Nuclear Grade Zirconium Market Size, Share, and Trends Analysis Report

CAGR :

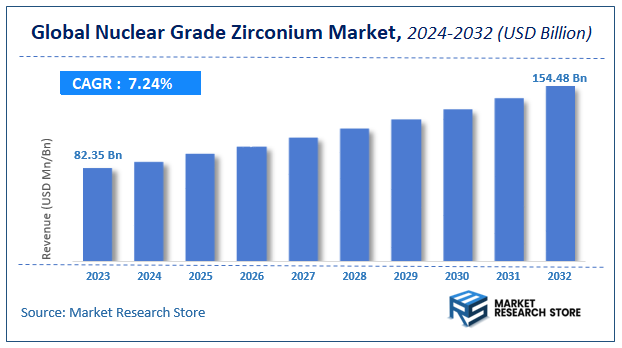

| Market Size 2023 (Base Year) | USD 82.35 Billion |

| Market Size 2032 (Forecast Year) | USD 154.48 Billion |

| CAGR | 7.24% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Nuclear Grade Zirconium Market Insights

According to Market Research Store, the global nuclear grade zirconium market size was valued at around USD 82.35 billion in 2023 and is estimated to reach USD 154.48 billion by 2032, to register a CAGR of approximately 7.24% in terms of revenue during the forecast period 2024-2032.

The nuclear grade zirconium report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032

To Get more Insights, Request a Free Sample

Global Nuclear Grade Zirconium Market: Overview

The Nuclear Grade Zirconium market is experiencing steady growth, driven by the increasing demand for high-performance materials in nuclear power generation. Nuclear-grade zirconium, primarily derived from zirconium alloys with minimal hafnium content, is used in nuclear reactors due to its exceptional corrosion resistance, high-temperature stability, and low neutron absorption properties. These characteristics make it an ideal material for fuel rod cladding and other critical reactor components in both pressurized water reactors (PWRs) and boiling water reactors (BWRs).

The growth of market is fueled by the global expansion of nuclear power infrastructure, particularly in regions aiming to enhance energy security and reduce carbon emissions. The increasing number of nuclear power plants, along with the rising demand for efficient and long-lasting reactor materials, is driving the need for high-purity zirconium alloys. Additionally, advancements in nuclear reactor technology, such as small modular reactors (SMRs) and next-generation reactors, are expected to create new opportunities for nuclear-grade zirconium suppliers.

Key Highlights

- The nuclear grade zirconium market is anticipated to grow at a CAGR of 7.24% during the forecast period.

- The global nuclear grade zirconium market was estimated to be worth approximately USD 82.35 billion in 2023 and is projected to reach a value of USD 154.48 billion by 2032.

- The growth of the nuclear grade zirconium market is being driven by the increasing global focus on nuclear energy as a cleaner alternative to fossil fuels, leading to new nuclear power plant constructions and the refurbishment of existing ones.

- Based on the product, the zirconium alloy segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the nuclear reactors segment is projected to swipe the largest market share.

- In terms of end-user, the nuclear power plants segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Nuclear Grade Zirconium Market: Dynamics

Key Drivers

- Nuclear Power Plant Construction: The construction of new nuclear power plants globally, particularly in developing economies, is a primary driver. Zirconium alloys are essential components in nuclear reactors, including fuel cladding and structural components.

- Refurbishment and Upgrades: The ongoing refurbishment and upgrades of existing nuclear power plants also contribute to the demand for nuclear-grade zirconium, as components need replacement and modernization.

- Nuclear Waste Management: Zirconium alloys are used in the storage and disposal of spent nuclear fuel, which is a growing concern globally, creating further market opportunities.

Restraints

- Nuclear Safety Concerns: Public concerns about the safety of nuclear power, particularly after incidents like Chernobyl and Fukushima, can hinder the growth of the nuclear industry and, consequently, the demand for zirconium.

- High Costs: The high cost of nuclear power plant construction and operation, including the specialized materials like nuclear-grade zirconium, can be a barrier to wider adoption.

- Stringent Regulations: The nuclear industry is heavily regulated, and compliance with safety and environmental regulations can be costly and time-consuming for zirconium producers and nuclear plant operators.

- Competition from Alternatives: In some specific applications, zirconium might face competition from alternative materials, though its unique properties often make it the preferred choice in core reactor components.

Opportunities

- Small Modular Reactors (SMRs): The emergence of SMRs, which are smaller and potentially safer than traditional reactors, could create new opportunities for zirconium demand.

- Advanced Reactor Designs: Development of advanced reactor designs, including Generation IV reactors, which may require different zirconium alloys with enhanced properties, offers potential for innovation and market growth.

- Nuclear Fusion Research: Ongoing research in nuclear fusion, which also uses specialized materials, could create future demand for zirconium or zirconium-based alloys.

- Global Energy Demand: The increasing global energy demand, especially in developing countries, could drive further investment in nuclear power and thus the demand for zirconium.

Challenges

- Maintaining Quality and Purity: Nuclear-grade zirconium requires extremely high purity and precise manufacturing processes. Maintaining this quality and consistency is crucial.

- Nuclear Waste Disposal: The long-term disposal of spent nuclear fuel containing zirconium remains a significant challenge for the nuclear industry.

- Public Perception: Negative public perception of nuclear power remains a significant hurdle for the industry and can influence investment and growth, impacting the market for zirconium.

- Supply Chain Security: Ensuring a secure and reliable supply chain for zirconium ore and the specialized manufacturing processes needed for nuclear-grade material is crucial.

Nuclear Grade Zirconium Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nuclear Grade Zirconium Market |

| Market Size in 2023 | USD 82.35 Billion |

| Market Forecast in 2032 | USD 154.48 Billion |

| Growth Rate | CAGR of 7.24% |

| Number of Pages | 180 |

| Key Companies Covered | Orano, Westinghouse, ATI, Chepetsky Mechanical Plant, Nuclear Fuel Complex, SNWZH, CNNC Jinghuan, Guangdong Orient Zirconic, Aohan China Titanium Industry, Baoti Huashen |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nuclear Grade Zirconium Market: Segmentation Insights

The global nuclear grade zirconium market is divided by product, application, end-user and region.

Segmentation Insights by Product

Based on product, the global nuclear grade zirconium market is divided into zirconium alloy, zirconium sponge, and zirconium powder.

The Zirconium Alloy segment dominates the Nuclear Grade Zirconium Market due to its extensive use in nuclear reactors. Zirconium alloys, particularly Zircaloy, are widely used as cladding material for nuclear fuel rods in light water reactors (LWRs) due to their excellent corrosion resistance, high strength, and low neutron absorption properties. The increasing global demand for nuclear energy, along with advancements in reactor technologies, has further solidified the dominance of zirconium alloys in the market.

The Zirconium Sponge segment holds a significant share as it serves as the primary raw material for manufacturing zirconium alloys. It undergoes further processing to produce high-purity zirconium for nuclear applications. While its direct application is limited, its role in the supply chain makes it a crucial part of the market.

The Zirconium Powder segment, though smaller in comparison, is used in specialized applications, including coatings, nuclear fuel fabrication, and advanced reactor designs. Its demand is expected to grow with the development of next-generation nuclear technologies, but it remains a niche market within the broader nuclear-grade zirconium sector.

Segmentation Insights by Application

On the basis of application, the global nuclear grade zirconium market is bifurcated into nuclear reactors, medical equipment, industrial applications, and others.

The Nuclear Reactors segment dominates the Nuclear Grade Zirconium Market due to its crucial role in nuclear fuel cladding and structural components within reactors. Zirconium alloys, particularly Zircaloy, are extensively used in light water reactors (LWRs) because of their exceptional corrosion resistance, high-temperature stability, and low neutron absorption properties. The increasing global demand for nuclear energy, along with the expansion of nuclear power plants and advancements in next-generation reactors, continues to drive the demand for nuclear-grade zirconium in this segment.

The Medical Equipment segment holds a smaller but significant share, as zirconium is used in medical applications such as implants, prosthetics, and radiology equipment. Its biocompatibility, strength, and corrosion resistance make it suitable for orthopedic and dental applications, though its consumption in this sector remains lower compared to nuclear reactors.

The Industrial Applications segment includes the use of nuclear-grade zirconium in chemical processing, aerospace, and specialized high-temperature environments. While this segment has niche applications, its market share is relatively smaller compared to nuclear reactors, as the stringent purity requirements for nuclear-grade zirconium limit its use in broader industrial applications.

Segmentation Insights by End-User

On the basis of End-User, the global nuclear grade zirconium market is bifurcated into nuclear power plants, healthcare, aerospace, and chemical processing.

The Nuclear Power Plants segment dominates the Nuclear Grade Zirconium Market, driven by its critical role in nuclear reactor operations. Nuclear-grade zirconium alloys, such as Zircaloy, are extensively used in fuel rod cladding and reactor components due to their low neutron absorption, high-temperature resistance, and exceptional corrosion resistance. The increasing demand for clean energy and the expansion of nuclear power projects worldwide continue to propel the growth of this segment.

The Healthcare segment holds a smaller but growing share, as zirconium is used in medical implants, dental prosthetics, and radiological equipment. Its biocompatibility, strength, and resistance to corrosion make it ideal for applications in orthopedic and dental surgery, though its market size remains limited compared to nuclear applications.

The Aerospace segment leverages nuclear-grade zirconium for its high-temperature stability and lightweight properties, making it suitable for specialized aerospace components and coatings. While it is not a primary material in aerospace, its use in high-performance applications, such as turbine engines and heat shields, contributes to steady demand.

The Chemical Processing segment utilizes zirconium in reactors, piping, and corrosion-resistant equipment for handling aggressive chemicals and high-temperature processes. However, this segment has a relatively smaller share as industrial-grade zirconium is often sufficient for most chemical applications, reducing the demand for the high-purity nuclear-grade variant.

Nuclear Grade Zirconium Market: Regional Insights

- North America is expected to dominates the global market

North America continues to be the dominant region in the Nuclear Grade Zirconium Market, driven by the well-established nuclear power sector in the United States and Canada. The U.S. remains one of the world's largest nuclear energy producers, with an extensive network of operational reactors requiring a steady supply of zirconium-based components, particularly for fuel cladding. Government support for nuclear energy, coupled with investments in next-generation reactor designs such as small modular reactors (SMRs), is fueling market growth. Additionally, collaborations between private companies and national laboratories for advanced zirconium alloys further enhance the region’s market position. However, the dependence on imports for raw materials and stringent regulatory approvals for nuclear-grade materials pose certain challenges.

Europe is another key market, with major demand coming from countries such as France, Russia, and the UK, which have strong nuclear power programs. France, in particular, heavily relies on nuclear energy, accounting for a substantial portion of its electricity generation. Russia's expanding nuclear power industry and expertise in reactor technology contribute to steady demand for nuclear-grade zirconium, especially for its international projects. Additionally, European Union initiatives to promote low-carbon energy sources, including nuclear power, support the long-term outlook of the market. Research efforts to develop accident-tolerant fuel (ATF) cladding and improve reactor safety standards are also driving innovation in zirconium-based materials. However, environmental concerns and regulatory challenges related to nuclear power plant expansions could impact future market growth.

Asia Pacific is the fastest-growing region in the Nuclear Grade Zirconium Market, driven by the rapid expansion of nuclear power capacity in China, India, South Korea, and Japan. China, in particular, has one of the world’s most aggressive nuclear power expansion programs, with numerous new reactors under construction and planned for the future. The country is increasing its domestic production capacity for zirconium alloys to reduce dependency on imports. India is also investing in nuclear power to meet its growing energy demands, creating additional opportunities for nuclear-grade zirconium suppliers. Japan, after gradually reviving its nuclear power sector post-Fukushima, is contributing to market growth through reactor restarts and safety-enhancement measures. South Korea remains a key player due to its well-established nuclear industry and international reactor export initiatives. The growing adoption of next-generation reactor technologies, including high-temperature gas-cooled reactors (HTGRs) and molten salt reactors (MSRs), is expected to further drive zirconium demand in the region.

Latin America has a relatively small but developing market, with Brazil and Argentina being the primary contributors. Brazil operates nuclear power plants and has long-term plans for expanding its nuclear capacity, which will sustain demand for nuclear-grade zirconium. Argentina, known for its expertise in small modular reactor (SMR) technology, continues to invest in its nuclear energy sector, creating potential opportunities for zirconium-based reactor components. However, economic instability and limited domestic zirconium production capacity present challenges to market growth in the region.

The Middle East & Africa is an emerging market for nuclear-grade zirconium, with countries such as the UAE and South Africa showing interest in nuclear power development. The UAE has launched its first nuclear power plant, the Barakah Nuclear Energy Plant, increasing demand for reactor materials, including zirconium. South Africa, which operates Africa’s only commercial nuclear power station, is exploring options for expanding its nuclear energy capacity. Additionally, Saudi Arabia and Egypt are evaluating nuclear power as part of their long-term energy strategies, potentially creating new opportunities for zirconium suppliers in the future. However, regulatory complexities and geopolitical uncertainties could impact the pace of nuclear energy expansion in this region.

Nuclear Grade Zirconium Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the nuclear grade zirconium market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global nuclear grade zirconium market include:

- Advanced Metallurgical Group (AMG)

- Alkane Resources Ltd.

- Aohan China Titanium Industry

- ATI

- Baoti Huashen

- Chepetsky Mechanical Plant

- CNNC Jinghuan

- Framatome (formerly Areva NP)

- Guangdong Orient Zirconic

- Indústrias Nucleares do Brasil (INB)

- Japan Nuclear Fuel Limited (JNFL)

- Luxfer Holdings PLC

- Nuclear Fuel Complex

- Nuclear Materials Authority (NMA)

- Nuclear Power Corporation of India Limited (NPCIL)

- Orano

- Shanghai No. 5 Steel Plant

- SNWZH

- State Atomic Energy Corporation ROSATOM

- Wah Chang (a subsidiary of ATI Inc.)

- Westinghouse

- Westinghouse Electric Company LLC

- Zirco Products

- Zirconium Chemicals Pvt. Ltd.

The global nuclear grade zirconium market is segmented as follows:

By Product

- Zirconium Alloy

- Zirconium Sponge

- Zirconium Powder

By Application

- Nuclear Reactors

- Medical Equipment

- Industrial Applications

- Others

By End-User

- Nuclear Power Plants

- Healthcare

- Aerospace

- Chemical Processing

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Nuclear Grade Zirconium

Request Sample

Nuclear Grade Zirconium