Plastic Extrusion Molded Parts Market Size, Share, and Trends Analysis Report

CAGR :

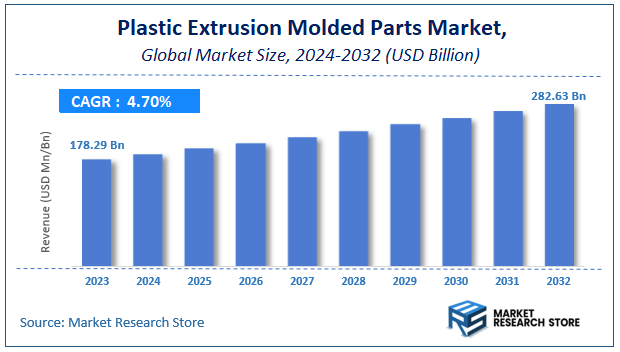

| Market Size 2023 (Base Year) | USD 178.29 Billion |

| Market Size 2032 (Forecast Year) | USD 282.63 Billion |

| CAGR | 4.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Plastic Extrusion Molded Parts Market Insights

According to Market Research Store, the global plastic extrusion molded parts market size was valued at around USD 178.29 million in 2023 and is estimated to reach USD 282.63 million by 2032, to register a CAGR of approximately 4.7% in terms of revenue during the forecast period 2024-2032.

The plastic extrusion molded parts report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Plastic Extrusion Molded Parts Market: Overview

This growth is driven by the rising demand for Plastic Extrusion Molded Parts, attributed to its increasing utilization in diverse applications and industries across global markets. The report highlights lucrative opportunities within the Plastic Extrusion Molded Parts Market at the country level and provides detailed insights into cost structures, key segments, emerging trends, regional dynamics, and the commercial advancements of leading global players during the forecast period from 2024 to 2032.

The Plastic Extrusion Molded Parts Market report presents comprehensive insights into an industry or industries, combining quantitative and qualitative analysis over a forecast period (2024-2032). It examines various critical factors, including product pricing, market penetration at country and regional levels, GDP impact, parent and sub-market dynamics, end-use industries, major players, consumer behavior, and economic, political, and social conditions. The Plastic Extrusion Molded Parts Market report is structured into multiple sections to deliver a well-rounded perspective, analyzing the market from every possible angle.

Key sections of the Plastic Extrusion Molded Parts Market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offers in-depth details based on Type, Mold Shape, Mold Typ, Extrusion Method, End-use Industry and other relevant classifications to support strategic marketing initiatives. Market Outlook provides a thorough analysis of market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. Internal factors (drivers and restraints) and external factors (opportunities and challenges) influencing the market are thoroughly examined. Competitive Landscape and Company Profiles highlight major players, their strategies, and market positioning to inform investment and business development decisions. This report also identifies trends driving innovation, outlines new business opportunities, and evaluates investment prospects in the Plastic Extrusion Molded Parts Market during the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global Plastic Extrusion Molded Parts market is estimated to grow annually at a CAGR of around 4.7% over the forecast period (2024-2032).

- In terms of revenue, the global Plastic Extrusion Molded Parts market size was valued at around USD 178.29 Billion in 2023 and is projected to reach USD 282.63 Billion by 2032.

- The market is projected to grow at a significant rate due to rising demand from industries such as construction, automotive, and electronics.

- Based on the Type, the Solid Parts (Round, Square, Hexagonal, Rectangular), Hollow Pipe & Tubing, Sheets & Films, Windshield Wipers and Squeegees, Automotive Trim, Conduit and Cable Protectors and Others segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Mold Shape, the T-Sections, U-Sections, Square Sections, I-Sections, L-Sections, Circular Sections and Others segment is anticipated to command the largest market share.

- In terms of Mold Typ, the Unscrewing Molds, Hot Runner Molds, Cold Runner Molds, Insulated Runner Molds and Others segment is anticipated to command the largest market share.

- By Extrusion Method, the Tubing Extrusion, Blow Film Extrusion, Sheet Film Extrusion, Over Jacket Extrusion and Others segment is anticipated to command the largest market share.

- Based on the End-use Industry, the Construction (Residential, Commercial, Industrial, Others), Automotive (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicles), Electrical & Electronics (Semiconductor, Appliances, Others), Packaging, Food & Beverage, Agriculture, Medical an segment is projected to swipe the largest market share.

- Based on region, Dominated Region is projected to dominate the global market during the forecast period.

Global Plastic Extrusion Molded Parts Market: Overview

Plastic extrusion molded parts are components manufactured using the plastic extrusion process, where raw plastic material is melted and forced through a shaped die to form continuous profiles. This method is widely used for producing complex cross-sectional parts such as pipes, tubing, window frames, automotive trim, and various industrial components. The extrusion process allows for high-volume production with consistent quality, making it a cost-effective solution for a wide range of applications across industries like automotive, construction, packaging, and consumer goods.

Key Highlights

- The plastic extrusion molded parts market is anticipated to grow at a CAGR of 4.7% during the forecast period.

- The global plastic extrusion molded parts market was estimated to be worth approximately USD 178.29 million in 2023 and is projected to reach a value of USD 282.63 million by 2032.

- The growth of the plastic extrusion molded parts market is being driven by increasing demand from automotive, construction, and packaging industries, cost-effective manufacturing, and advancements in extrusion technology.

- Based on the type, the hollow pipe & tubing segment is growing at a high rate and is projected to dominate the market.

- On the basis of mold shape, the circular sections segment is projected to swipe the largest market share.

- In terms of mold type, the hot runner molds segment is expected to dominate the market.

- Based on the extrusion method, the tubing extrusion segment is expected to dominate the market.

- On the basis of end-user, the construction segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Plastic Extrusion Molded Parts Market: Dynamics

Key Growth Drivers

- Growing Demand in Automotive Industry: Plastic extrusion molded parts are widely used in automotive components (e.g., seals, gaskets, trim) due to their lightweight, durability, and cost-effectiveness.

- Expansion of Construction Sector: Increasing use of extruded plastic parts in construction (e.g., pipes, profiles, insulation materials) for their corrosion resistance and ease of installation.

- Rise in Packaging Applications: Extruded plastic films, sheets, and containers are in high demand for food, beverage, and consumer goods packaging.

- Technological Advancements: Innovations in extrusion molding technologies (e.g., co-extrusion, micro-extrusion) improve product quality, precision, and efficiency.

- Sustainability Trends: Growing adoption of recyclable and bio-based plastics in extrusion molding to meet environmental regulations and consumer preferences.

Restraints

- Volatility in Raw Material Prices: Fluctuations in the prices of polymers (e.g., polyethylene, polypropylene) impact production costs and profitability.

- Environmental Concerns: Non-biodegradable plastics used in extrusion molding contribute to pollution, leading to stricter regulations and potential bans.

- Competition from Alternative Materials: Metals and composites are sometimes preferred for their superior strength and thermal properties in certain applications.

- High Initial Investment: Setting up extrusion molding facilities requires significant capital investment, which can be a barrier for small manufacturers.

Opportunities

- Development of Bio-based Plastics: Increasing R&D in biodegradable and bio-based plastics offers sustainable alternatives for extrusion molding.

- Emerging Markets: Rapid industrialization and urbanization in regions like Asia-Pacific and Latin America create significant growth opportunities.

- Customization and Innovation: Demand for customized and high-performance extruded parts in industries like healthcare, electronics, and aerospace.

- Circular Economy Initiatives: Opportunities to develop closed-loop recycling systems for plastic extrusion molded parts.

- Electric Vehicles (EVs): Growth in EV production drives demand for lightweight and durable extruded plastic components.

Challenges

- Regulatory Compliance: Meeting stringent environmental and safety regulations across different regions can be complex and costly.

- Technical Limitations: Some plastics may not meet the high thermal and mechanical requirements for advanced applications.

- Recycling Infrastructure: Lack of efficient recycling systems for plastic extrusion molded parts hinders sustainability efforts.

- Market Competition: Intense competition from low-cost manufacturers and alternative materials can pressure profit margins.

- Supply Chain Disruptions: Fluctuations in raw material availability and logistics challenges can impact production and delivery.

This report thoroughly analyzes the Plastic Extrusion Molded Parts Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

Plastic Extrusion Molded Parts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Extrusion Molded Parts Market |

| Market Size in 2023 | USD 178.29 Billion |

| Market Forecast in 2032 | USD 282.63 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 156 |

| Key Companies Covered | Duros Development, Nation Manufacturing and Industrial Products Corporation, Ply Gem Holdings, Mitsuwa Chemical, Eaton, MHG Asia Pacific, Rehau Incorporated, Vision Group, Denso, Foton Philippines, Isuzu, Roop Polymers |

| Segments Covered | By Type, By Mold Shape, By Mold Typ, By Extrusion Method, By End-use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plastic Extrusion Molded Parts Market: Segmentation Insights

The global plastic extrusion molded parts market is divided by type, mold shape, mold type, extrusion method, end-user, and region.

Segmentation Insights by Type

Based on type, the global plastic extrusion molded parts market is divided into solid parts, hollow pipe & tubing, sheets & films, windshield wipers & squeegees, automotive trim, conduit & cable protectors, and others.

The most dominant segment in the plastic extrusion molded parts market by type is Hollow Pipe & Tubing. This segment holds the largest market share due to its extensive application in industries such as construction, plumbing, automotive, and electrical. Hollow pipes and tubing are widely used for fluid transportation, electrical cable insulation, and structural components, making them indispensable across multiple sectors. The demand for lightweight, durable, and corrosion-resistant piping solutions continues to drive the growth of this segment.

Following closely, Sheets & Films form the second-largest segment. These materials are used in packaging, automotive interiors, construction materials, and medical applications. The growth of the packaging industry, especially in food and pharmaceuticals, has significantly contributed to the rising demand for plastic sheets and films. Their flexibility, transparency, and moisture resistance make them a preferred choice for various applications.

Solid Parts rank third in dominance, covering a wide range of applications in machinery, consumer goods, and industrial equipment. These parts include custom-molded plastic components used in various structural and functional roles. The increasing adoption of plastics to replace metal components for weight reduction and cost savings has driven the demand for solid parts.

Next, Automotive Trim represents a crucial segment, as plastic extrusion is widely used to manufacture interior and exterior trim components such as dashboards, door panels, and bumpers. The automotive industry’s focus on lightweight materials to improve fuel efficiency and vehicle aesthetics has led to increased use of plastic trim.

Windshield Wipers & Squeegees follow in market share, primarily due to their applications in the automotive and household cleaning sectors. These products require high durability, flexibility, and weather resistance, which plastic extrusion effectively provides.

Conduit & Cable Protectors hold a smaller yet significant share, as they are essential in safeguarding electrical wiring and cables. With the increasing infrastructure development and industrial automation, the demand for protective conduits is growing, albeit at a slower rate compared to other segments.

Segmentation Insights by Mold Shape

On the basis of mold shape, the global plastic extrusion molded parts market is bifurcated into t-sections, u-sections, square sections, i-sections, l-sections, circular sections, and others.

The most dominant segment in the plastic extrusion molded parts market by mold shape is Circular Sections. Circular extrusions, such as pipes, tubes, and cable protectors, are widely used in industries like construction, plumbing, automotive, and electrical. Their versatility in transporting fluids, insulating electrical wires, and acting as structural components drives their strong market demand. The preference for lightweight, corrosion-resistant, and durable materials in these industries further fuels the growth of this segment.

Following circular sections, Square Sections hold a significant market share. These extruded profiles are commonly used in framing, support structures, furniture, and industrial applications. Square-shaped extrusions offer high structural integrity and ease of assembly, making them suitable for various engineering and architectural applications.

T-Sections rank third in dominance, particularly in construction and automotive applications. They are widely used for reinforcement, joining, and providing additional structural strength to different assemblies. Their ability to distribute weight efficiently makes them an ideal choice for load-bearing applications.

U-Sections are next, primarily utilized in framing, sealing, and protective edge applications. They are commonly found in doors, windows, automotive trim, and structural reinforcements. The demand for flexible and impact-resistant U-section extrusions continues to grow in construction and industrial applications.

I-Sections follow, playing a crucial role in structural applications requiring high strength-to-weight ratios. They are commonly used in load-bearing structures, bridges, and industrial frameworks. Though not as widely used as circular or square sections, I-sections remain important in specialized applications requiring high durability.

L-Sections are widely used in corner reinforcement, edge protection, and trim applications. Their ability to provide stability and support in various assembly structures makes them a preferred choice in furniture, construction, and machinery. However, their market share is relatively smaller compared to other sections.

Segmentation Insights by Mold Type

Based on mold type, the global plastic extrusion molded parts market is divided into unscrewing molds, hot runner molds, cold runner molds, insulated runner molds, and others.

The most dominant segment in the plastic extrusion molded parts market by mold type is Hot Runner Molds. These molds are widely used in high-volume manufacturing because they improve cycle time, reduce material waste, and enhance part consistency. Industries such as automotive, packaging, medical devices, and consumer goods favor hot runner molds for their efficiency in producing high-quality plastic parts with minimal defects. The ability to maintain molten plastic in the system ensures faster injection and reduced scrap, making them the preferred choice for manufacturers.

Cold Runner Molds follow as the second most significant segment. These molds are simpler and more cost-effective than hot runner molds, making them ideal for small to medium production runs. Cold runner molds are commonly used in industries where material cost and tooling simplicity are prioritized, such as general consumer goods and basic industrial applications. However, they generate more material waste due to the presence of runners, which need to be trimmed and recycled.

Next, Unscrewing Molds hold a strong position, particularly in the production of threaded plastic parts. These molds are crucial for manufacturing caps, closures, bottle lids, and threaded components used in packaging, automotive, and medical industries. Their ability to produce intricate threaded parts with precision makes them essential for industries requiring secure fastening and sealing solutions.

Insulated Runner Molds rank lower in market share but still play a critical role in specialized applications. These molds combine aspects of both hot and cold runner systems, maintaining material temperature to reduce waste while offering more cost-effective tooling. They are commonly used in applications where material properties must be preserved, such as high-performance plastics used in electronics and medical components.

Segmentation Insights by Extrusion Method

On the basis of extrusion method, the global plastic extrusion molded parts market is bifurcated into tubing extrusion, blow film extrusion, sheet film extrusion, over jacket extrusion, and others.

The most dominant segment in the plastic extrusion molded parts market by extrusion method is Tubing Extrusion. This method is widely used in industries such as medical, automotive, construction, and industrial applications for manufacturing plastic tubes and pipes. Tubing extrusion is preferred for its ability to produce continuous hollow structures with consistent wall thickness, making it ideal for fluid transportation, electrical insulation, and structural components. The demand for lightweight, durable, and corrosion-resistant tubing in plumbing, HVAC, and medical applications further drives the growth of this segment.

Following tubing extrusion, Blow Film Extrusion holds a significant share of the market. This method is primarily used in packaging applications, including plastic bags, shrink wrap, and agricultural films. The increasing demand for flexible and lightweight packaging solutions, particularly in the food, pharmaceutical, and consumer goods industries, has led to steady growth in blow film extrusion. Its ability to produce thin, high-strength films with excellent barrier properties makes it a preferred choice for many manufacturers.

Sheet Film Extrusion ranks third, playing a crucial role in producing plastic sheets used in construction, automotive interiors, signage, and thermoforming applications. This method enables the production of durable, lightweight sheets that can be further processed into various end products. With the rising demand for protective barriers, insulation panels, and display materials, sheet film extrusion continues to be a key segment in the market.

Over Jacket Extrusion follows, primarily used in the production of protective coatings for wires, cables, and fiber optics. The growing need for durable and heat-resistant cable insulation in telecommunications, power distribution, and industrial machinery contributes to the steady demand for this extrusion method. However, its market share is relatively smaller compared to tubing and film extrusion due to its specialized applications.

Segmentation Insights by End-user

Based on end-user, the global plastic extrusion molded parts market is divided into construction, automotive, packaging, food & beverage, agriculture, medical, and others.

The most dominant segment in the plastic extrusion molded parts market by end-user is Construction. The construction industry extensively uses extruded plastic products such as pipes, conduits, window frames, wall panels, and insulation materials. The demand for lightweight, durable, and corrosion-resistant materials in infrastructure projects, residential buildings, and commercial developments drives the growth of this segment. The increasing adoption of PVC and other plastic-based materials for plumbing, electrical insulation, and structural applications further strengthens its dominance.

Following construction, Automotive is a significant segment, as plastic extrusion plays a crucial role in manufacturing lightweight and cost-effective components such as trims, seals, tubing, and protective covers. The push for fuel efficiency and electric vehicle (EV) advancements has accelerated the use of extruded plastics to replace heavier metal parts, reducing vehicle weight and improving performance. The automotive industry's continuous innovation in material engineering further contributes to this segment's growth.

Packaging ranks third in market share, primarily due to the extensive use of plastic films, sheets, and containers in the food, pharmaceutical, and consumer goods industries. The demand for flexible, lightweight, and cost-effective packaging solutions has driven the adoption of extruded plastic materials, particularly in food preservation, product protection, and sustainable packaging alternatives. The rise of e-commerce and increasing concerns about food safety have further boosted demand in this sector.

Food & Beverage follows closely, as extruded plastics are widely used in manufacturing food-grade containers, packaging films, and processing equipment components. The demand for hygienic, moisture-resistant, and cost-effective materials in food storage and distribution supports the growth of this segment. Regulatory compliance and the shift toward sustainable materials also impact innovation in food and beverage packaging.

Agriculture holds a steady position, with applications such as irrigation tubing, greenhouse films, and protective coverings. The need for durable and UV-resistant materials to improve agricultural productivity has led to increased adoption of extruded plastic components. The expansion of precision farming and greenhouse farming further drives this segment's growth.

Medical is a specialized yet growing segment, driven by the demand for extruded plastic tubing, medical-grade films, and protective enclosures used in medical devices and pharmaceutical packaging. The rise in healthcare infrastructure, advancements in medical technology, and stringent regulations for biocompatible materials contribute to the steady expansion of this sector.

Plastic Extrusion Molded Parts Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific stands as the dominant force in the plastic extrusion molded parts market, driven by rapid industrialization and urbanization in countries like China, India, and Japan. The region's burgeoning automotive, construction, and packaging industries have significantly increased the demand for extruded plastic components. China, in particular, has established itself as a major producer and consumer of these parts, benefiting from a robust manufacturing base and favorable government policies that promote industrial growth. Additionally, the availability of cost-effective labor and raw materials has attracted substantial investments, further solidifying Asia Pacific's leading position in the market.

North America holds a significant share of the plastic extrusion molded parts market, with the United States and Canada at the forefront. The region's well-established automotive and construction sectors are primary consumers of extruded plastic components. Technological advancements and a focus on sustainability have led to the development of high-quality, recyclable extrusion molded parts. Moreover, the rise of electric vehicles and smart infrastructure projects has spurred additional demand, as manufacturers seek lightweight and durable materials to enhance performance and efficiency.

Europe represents a substantial portion of the plastic extrusion molded parts market, characterized by its advanced automotive and construction industries. The region's emphasis on sustainability and circular economy principles has driven the demand for eco-friendly and recyclable plastic solutions. Stringent environmental regulations have compelled manufacturers to innovate and adopt sustainable practices, leading to the development of high-quality extrusion molded parts that meet both performance and environmental standards. Additionally, the growth of the electrical and electronics industry in Europe has further bolstered the demand for these components.

Central & South America are experiencing growth in the plastic extrusion molded parts market, propelled by expanding manufacturing sectors in countries such as Brazil and Argentina. The automotive industry, in particular, has seen significant development, increasing the demand for extruded plastic components. Investments in infrastructure and construction projects have also contributed to market growth, as these sectors require durable and cost-effective materials. However, economic fluctuations and political uncertainties in some countries may pose challenges to sustained growth in the region.

The Middle East & Africa region is witnessing a gradual increase in the adoption of plastic extrusion molded parts, driven by infrastructural development and a growing automotive sector. Countries like Saudi Arabia and South Africa are investing in manufacturing and construction projects, creating opportunities for market expansion. The demand for lightweight and economical materials in the automotive industry has further fueled the need for extruded plastic components. Nonetheless, the market's growth is tempered by economic diversification challenges and varying levels of industrialization across different countries in the region.

Recent Developments:

- In March 2022, France-based Benvic acquired Italy’s Modenplast to enhance its custom medical tubing solutions and strengthen its market presence.

- In November 2021, Meteor Group acquired U.S.-based Creative Extruded Products to expand its product portfolio, enhance technological capabilities, and strengthen its presence in North America.

Plastic Extrusion Molded Parts Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the plastic extrusion molded parts market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global plastic extrusion molded parts market include:

- Duros Development

- Nation Manufacturing and Industrial Products Corporation

- Ply Gem Holdings

- Rehau Incorporated

- Vision Group

- Denso

- Foton Philippines

- Isuzu

- Mitsuwa Chemical

- Eaton

- MHG Asia Pacific

- Rehau Incorporated

- Roop Polymers

The global plastic extrusion molded parts market is segmented as follows:

By Type

- Solid Parts

- Hollow Pipe & Tubing

- Sheets & Films

- Windshield Wipers and Squeegees

- Automotive Trim

- Conduit and Cable Protectors

- Others

By Mold Shape

- T-Sections

- U-Sections

- Square Sections

- I-Sections

- L-Sections

- Circular Sections

- Others

By Mold Type

- Unscrewing Molds

- Hot Runner Molds

- Cold Runner Molds

- Insulated Runner Molds

- Others

By Extrusion Method

- Tubing Extrusion

- Blow Film Extrusion

- Sheet Film Extrusion

- Over Jacket Extrusion

- Others

By End-user

- Construction

- Automotive

- Packaging

- Food & Beverage

- Agriculture

- Medical

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Plastic Extrusion Molded Parts

Request Sample

Plastic Extrusion Molded Parts