NiCd Batteries Market Size, Share, and Trends Analysis Report

CAGR :

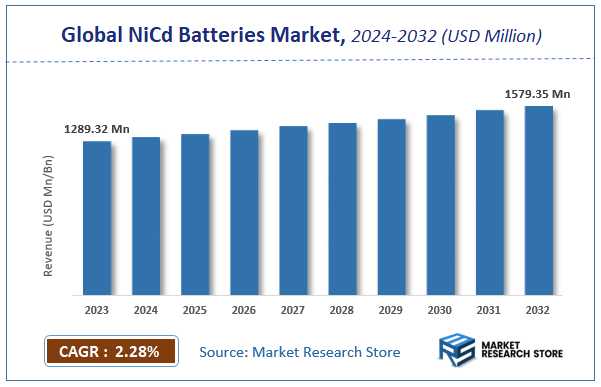

| Market Size 2023 (Base Year) | USD 1289.32 Million |

| Market Size 2032 (Forecast Year) | USD 1579.35 Million |

| CAGR | 2.28% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

NiCd Batteries Market Insights

According to Market Research Store, the global NiCd batteries market size was valued at around USD 1289.32 million in 2023 and is estimated to reach USD 1579.35 million by 2032, to register a CAGR of approximately 2.28% in terms of revenue during the forecast period 2024-2032.

The NiCd batteries report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global NiCd Batteries Market: Overview

Nickel-Cadmium (NiCd) batteries are a type of rechargeable battery that consists of nickel oxide hydroxide and cadmium as the electrodes, with an alkaline electrolyte. Known for their durability, they can withstand extreme temperatures and offer high discharge rates, making them suitable for applications requiring a steady power supply. Historically, NiCd batteries were commonly used in various consumer electronics, power tools, and medical devices due to their long cycle life and reliability. They also perform well in low temperatures, which made them ideal for aerospace and military applications.

Key Highlights

- The NiCd batteries market is anticipated to grow at a CAGR of 2.28% during the forecast period.

- The global NiCd batteries market was estimated to be worth approximately USD 1289.32 million in 2023 and is projected to reach a value of USD 1579.35 million by 2032.

- The growth of the NiCd batteries market is being driven by the increasing demand for energy storage solutions in renewable energy systems, the growth of electric vehicles, and the need for reliable backup power in sectors like telecommunications, aerospace, and defense.

- Based on the battery voltage, the 1-12V segment is growing at a high rate and is projected to dominate the market.

- On the basis of battery capacity, the 50mAh segment is projected to swipe the largest market share.

- In terms of battery size, the AA segment is expected to dominate the market.

- Based on the application, the power tools segment is expected to dominate the market.

- On the basis of end users, the industrial segment is projected to swipe the largest market share.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

NiCd Batteries Market: Dynamics

Key Growth Drivers:

- Niche Applications: NiCd batteries are still preferred in specific applications due to their robustness, ability to withstand extreme temperatures, and long shelf life. These include emergency lighting, power tools, and some specialized industrial equipment.

- Cost-Effectiveness in Certain Applications: For certain high-drain applications where replacement frequency is a major concern, NiCd batteries can be a more cost-effective choice compared to some newer technologies, despite having lower energy density.

Restraints:

- Environmental Concerns: Cadmium is a toxic heavy metal, and NiCd batteries pose environmental risks during disposal and recycling. This is a major factor limiting their widespread use and driving regulations against them.

- Lower Energy Density: Compared to newer battery technologies like Lithium-ion, NiCd batteries have significantly lower energy density, meaning they store less energy for the same size and weight.

- Memory Effect: NiCd batteries can suffer from the "memory effect," where they lose capacity if repeatedly charged before being fully discharged. This requires specific charging regimes and can be inconvenient for users.

- Strict Regulations: Due to their environmental impact, NiCd batteries are subject to increasingly stringent regulations in many countries, restricting their use and sale.

Opportunities:

- Recycling and Recovery: The focus on recycling and recovering valuable materials from spent NiCd batteries presents an opportunity for companies specializing in battery recycling.

- Advanced Manufacturing Techniques: Research into improving the manufacturing processes and reducing the cadmium content could make NiCd batteries more environmentally friendly and potentially revive their use in some niche areas.

- Specialized Applications: Focusing on specific niche applications where NiCd batteries still offer advantages (e.g., in harsh environments or for high-drain applications) could provide some market stability.

Challenges:

- Competition from Newer Technologies: Lithium-ion batteries and other advanced battery technologies are rapidly replacing NiCd batteries in most applications due to their higher energy density, longer cycle life, and lack of memory effect.

- Price Pressure: The declining prices of competing battery technologies are putting further pressure on the NiCd battery market.

- Negative Public Perception: The environmental concerns associated with cadmium have created a negative public perception of NiCd batteries, making them less attractive to consumers.

NiCd Batteries Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | NiCd Batteries Market |

| Market Size in 2023 | USD 1289.32 Million |

| Market Forecast in 2032 | USD 1579.35 Million |

| Growth Rate | CAGR of 2.28% |

| Number of Pages | 140 |

| Key Companies Covered | AEG Powertools, Bosch production tools, J&A Electronics, Power Sonic, ZEUS Battery Products, Cantec Systems, Shenzen Nova, Panasonic, Alcad, Cell Pack Solutions, M&B's Battery, GS Battery, EnerSys, Saft Batteries, Interberg Batteries, Cell-Con, DeliPow, United Power-tech, Shenzhen Suyu Technology |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

NiCd Batteries Market: Segmentation Insights

The global NiCd batteries market is divided by battery voltage, battery capacity, battery size, application, end users, and region.

Segmentation Insights by Battery Voltage

Based on battery voltage, the global NiCd batteries market is divided into 1V, 1-12V, 24V, and >24V.

The most dominant segment is the 1-12V range, which is widely used due to its versatility and cost-effectiveness. These batteries are commonly found in portable tools, consumer electronics, and various backup power applications. Their compact size, reliable performance, and ability to function effectively across a range of devices make them the preferred choice in many industries. The 1-12V batteries provide an ideal balance of power and size, driving their dominance in the market.

Next is the 1V segment, which, while not as widely used as the 1-12V range, is still significant in applications requiring small, low-power batteries. These are commonly employed in small-scale electronics like hearing aids, clocks, and other low-voltage devices. Although their market share is smaller, their specific application niche makes them indispensable in certain sectors.

The 24V segment is also quite important, especially in larger industrial and backup power systems. These batteries are typically used in more substantial applications, such as emergency lighting, telecommunications equipment, and some larger electric tools. However, their market share is smaller than the 1-12V and 1V segments, as they cater to more specialized needs.

The >24V segment, while essential in high-power applications, is the least dominant. This category includes batteries used in electric vehicles, large backup power systems, and other industrial uses that demand high energy. The larger size and higher voltage requirements mean these batteries are less common compared to the lower voltage segments, making them the smallest segment in the NiCd battery market.

Segmentation Insights by Battery Capacity

On the basis of battery capacity, the global NiCd batteries market is bifurcated into 50mAh, 50mAh-1000mAh, 1000mAh-2000mAh, and >2000mAh.

The 50mAh segment is the most dominant, primarily because it is widely used in low-power consumer electronics and devices. These small-capacity batteries are found in items such as cameras, remote controls, portable radios, and toys. Their compact size, cost-effectiveness, and reliability make them a popular choice for devices that do not require long-lasting power, contributing to their dominance in the market.

Following that is the 50mAh-1000mAh segment. This range caters to medium-power applications and is commonly used in devices such as handheld power tools, portable lighting, and some types of medical equipment. These batteries offer a higher energy output compared to the 50mAh segment, which is essential for applications requiring more extended usage and moderate power. While not as dominant as the 50mAh segment, they hold a significant share due to their versatility.

The 1000mAh-2000mAh segment caters to higher power applications, including larger power tools, consumer electronics, and some industrial equipment. These batteries provide a longer runtime and higher performance, which is essential for applications requiring sustained energy over extended periods. While they have a smaller market share compared to the lower capacity segments, they are still critical in sectors like industrial applications and higher-end consumer goods.

The >2000mAh segment, which includes the highest capacity NiCd batteries, is the least dominant. These batteries are used in specialized, high-power applications, such as large industrial machines, electric vehicles, and backup power systems. While essential for these heavy-duty uses, the segment remains small due to the niche market for such high-capacity batteries. Their applications are more specialized, resulting in a lower overall share in the NiCd battery market.

Segmentation Insights by Battery Size

On the basis of battery size, the global NiCd batteries market is bifurcated into AA, AAA, C, D, and 9V.

The AA segment is the most dominant. AA batteries are widely used in a broad range of consumer electronics, such as digital cameras, toys, flashlights, and remote controls. Their compact size and reliable power output make them highly versatile and ideal for everyday devices. Due to the high demand for portable electronics, the AA segment remains the largest and most significant in the NiCd battery market.

Next is the AAA segment, which, though smaller than AA, is still highly significant. AAA batteries are often used in smaller, more compact devices like remote controls, wireless mice, and small electronic devices. Their smaller size limits their power capacity but makes them a popular choice for low-power applications. The AAA size has a solid market share, though it doesn't quite match the dominance of the AA batteries.

The C and D segments are typically used in larger devices that require more power than AA or AAA batteries can provide. C batteries are often found in portable radios, toys, and flashlights, while D batteries are used in larger devices like lanterns, large toys, and some industrial tools. Both of these sizes cater to medium- to high-power applications, but their market share is smaller compared to the AA and AAA segments, as they are generally used in more specialized devices.

Lastly, the 9V segment, while essential for applications that need a higher voltage, is the least dominant. 9V batteries are commonly used in smoke detectors, guitar pedals, medical devices, and some radios. While critical in their specific applications, the niche usage of 9V batteries limits their overall share in the market compared to the more universally used AA and AAA sizes.

Segmentation Insights by Application

On the basis of application, the global NiCd batteries market is bifurcated into power tools, electronics, medical equipment, and toys.

The Power Tools segment is the most dominant in the NiCd battery market. NiCd batteries are widely used in cordless power tools, such as drills, saws, and sanders, due to their durability, rechargeability, and ability to deliver consistent power over a prolonged period. The power tools industry relies heavily on NiCd batteries for their high discharge rates and long operational life, making it the leading application segment.

The Electronics segment follows closely, with NiCd batteries used in a variety of consumer electronics. These include products such as portable radios, cameras, remote controls, and some handheld devices. NiCd batteries are favored for their reliability and cost-effectiveness in smaller electronics, making this application area a significant portion of the market, though not as dominant as power tools.

The Medical Equipment segment is also notable, though it holds a smaller market share compared to power tools and electronics. NiCd batteries are used in medical devices such as infusion pumps, diagnostic equipment, and portable medical tools, where a reliable, rechargeable power source is needed. While the market for NiCd batteries in medical applications is essential, it is more niche, contributing to a smaller overall segment.

The Toys segment is the least dominant, although it remains a key application area. NiCd batteries are often used in toys, especially in battery-operated ones that require moderate power. These batteries provide an economical and reliable energy source for toys, but as other technologies like lithium-ion batteries become more popular in portable electronics and toys, the NiCd segment has seen a decline in market share in this area. Despite this, it remains a significant application for NiCd batteries.

Segmentation Insights by End Users

On the basis of end users, the global NiCd batteries market is bifurcated into industrial, commercial, residential, and government.

The Industrial segment is the most dominant end-user category for NiCd batteries. These batteries are heavily utilized in industrial applications due to their robustness, reliability, and ability to function in demanding environments. NiCd batteries are used in backup power systems, emergency lighting, material handling equipment, and various types of machinery that require a steady and durable energy source. Their high discharge rates and ability to perform in extreme conditions make them a preferred choice in industrial settings, leading to this segment holding the largest share in the market.

The Commercial segment follows closely behind in terms of market dominance. NiCd batteries are commonly used in commercial applications like point-of-sale (POS) systems, portable lighting, and backup power for telecommunications. Businesses that rely on constant power, such as in retail, healthcare, and hospitality, use NiCd batteries in devices that demand reliable, rechargeable power sources. This segment has a significant share, particularly due to the growing need for uninterrupted power in commercial operations.

The Residential segment is also a key end user but holds a smaller share compared to industrial and commercial sectors. NiCd batteries are commonly used in household devices, such as cordless phones, flashlights, smoke detectors, and small household appliances. While demand for NiCd batteries in residential settings remains steady, it is outpaced by the demand from industrial and commercial users who require more power-intensive solutions.

The Government segment is the least dominant end-user category. NiCd batteries are used in some government applications, such as in military equipment, emergency services, and backup power systems for critical infrastructure. While important in these specific areas, the government sector's demand for NiCd batteries is smaller compared to other sectors, mainly due to the limited scope of use and the increasing trend toward newer technologies in government applications.

NiCd Batteries Market: Regional Insights

-

Asia-Pacific is expected to dominates the global market

The Asia-Pacific region dominates the NiCd battery market, with countries like China, Japan, and India leading the demand. The region's robust industrial growth, expanding renewable energy sector, and increasing demand for electric vehicles have significantly contributed to the market's growth. China, in particular, is a key player due to its large-scale manufacturing capabilities and heavy investments in clean energy. The proliferation of electric vehicles and the need for power backup solutions further fuel the market, making it the most dominant region globally.

North America follows as the second-largest market for NiCd batteries, driven primarily by the United States, Canada, and Mexico. The demand in this region is fueled by the growth of electric vehicles and the increasing adoption of NiCd batteries in aerospace, defense, and telecommunications sectors. The U.S. military’s reliance on NiCd batteries for various applications, including communication systems and backup power, also adds to the market's expansion. Furthermore, the rise in renewable energy applications, including solar power storage, boosts the region's need for reliable energy storage solutions like NiCd batteries.

Europe ranks third in the NiCd battery market, with strong contributions from countries such as Germany, France, and the United Kingdom. This region benefits from increasing renewable energy investments, with NiCd batteries being used in energy storage systems to support intermittent power sources like wind and solar. Additionally, Europe’s commitment to reducing carbon emissions and its push toward electric vehicles, along with its stringent regulations on battery recycling, also support the growth of NiCd batteries in various sectors, including automotive and industrial applications.

Latin America, particularly Brazil and Argentina, is experiencing a rise in industrial activities, which is pushing up the demand for NiCd batteries. The growth in these markets is largely driven by the need for reliable and durable energy storage solutions for both residential and industrial applications. The region's automotive sector, which is steadily adopting electric vehicles, also contributes to the growing use of NiCd batteries. Despite being a smaller market compared to Asia-Pacific and North America, Latin America's economic development is paving the way for future growth in NiCd battery usage.

The Middle East and Africa (MEA) region, while not as dominant as the others, shows gradual growth due to industrial expansion in countries like Saudi Arabia, the United Arab Emirates, and South Africa. The region's reliance on energy storage solutions, especially in off-grid and remote areas, drives the demand for NiCd batteries. Additionally, the rising demand for renewable energy, especially solar power, in these regions is influencing the adoption of NiCd batteries as storage solutions. The MEA market is expected to grow steadily as industrial and infrastructure projects increase across the region.

NiCd Batteries Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the NiCd batteries market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global NiCd batteries market include:

- AEG Powertools

- Bosch production tools

- J&A Electronics

- Power Sonic

- ZEUS Battery Products

- Cantec Systems

- Shenzen Nova

- Panasonic

- Alcad

- Cell Pack Solutions

- M&B's Battery

- GS Battery

- EnerSys

- Saft Batteries

- Interberg Batteries

- Cell-Con

- DeliPow

- United Power-tech

- Shenzhen Suyu Technology

The global NiCd batteries market is segmented as follows:

By Battery Voltage

- 1V

- 1-12V

- 24V

- >24V

By Battery Capacity

- 50mAh

- 50mAh-1000mAh

- 1000mAh-2000mAh

- >2000mAh

By Battery Size

- AA

- AAA

- C

- D

- 9V

By Application

- Power Tools

- Electronics

- Medical Equipment

- Toys

By End Users

- Industrial

- Commercial

- Residential

- Government

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global NiCd batteries market size was projected at approximately US$ 1289.32 million in 2023. Projections indicate that the market is expected to reach around US$ 1579.35 million in revenue by 2032.

The global NiCd batteries market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 2.28% during the forecast period from 2024 to 2032.

Asia-Pacific is expected to dominate the global NiCd batteries market.

The global NiCd batteries market is driven by the increasing demand for energy storage solutions in renewable energy systems, the growth of electric vehicles, and the need for reliable backup power in sectors like telecommunications, aerospace, and defense. Additionally, their durability and performance in extreme conditions boost their adoption.

Some of the prominent players operating in the global NiCd batteries market are; AEG Powertools, Bosch production tools, J&A Electronics, Power Sonic, ZEUS Battery Products, Cantec Systems, Shenzen Nova, Panasonic, Alcad, Cell Pack Solutions, M&B's Battery, GS Battery, EnerSys, Saft Batteries, Interberg Batteries, Cell-Con, DeliPow, United Power-tech, Shenzhen Suyu Technology, and others.

The global NiCd batteries market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

NiCd Batteries

Request Sample

NiCd Batteries