Plastics Bottle Market Size, Share, and Trends Analysis Report

CAGR :

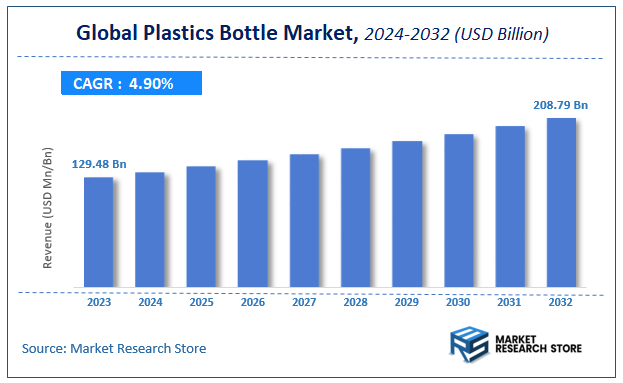

| Market Size 2023 (Base Year) | USD 129.48 Billion |

| Market Size 2032 (Forecast Year) | USD 208.79 Billion |

| CAGR | 4.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Plastics Bottle Market Insights

According to Market Research Store, the global plastics bottle market size was valued at around USD 129.48 billion in 2023 and is estimated to reach USD 208.79 billion by 2032, to register a CAGR of approximately 4.9% in terms of revenue during the forecast period 2024-2032.

The plastics bottle report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Plastics Bottle Market: Overview

The Plastic Bottle Market encompasses the production, distribution, and consumption of bottles made from various plastic materials, including Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), and Polypropylene (PP). These bottles are widely used for packaging beverages, personal care products, pharmaceuticals, and household chemicals due to their lightweight nature, durability, and cost-effectiveness. The market is driven by continuous advancements in plastic manufacturing technologies, increasing demand for convenient and portable packaging solutions, and evolving consumer preferences for sustainable and recyclable materials.

Key Highlights

- The plastics bottle market is anticipated to grow at a CAGR of 4.9% during the forecast period.

- The global plastics bottle market was estimated to be worth approximately USD 129.48 billion in 2023 and is projected to reach a value of USD 208.79 billion by 2032.

- The growth of the plastics bottle market is being driven by the persistent demand for convenient and cost-effective packaging solutions across various industries, including beverages, food, pharmaceuticals, and personal care.

- Based on the material type, the PET segment is growing at a high rate and is projected to dominate the market.

- On the basis of capacity, the less than 250 ml segment is projected to swipe the largest market share.

- In terms of end use, the food segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Plastics Bottle Market: Dynamics

The plastics bottle market is a significant segment of the packaging industry. Here's a breakdown of its dynamics:

Key Drivers

- Convenience and Portability: Plastic bottles are lightweight, durable, and easily transportable, making them a preferred choice for beverages, personal care products, and household chemicals.

- Cost-Effectiveness: Compared to alternatives like glass or metal, plastic bottles are often more cost-effective to produce and transport.

- Versatility in Design and Functionality: Plastics can be molded into various shapes, sizes, and colors, allowing for product differentiation and customization. They can also incorporate features like easy-grip handles and dispensing closures.

- Extended Shelf Life: Plastic bottles provide a good barrier against moisture and oxygen, extending the shelf life of packaged products.

- Growth in the Beverage Industry: The increasing consumption of bottled water, soft drinks, and other beverages is a major driver of the plastics bottle market.

Restraints

- Environmental Concerns: Plastic waste and its impact on the environment are a major concern, leading to increasing pressure to reduce plastic consumption and improve recycling rates.

- Regulatory Pressures: Governments worldwide are implementing regulations to restrict the use of single-use plastics and promote sustainable packaging.

- Public Perception: Negative public perception of plastic packaging can influence consumer purchasing decisions.

- Volatility of Raw Material Prices: Fluctuations in the price of raw materials, such as petroleum-based resins, can impact production costs.

- Competition from Alternative Packaging: Alternative packaging materials, such as paper-based cartons, aluminum cans, and biodegradable plastics, are gaining popularity.

Opportunities

- Development of Sustainable Plastics: Investing in research and development of bio-based plastics, recycled plastics (rPET), and biodegradable plastics can address environmental concerns.

- Advanced Recycling Technologies: Implementing advanced recycling technologies, such as chemical recycling, can improve the recycling rate of plastic bottles.

- Lightweighting and Design Innovation: Optimizing bottle designs to reduce material usage and improve recyclability can enhance sustainability.

- Smart Packaging: Incorporating smart technologies, such as QR codes, RFID tags, and sensors, into plastic bottles can enhance product traceability and consumer engagement.

- Expansion in Emerging Markets: Growing demand for packaged goods in emerging economies presents significant opportunities for the plastics bottle market.

Challenges

- Improving Recycling Infrastructure: Developing and improving recycling infrastructure is crucial for increasing the recycling rate of plastic bottles.

- Changing Consumer Behavior: Encouraging consumers to adopt sustainable consumption habits, such as recycling and reducing plastic waste, is a key challenge.

- Meeting Stringent Regulatory Requirements: Complying with evolving regulations related to plastic packaging and environmental protection can be complex.

- Maintaining Cost-Effectiveness: Balancing the need for sustainable packaging solutions with the cost-effectiveness of plastic bottles is a challenge.

- Combating Misinformation: Providing accurate information to the public regarding plastic types, and the actual effects of proper recycling is a constant battle.

Plastics Bottle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastics Bottle Market |

| Market Size in 2023 | USD 129.48 Billion |

| Market Forecast in 2032 | USD 208.79 Billion |

| Growth Rate | CAGR of 4.9% |

| Number of Pages | 140 |

| Key Companies Covered | Greif, Alpla, Silgan, DS Smith, RPC Group, Graham Packaging, Rexam, Cawthorn, Bemis, Menasha Corporation, Berry Global, Amcor, Sterigenics, Crown Holdings, Sonoco |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plastics Bottle Market: Segmentation Insights

The global plastics bottle market is divided by material type, capacity, end use, and region.

Segmentation Insights by Material Type

Based on material type, the global plastics bottle market is divided into PET, PP, PE, PVC, and others.

The PET (Polyethylene Terephthalate) segment dominates the Plastics Bottle Market due to its widespread use in beverage, food, and personal care packaging. PET bottles offer excellent clarity, lightweight properties, and recyclability, making them the preferred choice for bottled water, carbonated drinks, and juices. Additionally, their high strength-to-weight ratio and resistance to impact contribute to their dominance in the market. The increasing focus on sustainability has also driven innovations in recycled PET (rPET), further strengthening its market position.

The PP (Polypropylene) segment is growing steadily, driven by its high resistance to heat and chemicals. PP bottles are commonly used in pharmaceutical packaging, food containers, and personal care products such as shampoos and lotions. The material's ability to withstand high temperatures makes it suitable for hot-fill applications, expanding its adoption in various industries.

The PE (Polyethylene) segment includes both high-density polyethylene (HDPE) and low-density polyethylene (LDPE), with HDPE being more dominant due to its durability and moisture resistance. HDPE bottles are widely used in dairy products, household cleaners, and industrial chemicals. LDPE, on the other hand, is used for squeeze bottles and flexible packaging applications. The versatility and cost-effectiveness of PE bottles continue to support their market demand.

The PVC (Polyvinyl Chloride) segment, though declining in popularity due to environmental concerns, is still used in specialized applications such as oil bottles, chemical containers, and medical packaging. PVC bottles offer excellent durability and resistance to chemicals but face regulatory scrutiny and recycling challenges, which have led manufacturers to explore alternative materials.

Segmentation Insights by Capacity

On the basis of capacity, the global plastics bottle market is bifurcated into less than 250 ml, 250 ml to 500 ml, and more than 500 ml.

The Less than 250 ml segment dominates the Plastics Bottle Market due to its extensive use in personal care, pharmaceuticals, and travel-sized beverage packaging. These small-capacity bottles are widely preferred for hand sanitizers, eye drops, essential oils, and single-use beverage containers. The growing demand for convenient, portable, and single-serving packaging solutions has significantly boosted the adoption of bottles in this category.

The 250 ml to 500 ml segment holds a substantial market share, primarily driven by its application in bottled water, soft drinks, and personal care products like shampoos and lotions. These bottles offer an optimal balance between portability and storage capacity, making them highly popular in the food & beverage and cosmetics industries. The increasing preference for sustainable packaging solutions has also driven innovations in lightweight and recyclable materials within this segment.

The More than 500 ml segment is witnessing steady growth, particularly in bulk packaging for household cleaning products, cooking oils, and large beverage bottles. This segment is highly preferred in family-sized beverage containers, multipurpose detergents, and industrial chemicals, where larger volumes are required. The demand for eco-friendly and reusable large plastic bottles is further influencing market trends, with manufacturers focusing on sustainable and durable materials.

Segmentation Insights by End Use

On the basis of end use, the global plastics bottle market is bifurcated into food, beverage, pharmaceuticals, personal care & cosmetics, homecare, and others.

The Food segment dominates the Plastics Bottle Market, driven by the growing demand for packaged and processed foods requiring durable, lightweight, and cost-effective packaging solutions. Plastic bottles are widely used for sauces, condiments, dressings, and edible oils due to their superior barrier properties, extended shelf life, and convenience in handling and storage. The rise of on-the-go consumption trends has further fueled the adoption of plastic food bottles, particularly in emerging economies.

The Beverage segment holds a significant market share, primarily due to the extensive use of plastic bottles for water, carbonated drinks, juices, and dairy products. PET bottles, known for their transparency, recyclability, and lightweight nature, are the preferred choice in this category. The increasing demand for sustainable packaging has led to innovations in bio-based and recycled plastic bottles, supporting the segment's growth.

The Pharmaceuticals segment is expanding due to the rising need for secure and contamination-free packaging solutions for liquid medications, syrups, and vitamin supplements. Plastic bottles, particularly those made from HDPE and PET, provide excellent chemical resistance, tamper-evident features, and UV protection, ensuring the safety and efficacy of pharmaceutical products. The growth of the healthcare industry and stringent regulatory standards are key factors driving this segment.

The Personal Care & Cosmetics segment is witnessing steady growth, fueled by the increasing demand for skincare, haircare, and hygiene products. Plastic bottles are widely used for shampoos, lotions, body washes, and perfumes due to their versatility, aesthetic appeal, and cost efficiency. The rising trend of premium packaging and the use of recycled plastics in beauty and personal care products are shaping market dynamics.

The Homecare segment is gaining traction, particularly in the packaging of cleaning agents, disinfectants, detergents, and air fresheners. Plastic bottles in this category are preferred for their durability, chemical resistance, and ease of dispensing. The rising consumer awareness of sustainable packaging has encouraged manufacturers to develop eco-friendly and biodegradable plastic bottle alternatives, further influencing market growth.

Plastics Bottle Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the Plastics Bottle Market due to high consumption of bottled beverages, strong demand for pharmaceutical packaging, and advancements in plastic recycling technologies. The United States leads the region, with increasing demand for PET (polyethylene terephthalate) bottles in the beverage industry, including bottled water, carbonated soft drinks, and energy drinks. The growing focus on sustainable packaging and the introduction of bio-based and recycled plastic bottles are shaping the market. Canada also contributes to market growth, with rising adoption of eco-friendly plastic packaging solutions and increased regulatory support for plastic waste management.

Europe is a significant market, driven by strict environmental regulations, increasing demand for sustainable plastic bottles, and a strong presence of key beverage manufacturers. Germany, the UK, and France are key contributors. Germany’s advanced recycling infrastructure and high adoption of rPET (recycled PET) bottles are fueling growth. The UK is witnessing rising demand for lightweight plastic bottles in the personal care and food & beverage sectors, with manufacturers focusing on biodegradable and compostable plastics. France, with its stringent single-use plastic regulations, is promoting innovation in reusable and bio-based plastic bottles. The European Union’s commitment to reducing plastic waste and increasing circular economy initiatives further supports market expansion.

Asia Pacific is the fastest-growing region in the Plastics Bottle Market, driven by increasing urbanization, rising disposable incomes, and growing demand for bottled beverages and packaged products. China, India, Japan, and South Korea are key markets. China leads in plastic bottle production and consumption, supported by high demand from the beverage and personal care industries. The country is also investing in plastic recycling technologies to reduce environmental impact. India is witnessing rapid market growth due to increasing bottled water consumption, expanding pharmaceutical packaging needs, and government initiatives promoting plastic waste management. Japan and South Korea, known for their technological advancements, are focusing on sustainable plastic packaging and smart bottle innovations with RFID and tracking technologies. The rising e-commerce sector in the region is further boosting demand for plastic bottles in logistics and packaging.

Latin America is experiencing steady growth, with Brazil and Mexico leading the market. The region’s expanding beverage industry, increasing use of plastic bottles in household and personal care products, and improving waste management initiatives are key growth drivers. Brazil’s strong demand for PET bottles in the soft drink and water industries supports market expansion, while Mexico’s focus on sustainable packaging solutions is influencing manufacturers to adopt recycled and biodegradable plastics. However, regulatory challenges regarding plastic waste management and the push for alternatives may impact long-term growth.

The Middle East & Africa is witnessing growing demand for plastic bottles, particularly in the beverage, pharmaceutical, and household product sectors. The UAE, Saudi Arabia, and South Africa are key markets. Saudi Arabia’s increasing bottled water consumption and investments in sustainable plastic production contribute to market expansion. The UAE is adopting advanced plastic recycling solutions and promoting eco-friendly packaging alternatives. South Africa’s demand is rising due to the expanding FMCG sector and increasing awareness of plastic waste management. However, challenges related to plastic pollution and government regulations on single-use plastics may influence market dynamics in the coming years.

Recent Developments:

- June 2024: A customizable rectangular Domino container was recently introduced by Berry Global Group Inc., a global leader in sustainable packaging. Designed for the beauty, home, and personal care markets, this novel product is capable of being manufactured from 100% post-consumer recycled (PCR) plastic. A 75-millimeter-wide front face and side panels are featured on the 250 ml Domino bottle, which can be customized to meet the specific requirements of the brand.

- April 2024: Amcor PLC launched a revolutionary 1 liter carbonated soft drink (CSD) vessel that is entirely composed of post-consumer recycled (PCR) polyethylene terephthalate (PET) material. This innovative stock container, according to the company, enables beverage brands to expedite their market entry and address the increasing sustainability demands and regulations.

Plastics Bottle Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the plastics bottle market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global plastics bottle market include:

- Alpack Plastics

- Alpha Packaging

- Alpla

- Altium Packaging

- Amcor

- Bemis

- Bericap Gmbh & Co. KG

- Berry Global

- Cawthorn

- CKS Packaging Inc

- Comar LLC

- Constar Internationals, Inc.

- Container Corporation of Canada

- Cospack America Corporation

- Crown Holdings

- DS Smith

- Graham Packaging

- Greif

- Greiner Packaging

- Menasha Corporation

- Ontario Plastic Container Producers Ltd.

- Plastic Holdings Inc

- Plastipak Holdings, Inc.

- Resilux NV

- Rexam Inc.

- RPC Group

- Silgan Holdings

- Sterigenics

- Weener Plastics Group BV

The global plastics bottle market is segmented as follows:

By Material Type

- PET

- PP

- PE

- PVC

- Others

By Capacity

- Less than 250 ml

- 250 ml to 500 ml

- More than 500 ml

By End Use

- Food

- Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Homecare

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Plastics Bottle

Request Sample

Plastics Bottle