Micro Lens Arrays Market Size, Share, and Trends Analysis Report

CAGR :

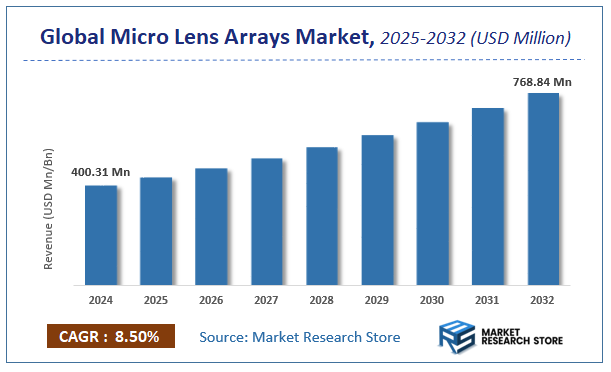

| Market Size 2024 (Base Year) | USD 400.31 Million |

| Market Size 2032 (Forecast Year) | USD 768.84 Million |

| CAGR | 8.5% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global micro lens arrays market size was valued at approximately USD 400.31 Million in 2024. The market is projected to grow significantly, reaching USD 768.84 Million by 2032, growing at a compound annual growth rate (CAGR) of 8.5% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the micro lens arrays industry.

To Get more Insights, Request a Free Sample

Micro Lens Arrays Market: Overview

The growth of the micro lens arrays market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The micro lens arrays market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the micro lens arrays market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global micro lens arrays market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2025-2032).

- In terms of revenue, the global micro lens arrays market size was valued at around USD 400.31 Million in 2024 and is projected to reach USD 768.84 Million by 2032.

- The market is projected to grow at a significant rate due to Rising adoption in 3D sensing, imaging, and optical communication systems, growing demand for AR/VR devices, and increasing use in consumer electronics are driving the Micro Lens Arrays market.

- Based on the Products, the Aspherical Microlens Array segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Telecommunications and IT segment is anticipated to command the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Micro Lens Arrays Market: Report Scope

This report thoroughly analyzes the micro lens arrays market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Micro Lens Arrays Market |

| Market Size in 2024 | USD 400.31 Million |

| Market Forecast in 2032 | USD 768.84 Million |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 215 |

| Key Companies Covered | Asahi Glass Co. Ltd (AGC), Holographix LLC, Nalux CO. LTD, Ingeneric GmbH, Jenoptik, RPC Photonics, Axetris AG, Sumita Optical Glass Inc, LIMO GmbH, Nippon Electric Glass Co. Ltd (NEG) |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Micro Lens Arrays Market: Dynamics

Key Growth Drivers :

The Micro Lens Arrays (MLAs) market is primarily driven by the escalating demand for advanced optical components across various high-growth industries. A major impetus comes from the increasing adoption of MLAs in consumer electronics, particularly in smartphone cameras, augmented reality (AR) and virtual reality (VR) headsets, and display technologies, where they enable miniaturization, improved image quality, and enhanced light management. The rapid expansion of the automotive sector, with a growing focus on advanced driver-assistance systems (ADAS), LiDAR, and head-up displays (HUDs), also fuels the demand for MLAs due to their ability to precisely control light for sensing and projection applications. Furthermore, the burgeoning photonics industry, including fiber optic communication, optical sensors, and laser applications, leverages MLAs for efficient light coupling, beam shaping, and homogenization, thus contributing significantly to market growth. The inherent advantages of MLAs, such as their compact size, lightweight nature, and ability to perform complex optical functions, make them indispensable in these high-tech applications.

Restraints :

Despite the strong growth drivers, the Micro Lens Arrays market faces several significant restraints. The high precision manufacturing processes required for producing MLAs, which often involve specialized lithography, molding, or etching techniques, result in high production costs. This can make MLAs less competitive against traditional optical components in certain cost-sensitive applications. The complexity of designing and fabricating MLAs for specific applications, particularly those requiring intricate geometries or diverse optical properties, necessitates advanced expertise and specialized equipment, which can limit the number of manufacturers and drive up development costs. Furthermore, the material limitations, such as the thermal expansion coefficients, refractive indices, and absorption characteristics of the chosen substrates, can restrict the performance and application range of MLAs in harsh environments or high-power laser systems. The lack of standardized testing and characterization methods for MLAs across the industry can also create inconsistencies in quality and performance, posing a challenge for widespread adoption.

Opportunities :

The Micro Lens Arrays market is rich with opportunities for innovation and expansion. The continuous development of advanced manufacturing techniques, such as nanoimprint lithography, two-photon polymerization, and wafer-level optics, offers the potential to reduce production costs, increase throughput, and enable the fabrication of even more complex and precise MLA structures. The growing demand for enhanced imaging and sensing capabilities in emerging fields like biomedical diagnostics, industrial inspection, and security surveillance presents new application areas for MLAs. For instance, in medical imaging, MLAs can improve the resolution and field of view of endoscopes and optical coherence tomography (OCT) systems. The integration of MLAs with other optical and electronic components to create highly compact and integrated optical modules for applications like LiDAR sensors and smart lighting systems offers significant value. Furthermore, the development of tunable and reconfigurable MLAs, which can dynamically adjust their optical properties, opens up possibilities for adaptive optics, variable focus lenses, and advanced beam steering applications, catering to a new generation of flexible optical systems.

Challenges :

The Micro Lens Arrays market is confronted with several critical challenges. Maintaining high yield and consistent quality during mass production, especially for complex MLA designs with sub-micron features, is a significant manufacturing hurdle. Defects at this scale can severely impact optical performance. The precise alignment and integration of MLAs into larger optical systems pose a considerable technical challenge, as even slight misalignments can lead to performance degradation. This requires highly accurate assembly processes and robust packaging solutions. Furthermore, ensuring the long-term reliability and durability of MLAs, especially when subjected to varying environmental conditions (e.g., temperature fluctuations, humidity, vibration) or high-power optical radiation, is crucial for widespread adoption in demanding applications. The protection of intellectual property related to unique MLA designs and fabrication processes is also a challenge in a rapidly evolving technological landscape. Lastly, the need for specialized design and simulation software, coupled with the expertise to effectively utilize it, can be a barrier for new entrants and smaller firms in the market.

Micro Lens Arrays Market: Segmentation Insights

The global micro lens arrays market is segmented based on Products, Applications, and Region. All the segments of the micro lens arrays market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global micro lens arrays market is divided into Aspherical Microlens Array, Spherical Microlens Array.

On the basis of Applications, the global micro lens arrays market is bifurcated into Telecommunications and IT, Automotive Industry, Solar Modules, Medical Industry, Others.

Micro Lens Arrays Market: Regional Insights

The Asia-Pacific region, led by China, South Korea, and Japan, is the dominant force in the global micro lens arrays market. This leadership is driven by its unparalleled electronics manufacturing ecosystem, which consumes MLA components for smartphones (e.g., in-depth sensors and compact cameras), VR/AR devices, and optical communication systems. According to market research from sources like Yole Développement and Mordor Intelligence, Asia-Pacific holds the largest market share, often estimated to be well over 50%. While North America and Europe remain critical for high-end R&D and specialized applications in medical imaging and defense, they cannot match the volume demand and integrated supply chain of Asia-Pacific. The region's concentration of key manufacturers and its role as the world's primary hub for consumer electronics production solidify its commanding market position.

Micro Lens Arrays Market: Competitive Landscape

The micro lens arrays market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Micro Lens Arrays Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Asahi Glass Co. Ltd (AGC)

- Holographix LLC

- Nalux CO. LTD

- Ingeneric GmbH

- Jenoptik

- RPC Photonics

- Axetris AG

- Sumita Optical Glass Inc

- LIMO GmbH

- Nippon Electric Glass Co. Ltd (NEG)

The Global Micro Lens Arrays Market is Segmented as Follows:

By Products

- Aspherical Microlens Array

- Spherical Microlens Array

By Applications

- Telecommunications and IT

- Automotive Industry

- Solar Modules

- Medical Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Micro Lens Arrays Market Share by Type (2020-2026) 1.5.2 Aspherical Microlens Array 1.5.3 Spherical Microlens Array 1.6 Market by Application 1.6.1 Global Micro Lens Arrays Market Share by Application (2020-2026) 1.6.2 Telecommunications and IT 1.6.3 Automotive Industry 1.6.4 Solar Modules 1.6.5 Medical Industry 1.6.6 Others 1.7 Micro Lens Arrays Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Micro Lens Arrays Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Micro Lens Arrays Market 3.1 Value Chain Status 3.2 Micro Lens Arrays Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Micro Lens Arrays 3.2.3 Labor Cost of Micro Lens Arrays 3.2.3.1 Labor Cost of Micro Lens Arrays Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Asahi Glass Co., Ltd (AGC) 4.1.1 Asahi Glass Co., Ltd (AGC) Basic Information 4.1.2 Micro Lens Arrays Product Profiles, Application and Specification 4.1.3 Asahi Glass Co., Ltd (AGC) Micro Lens Arrays Market Performance (2015-2020) 4.1.4 Asahi Glass Co., Ltd (AGC) Business Overview 4.2 Holographix LLC 4.2.1 Holographix LLC Basic Information 4.2.2 Micro Lens Arrays Product Profiles, Application and Specification 4.2.3 Holographix LLC Micro Lens Arrays Market Performance (2015-2020) 4.2.4 Holographix LLC Business Overview 4.3 Nalux CO., LTD 4.3.1 Nalux CO., LTD Basic Information 4.3.2 Micro Lens Arrays Product Profiles, Application and Specification 4.3.3 Nalux CO., LTD Micro Lens Arrays Market Performance (2015-2020) 4.3.4 Nalux CO., LTD Business Overview 4.4 Ingeneric GmbH 4.4.1 Ingeneric GmbH Basic Information 4.4.2 Micro Lens Arrays Product Profiles, Application and Specification 4.4.3 Ingeneric GmbH Micro Lens Arrays Market Performance (2015-2020) 4.4.4 Ingeneric GmbH Business Overview 4.5 Jenoptik 4.5.1 Jenoptik Basic Information 4.5.2 Micro Lens Arrays Product Profiles, Application and Specification 4.5.3 Jenoptik Micro Lens Arrays Market Performance (2015-2020) 4.5.4 Jenoptik Business Overview 4.6 RPC Photonics 4.6.1 RPC Photonics Basic Information 4.6.2 Micro Lens Arrays Product Profiles, Application and Specification 4.6.3 RPC Photonics Micro Lens Arrays Market Performance (2015-2020) 4.6.4 RPC Photonics Business Overview 4.7 Axetris AG 4.7.1 Axetris AG Basic Information 4.7.2 Micro Lens Arrays Product Profiles, Application and Specification 4.7.3 Axetris AG Micro Lens Arrays Market Performance (2015-2020) 4.7.4 Axetris AG Business Overview 4.8 Sumita Optical Glass, Inc 4.8.1 Sumita Optical Glass, Inc Basic Information 4.8.2 Micro Lens Arrays Product Profiles, Application and Specification 4.8.3 Sumita Optical Glass, Inc Micro Lens Arrays Market Performance (2015-2020) 4.8.4 Sumita Optical Glass, Inc Business Overview 4.9 LIMO GmbH 4.9.1 LIMO GmbH Basic Information 4.9.2 Micro Lens Arrays Product Profiles, Application and Specification 4.9.3 LIMO GmbH Micro Lens Arrays Market Performance (2015-2020) 4.9.4 LIMO GmbH Business Overview 4.10 Nippon Electric Glass Co., Ltd (NEG) 4.10.1 Nippon Electric Glass Co., Ltd (NEG) Basic Information 4.10.2 Micro Lens Arrays Product Profiles, Application and Specification 4.10.3 Nippon Electric Glass Co., Ltd (NEG) Micro Lens Arrays Market Performance (2015-2020) 4.10.4 Nippon Electric Glass Co., Ltd (NEG) Business Overview 5 Global Micro Lens Arrays Market Analysis by Regions 5.1 Global Micro Lens Arrays Sales, Revenue and Market Share by Regions 5.1.1 Global Micro Lens Arrays Sales by Regions (2015-2020) 5.1.2 Global Micro Lens Arrays Revenue by Regions (2015-2020) 5.2 North America Micro Lens Arrays Sales and Growth Rate (2015-2020) 5.3 Europe Micro Lens Arrays Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Micro Lens Arrays Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Micro Lens Arrays Sales and Growth Rate (2015-2020) 5.6 South America Micro Lens Arrays Sales and Growth Rate (2015-2020) 6 North America Micro Lens Arrays Market Analysis by Countries 6.1 North America Micro Lens Arrays Sales, Revenue and Market Share by Countries 6.1.1 North America Micro Lens Arrays Sales by Countries (2015-2020) 6.1.2 North America Micro Lens Arrays Revenue by Countries (2015-2020) 6.1.3 North America Micro Lens Arrays Market Under COVID-19 6.2 United States Micro Lens Arrays Sales and Growth Rate (2015-2020) 6.2.1 United States Micro Lens Arrays Market Under COVID-19 6.3 Canada Micro Lens Arrays Sales and Growth Rate (2015-2020) 6.4 Mexico Micro Lens Arrays Sales and Growth Rate (2015-2020) 7 Europe Micro Lens Arrays Market Analysis by Countries 7.1 Europe Micro Lens Arrays Sales, Revenue and Market Share by Countries 7.1.1 Europe Micro Lens Arrays Sales by Countries (2015-2020) 7.1.2 Europe Micro Lens Arrays Revenue by Countries (2015-2020) 7.1.3 Europe Micro Lens Arrays Market Under COVID-19 7.2 Germany Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.2.1 Germany Micro Lens Arrays Market Under COVID-19 7.3 UK Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.3.1 UK Micro Lens Arrays Market Under COVID-19 7.4 France Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.4.1 France Micro Lens Arrays Market Under COVID-19 7.5 Italy Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.5.1 Italy Micro Lens Arrays Market Under COVID-19 7.6 Spain Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.6.1 Spain Micro Lens Arrays Market Under COVID-19 7.7 Russia Micro Lens Arrays Sales and Growth Rate (2015-2020) 7.7.1 Russia Micro Lens Arrays Market Under COVID-19 8 Asia-Pacific Micro Lens Arrays Market Analysis by Countries 8.1 Asia-Pacific Micro Lens Arrays Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Micro Lens Arrays Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Micro Lens Arrays Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Micro Lens Arrays Market Under COVID-19 8.2 China Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.2.1 China Micro Lens Arrays Market Under COVID-19 8.3 Japan Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.3.1 Japan Micro Lens Arrays Market Under COVID-19 8.4 South Korea Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.4.1 South Korea Micro Lens Arrays Market Under COVID-19 8.5 Australia Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.6 India Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.6.1 India Micro Lens Arrays Market Under COVID-19 8.7 Southeast Asia Micro Lens Arrays Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Micro Lens Arrays Market Under COVID-19 9 Middle East and Africa Micro Lens Arrays Market Analysis by Countries 9.1 Middle East and Africa Micro Lens Arrays Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Micro Lens Arrays Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Micro Lens Arrays Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Micro Lens Arrays Market Under COVID-19 9.2 Saudi Arabia Micro Lens Arrays Sales and Growth Rate (2015-2020) 9.3 UAE Micro Lens Arrays Sales and Growth Rate (2015-2020) 9.4 Egypt Micro Lens Arrays Sales and Growth Rate (2015-2020) 9.5 Nigeria Micro Lens Arrays Sales and Growth Rate (2015-2020) 9.6 South Africa Micro Lens Arrays Sales and Growth Rate (2015-2020) 10 South America Micro Lens Arrays Market Analysis by Countries 10.1 South America Micro Lens Arrays Sales, Revenue and Market Share by Countries 10.1.1 South America Micro Lens Arrays Sales by Countries (2015-2020) 10.1.2 South America Micro Lens Arrays Revenue by Countries (2015-2020) 10.1.3 South America Micro Lens Arrays Market Under COVID-19 10.2 Brazil Micro Lens Arrays Sales and Growth Rate (2015-2020) 10.2.1 Brazil Micro Lens Arrays Market Under COVID-19 10.3 Argentina Micro Lens Arrays Sales and Growth Rate (2015-2020) 10.4 Columbia Micro Lens Arrays Sales and Growth Rate (2015-2020) 10.5 Chile Micro Lens Arrays Sales and Growth Rate (2015-2020) 11 Global Micro Lens Arrays Market Segment by Types 11.1 Global Micro Lens Arrays Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Micro Lens Arrays Sales and Market Share by Types (2015-2020) 11.1.2 Global Micro Lens Arrays Revenue and Market Share by Types (2015-2020) 11.2 Aspherical Microlens Array Sales and Price (2015-2020) 11.3 Spherical Microlens Array Sales and Price (2015-2020) 12 Global Micro Lens Arrays Market Segment by Applications 12.1 Global Micro Lens Arrays Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Micro Lens Arrays Sales and Market Share by Applications (2015-2020) 12.1.2 Global Micro Lens Arrays Revenue and Market Share by Applications (2015-2020) 12.2 Telecommunications and IT Sales, Revenue and Growth Rate (2015-2020) 12.3 Automotive Industry Sales, Revenue and Growth Rate (2015-2020) 12.4 Solar Modules Sales, Revenue and Growth Rate (2015-2020) 12.5 Medical Industry Sales, Revenue and Growth Rate (2015-2020) 12.6 Others Sales, Revenue and Growth Rate (2015-2020) 13 Micro Lens Arrays Market Forecast by Regions (2020-2026) 13.1 Global Micro Lens Arrays Sales, Revenue and Growth Rate (2020-2026) 13.2 Micro Lens Arrays Market Forecast by Regions (2020-2026) 13.2.1 North America Micro Lens Arrays Market Forecast (2020-2026) 13.2.2 Europe Micro Lens Arrays Market Forecast (2020-2026) 13.2.3 Asia-Pacific Micro Lens Arrays Market Forecast (2020-2026) 13.2.4 Middle East and Africa Micro Lens Arrays Market Forecast (2020-2026) 13.2.5 South America Micro Lens Arrays Market Forecast (2020-2026) 13.3 Micro Lens Arrays Market Forecast by Types (2020-2026) 13.4 Micro Lens Arrays Market Forecast by Applications (2020-2026) 13.5 Micro Lens Arrays Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Micro Lens Arrays

Request Sample

Micro Lens Arrays