Low Rolling Resistance Tire Market Size, Share, and Trends Analysis Report

CAGR :

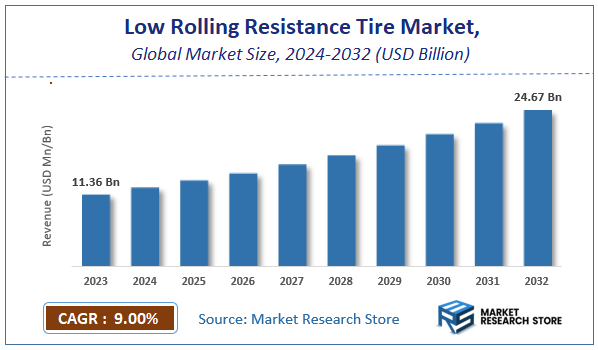

| Market Size 2023 (Base Year) | USD 11.36 Billion |

| Market Size 2032 (Forecast Year) | USD 24.67 Billion |

| CAGR | 9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Low Rolling Resistance Tire Market Insights

According to Market Research Store, the global low rolling resistance tire market size was valued at around USD 11.36 billion in 2023 and is estimated to reach USD 24.67 billion by 2032, to register a CAGR of approximately 9.00% in terms of revenue during the forecast period 2024-2032.

The low rolling resistance tire report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Low Rolling Resistance Tire Market: Overview

Low rolling resistance (LRR) tires are designed to reduce the energy loss as a tire rolls, offering improved fuel efficiency in vehicles. These tires are made with specialized tread patterns, materials, and construction techniques that minimize friction between the tire and the road surface. The reduced friction allows vehicles to use less fuel or energy, thereby lowering greenhouse gas emissions and reducing fuel costs. LRR tires are commonly used in electric vehicles (EVs) and hybrid vehicles, where efficiency and battery range are key concerns.

Key Highlights

- The low rolling resistance tire market is anticipated to grow at a CAGR of 9.00% during the forecast period.

- The global low rolling resistance tire market was estimated to be worth approximately USD 11.36 billion in 2023 and is projected to reach a value of USD 24.67 billion by 2032.

- The growth of the low rolling resistance tire market is being driven by the increasing demand for fuel-efficient vehicles and the growing adoption of electric vehicles (EVs) globally.

- Based on the vehicle type, the passenger cars segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the on-road segment is projected to swipe the largest market share.

- In terms of sales channel, the OEM segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Low Rolling Resistance Tire Market: Dynamics

Key Growth Drivers:

- Fuel Efficiency: Reduced fuel consumption leads to lower operating costs for consumers and businesses.

- Environmental Concerns: Lower emissions contribute to reduced carbon footprint and improved air quality.

- Government Regulations: Increasingly stringent fuel economy standards mandate the use of more efficient tires.

- Technological Advancements: Continuous innovation in tire materials and design leads to improved performance and efficiency.

Restraints:

- Performance Trade-offs: Lower rolling resistance can sometimes compromise grip, braking, and handling in certain conditions.

- Higher Initial Cost: Low rolling resistance tires generally have a higher initial purchase price compared to standard tires.

- Limited Availability: In some regions and for certain vehicle types, the availability of low rolling resistance tires might be limited.

Opportunities:

- Growing Electric Vehicle Market: Electric vehicles benefit significantly from reduced rolling resistance due to their already high energy efficiency.

- Advancements in Tire Materials: New materials like silica and nanotechnology offer potential for further improvements in rolling resistance.

- Expanding Market in Developing Economies: Increasing vehicle ownership in developing countries creates a growing market for fuel-efficient tires.

Challenges:

- Balancing Performance and Efficiency: Achieving optimal balance between low rolling resistance and other critical performance parameters like wet grip and durability remains a challenge.

- Maintaining Consumer Awareness: Educating consumers about the benefits of low rolling resistance tires and dispelling common misconceptions is crucial.

- Competition: Intense competition among tire manufacturers requires continuous innovation and cost-effectiveness to maintain market share.

Low Rolling Resistance Tire Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Low Rolling Resistance Tire Market |

| Market Size in 2023 | USD 11.36 Billion |

| Market Forecast in 2032 | USD 24.67 Billion |

| Growth Rate | CAGR of 9% |

| Number of Pages | 140 |

| Key Companies Covered | Bridgestone Corporation (Japan), The Goodyear Tire & Rubber Company (U.S.), Sumitomo Rubber Industries, Ltd (Japan), Pirelli & C. S.p.A. (Italy), Hankook Tire & Technology (South Korea), MICHELIN (France), Continental AG (Germany), Trelleborg AB (publ) (Sweden), The Yokohama Rubber Co. Ltd (Japan), APOLLO TYRES LTD (India), Maxxis International–USA. (U.S.), Marangoni S.p.A (Italy), MRF Limited (India), Cooper Tire & Rubber Company (U.S.), Toyo Tire & Rubber Co. Ltd. (Japan), KUMHO TIRE (South Korea), Nokian Tyres plc. (Finland) |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Low Rolling Resistance Tire Market: Segmentation Insights

The global low rolling resistance tire market is divided by vehicle type, application, sales channel, and region.

Segmentation Insights by Vehicle Type

Based on vehicle type, the global low rolling resistance tire market is divided into two-wheeler, passenger car, light commercial vehicle, heavy commercial vehicle, and others.

The passenger cars segment dominate the market due to the increasing focus on fuel efficiency and reducing carbon emissions. The demand for low rolling resistance tires is highest in this segment because these tires offer improved fuel economy, which is a significant concern for private car owners looking to save on fuel costs.

Following passenger cars, light commercial vehicles (LCVs) are the second most significant segment. LCVs, which include vans and small trucks, are widely used for urban deliveries, logistics, and transportation. The emphasis on sustainability and cost-effective operations has led to a growing preference for low rolling resistance tires in this category as they help reduce operating costs by improving fuel efficiency.

Heavy commercial vehicles (HCVs), including large trucks and buses, rank third. While these vehicles consume large amounts of fuel, the adoption of low rolling resistance tires is more gradual due to the higher upfront cost and the longer lifespan of the tires. However, with the growing trend of reducing fleet operating costs, this segment is seeing an increasing shift toward low rolling resistance tires, particularly in fleet operations.

The two-wheeler segment is next in line, although its share in the low rolling resistance tire market is relatively smaller compared to the aforementioned vehicle types. Two-wheelers typically consume less fuel, and the direct impact of low rolling resistance tires on fuel savings is not as pronounced. However, with rising environmental awareness and advancements in tire technology, two-wheelers are beginning to adopt these tires to meet sustainability goals.

Segmentation Insights by Application

On the basis of application, the global low rolling resistance tire market is bifurcated into on-road and off-road.

On-road applications dominate the market due to the widespread use of vehicles on highways, city streets, and other paved roads. On-road tires, which are optimized for fuel efficiency and reduced rolling resistance, are used in a variety of vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles. The primary drivers for low rolling resistance tires in on-road applications are the rising fuel prices, environmental regulations, and the push for greener transportation solutions. These tires offer improved fuel economy and lower carbon emissions, making them highly sought after by both consumers and fleet operators who want to reduce their operating costs.

Following on-road applications, off-road usage represents a smaller portion of the low rolling resistance tire market. Off-road vehicles, such as those used in construction, agriculture, and mining, typically operate in harsh conditions where durability and traction are more critical than rolling resistance. While some off-road vehicles, especially those in the agriculture and mining sectors, are beginning to incorporate low rolling resistance tires to reduce fuel costs, the primary focus for these vehicles remains on tire strength, load-bearing capacity, and resistance to wear. Therefore, the demand for low rolling resistance tires in off-road applications is growing at a slower pace compared to on-road applications.

Segmentation Insights by Sales Channel

Based on sales channel, the global low rolling resistance tire market is divided into OEM and aftermarket.

OEM (Original Equipment Manufacturer) is the most dominant sales channel for low rolling resistance tires. OEMs typically supply these tires to vehicle manufacturers for use in new vehicle models. The growing emphasis on fuel efficiency and sustainability in the automotive industry has led manufacturers to equip new vehicles with low rolling resistance tires as a standard or optional feature. This segment benefits from long-term relationships between tire manufacturers and automakers, as well as from the increasing demand for eco-friendly and fuel-efficient vehicles. With global automotive manufacturers focusing on improving vehicle fuel economy, the OEM channel continues to be a major driver of low rolling resistance tire adoption, especially in passenger cars and light commercial vehicles.

The Aftermarket segment, while still significant, is smaller compared to OEM sales. This channel includes the replacement of tires for vehicles already in operation. As the global fleet of vehicles ages, the demand for tire replacements in the aftermarket is substantial. Consumers and fleet operators increasingly seek low rolling resistance tires in the aftermarket to replace their worn-out tires with options that can help improve fuel efficiency and reduce operating costs. However, the aftermarket segment tends to be more price-sensitive, which can sometimes limit the adoption of low rolling resistance tires due to their higher upfront cost compared to traditional tires. Despite this, growing environmental awareness and the long-term cost benefits of improved fuel efficiency are driving steady growth in the aftermarket segment.

Low Rolling Resistance Tire Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region leads the low rolling resistance tire market, driven by rapid industrialization and a significant increase in vehicle production, particularly in countries like China, India, and Japan. The region's focus on environmental sustainability and fuel efficiency has further accelerated the adoption of these tires.

North America follows closely, with the United States and Canada prioritizing fuel efficiency and environmental concerns. Stringent regulatory standards and a strong automotive industry have propelled the demand for low rolling resistance tires in this region.

Europe also exhibits substantial growth, influenced by strict environmental regulations and a high concentration of automotive manufacturers. Countries such as Germany, France, and the United Kingdom are at the forefront, integrating low rolling resistance tires into their vehicle fleets to meet sustainability goals.

The Middle East and Africa region shows a growing interest in low rolling resistance tires, particularly in countries with expanding automotive markets. While the market is still developing, increasing awareness of fuel efficiency and environmental impact is driving gradual adoption.

South America has a smaller share in the low rolling resistance tire market. However, countries like Brazil and Argentina are beginning to recognize the benefits of these tires, leading to a modest increase in their usage.

Low Rolling Resistance Tire Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the low rolling resistance tire market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global low rolling resistance tire market include:

- Falken Tire

- MRF Tyres

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd.

- Pirelli & C. S.p.A.

- Hankook Tire

- Cheng Shin Rubber Industry Co.

- Kumho Tire

- Zhongce Rubber Group Co.Ltd

- Nokian Tyres plc

- Michelin

- Continental AG

- Firestone Tire and Rubber Company

- Cooper Tire & Rubber Company

- Toyo Tire & Rubber Company

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

The global low rolling resistance tire market is segmented as follows:

By Vehicle Type

- Two-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

By Application

- On-road

- Off-road

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global low rolling resistance tire market size was projected at approximately US$ 11.36 billion in 2023. Projections indicate that the market is expected to reach around US$ 24.67 billion in revenue by 2032.

The global low rolling resistance tire market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 9.00% during the forecast period from 2024 to 2032.

Asia Pacific is expected to dominate the global low rolling resistance tire market.

The global low rolling resistance tire market is primarily driven by increasing demand for fuel efficiency, stringent environmental regulations, and the automotive industry's push towards sustainability. Additionally, the growing awareness of reducing carbon emissions and improving vehicle performance fuels market growth.

Some of the prominent players operating in the global low rolling resistance tire market are; Falken Tire, MRF Tyres, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Sumitomo Rubber Industries Ltd., Pirelli & C. S.p.A., Hankook Tire, Cheng Shin Rubber Industry Co., Kumho Tire, Zhongce Rubber Group Co.Ltd, Nokian Tyres plc, Michelin, Continental AG, Firestone Tire and Rubber Company, Cooper Tire & Rubber Company , Toyo Tire & Rubber Company, Yokohama Rubber Co. Ltd., Apollo Tyres Ltd., and others.

Table Of Content

Inquiry For Buying

Low Rolling Resistance Tire

Request Sample

Low Rolling Resistance Tire