Power Discreter for Electric Vehicles Market Size, Share, and Trends Analysis Report

CAGR :

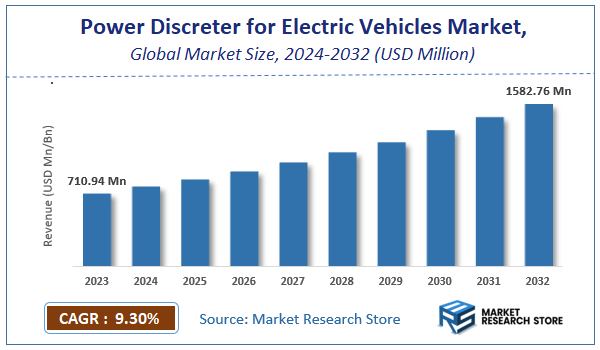

| Market Size 2023 (Base Year) | USD 710.94 Million |

| Market Size 2032 (Forecast Year) | USD 1582.76 Million |

| CAGR | 9.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Power Discreter for Electric Vehicles Market Insights

According to Market Research Store, the global power discreter for electric vehicles market size was valued at around USD 710.94 million in 2023 and is estimated to reach USD 1582.76 million by 2032, to register a CAGR of approximately 9.3% in terms of revenue during the forecast period 2024-2032.

The power discreter for electric vehicles report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Power Discreter for Electric Vehicles Market: Overview

Power discreter for electric vehicles are fundamental semiconductor components that manage and switch high electrical currents in electric vehicle (EV) systems. These devices include MOSFETs, IGBTs, diodes, and thyristors that regulate power flow in critical EV applications like traction inverters, onboard chargers, DC-DC converters, and battery management systems. The transition to wide-bandgap semiconductors (SiC and GaN) is revolutionizing this sector by enabling higher efficiency, faster switching speeds, and better thermal performance compared to traditional silicon-based solutions. Power discretes are essential for improving EV range, reducing charging times, and enhancing overall energy efficiency in modern electric powertrains.

The global power discreter for electric vehicles is experiencing exponential growth, driven by surging electric vehicle production and increasing voltage requirements in next-generation EV platforms. Key growth factors include automotive OEMs' transition to 800V architectures, government mandates for electrification, and consumer demand for longer-range vehicles. The market is characterized by intense competition between established silicon players and emerging wide-bandgap semiconductor manufacturers, with innovation focusing on higher power density, improved thermal management, and cost reduction. While supply chain constraints and material costs present challenges, the sector benefits from massive investments in semiconductor fabrication capacity and strategic partnerships between chipmakers and automakers. The market is further propelled by advancements in modular power electronics and integrated powertrain solutions that optimize performance while reducing system complexity.

Key Highlights

- The power discreter for electric vehicles market is anticipated to grow at a CAGR of 9.3% during the forecast period.

- The global power discreter for electric vehicles market was estimated to be worth approximately USD 710.94 million in 2023 and is projected to reach a value of USD 1582.76 million by 2032.

- The growth of the power discreter for electric vehicles market is being driven by the fundamental shift towards automotive electrification, which necessitates a substantial increase in power discrete components for essential EV systems like battery management and power conversion.

- Based on the type, the GaN segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the HEV segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Power Discreter for Electric Vehicles Market: Dynamics

Key Growth Drivers

- Surging Electric Vehicle Production and Sales: The exponential growth in global EV adoption directly translates to a massive increase in demand for power discretes used in their powertrain and charging systems.

- Increasing Power Density Requirements: As EVs evolve, there's a constant push for higher power density in power electronic components to reduce size, weight, and cost, driving the need for advanced discrete devices.

- Demand for Higher Efficiency: Efficient power conversion is critical for maximizing EV range and minimizing energy losses. This necessitates the use of high-efficiency power discretes with low on-state resistance and switching losses.

- Advancements in Semiconductor Materials: The transition towards wide-bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) in discrete power devices offers superior performance (higher efficiency, higher switching frequencies, better thermal management) compared to traditional silicon, driving their adoption in EVs.

- Stringent Automotive Reliability and Safety Standards: The automotive industry demands extremely high reliability and safety standards for electronic components, including power discretes, ensuring consistent and dependable performance over the vehicle's lifespan.

- Proliferation of Auxiliary Systems in EVs: Beyond the main powertrain, EVs feature numerous auxiliary systems like power steering, climate control, and braking, all requiring power management and thus utilizing discrete power semiconductors.

- Growth of Fast Charging Infrastructure: The development of faster charging technologies necessitates power electronic systems capable of handling higher power levels, driving the demand for robust and high-performance discrete power devices.

- Cost Reduction Efforts in EV Components: While performance is key, the automotive industry is highly cost-sensitive. Innovations in discrete power device manufacturing and materials are crucial for reducing overall EV costs.

Restraints

- High Cost of Advanced Materials (SiC and GaN): While offering superior performance, SiC and GaN power discretes are currently more expensive than their silicon counterparts, potentially limiting their widespread adoption in cost-sensitive EV segments.

- Supply Chain Constraints and Geopolitical Factors: The semiconductor industry, including power discretes, has faced supply chain disruptions, and geopolitical tensions can further impact the availability and pricing of these critical components.

- Complex Thermal Management Requirements: High-power density and high-frequency operation of advanced power discretes generate significant heat, requiring sophisticated and potentially costly thermal management solutions.

- Stringent Qualification Processes and Long Development Cycles: Automotive-grade power discretes undergo rigorous qualification processes and have long development cycles, which can slow down the adoption of new technologies.

- Standardization Challenges: Lack of complete standardization in certain aspects of power discrete packaging and interfaces can create challenges for designers and manufacturers.

- Competition from Integrated Power Modules: Integrated power modules (IPMs) offer a more compact and often easier-to-implement solution for power conversion, posing competition to discrete power devices in certain EV applications.

- Dependence on Raw Material Availability and Pricing: The production of semiconductor materials relies on specific raw materials, and fluctuations in their availability and pricing can impact the cost of power discretes.

- Conservative Nature of the Automotive Industry: The automotive industry is generally risk-averse, and the adoption of new power discrete technologies requires extensive validation and proven reliability.

Opportunities

- Further Cost Reduction in SiC and GaN Manufacturing: Advancements in manufacturing processes and increased production volumes are expected to drive down the cost of SiC and GaN power discretes, making them more competitive.

- Development of More Efficient and Compact Packaging Technologies: Innovations in packaging can improve thermal performance and reduce the size and weight of discrete power devices.

- Integration of Sensing and Control Functions: Incorporating current and temperature sensing, as well as control functionalities, directly into discrete power devices can simplify system design and improve performance.

- Standardization Efforts for Easier Adoption: Industry-wide efforts to standardize packaging and interfaces can facilitate easier adoption and sourcing of discrete power devices.

- Growth in Specific EV Segments (e.g., High-Performance EVs): High-performance EVs with demanding power requirements are more likely to adopt advanced and potentially more expensive discrete power solutions like SiC and GaN.

- Expansion into Charging Infrastructure: The growth of EV charging infrastructure, including ultra-fast chargers, will drive demand for high-power discrete semiconductors.

- Development of Robust and Reliable Devices for Harsh Automotive Environments: Continued focus on developing power discretes that can withstand the demanding temperature, vibration, and humidity conditions within EVs.

- Customization and Application-Specific Designs: Tailoring discrete power device characteristics to the specific needs of different EV subsystems can optimize performance and efficiency.

Challenges

- Meeting the Demanding Reliability and Lifespan Requirements of Automotive Applications: Ensuring that power discretes can reliably operate for the entire lifespan of an EV under various operating conditions.

- Managing the Heat Dissipation Challenges of High-Power Devices: Developing effective and cost-efficient thermal management solutions for increasingly powerful discrete components.

- Balancing Performance and Cost Competitiveness: Providing high-performance power discretes at a cost that is acceptable to the price-sensitive automotive market.

- Ensuring a Stable and Secure Supply Chain: Mitigating the risks of supply chain disruptions and ensuring a consistent supply of high-quality power discretes.

- Keeping Pace with the Rapid Innovation in EV Technology: Continuously developing and qualifying new power discrete technologies to meet the evolving demands of the EV market.

- Addressing Electromagnetic Compatibility (EMC) and Electromagnetic Interference (EMI) Issues: Ensuring that high-frequency switching of power discretes does not interfere with other electronic systems in the vehicle.

- Developing Robust Testing and Validation Procedures: Implementing comprehensive testing and validation protocols to ensure the safety and reliability of new power discrete technologies in automotive applications.

- Collaborating Across the Value Chain: Effective collaboration between semiconductor manufacturers, Tier 1 suppliers, and automotive OEMs is crucial for successful integration of new power discrete technologies.

Power Discreter for Electric Vehicles Market: Report Scope

This report thoroughly analyzes the Power Discreter for Electric Vehicles Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Power Discreter for Electric Vehicles Market |

| Market Size in 2023 | USD 710.94 Million |

| Market Forecast in 2032 | USD 1582.76 Million |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 186 |

| Key Companies Covered | Mitsubishi Electric, Fuji Electric, SEMIKRON, ON Semiconductor, Renesas Electronics, Vishay Intertechnology, Texas Instruments, Toshiba, Stmicroelectronics, NXP Semiconductors, Microsemi Corporation |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Power Discreter for Electric Vehicles Market: Segmentation Insights

The global power discreter for electric vehicles market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global power discreter for electric vehicles market is divided into GaN, SiC, and others.

GaN (Gallium Nitride) power discreter for electric vehicles dominate are known for their high switching frequencies and efficiency in compact designs, making them suitable for applications such as onboard chargers and low- to medium-voltage DC-DC converters. These components are known for their ability to operate at high frequencies, allowing smaller passive components and lighter systems. GaN devices are typically used in onboard chargers, DC-DC converters, and infotainment systems due to their fast-switching capabilities and efficiency gains. However, GaN still faces barriers in high-power automotive traction systems due to thermal management and voltage limitations. As a result, adoption is primarily concentrated in auxiliary EV systems and light-duty vehicles, where power requirements are moderate.

SiC (Silicon Carbide) power discreter for electric vehicles the electric vehicle market segment due to their superior capabilities in high-voltage and high-temperature operations. SiC technology is a key enabler of EV traction inverters, main powertrains, fast-charging stations, and battery management systems. These components provide lower switching losses, higher power density, and better thermal performance compared to traditional silicon-based and even GaN components in high-power scenarios. Automakers such as Tesla, BYD, and Porsche are actively integrating SiC-based systems to improve vehicle range, performance, and charging speed. Additionally, increased production capacity and declining SiC costs are accelerating its large-scale adoption, particularly in medium- and high-voltage electric vehicle architectures.

Segmentation Insights by Application

On the basis of application, the global power discreter for electric vehicles market is bifurcated into HEV, EV, and PHEV.

HEV (Hybrid Electric Vehicles): This segment is the most dominant in terms of power discreter for electric vehicles demand. Power discretes used in HEVs are primarily integrated into systems that manage both the internal combustion engine and electric powertrain. These include inverter control units, battery management systems (BMS), DC-DC converters, and energy recovery modules. Though HEVs require less power electronics compared to full EVs, they still rely on efficient switching components to optimize fuel efficiency and reduce carbon emissions. The adoption rate of HEVs remains significant in regions where EV charging infrastructure is still developing. However, their market share is expected to plateau as countries shift toward stricter zero-emission vehicle mandates.

EV (Battery Electric Vehicles): EVs rely entirely on electric propulsion, which necessitates advanced power management for high-efficiency energy conversion and distribution. Key applications for power discretes in EVs include traction inverters, onboard chargers, battery charging controllers, and thermal management systems. With global automakers scaling up EV production and introducing 800V architectures to enable ultra-fast charging and better performance, the demand for high-voltage SiC and GaN-based power discretes is accelerating. This surge is further fueled by government subsidies, carbon neutrality goals, and falling battery costs, making EVs a central driver of the power discreter market.

PHEV (Plug-in Hybrid Electric Vehicles): PHEVs combine internal combustion engines with larger battery packs that can be externally charged, requiring a moderate level of power electronic complexity. Power discretes in PHEVs are found in onboard chargers, electric drive systems, regenerative braking units, and hybrid control systems. This segment offers a transitional solution for consumers not yet ready for full EV adoption. However, PHEV growth is expected to be outpaced by EVs in the long term due to policy incentives favoring zero-emission vehicles and rising consumer confidence in EV range and charging infrastructure.

Power Discreter for Electric Vehicles Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Power Discreter for Electric Vehicles Market, supported by strong EV production and innovation across the United States and Canada. The region benefits from the presence of major EV manufacturers, advanced R&D facilities, and government incentives promoting clean energy transportation. U.S. automakers are increasingly integrating silicon carbide discretes into EV architectures to enhance efficiency, reduce thermal losses, and extend vehicle range. Additionally, strategic partnerships between automakers and semiconductor companies are fostering customized discrete solutions for traction and fast-charging systems. The push toward domestic semiconductor manufacturing is also positively impacting regional supply chains.

Europe holds a significant market share, driven by stringent carbon emission targets and robust EV manufacturing in countries such as Germany, France, and the Netherlands. European automotive OEMs are actively transitioning to electric mobility and require high-performance discretes to meet design specifications around thermal management, compactness, and power density. The demand is particularly strong for discrete MOSFETs and diodes used in auxiliary power control systems and energy recovery modules. Local initiatives like the European Green Deal and electrification mandates are accelerating investments in next-gen semiconductor fabrication and power electronic integration.

Asia Pacific is the fastest-growing region in the Power Discreter for Electric Vehicles Market, with China, Japan, and South Korea as key contributors. China dominates EV production globally and has a highly integrated value chain encompassing battery, motor, and semiconductor manufacturing. Discretes such as high-voltage IGBTs and silicon carbide devices are increasingly used in traction inverters and onboard charging systems to meet domestic performance and energy efficiency standards. Japan and South Korea, with strong electronics industries, are advancing power discrete technology through innovations in materials and packaging, supporting both domestic and export-driven EV markets.

Latin America is witnessing emerging demand, particularly in Brazil and Mexico, where automotive manufacturing is expanding alongside rising EV adoption. Though still at an early stage, automakers and component suppliers are beginning to invest in efficient power management systems for hybrid and electric platforms. Power discretes are favored in cost-sensitive segments due to their flexibility and scalability for localized EV configurations. Regional trade agreements and supply chain integrations with North American markets are expected to support steady growth.

Middle East and Africa is a developing region for EV infrastructure, and demand for power discretes is growing in alignment with government electrification plans and sustainable mobility initiatives. The United Arab Emirates and Saudi Arabia are leading regional efforts to diversify energy use and invest in smart transportation. Power discretes are being adopted in pilot EV programs and electric public transit fleets, especially in applications requiring rugged, temperature-resistant, and high-efficiency components.

Power Discreter for Electric Vehicles Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the power discreter for electric vehicles market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global power discreter for electric vehicles market include:

- Mitsubishi Electric

- Fuji Electric

- SEMIKRON

- ON Semiconductor

- Renesas Electronics

- Vishay Intertechnology

- Texas Instruments

- Toshiba

- Stmicroelectronics

- NXP Semiconductors

- Microsemi Corporation

The global power discreter for electric vehicles market is segmented as follows:

By Type

- GaN

- SiC

- Others

By Application

- HEV

- EV

- PHEV

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Power Discreter for Electric Vehicles

Request Sample

Power Discreter for Electric Vehicles