Polyester Polyols for Rigid Foam Market Size, Share, and Trends Analysis Report

CAGR :

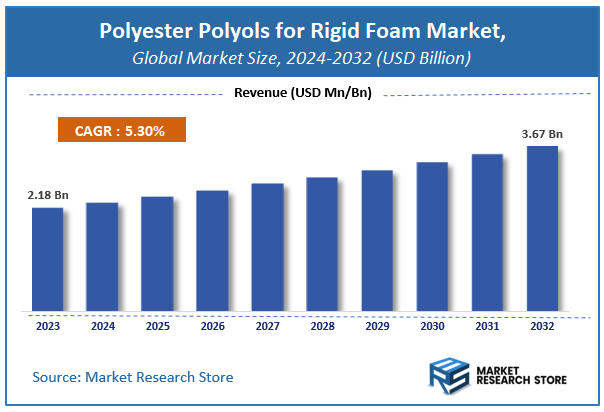

| Market Size 2023 (Base Year) | USD 2.18 Billion |

| Market Size 2032 (Forecast Year) | USD 3.67 Billion |

| CAGR | 5.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Polyester Polyols for Rigid Foam Market Insights

According to Market Research Store, the global polyester polyols for rigid foam market size was valued at around USD 2.18 billion in 2023 and is estimated to reach USD 3.67 billion by 2032, to register a CAGR of approximately 5.3% in terms of revenue during the forecast period 2024-2032.

The polyester polyols for rigid foam report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032

To Get more Insights, Request a Free Sample

Global Polyester Polyols for Rigid Foam Market: Overview

Polyester polyols for rigid foam are specialized chemical compounds used as key components in the production of rigid polyurethane foams. These polyols are synthesized through the polycondensation of dicarboxylic acids and glycols, often incorporating recycled materials or bio-based content for enhanced sustainability. Rigid foams made with polyester polyols are known for their excellent thermal insulation properties, high mechanical strength, and superior chemical resistance, making them ideal for applications in construction, refrigeration, and automotive sectors. The growing demand for energy-efficient insulation materials, coupled with stringent environmental regulations promoting sustainable solutions, is driving the market for polyester polyols in rigid foam production.

Key Highlights

- The polyester polyols for rigid foam market is anticipated to grow at a CAGR of 5.3% during the forecast period.

- The global polyester polyols for rigid foam market was estimated to be worth approximately USD 2.18 billion in 2023 and is projected to reach a value of USD 3.67 billion by 2032.

- The growth of the polyester polyols for rigid foam market is being driven by the growing demand for energy-efficient insulation in construction and refrigeration industries, expansion of the automotive sector, and increasing focus on sustainable and bio-based materials.

- Based on the type, the aromatic polyether polyols segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the construction segment is projected to swipe the largest market share.

- In terms of end-user, the industrial segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Polyester Polyols for Rigid Foam Market: Dynamics

Key Growth Drivers

- Excellent Insulation Properties: Polyester polyols provide superior thermal insulation, making them ideal for rigid foams used in construction, refrigeration, and HVAC systems.

- Growing Construction Sector: Increasing demand for energy-efficient building materials drives the use of polyester polyol-based rigid foams for insulation.

- Sustainability Trends: Polyester polyols can be derived from renewable resources, aligning with the global shift toward eco-friendly materials.

- Expanding Appliances Industry: The need for energy-efficient refrigeration and cooling systems boosts demand for rigid foams.

Restraints

- High Raw Material Costs: Fluctuations in the prices of raw materials like adipic acid and phthalic anhydride can increase production costs, limiting market growth.

- Competition from Polyether Polyols: Polyether polyols are cheaper and offer better hydrolysis resistance, posing a challenge to polyester polyols in certain applications.

- Processing Challenges: Polyester polyols require precise processing conditions, which can increase manufacturing complexity and costs.

Opportunities

- Emerging Markets: Rapid urbanization and infrastructure development in Asia-Pacific and other developing regions create significant growth opportunities.

- Innovation in Bio-based Polyols: Development of bio-based polyester polyols from renewable resources can attract environmentally conscious industries and expand market reach.

- Energy Efficiency Regulations: Stricter energy efficiency standards in construction and appliances drive demand for high-performance insulation materials.

Challenges

- Regulatory Compliance: Stringent environmental and safety regulations may increase production costs and limit market expansion.

- Hydrolysis Sensitivity: Polyester polyols are more susceptible to hydrolysis compared to polyether polyols, which can restrict their use in humid or wet environments.

- Supply Chain Disruptions: Geopolitical issues and raw material shortages can impact production and pricing.

Polyester Polyols for Rigid Foam Market: Report Scope

This report thoroughly analyzes the Polyester Polyols for Rigid Foam Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyester Polyols for Rigid Foam Market |

| Market Size in 2023 | USD 2.18 Billion |

| Market Forecast in 2032 | USD 3.67 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 178 |

| Key Companies Covered | BASF SE, Dow Chemical Company, Covestro AG, Huntsman Corporation, Shell Chemicals, Wanhua Chemical Group Co. Ltd., Repsol S.A., Mitsui Chemicals Inc., KPX Chemical Co. Ltd., Stepan Company, Perstorp Holding AB, Royal Dutch Shell plc, Bayer MaterialScience |

| Segments Covered | By Product Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyester Polyols for Rigid Foam Market: Segmentation Insights

The global polyester polyols for rigid foam market is divided by type, application, end-user, and region.

Segmentation Insights by Type

Based on type, the global polyester polyols for rigid foam market is divided into aromatic polyether polyols and aliphatic polyether polyols.

Aromatic polyether polyols dominate the polyester polyols for rigid foam market due to their superior thermal stability, mechanical strength, and cost-effectiveness. These polyols are widely used in applications such as insulation for construction, refrigeration, and industrial storage, where high-performance thermal insulation is crucial. Their compatibility with various blowing agents and flame retardant additives makes them the preferred choice for industries requiring enhanced fire resistance and structural integrity. Additionally, the cost advantage of aromatic polyether polyols over their aliphatic counterparts further strengthens their market position, making them the go-to option for manufacturers looking for efficient and durable rigid foam solutions.

On the other hand, aliphatic polyether polyols, while less dominant, offer unique advantages such as superior UV resistance, lower odor, and improved hydrolytic stability. These properties make them suitable for specialized applications where resistance to environmental degradation is a priority, such as coatings, adhesives, and sealants used in outdoor and marine environments. However, their higher production cost and relatively lower mechanical strength compared to aromatic polyether polyols limit their widespread adoption in the rigid foam industry. Consequently, their market share remains smaller, catering mainly to niche applications that require enhanced weathering resistance and longevity.

Segmentation Insights by Application

On the basis of application, the global polyester polyols for rigid foam market is bifurcated into construction, appliances, automotive, packaging, and others.

The construction segment holds the dominant position in the polyester polyols for rigid foam market, primarily due to the extensive use of rigid foam insulation in buildings and infrastructure. These polyols are widely utilized in the production of polyurethane (PU) foams, which offer exceptional thermal insulation, moisture resistance, and durability. With growing emphasis on energy-efficient buildings and stringent environmental regulations promoting sustainable construction materials, the demand for rigid foam insulation continues to rise, further solidifying the dominance of this segment.

The appliances segment follows closely, driven by the need for efficient thermal insulation in refrigeration and cooling systems. Polyester polyols are crucial in manufacturing rigid polyurethane foams used in refrigerators, freezers, and HVAC systems, ensuring energy efficiency and temperature control. The increasing consumer demand for energy-efficient appliances, coupled with technological advancements in refrigeration insulation, supports the steady growth of this segment.

The automotive sector is another significant application area, utilizing polyester polyols in lightweight rigid foams for vehicle interiors, insulation panels, and structural components. As the automotive industry shifts toward fuel efficiency and sustainability, the demand for lightweight materials with high durability and thermal resistance is increasing, making rigid foam a preferred choice for various applications.

The packaging segment, while smaller in market share, benefits from the protective and insulating properties of rigid foam. Polyester polyols contribute to the development of impact-resistant and thermally stable packaging materials used for transporting temperature-sensitive products such as pharmaceuticals, chemicals, and food. Although this segment is not as dominant as construction or appliances, its steady demand is fueled by the growth of e-commerce and cold chain logistics.

Segmentation Insights by End-User

On the basis of end-user, the global polyester polyols for rigid foam market is bifurcated into residential, commercial, and industrial.

The industrial segment is the dominant end-user in the polyester polyols for rigid foam market, primarily due to the extensive use of rigid polyurethane (PU) foams in large-scale insulation applications. Industrial facilities, including warehouses, cold storage units, and manufacturing plants, require high-performance insulation materials to maintain energy efficiency and temperature control. The increasing focus on sustainability and energy conservation in industries has further driven the demand for rigid foams, making polyester polyols a key component in industrial insulation solutions.

The commercial segment follows, benefiting from the rising demand for energy-efficient insulation in office buildings, shopping malls, hotels, and healthcare facilities. With stringent building codes and regulations promoting thermal insulation and fire resistance, commercial establishments are increasingly adopting rigid PU foams. The growth of green building initiatives and the need for HVAC efficiency further contribute to the expanding use of polyester polyols in this segment.

The residential segment, while smaller in comparison, is steadily growing due to increasing awareness of energy-efficient housing solutions. Rigid foams containing polyester polyols are used in home insulation, roofing, and walls to enhance thermal efficiency and reduce energy costs. With the rise of eco-friendly construction and government incentives for sustainable housing, the residential sector is expected to witness gradual growth, though it remains less dominant than industrial and commercial applications.

Polyester Polyols for Rigid Foam Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific leads the polyester polyols for rigid foam market, driven by rapid industrialization and urbanization in countries like China and India. The booming construction sector in these nations has heightened the demand for energy-efficient insulation materials, where rigid polyurethane foams are extensively utilized. Additionally, the automotive industry's expansion in the region, coupled with increasing production of appliances, has further bolstered the consumption of polyester polyols. The region's dominance is also supported by favorable government policies promoting infrastructure development and energy efficiency.

North America holds a significant share of the polyester polyols for rigid foam market, underpinned by a mature construction industry and a strong emphasis on energy-efficient building practices. The region's well-established automotive sector also contributes to the steady demand for rigid foams, which are integral in vehicle manufacturing for applications requiring lightweight and durable materials. Moreover, advancements in technology and a focus on sustainability have led to the development of bio-based polyester polyols, aligning with the region's environmental initiatives.

Europe represents a substantial market for polyester polyols for rigid foam, driven by stringent environmental regulations and a robust automotive industry. The region's commitment to reducing carbon emissions has led to increased adoption of energy-efficient insulation materials in both residential and commercial construction. Furthermore, the presence of major automobile manufacturers in countries like Germany and France has sustained the demand for rigid foams in vehicle production. The European market continues to innovate, focusing on sustainable and high-performance materials to meet evolving industry standards.

Latin America shows a growing market for polyester polyols for rigid foam, propelled by expanding construction activities and a burgeoning automotive sector. Countries such as Brazil and Mexico are witnessing increased infrastructure development, boosting the need for effective insulation solutions. Additionally, the rising middle-class population and urbanization trends have led to higher demand for consumer appliances, further driving the market for rigid foams. Economic growth and governmental support for industrialization are expected to continue fostering market expansion in this region.

Middle East and Africa is experiencing a steady increase in the polyester polyols for rigid foam market, primarily due to infrastructural development and growth in the construction industry. The demand for energy-efficient buildings in countries like the United Arab Emirates and Saudi Arabia has led to the adoption of rigid polyurethane foams for insulation purposes. Additionally, the development of the packaging industry in these regions contributes to the demand for polyester polyols.

Polyester Polyols for Rigid Foam Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the polyester polyols for rigid foam market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global polyester polyols for rigid foam market include:

- BASF

- DowDuPont

- DIC Corporation

- Stepan Company

- Hunstman

- OLEON

- Hokoku Corporation

- Carpenter

- Lyondellbasell

- Shell

- Sinopec

- CNPC

- Evonik

- Perstorp

- INVISTA

- AGC Chemicals

- Tosoh

- Huafeng Group

- Shandong Huacheng

The global polyester polyols for rigid foam market is segmented as follows:

By Type

- Aromatic Polyether Polyols

- Aliphatic Polyether Polyols

By Application

- Construction

- Appliances

- Automotive

- Packaging

- Others

By End-User

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Polyester Polyols for Rigid Foam

Request Sample

Polyester Polyols for Rigid Foam