Medical Ultrasonography Equipment Market Size, Share, and Trends Analysis Report

CAGR :

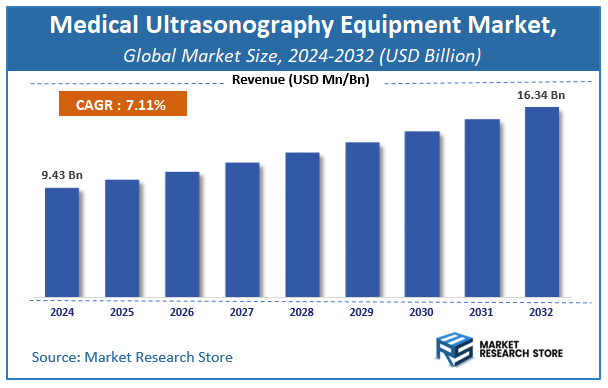

| Market Size 2024 (Base Year) | USD 9.43 Billion |

| Market Size 2032 (Forecast Year) | USD 16.34 Billion |

| CAGR | 7.11% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global medical ultrasonography equipment market size was valued at approximately USD 9.43 Billion in 2024. The market is projected to grow significantly, reaching USD 16.34 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.11% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the medical ultrasonography equipment industry.

To Get more Insights, Request a Free Sample

Medical Ultrasonography Equipment Market: Overview

The growth of the medical ultrasonography equipment market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The medical ultrasonography equipment market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the medical ultrasonography equipment market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global medical ultrasonography equipment market is estimated to grow annually at a CAGR of around 7.11% over the forecast period (2025-2032).

- In terms of revenue, the global medical ultrasonography equipment market size was valued at around USD 9.43 Billion in 2024 and is projected to reach USD 16.34 Billion by 2032.

- The market is projected to grow at a significant rate due to Increasing prevalence of chronic diseases, growing demand for non-invasive imaging techniques, and rising advancements in ultrasound technology are driving the global Medical Ultrasonography Equipment market.

- Based on the Products, the Trolley/cart Based segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Therapeutic Ultrasound segment is anticipated to command the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Medical Ultrasonography Equipment Market: Report Scope

This report thoroughly analyzes the medical ultrasonography equipment market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Ultrasonography Equipment Market |

| Market Size in 2024 | USD 9.43 Billion |

| Market Forecast in 2032 | USD 16.34 Billion |

| Growth Rate | CAGR of 7.11% |

| Number of Pages | 204 |

| Key Companies Covered | Esaote S.P.A., General Electric Company, Hitachi Ltd., Boston Scientific, Fujifilm Holdings Corporation, Siemens Healthcare, Koninklijke Philips N.V., Mindray Medical International Ltd., Analogic Corporation, Toshiba Corporation, Shimadzu Corporation, Samsung Electronics Co. Ltd. |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Ultrasonography Equipment Market: Dynamics

Key Growth Drivers :

The Medical Ultrasonography Equipment market is propelled by several significant factors. A primary driver is the increasing prevalence of chronic diseases and age-related conditions globally, necessitating early and accurate diagnosis, for which ultrasonography is a safe and effective imaging modality. The non-invasive nature of ultrasound, coupled with its real-time imaging capabilities and lack of ionizing radiation, makes it a preferred choice over other imaging techniques for various applications, including obstetrics, cardiology, and emergency medicine. Technological advancements, such as the development of 3D/4D ultrasound, elastography, and contrast-enhanced ultrasound, are expanding the diagnostic capabilities and precision of these devices, further driving their adoption. Moreover, the growing demand for point-of-care (PoC) ultrasound devices, which enable quicker diagnosis and intervention in diverse clinical settings, from emergency rooms to remote clinics, is also a crucial growth catalyst.

Restraints :

Despite its growth, the Medical Ultrasonography Equipment market faces several restraints. The high cost of advanced ultrasonography equipment, particularly for high-end systems with specialized features, can be a significant barrier for healthcare providers, especially in developing countries or smaller clinics with limited budgets. This can lead to slower adoption rates or reliance on refurbished equipment. The availability of alternative imaging modalities, such as MRI, CT scans, and X-rays, provides competition, with each modality offering unique advantages for specific diagnostic needs. While ultrasound excels in many areas, the presence of these alternatives can limit its market share in others. Furthermore, the requirement for skilled professionals to operate and interpret ultrasound images accurately poses a challenge. A shortage of trained sonographers and radiologists can hinder the widespread utilization of these devices, particularly in underserved regions. Reimbursement policies and varying regulatory frameworks across different countries can also impact market growth by affecting the profitability and market access for manufacturers.

Opportunities :

The Medical Ultrasonography Equipment market presents numerous opportunities for innovation and expansion. The increasing focus on early disease diagnosis and preventive healthcare offers a significant avenue for growth, as ultrasound is a cost-effective and accessible tool for screening and monitoring various conditions. The miniaturization of ultrasound devices and the development of portable, handheld units are creating new opportunities in point-of-care diagnostics, home healthcare, and remote medicine, expanding their application beyond traditional hospital settings. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) for image analysis, automated measurements, and enhanced diagnostic accuracy represents a transformative opportunity. AI can help address the challenge of skilled personnel by assisting in interpretation and improving workflow efficiency. Emerging applications in non-traditional areas like musculoskeletal imaging, neurology, and therapy guidance also present new market segments. Tele-ultrasound, allowing remote expert consultation and image interpretation, offers an opportunity to extend specialist care to remote areas.

Challenges :

The Medical Ultrasonography Equipment market is confronted with several challenges that require strategic solutions. Ensuring the accuracy and consistency of ultrasound readings, which can be highly operator-dependent, remains a critical challenge. Variations in operator skill and technique can impact diagnostic reliability. Intense competition among key players in the market, leading to aggressive pricing strategies and continuous innovation demands, puts pressure on profit margins for manufacturers. The rapid pace of technological advancements, while an opportunity, also poses a challenge for healthcare providers to keep their equipment updated and for manufacturers to continually invest in R&D to stay competitive. Cybersecurity threats to networked ultrasound devices and patient data, particularly with increasing connectivity and data sharing, are a growing concern. Protecting sensitive patient information and ensuring the integrity of diagnostic data requires robust cybersecurity measures. Additionally, the challenge of disposing of outdated equipment in an environmentally responsible manner is becoming increasingly important for manufacturers and healthcare facilities.

Medical Ultrasonography Equipment Market: Segmentation Insights

The global medical ultrasonography equipment market is segmented based on Products, Applications, and Region. All the segments of the medical ultrasonography equipment market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global medical ultrasonography equipment market is divided into Trolley/cart Based, Compact, Handheld Ultrasound.

On the basis of Applications, the global medical ultrasonography equipment market is bifurcated into Therapeutic Ultrasound, Diagnostic ultrasound.

Medical Ultrasonography Equipment Market: Regional Insights

North America dominates the medical ultrasonography equipment market, holding the largest global share. This lead is driven by advanced technology adoption, strong reimbursement policies, and high rates of chronic disease. While Asia-Pacific is the fastest-growing region, North America's established healthcare infrastructure and higher spending keep it in the top position.

Medical Ultrasonography Equipment Market: Competitive Landscape

The medical ultrasonography equipment market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Medical Ultrasonography Equipment Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Esaote S.P.A.

- General Electric Company

- Hitachi Ltd.

- Boston Scientific

- Fujifilm Holdings Corporation

- Siemens Healthcare

- Koninklijke Philips N.V.

- Mindray Medical International Ltd.

- Analogic Corporation

- Toshiba Corporation

- Shimadzu Corporation

- Samsung Electronics Co. Ltd.

The Global Medical Ultrasonography Equipment Market is Segmented as Follows:

By Products

- Trolley/cart Based

- Compact

- Handheld Ultrasound

By Applications

- Therapeutic Ultrasound

- Diagnostic ultrasound

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Medical Ultrasonography Equipment Market Share by Type (2020-2026) 1.5.2 Trolley/cart Based 1.5.3 Compact 1.5.4 Handheld Ultrasound 1.6 Market by Application 1.6.1 Global Medical Ultrasonography Equipment Market Share by Application (2020-2026) 1.6.2 Therapeutic Ultrasound 1.6.3 Diagnostic ultrasound 1.7 Medical Ultrasonography Equipment Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Medical Ultrasonography Equipment Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Medical Ultrasonography Equipment Market 3.1 Value Chain Status 3.2 Medical Ultrasonography Equipment Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Medical Ultrasonography Equipment 3.2.3 Labor Cost of Medical Ultrasonography Equipment 3.2.3.1 Labor Cost of Medical Ultrasonography Equipment Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Esaote S.P.A. 4.1.1 Esaote S.P.A. Basic Information 4.1.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.1.3 Esaote S.P.A. Medical Ultrasonography Equipment Market Performance (2015-2020) 4.1.4 Esaote S.P.A. Business Overview 4.2 General Electric Company 4.2.1 General Electric Company Basic Information 4.2.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.2.3 General Electric Company Medical Ultrasonography Equipment Market Performance (2015-2020) 4.2.4 General Electric Company Business Overview 4.3 Hitachi Ltd. 4.3.1 Hitachi Ltd. Basic Information 4.3.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.3.3 Hitachi Ltd. Medical Ultrasonography Equipment Market Performance (2015-2020) 4.3.4 Hitachi Ltd. Business Overview 4.4 Boston Scientific 4.4.1 Boston Scientific Basic Information 4.4.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.4.3 Boston Scientific Medical Ultrasonography Equipment Market Performance (2015-2020) 4.4.4 Boston Scientific Business Overview 4.5 Fujifilm Holdings Corporation 4.5.1 Fujifilm Holdings Corporation Basic Information 4.5.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.5.3 Fujifilm Holdings Corporation Medical Ultrasonography Equipment Market Performance (2015-2020) 4.5.4 Fujifilm Holdings Corporation Business Overview 4.6 Siemens Healthcare 4.6.1 Siemens Healthcare Basic Information 4.6.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.6.3 Siemens Healthcare Medical Ultrasonography Equipment Market Performance (2015-2020) 4.6.4 Siemens Healthcare Business Overview 4.7 Koninklijke Philips N.V. 4.7.1 Koninklijke Philips N.V. Basic Information 4.7.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.7.3 Koninklijke Philips N.V. Medical Ultrasonography Equipment Market Performance (2015-2020) 4.7.4 Koninklijke Philips N.V. Business Overview 4.8 Mindray Medical International Ltd. 4.8.1 Mindray Medical International Ltd. Basic Information 4.8.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.8.3 Mindray Medical International Ltd. Medical Ultrasonography Equipment Market Performance (2015-2020) 4.8.4 Mindray Medical International Ltd. Business Overview 4.9 Analogic Corporation 4.9.1 Analogic Corporation Basic Information 4.9.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.9.3 Analogic Corporation Medical Ultrasonography Equipment Market Performance (2015-2020) 4.9.4 Analogic Corporation Business Overview 4.10 Toshiba Corporation 4.10.1 Toshiba Corporation Basic Information 4.10.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.10.3 Toshiba Corporation Medical Ultrasonography Equipment Market Performance (2015-2020) 4.10.4 Toshiba Corporation Business Overview 4.11 Shimadzu Corporation 4.11.1 Shimadzu Corporation Basic Information 4.11.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.11.3 Shimadzu Corporation Medical Ultrasonography Equipment Market Performance (2015-2020) 4.11.4 Shimadzu Corporation Business Overview 4.12 Samsung Electronics Co. Ltd. 4.12.1 Samsung Electronics Co. Ltd. Basic Information 4.12.2 Medical Ultrasonography Equipment Product Profiles, Application and Specification 4.12.3 Samsung Electronics Co. Ltd. Medical Ultrasonography Equipment Market Performance (2015-2020) 4.12.4 Samsung Electronics Co. Ltd. Business Overview 5 Global Medical Ultrasonography Equipment Market Analysis by Regions 5.1 Global Medical Ultrasonography Equipment Sales, Revenue and Market Share by Regions 5.1.1 Global Medical Ultrasonography Equipment Sales by Regions (2015-2020) 5.1.2 Global Medical Ultrasonography Equipment Revenue by Regions (2015-2020) 5.2 North America Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 5.3 Europe Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 5.6 South America Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 6 North America Medical Ultrasonography Equipment Market Analysis by Countries 6.1 North America Medical Ultrasonography Equipment Sales, Revenue and Market Share by Countries 6.1.1 North America Medical Ultrasonography Equipment Sales by Countries (2015-2020) 6.1.2 North America Medical Ultrasonography Equipment Revenue by Countries (2015-2020) 6.1.3 North America Medical Ultrasonography Equipment Market Under COVID-19 6.2 United States Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 6.2.1 United States Medical Ultrasonography Equipment Market Under COVID-19 6.3 Canada Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 6.4 Mexico Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7 Europe Medical Ultrasonography Equipment Market Analysis by Countries 7.1 Europe Medical Ultrasonography Equipment Sales, Revenue and Market Share by Countries 7.1.1 Europe Medical Ultrasonography Equipment Sales by Countries (2015-2020) 7.1.2 Europe Medical Ultrasonography Equipment Revenue by Countries (2015-2020) 7.1.3 Europe Medical Ultrasonography Equipment Market Under COVID-19 7.2 Germany Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.2.1 Germany Medical Ultrasonography Equipment Market Under COVID-19 7.3 UK Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.3.1 UK Medical Ultrasonography Equipment Market Under COVID-19 7.4 France Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.4.1 France Medical Ultrasonography Equipment Market Under COVID-19 7.5 Italy Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.5.1 Italy Medical Ultrasonography Equipment Market Under COVID-19 7.6 Spain Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.6.1 Spain Medical Ultrasonography Equipment Market Under COVID-19 7.7 Russia Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 7.7.1 Russia Medical Ultrasonography Equipment Market Under COVID-19 8 Asia-Pacific Medical Ultrasonography Equipment Market Analysis by Countries 8.1 Asia-Pacific Medical Ultrasonography Equipment Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Medical Ultrasonography Equipment Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Medical Ultrasonography Equipment Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Medical Ultrasonography Equipment Market Under COVID-19 8.2 China Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.2.1 China Medical Ultrasonography Equipment Market Under COVID-19 8.3 Japan Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.3.1 Japan Medical Ultrasonography Equipment Market Under COVID-19 8.4 South Korea Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.4.1 South Korea Medical Ultrasonography Equipment Market Under COVID-19 8.5 Australia Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.6 India Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.6.1 India Medical Ultrasonography Equipment Market Under COVID-19 8.7 Southeast Asia Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Medical Ultrasonography Equipment Market Under COVID-19 9 Middle East and Africa Medical Ultrasonography Equipment Market Analysis by Countries 9.1 Middle East and Africa Medical Ultrasonography Equipment Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Medical Ultrasonography Equipment Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Medical Ultrasonography Equipment Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Medical Ultrasonography Equipment Market Under COVID-19 9.2 Saudi Arabia Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 9.3 UAE Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 9.4 Egypt Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 9.5 Nigeria Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 9.6 South Africa Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 10 South America Medical Ultrasonography Equipment Market Analysis by Countries 10.1 South America Medical Ultrasonography Equipment Sales, Revenue and Market Share by Countries 10.1.1 South America Medical Ultrasonography Equipment Sales by Countries (2015-2020) 10.1.2 South America Medical Ultrasonography Equipment Revenue by Countries (2015-2020) 10.1.3 South America Medical Ultrasonography Equipment Market Under COVID-19 10.2 Brazil Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 10.2.1 Brazil Medical Ultrasonography Equipment Market Under COVID-19 10.3 Argentina Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 10.4 Columbia Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 10.5 Chile Medical Ultrasonography Equipment Sales and Growth Rate (2015-2020) 11 Global Medical Ultrasonography Equipment Market Segment by Types 11.1 Global Medical Ultrasonography Equipment Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Medical Ultrasonography Equipment Sales and Market Share by Types (2015-2020) 11.1.2 Global Medical Ultrasonography Equipment Revenue and Market Share by Types (2015-2020) 11.2 Trolley/cart Based Sales and Price (2015-2020) 11.3 Compact Sales and Price (2015-2020) 11.4 Handheld Ultrasound Sales and Price (2015-2020) 12 Global Medical Ultrasonography Equipment Market Segment by Applications 12.1 Global Medical Ultrasonography Equipment Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Medical Ultrasonography Equipment Sales and Market Share by Applications (2015-2020) 12.1.2 Global Medical Ultrasonography Equipment Revenue and Market Share by Applications (2015-2020) 12.2 Therapeutic Ultrasound Sales, Revenue and Growth Rate (2015-2020) 12.3 Diagnostic ultrasound Sales, Revenue and Growth Rate (2015-2020) 13 Medical Ultrasonography Equipment Market Forecast by Regions (2020-2026) 13.1 Global Medical Ultrasonography Equipment Sales, Revenue and Growth Rate (2020-2026) 13.2 Medical Ultrasonography Equipment Market Forecast by Regions (2020-2026) 13.2.1 North America Medical Ultrasonography Equipment Market Forecast (2020-2026) 13.2.2 Europe Medical Ultrasonography Equipment Market Forecast (2020-2026) 13.2.3 Asia-Pacific Medical Ultrasonography Equipment Market Forecast (2020-2026) 13.2.4 Middle East and Africa Medical Ultrasonography Equipment Market Forecast (2020-2026) 13.2.5 South America Medical Ultrasonography Equipment Market Forecast (2020-2026) 13.3 Medical Ultrasonography Equipment Market Forecast by Types (2020-2026) 13.4 Medical Ultrasonography Equipment Market Forecast by Applications (2020-2026) 13.5 Medical Ultrasonography Equipment Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Medical Ultrasonography Equipment

Request Sample

Medical Ultrasonography Equipment