

Asia-Pacific dominates the global Li-ion battery market, with China, Japan, and South Korea being the key contributors. China is the largest producer and consumer of Li-ion batteries, fueled by its leadership in EV production, government subsidies for clean energy adoption, and the presence of major battery manufacturers like CATL and BYD. Japan and South Korea are also pivotal markets, with companies such as Panasonic, LG Chem, and Samsung SDI driving innovation in battery technology. The region benefits from an established manufacturing ecosystem, economies of scale, and increasing adoption of EVs and renewable energy solutions. India is also emerging as a significant market, with initiatives to promote local battery manufacturing and EV adoption.

North America is a significant market for Li-ion batteries, driven by the rapid adoption of electric vehicles (EVs), advancements in renewable energy storage solutions, and the widespread use of consumer electronics. The United States leads the region, with strong government support for EV adoption, investments in battery production facilities, and growing demand for energy-efficient solutions. Companies such as Tesla, which operates its Gigafactory in Nevada, contribute significantly to the growth of the market. The rise in clean energy initiatives, such as solar and wind energy projects, further boosts the demand for Li-ion batteries in energy storage systems.

Europe holds a prominent position in the Li-ion battery market, supported by stringent environmental regulations, ambitious goals for carbon neutrality, and increasing investments in EV infrastructure. Countries like Germany, France, Norway, and the UK are leading the region in EV adoption, driving the demand for Li-ion batteries. The European Union's initiatives, such as the European Battery Alliance, focus on developing a sustainable and competitive battery industry, encouraging local production and reducing reliance on imports. Additionally, the region's growing renewable energy projects, combined with a strong push for battery recycling and sustainable technologies, further drive market growth.

Latin America is an emerging market for Li-ion batteries, with growing demand for EVs and renewable energy projects in countries like Brazil, Chile, and Mexico. The region's abundant natural resources, including lithium reserves in countries like Chile and Argentina, provide a strategic advantage for local battery production. Government initiatives to promote clean energy and sustainable transportation are expected to drive the market further. For instance, Chile is heavily investing in renewable energy storage solutions, while Brazil is seeing an increase in EV adoption, boosting the demand for Li-ion batteries.

The Middle East and Africa (MEA) region is witnessing gradual growth in the Li-ion battery market, driven by renewable energy projects and the adoption of EVs in urban areas. Countries like the UAE and Saudi Arabia are leading the transition toward clean energy, with significant investments in solar power storage systems and EV infrastructure. South Africa is also seeing increased interest in energy storage solutions to address power outages and reliance on renewable energy sources. However, challenges such as high costs and limited infrastructure continue to impact the market's growth potential in this region.

Li-ion Battery Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the li-ion battery market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global li-ion battery market include:

- AESC

- Amperex Technology

- BYD Company

- CATL

- Electrovaya

- Kolam

- Leclanché

- LG Chem

- Maxwell Technologies

- Panasonic

- Saft

- Samsung SDI

- Shenzhen BAK Battery

- Sony Energy Devices

- Tianjin Lishen Battery

- Toshiba

- Valence Technology

The global li-ion battery market is segmented as follows:

By Product

- Lithium-Cobalt Oxide Battery

- Lithium-Titanate Battery

- Lithium-Iron Phosphate Battery

- Lithium-Nickel Manganese Cobalt Oxide Battery

- Lithium-Manganese Oxide Battery

By Application

- Smartphones

- Laptops

- Tablets

- Digital Cameras

- MP3 Players

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global li-ion battery market size was projected at approximately US$ 56.8 billion in 2023. Projections indicate that the market is expected to reach around US$ 190.62 billion in revenue by 2032.

The global li-ion battery market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 14.4% during the forecast period from 2024 to 2032.

Asia-Pacific is expected to dominate the global li-ion battery market.

The global Li-ion battery market is primarily driven by the surging demand for electric vehicles, coupled with the increasing adoption of renewable energy sources and the growing need for energy storage solutions.

Some of the prominent players operating in the global li-ion battery market are; AESC, Amperex Technology, BYD Company, CATL, Electrovaya, Kolam, Leclanché, LG Chem, Maxwell Technologies, Panasonic, Saft, Samsung SDI, Shenzhen BAK Battery, Sony Energy Devices, Tianjin Lishen Battery, Toshiba, Valence Technology, and others.

Table Of Content

Inquiry For Buying

Li-ion Battery

Request Sample

Li-ion Battery