Radio Access Network Telecom Equipment Market Size, Share, and Trends Analysis Report

CAGR :

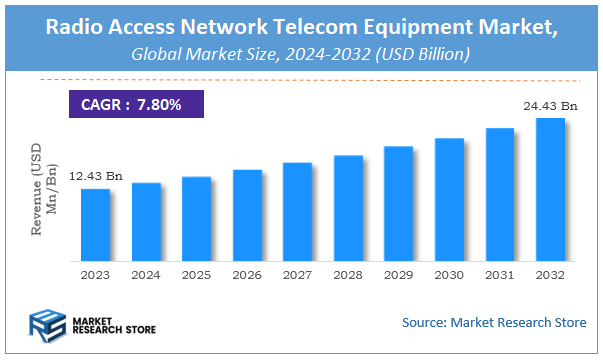

| Market Size 2023 (Base Year) | USD 12.43 Billion |

| Market Size 2032 (Forecast Year) | USD 24.43 Billion |

| CAGR | 7.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Radio Access Network Telecom Equipment Market Insights

According to Market Research Store, the global radio access network telecom equipment market size was valued at around USD 12.43 billion in 2023 and is estimated to reach USD 24.43 billion by 2032, to register a CAGR of approximately 7.8% in terms of revenue during the forecast period 2024-2032.

The radio access network telecom equipment report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Radio Access Network Telecom Equipment Market: Overview

The radio access network telecom equipment market encompasses the infrastructure and hardware essential for facilitating wireless communication between user devices and the core network. This includes components such as base stations, antennas, and radio transceivers that are pivotal in enabling mobile connectivity.

The market is experiencing significant growth, driven by the escalating demand for high-speed mobile data services, the widespread adoption of smartphones, and the global rollout of 5G networks. Technological advancements, such as the integration of cloud technologies into RAN infrastructure (Cloud-RAN), are enhancing network efficiency and scalability by centralizing the management and processing of network functions. Additionally, the adoption of Open RAN is promoting increased market competition by allowing operators to move away from proprietary solutions, fostering innovation, and enabling more flexible and efficient network upgrades and expansions. These developments are collectively propelling the expansion of the RAN Telecom Equipment Market.

Key Highlights

- The radio access network telecom equipment market is anticipated to grow at a CAGR of 7.8% during the forecast period.

- The global radio access network telecom equipment market was estimated to be worth approximately USD 12.43 billion in 2023 and is projected to reach a value of USD 24.43 billion by 2032.

- The growth of the radio access network telecom equipment market is being driven by the ever-increasing demand for mobile data, the rapid advancement and deployment of 5G technology, and the rising number of connected devices, including smartphones and IoT devices.

- Based on the type, the macro station segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the telecom operators segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Radio Access Network Telecom Equipment Market: Dynamics

Key Growth Drivers

- 5G Network Deployments: The ongoing and accelerating global rollout of 5G networks is the primary driver, requiring significant investments in new RAN equipment with higher capacity, lower latency, and support for new spectrum bands.

- Increasing Mobile Data Traffic: The ever-growing demand for mobile data driven by video streaming, IoT devices, and bandwidth-intensive applications necessitates RAN upgrades and expansions to handle the increased load.

- Demand for Enhanced Mobile Broadband (eMBB): Users expect faster download and upload speeds for various applications, pushing mobile operators to invest in advanced RAN technologies that can deliver enhanced mobile broadband experiences.

- Growth of Massive Machine-Type Communications (mMTC) for IoT: The proliferation of IoT devices requiring wide-area connectivity and low power consumption drives the need for RAN infrastructure that can efficiently support massive numbers of connected devices.

- Demand for Ultra-Reliable Low-Latency Communications (URLLC) for Critical Applications: Emerging applications like autonomous vehicles, industrial automation, and remote surgery require ultra-reliable and low-latency connectivity, necessitating specialized RAN equipment and architectures.

- Government Initiatives and Spectrum Auctions: Government policies promoting digital infrastructure development and the allocation of new spectrum bands through auctions incentivize mobile operators to invest in and upgrade their RAN.

- Private 5G Network Deployments: The increasing adoption of private 5G networks by enterprises for specific industrial and commercial applications creates a new demand segment for RAN equipment.

- Open RAN (O-RAN) Initiatives: The push towards open and interoperable RAN architectures, allowing for a more diverse vendor ecosystem, is driving innovation and potentially lowering costs, thus encouraging deployments.

Restraints

- High Capital Expenditure (CAPEX) for Network Deployments: Deploying and upgrading RAN infrastructure, especially for 5G, requires substantial upfront investments, which can be a barrier for some mobile operators, particularly in price-sensitive markets.

- Spectrum Availability and Cost: Access to sufficient and affordable spectrum is crucial for deploying advanced RAN technologies. The limited availability and high cost of spectrum in some regions can hinder deployments.

- Complexity of Network Deployment and Integration: Deploying new RAN equipment and integrating it with existing infrastructure can be technically complex and time-consuming, requiring specialized expertise.

- Concerns Regarding 5G Health and Environmental Impact: Misinformation and public concerns about the potential health and environmental effects of 5G technology can sometimes lead to delays in network deployments.

- Geopolitical Tensions and Vendor Restrictions: Geopolitical tensions and government restrictions on certain telecom equipment vendors can disrupt supply chains and impact market competition.

- Return on Investment (ROI) Uncertainty for 5G: While the long-term potential of 5G is significant, the immediate ROI for mobile operators can be uncertain, especially in the early stages of deployment.

- Permitting and Regulatory Hurdles: Obtaining the necessary permits for building new cell sites and deploying infrastructure can be a lengthy and complex process.

- Power Consumption and Site Density Challenges: 5G networks often require a higher density of cell sites and can consume more power, leading to increased operational expenses (OPEX) and infrastructure challenges.

Opportunities

- Small Cell Deployments: The need for increased capacity and coverage in dense urban areas and indoor environments drives the demand for small cell RAN equipment.

- Massive MIMO (Multiple-Input Multiple-Output) Technologies: The deployment of massive MIMO antennas significantly increases network capacity and efficiency, creating opportunities for vendors specializing in these technologies.

- Virtualization and Software-Defined RAN (vRAN/SD-RAN): The trend towards virtualizing RAN functions and using software-defined networking offers greater flexibility, scalability, and cost-efficiency.

- Artificial Intelligence (AI) and Machine Learning (ML) in RAN Management: Utilizing AI/ML for intelligent network optimization, predictive maintenance, and resource allocation can improve network performance and reduce OPEX.

- Energy-Efficient RAN Solutions: The focus on sustainability and reducing energy consumption drives the demand for energy-efficient RAN equipment and power management solutions.

- Network Slicing for Diverse Use Cases: 5G network slicing allows operators to create virtualized and isolated network partitions for specific applications and services, opening up new revenue opportunities.

- Edge Computing Integration with RAN: Bringing computing resources closer to the edge of the network can enable low-latency applications and create new opportunities for RAN infrastructure.

- Private 5G Network Solutions: The burgeoning market for private 5G networks across various industries presents a significant opportunity for RAN equipment vendors.

Challenges

- Managing the Complexity of Heterogeneous Networks: Operating and optimizing networks with a mix of 2G, 3G, 4G, and 5G technologies is a significant challenge.

- Ensuring Security in Open and Virtualized RAN Architectures: Addressing the security vulnerabilities that may arise with the disaggregation and virtualization of RAN components.

- Achieving True Interoperability in O-RAN Environments: Ensuring seamless interoperability between equipment from different O-RAN vendors is crucial for the success of open RAN.

- Optimizing Network Performance for Diverse 5G Use Cases: Tailoring RAN parameters and configurations to meet the specific requirements of eMBB, mMTC, and URLLC applications simultaneously.

- Reducing the Total Cost of Ownership (TCO) of 5G Networks: Balancing the need for advanced capabilities with the economic realities of network deployment and operation.

- Addressing the Skills Gap in Telecom Engineering: The deployment and management of advanced RAN technologies require a skilled workforce, and addressing the existing skills gap is crucial.

- Dealing with Supply Chain Vulnerabilities and Diversification: Ensuring a resilient and diversified supply chain for critical RAN components.

- Navigating Evolving Regulatory Landscapes and Standards: Keeping pace with the rapidly evolving regulatory environment and technical standards for 5G and future mobile technologies.

Radio Access Network Telecom Equipment Market: Report Scope

This report thoroughly analyzes the Radio Access Network Telecom Equipment Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Radio Access Network Telecom Equipment Market |

| Market Size in 2023 | USD 12.43 Billion |

| Market Forecast in 2032 | USD 24.43 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 188 |

| Key Companies Covered | Huawei, Nokia, Ericsson, Cisco Systems, ZTE, Samsung, Ciena, Fujitsu, Juniper Networks, FiberHome Technologies |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Radio Access Network Telecom Equipment Market: Segmentation Insights

The global radio access network telecom equipment market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global radio access network telecom equipment market is divided into macro station, micro station, pico station, and femto station.

Macro Station dominates the radio access network telecom equipment market due to its extensive use in wide-area coverage and backbone connectivity in both urban and rural deployments. These high-power base stations are critical for supporting large user bases and ensuring strong signal penetration, especially for 4G and 5G services. Mobile network operators heavily rely on macro stations for national and regional coverage, making them the backbone of telecom infrastructure. With continued investment in 5G rollouts and network modernization, this segment remains the most significant in terms of revenue and volume.

Micro Station plays a pivotal role in enhancing network capacity and coverage in dense urban environments where macro cells face signal degradation due to building obstructions or high user density. These low-power stations are deployed on street furniture, lamp posts, and building walls to support high traffic areas like shopping malls, stadiums, and business districts. The demand for micro stations is growing rapidly, driven by the surge in mobile data consumption and need for seamless connectivity.

Pico Station is designed for indoor environments and small venues such as offices, cafes, and retail stores. They offer localized coverage and are instrumental in ensuring high-speed connectivity in indoor spaces where macro and micro signals may be weak. The adoption of pico cells is expanding in response to the increasing use of smart devices and IoT technologies within enterprises and retail sectors.

Femto Station is a consumer-grade, low-power RAN device often used in residential or small office settings to improve indoor signal quality. These are typically plug-and-play units connected to broadband and used to alleviate poor indoor mobile coverage. Although smaller in market share compared to other station types, femto stations have a stable demand in areas with poor network penetration and remain relevant for consumer-level telecom enhancement.

Segmentation Insights by Application

On the basis of application, the global radio access network telecom equipment market is bifurcated into telecom operators, government and company, and other.

Telecom Operators represent the largest and most dominant application segment in the radio access network telecom equipment market. These operators are responsible for the deployment, maintenance, and expansion of network infrastructure. With the rapid rollouts of 5G technology, telecom operators are investing heavily in RAN equipment to meet the growing demand for faster data speeds, higher network capacity, and improved connectivity. The shift towards network densification and small cell deployment, driven by the rise of mobile data traffic and the IoT, is leading telecom operators to further increase their expenditure on RAN equipment. Telecom operators are also at the forefront of innovations in network architecture, such as virtualized RAN (vRAN), which is being widely adopted to enhance network performance, flexibility, and cost-efficiency.

Government and Company applications, while smaller compared to telecom operators, are also crucial in the development of RAN infrastructure. Governments worldwide are focusing on increasing connectivity, especially in rural or underserved regions, to bridge the digital divide. This often involves partnerships with private companies for the provision of telecommunication services and infrastructure, including RAN equipment. Governments also play a significant role in creating regulatory frameworks that drive the adoption and deployment of new RAN technologies, such as 5G. On the other hand, private companies, including enterprises and industrial sectors, are adopting RAN technologies to support private networks, enhance operational efficiency, and ensure secure, high-speed connectivity for business-critical applications.

Radio Access Network Telecom Equipment Market: Regional Insights

- North America is expected to dominate the global market.

North America remains the dominant region in the radio access network telecom equipment market, propelled by significant investments in 5G infrastructure and a well-established telecommunications ecosystem. The United States leads this growth, with major telecom operators like Verizon, AT&T, and T-Mobile heavily investing in 5G and Open RAN technologies. In particular, AT&T’s partnership with Ericsson to implement Open RAN technology demonstrates the shift towards more flexible, cost-effective network architectures. North America's dominance is also supported by government initiatives aimed at securing and advancing the telecom network, ensuring a diverse and secure supply chain. The region's high demand for mobile broadband services, the proliferation of connected devices, and technological innovation make it the leader in the RAN market.

Asia-Pacific region is rapidly expanding in the RAN telecom equipment market, with countries like China, India, Japan, and South Korea leading the way. The region is witnessing a fast-paced rollout of 5G networks to meet the rising demand for mobile broadband and connected devices. Asia-Pacific’s focus on technological innovation and digital transformation is driving the adoption of advanced RAN technologies, positioning it as a significant player globally. While not as dominant as North America, the region’s growth trajectory and the sheer scale of its telecom infrastructure give it a leading role in the market.

Europe shows steady growth in the RAN telecom equipment market, with key countries like Germany, the United Kingdom, and France leading the way. The European Union’s focus on digital connectivity and policies supporting 5G deployment contribute to this growth. A notable trend is the increasing adoption of Open RAN solutions in Europe, which enhances network flexibility and reduces reliance on traditional equipment vendors. While Europe is not the dominant region, its commitment to 5G infrastructure and digital transformation continues to strengthen its position in the market.

Latin America is gradually adopting RAN telecom equipment, particularly in countries like Brazil and Mexico, driven by the need to enhance mobile network coverage and meet the growing demand for mobile data. Although economic challenges and regulatory barriers exist, the push for digital inclusion and expanded mobile broadband networks is fueling the region’s growth. While it is not a dominant market, Latin America is steadily increasing its share in the global RAN market.

Middle East & Africa region is still in the early stages of developing its RAN telecom equipment market, but there is significant investment in improving telecommunications infrastructure. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are focusing on digital transformation and 5G deployment as part of broader economic growth initiatives. Although the region faces challenges such as geopolitical instability and infrastructure limitations, its commitment to technological advancement is gradually positioning it for growth in the RAN sector.

Radio Access Network Telecom Equipment Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the radio access network telecom equipment market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global radio access network telecom equipment market include:

- Huawei

- Nokia

- Ericsson

- Cisco Systems

- ZTE

- Samsung

- Ciena

- Fujitsu

- Juniper Networks

- FiberHome Technologies

The global radio access network telecom equipment market is segmented as follows:

By Type

- Macro Station

- Micro Station

- Pico Station

- Femto Station

By Application

- Telecom Operators

- Government and Company

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Radio Access Network Telecom Equipment

Request Sample

Radio Access Network Telecom Equipment