Property and Casualty Reinsurance Providers Market Size, Share, and Trends Analysis Report

CAGR :

| Market Size 2023 (Base Year) | USD 509.16 Billion |

| Market Size 2032 (Forecast Year) | USD 712.25 Billion |

| CAGR | 3.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Property And Casualty Reinsurance Providers Market Insights

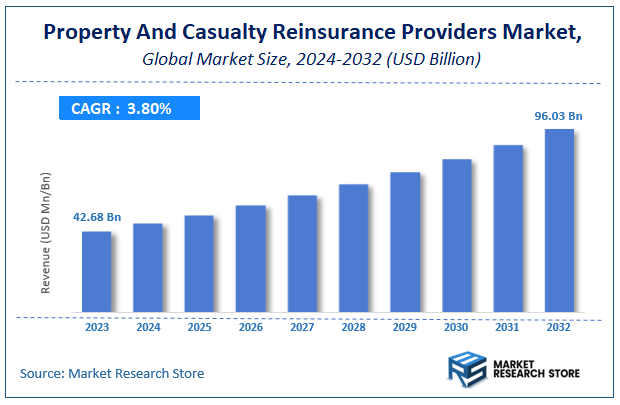

According to Market Research Store, the global property and casualty reinsurance providers market size was valued at around USD 509.16 billion in 2023 and is estimated to reach USD 712.25 billion by 2032, to register a CAGR of approximately 3.8% in terms of revenue during the forecast period 2024-2032.

The property and casualty reinsurance providers report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Property and Casualty Reinsurance Providers Market: Overview

Property and Casualty Reinsurance Providers are companies that offer financial protection to insurance companies by covering a portion of their risk portfolios related to property and casualty insurance. These providers do not sell insurance directly to individuals or businesses; instead, they work behind the scenes with primary insurers to help them manage large or unexpected losses. By doing so, reinsurance providers improve the financial stability and risk-bearing capacity of insurers, especially in the event of disasters such as hurricanes, earthquakes, floods, fires, or liability claims.

Property reinsurance typically covers damage or loss to physical assets like homes, commercial buildings, and factories, while casualty reinsurance focuses on legal liabilities resulting from injuries or damages caused to others, including automobile accidents, workplace injuries, or product defects. Reinsurers help distribute these risks across a broader financial network, allowing primary insurers to underwrite more policies than they could on their own.

Key Highlights

- The property and casualty reinsurance providers market is anticipated to grow at a CAGR of 3.8% during the forecast period.

- The global property and casualty reinsurance providers market was estimated to be worth approximately USD 509.16 billion in 2023 and is projected to reach a value of USD 712.25 billion by 2032.

- The growth of the property and casualty reinsurance providers market is being driven by a confluence of factors including the increasing frequency and severity of natural catastrophes, rising cyber threats, and the growing complexity of business risks in an interconnected world.

- Based on the type, the proportional reinsurance segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the personal segment is projected to swipe the largest market share.

- In terms of distribution channel, the direct writing segment is expected to dominate the market.

- Based on the end-user, the insurance companies segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Property and Casualty Reinsurance Providers Market: Dynamics

Key Growth Drivers

- Increasing Frequency and Severity of Natural Catastrophes: Rising global temperatures and changing climate patterns are leading to more frequent and intense natural disasters (hurricanes, floods, wildfires), increasing the demand for reinsurance to help primary insurers manage these large-scale losses.

- Growth in Global Insurance Penetration: As economies develop and insurance awareness grows in emerging markets, the overall volume of insured risks increases, subsequently driving the need for reinsurance capacity.

- Complex and Evolving Risks: The emergence of new and complex risks, such as cyberattacks, supply chain disruptions, and pandemic-related losses, necessitates reinsurance solutions to help primary insurers underwrite these less understood exposures.

- Stringent Regulatory and Capital Requirements: Regulatory frameworks like Solvency II require primary insurers to hold adequate capital reserves. Reinsurance allows them to manage their capital more efficiently by transferring some of their risk.

- Demand for Specialized Reinsurance Coverage: Primary insurers increasingly seek tailored reinsurance solutions for specific lines of business or unique risk profiles, driving demand for specialized reinsurance products.

- Technological Advancements in Risk Modeling: Sophisticated catastrophe models and data analytics enable reinsurers to better assess and price risks, providing more accurate and reliable reinsurance coverage.

- Urbanization and Concentration of Assets: The increasing concentration of populations and high-value assets in urban areas exposes insurers to larger potential losses from single events, increasing their reliance on reinsurance.

- Low Interest Rate Environment (Historically): While interest rates have risen recently, the prolonged period of low interest rates put pressure on insurers' investment income, making reinsurance a more attractive tool for managing capital and risk.

Restraints

- High Cost of Reinsurance: Reinsurance premiums can be a significant expense for primary insurers, especially after periods of high losses or in markets with limited reinsurance capacity.

- Capacity Constraints in Certain Markets: Following major catastrophic events, the availability of reinsurance capacity, particularly for certain regions or perils, can become limited, leading to higher prices and potentially less coverage.

- Complexity of Reinsurance Contracts: Reinsurance agreements can be complex legal documents, requiring significant expertise to negotiate and understand.

- Counterparty Credit Risk: Primary insurers face the risk that their reinsurers may not be able to meet their obligations in the event of large losses.

- Lack of Transparency in Some Reinsurance Markets: Information asymmetry and a lack of transparency in certain reinsurance markets can make it challenging for primary insurers to assess the true cost and value of reinsurance coverage.

- Impact of Soft Market Conditions: Periods of low loss activity and abundant reinsurance capital can lead to a "soft market" with lower prices, potentially squeezing reinsurers' profitability and impacting their long-term sustainability.

- Increasing Use of Alternative Capital: The growth of alternative capital providers (e.g., insurance-linked securities - ILS) offers primary insurers alternative risk transfer mechanisms, potentially reducing their reliance on traditional reinsurance.

- Geopolitical and Economic Uncertainty: Global economic downturns or geopolitical instability can impact the financial stability of both primary insurers and reinsurers, potentially reducing the demand for or supply of reinsurance.

Opportunities

- Development of Innovative Reinsurance Products: Creating new and tailored reinsurance solutions to address emerging risks like cyber, climate change, and pandemics.

- Leveraging Technology for Enhanced Risk Assessment and Pricing: Utilizing AI, machine learning, and big data to improve risk modeling, underwriting, and pricing accuracy.

- Expanding into Emerging Markets: Offering reinsurance solutions in underserved and rapidly growing insurance markets around the world.

- Providing Value-Added Services: Offering primary insurers services beyond pure risk transfer, such as risk consulting, data analytics, and claims management expertise.

- Facilitating Climate Risk Transfer: Developing reinsurance solutions that support the transition to a low-carbon economy and help insurers manage climate-related risks.

- Utilizing Parametric Insurance and ILS Structures: Expanding the use of alternative risk transfer mechanisms to provide more efficient and transparent coverage for specific perils.

- Building Stronger Partnerships with Primary Insurers: Developing long-term, strategic relationships based on trust and mutual understanding of risk.

- Focusing on Sustainability and ESG Factors: Incorporating environmental, social, and governance considerations into underwriting and investment strategies.

Challenges

- Maintaining Profitability in a Competitive Market: Balancing the need to provide competitive pricing with the goal of achieving sustainable profitability, especially in a market with significant capacity.

- Accurately Assessing and Pricing Catastrophic Risks: The inherent uncertainty and potential for extreme losses from natural disasters make accurate risk assessment and pricing a constant challenge.

- Managing the Impact of Climate Change: Understanding and pricing the increasing frequency and severity of climate-related events is a significant and evolving challenge.

- Adapting to Technological Disruption: Embracing and integrating new technologies like AI and blockchain into reinsurance operations and product offerings.

- Attracting and Retaining Talent: The reinsurance industry requires specialized expertise, and attracting and retaining skilled professionals is crucial for future success.

- Navigating Evolving Regulatory Landscapes: Keeping abreast of and complying with changing regulatory requirements across different jurisdictions.

- Building Resilience to Systemic Risks: Developing strategies to manage the potential for correlated losses across multiple lines of business or geographies.

- Maintaining Relevance in the Face of Alternative Capital: Demonstrating the unique value proposition of traditional reinsurance beyond pure risk transfer.

Property And Casualty Reinsurance Providers Market: Report Scope

This report thoroughly analyzes the Property And Casualty Reinsurance Providers Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Property And Casualty Reinsurance Providers Market |

| Market Size in 2023 | USD 509.16 Billion |

| Market Forecast in 2032 | USD 712.25 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 184 |

| Key Companies Covered | SCOR SE, AXA Group, Berkshire Hathaway Reinsurance Group, Zurich Insurance Group, Munich Reinsurance America Inc., Swiss Reinsurance Company Ltd, XL Group Ltd, QBE Insurance Group Ltd, Hannover Reinsurance A G, Lloyd's of London |

| Segments Covered | By Type, By Application, By Distribution Channel, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Property and Casualty Reinsurance Providers Market: Segmentation Insights

The global property and casualty reinsurance providers market is divided by type, application, distribution channel, end-user, and region.

Segmentation Insights by Type

Based on type, the global property and casualty reinsurance providers market is divided into proportional reinsurance and non-proportional reinsurance.

The Proportional Reinsurance segment dominates the property and casualty reinsurance providers market by type. In this model, the reinsurer shares a proportional share of premiums and losses with the insurer, making it an attractive choice for insurers seeking predictable loss-sharing arrangements. It is especially favored in markets where risk predictability is moderate and underwriters seek closer alignment with reinsurers to manage exposures effectively. Its popularity among small and mid-sized insurers for stabilizing underwriting results also contributes to its leading position in the market.

Non-Proportional Reinsurance, on the other hand, covers losses that exceed a specified threshold, and is typically used for catastrophe coverage or excess-of-loss situations. This type is crucial for insurers with high-value or volatile portfolios as it helps in protecting against significant financial disruptions. While not as widely used as proportional arrangements in terms of frequency, non-proportional reinsurance plays a strategic role in capital protection, particularly among large insurers dealing with high-risk portfolios.

Segmentation Insights by Application

On the basis of application, the global property and casualty reinsurance providers market is bifurcated into personal and commercial.

Personal segment dominates the Property and Casualty Reinsurance Providers Market due to the sheer volume of individual insurance policies and the growing need for financial protection among consumers. This segment includes a wide range of policies such as homeowners insurance, automobile insurance, renters insurance, and personal liability coverage. The increasing frequency and severity of natural disasters like floods, wildfires, and hurricanes have led to higher claims, prompting primary insurers to depend more on reinsurance to maintain solvency and pricing stability. Moreover, the rise in consumer awareness regarding the importance of risk coverage, especially in developing regions, has further driven the expansion of personal lines. Technological advancements in claims processing and policy underwriting have also made it easier for insurers to offer and reinsure personal insurance products at scale.

Commercial segment, while slightly behind personal lines in terms of volume, plays a crucial role in the overall reinsurance landscape due to the higher financial stakes involved. This includes insurance for businesses covering commercial property, liability, business interruption, professional indemnity, and fleet insurance. Reinsurers are vital in absorbing the significant risks posed by large-scale commercial operations, especially in sectors prone to high losses such as energy, construction, logistics, and finance. Increasing complexities in global supply chains, cyber threats, and regulatory compliance are pushing businesses to seek robust insurance coverage, which in turn fuels demand for commercial reinsurance. Customized treaty structures, facultative reinsurance options, and risk-sharing mechanisms are becoming more prevalent to accommodate the unique risk profiles of commercial entities.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global property and casualty reinsurance providers market is bifurcated into direct writing and brokers.

Direct Writing segment dominates the Property and Casualty Reinsurance Providers Market due to the increasing preference among insurers for streamlined operations and direct relationships with reinsurers. In this model, reinsurance companies work directly with primary insurers, eliminating the need for intermediaries. This direct interaction allows for faster decision-making, clearer communication, and cost savings by avoiding broker commissions. Many large and well-established insurance firms prefer direct writing due to the ability to negotiate customized reinsurance treaties and maintain greater control over the underwriting process. Additionally, advancements in data analytics and digital platforms have made it easier for reinsurers to assess risks and manage portfolios independently, further supporting the growth of this channel.

Brokers segment, while secondary, continues to hold significant importance, especially in complex or high-value reinsurance arrangements. Brokers act as intermediaries, providing expertise in risk placement, negotiation, and treaty structuring between insurers and reinsurers. They are particularly valuable for smaller or mid-sized insurance companies that lack in-house reinsurance capabilities or for those entering new markets where local knowledge and established networks are essential. Brokers also play a critical role in facilitating facultative reinsurance for unique or large-scale risks that require bespoke solutions. Despite the rise in direct placements, many reinsurers still rely on brokers to access a broader client base and diversify their portfolios.

Segmentation Insights by End-User

On the basis of end-user, the global property and casualty reinsurance providers market is bifurcated into insurance companies, government, and others.

Insurance Companies segment dominates the Property and Casualty Reinsurance Providers Market as the primary end-user, owing to their consistent and high-volume demand for reinsurance solutions. Insurance companies seek to transfer portions of their risk portfolios to reinsurers to ensure financial stability, meet regulatory capital requirements, and protect themselves against catastrophic losses. Reinsurance allows them to expand underwriting capacity, maintain solvency during unexpected claim surges, and manage exposure to specific types of risks such as natural disasters, large-scale liability claims, or economic downturns. The reliance on both proportional and non-proportional reinsurance structures also enables insurers to tailor their risk management strategies to market conditions and product lines, thereby making them the largest and most consistent customer base in this market.

Government segment, while smaller, plays a crucial role in certain regions and under specific circumstances, particularly in scenarios involving public-sector insurance programs or state-backed catastrophic risk pools. Governments often engage reinsurance providers to support national insurance initiatives, such as crop insurance, flood coverage, or disaster risk management schemes. In emerging markets, governmental involvement in the reinsurance sector is sometimes aimed at stabilizing the insurance industry and encouraging private participation by sharing risks with global reinsurers. Additionally, in the aftermath of natural disasters or major geopolitical events, governments may use reinsurance to mitigate fiscal burdens and accelerate recovery efforts, contributing to this segment's strategic significance despite its limited scale.

Property and Casualty Reinsurance Providers Market: Regional Insights

- North America is expected to dominate the global market.

North America is the dominant region in the Property and Casualty Reinsurance Providers Market due to its advanced insurance ecosystem, high exposure to natural catastrophes, and established regulatory framework. The U.S. in particular has a complex and highly active property and casualty insurance market that frequently turns to reinsurance providers to manage catastrophe risks such as hurricanes, floods, and wildfires. Reinsurers in the region are also involved in structured reinsurance programs, supporting both traditional insurers and alternative capital providers. Additionally, there is a growing reliance on parametric and facultative reinsurance products to help manage emerging risks linked to climate change and extreme weather events. The continued demand for capital relief and risk transfer, especially in high-risk coastal and wildfire-prone zones, ensures sustained relevance of reinsurers in North America.

Europe holds a substantial portion of the reinsurance market, supported by well-established reinsurers, diversified insurance structures, and a relatively stable risk environment. The region benefits from the presence of several global reinsurance leaders who have strong balance sheets and access to sophisticated catastrophe modeling capabilities. European reinsurers often provide coverage for industrial risks, environmental liabilities, cyber exposures, and large property portfolios. Countries such as Germany, Switzerland, and the UK serve as hubs for international reinsurance activity. Additionally, Solvency II regulations and transparent risk management practices have fostered innovation in reinsurance structures, including capital market solutions like insurance-linked securities (ILS). The growing complexity of European property and liability exposures, including geopolitical and climate-related risks, further drives reinsurance uptake.

Asia-Pacific is one of the fastest-growing regions in the Property and Casualty Reinsurance Providers Market, driven by rapid urbanization, increasing asset accumulation, and rising natural disaster exposure. Countries like China, India, and Japan are central to regional growth, with governments and insurers increasingly recognizing the importance of reinsurance in managing both catastrophe and long-tail liability risks. Japan, with its high exposure to earthquakes and typhoons, has long relied on both domestic and international reinsurers to stabilize its insurance market. China is rapidly developing its reinsurance infrastructure through state-owned and private players, supported by government-led efforts to improve financial resilience. Additionally, regional reinsurers in Southeast Asia are expanding their capacities to meet demand from both primary insurers and government-backed risk pools. The region’s exposure to floods, cyclones, and earthquakes makes reinsurance a vital risk management tool.

Latin America presents a growing market for property and casualty reinsurance, supported by increasing insurance penetration and heightened awareness of disaster risk management. Countries such as Brazil, Mexico, Chile, and Colombia are actively developing insurance markets that rely heavily on reinsurance due to limited domestic underwriting capacity. Catastrophic events like floods, earthquakes, and landslides regularly disrupt economic activities in the region, prompting governments and insurers to strengthen their reinsurance partnerships. International reinsurers often provide key support to local insurance markets by absorbing large-scale risks and offering technical expertise in underwriting and risk modeling. The expansion of agriculture and infrastructure sectors, along with economic development initiatives, further fuels the need for comprehensive reinsurance solutions in Latin America.

Middle East & Africa are developing regions in the property and casualty reinsurance market, each with distinct drivers. In the Middle East, countries like the UAE, Saudi Arabia, and Qatar are investing heavily in infrastructure, real estate, and large-scale events that require advanced risk mitigation strategies. These high-value assets often necessitate sophisticated reinsurance coverage, including facultative placements and treaty arrangements. The region also experiences risks from extreme weather, political instability, and cyber threats, leading to diversified reinsurance portfolios. In Africa, the market is less mature but is steadily growing as regulatory reforms improve the insurance environment. Countries such as South Africa, Kenya, and Nigeria are building reinsurance capacity to support domestic insurers and reduce reliance on foreign reinsurers. The continent’s vulnerability to natural disasters such as droughts and floods further underlines the critical role of reinsurance in promoting economic stability and disaster recovery.

Property and Casualty Reinsurance Providers Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the property and casualty reinsurance providers market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global property and casualty reinsurance providers market include:

- SCOR SE

- AXA Group

- Berkshire Hathaway Reinsurance Group

- Zurich Insurance Group

- Munich Reinsurance America Inc.

- Swiss Reinsurance Company Ltd

- XL Group Ltd

- QBE Insurance Group Ltd

- Hannover Reinsurance A G

- Lloyd's of London

The global property and casualty reinsurance providers market is segmented as follows:

By Type

- Proportional Reinsurance

- Non-Proportional Reinsurance

By Application

- Personal

- Commercial

By Distribution Channel

- Direct Writing

- Brokers

By End-User

- Insurance Companies

- Government

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Property and Casualty Reinsurance Providers

Request Sample

Property and Casualty Reinsurance Providers