Rear & Front Drive Shaft Market Size, Share, and Trends Analysis Report

CAGR :

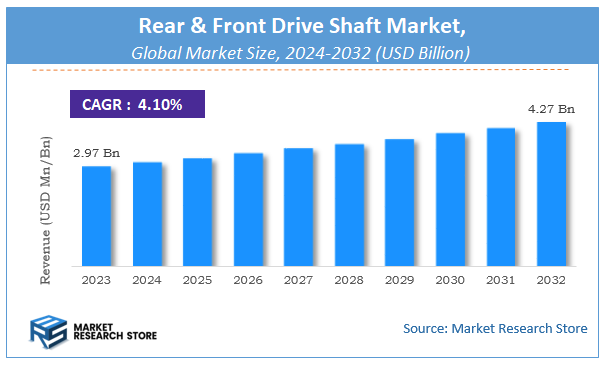

| Market Size 2023 (Base Year) | USD 2.97 Billion |

| Market Size 2032 (Forecast Year) | USD 4.27 Billion |

| CAGR | 4.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rear & Front Drive Shaft Market Insights

According to Market Research Store, the global rear & front drive shaft market size was valued at around USD 2.97 billion in 2023 and is estimated to reach USD 4.27 billion by 2032, to register a CAGR of approximately 4.1% in terms of revenue during the forecast period 2024-2032.

The rear & front drive shaft report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rear & Front Drive Shaft Market: Overview

Rear & Front Drive Shaft Market is an integral part of the automotive components industry, focusing on the production and development of shafts that transmit torque from the engine to the wheels. These components play a critical role in ensuring the efficient movement of vehicles, especially in rear-wheel, front-wheel, and all-wheel drive systems. The market is primarily driven by the ongoing expansion of the automotive sector and increasing demand for durable, lightweight, and high-performance vehicle parts. As the industry moves toward fuel efficiency and emission reduction, manufacturers are developing advanced drive shaft systems, including hollow and composite variants, which help in reducing overall vehicle weight without compromising strength or performance. The adoption of electric and hybrid vehicles is also influencing innovations in drive shaft technologies, as new powertrain configurations require tailored torque transmission systems.

Key Highlights

- The rear & front drive shaft market is anticipated to grow at a CAGR of 4.1% during the forecast period.

- The global rear & front drive shaft market was estimated to be worth approximately USD 2.97 billion in 2023 and is projected to reach a value of USD 4.27 billion by 2032.

- The growth of the rear & front drive shaft market is being driven by increasing vehicle production and a rising demand for efficient power transmission systems.

- Based on the product type, the single piece drive shaft segment is growing at a high rate and is projected to dominate the market.

- On the basis of vehicle type, the passenger cars segment is projected to swipe the largest market share.

- In terms of material, the steel segment is expected to dominate the market.

- Based on the sales channel, the OEM segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Rear & Front Drive Shaft Market: Dynamics

Key Growth Drivers:

- Increasing Vehicle Production Globally: The overall growth in automobile production worldwide, driven by rising population and disposable income, directly translates to higher demand for drive shafts. As more vehicles are manufactured, the need for both front and rear drive shafts (depending on the vehicle's drive type) increases.

- Rising Demand for SUVs and Light Commercial Vehicles (LCVs): SUVs and LCVs, which often utilize AWD or 4WD systems, require both front and rear drive shafts. The increasing popularity of these vehicle types globally is a significant driver for the market.

- Growing Adoption of All-Wheel Drive (AWD) and Four-Wheel Drive (4WD) Systems: Consumer preference for enhanced traction, stability, and off-road capabilities is leading to a greater adoption of AWD and 4WD systems in passenger cars and light trucks, thereby boosting the demand for both front and rear drive shafts.

- Stringent Safety Regulations: Regulations mandating advanced safety features, which can sometimes necessitate specific drive shaft designs for optimal vehicle control and stability, contribute to market growth.

- Demand for High-Performance Vehicles: The increasing demand for sports cars, performance sedans, and high-performance SUVs, which often utilize robust and precisely engineered drive shafts for optimal power delivery and handling, fuels market growth.

- Technological Advancements in Drive Shaft Design: Innovations in materials (e.g., lightweight composites), design (e.g., constant velocity joints), and manufacturing processes leading to more efficient, durable, and lighter drive shafts are driving market growth by offering improved vehicle performance and fuel efficiency.

Restraints:

- Shift Towards Electric Vehicles (EVs): Battery electric vehicles (BEVs) typically do not require traditional mechanical drive shafts as each wheel is often powered by individual electric motors. The increasing adoption of EVs poses a significant long-term restraint on the demand for conventional front and rear drive shafts.

- Fluctuations in Raw Material Prices: The cost of raw materials such as steel and aluminum, which are primary components in drive shaft manufacturing, can fluctuate significantly, impacting production costs and potentially limiting market growth or profitability.

- Increasing Focus on Vehicle Lightweighting: While advancements in materials are a growth driver, the overall industry trend towards vehicle lightweighting to improve fuel efficiency and reduce emissions might lead to a decrease in the overall weight and size of drive shafts, potentially impacting revenue per unit.

- Economic Downturns and Automotive Sales Slumps: Economic recessions can lead to a decrease in overall vehicle sales, directly impacting the demand for automotive components, including drive shafts.

- Competition from Integrated Powertrain Solutions: Some powertrain designs might integrate functionalities that reduce the need for traditional separate drive shafts, posing a competitive threat.

- Aftermarket Competition and Pricing Pressure: The aftermarket for drive shaft replacements is competitive, and pricing pressure can impact the profitability of original equipment manufacturers (OEMs) and suppliers.

Opportunities:

- Hybrid Vehicle Market Growth: Hybrid electric vehicles (HEVs) often utilize both an internal combustion engine and electric motors, and many still require drive shafts to transmit power. The growth of the HEV market presents an opportunity for drive shaft manufacturers.

- Development of Lightweight and Advanced Materials: Continued research and development in lightweight materials like carbon fiber composites and advanced alloys offer opportunities to manufacture more efficient and high-performance drive shafts.

- Focus on Noise, Vibration, and Harshness (NVH) Reduction: There is an increasing demand for drive shafts that minimize NVH for a smoother and more comfortable driving experience, providing opportunities for manufacturers to innovate in this area.

- Expansion in the Off-Highway Vehicle Sector: The demand for drive shafts in off-highway vehicles such as agricultural equipment, construction machinery, and mining vehicles remains significant and offers growth opportunities.

- Aftermarket for Replacement and Upgradation: The aftermarket for replacing worn-out or damaged drive shafts and upgrading to higher-performance versions continues to be a significant opportunity for manufacturers and suppliers.

- Supplying to Electric Vehicle Startups: While pure EVs don't use traditional drive shafts, some emerging electric vehicle designs or specialized applications might still incorporate shaft-based power transmission, presenting niche opportunities.

Challenges:

- Adapting to the Electrification Trend: The most significant challenge is the long-term shift towards electric vehicles and the need for drive shaft manufacturers to diversify their product portfolios or find new applications for their expertise.

- Meeting Stringent Performance and Durability Requirements: Drive shafts are critical components that must withstand high torque, varying speeds, and harsh operating conditions. Meeting increasingly stringent performance and durability requirements is a continuous challenge.

- Cost Optimization and Price Competitiveness: Automotive manufacturers constantly seek cost reductions from their suppliers. Drive shaft manufacturers face the challenge of maintaining quality and performance while remaining price-competitive.

- Managing Complex Supply Chains: Ensuring a reliable and cost-effective supply of raw materials and components across a global supply chain can be challenging, especially in times of geopolitical instability or logistical disruptions.

- Keeping Pace with Rapid Technological Advancements: The automotive industry is evolving rapidly, with new powertrain technologies and vehicle architectures emerging. Drive shaft manufacturers need to continuously adapt and innovate to remain relevant.

- Addressing Environmental Concerns in Manufacturing: The manufacturing processes for drive shafts can have environmental impacts. Adopting more sustainable manufacturing practices and reducing the carbon footprint is an increasing challenge and responsibility.

Rear & Front Drive Shaft Market: Report Scope

This report thoroughly analyzes the Rear & Front Drive Shaft Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rear & Front Drive Shaft Market |

| Market Size in 2023 | USD 2.97 Billion |

| Market Forecast in 2032 | USD 4.27 Billion |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 167 |

| Key Companies Covered | GKN, NTN, SDS, Dana, Nexteer, Hyundai-Wia, IFA Rotorion, Meritor, AAM, Neapco, JTEKT, Yuandong, Wanxiang |

| Segments Covered | By Product Type, By Vehicle Type, By Material, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rear & Front Drive Shaft Market: Segmentation Insights

The global rear & front drive shaft market is divided by product type, vehicle type, material, sales channel, and region.

Segmentation Insights by Product Type

Based on product type, the global rear & front drive shaft market is divided into single piece drive shaft, two piece drive shaft, and slip-in-tube drive shaft.

Single Piece Drive Shafts are the dominate segment in the rear & front drive shaft market, primarily because of their straightforward design, lower production and maintenance costs, and efficient torque transmission in vehicles with shorter distances between the transmission and the drive axle. These shafts are known for their simplicity, light weight, and cost-effectiveness. They offer smooth transmission of torque with fewer components and minimal maintenance requirements, making them suitable for light-duty vehicles, including sedans and some compact trucks. However, their application is limited by their length and strength; they can become unstable at higher rotational speeds if used in long-wheelbase vehicles, which restricts their adoption in larger or high-performance vehicles.

Two Piece Drive Shafts serve vehicles with longer wheelbases, such as trucks, large SUVs, and commercial vehicles. Comprising two connected shafts with a center bearing support, they provide greater strength, better torque distribution, and reduced vibration during operation. This makes them ideal for heavy-duty applications and vehicles with higher load demands. Additionally, their enhanced performance and reliability over long distances contribute to their widespread use across automotive and commercial transport sectors. The ability to better manage driveline angles and accommodate chassis flex in larger vehicles further supports the dominance of two piece drive shafts in the market.

Slip-in-Tube Drive Shafts are a specialized segment designed for impact absorption and adaptability to varying vehicle dynamics. These shafts include an internal slip mechanism that allows for compression and extension during motion, making them particularly suitable for off-road vehicles, high-performance automobiles, and applications requiring frequent suspension movement. Their flexibility helps maintain driveline alignment and reduces the risk of shaft damage under extreme conditions. Although they offer advanced functionality, their adoption is relatively niche due to higher manufacturing costs and specific use-case scenarios. They are typically preferred in vehicles that demand greater adaptability to terrain or driving conditions.

Segmentation Insights by Vehicle Type

On the basis of vehicle type, the global rear & front drive shaft market is bifurcated into passenger cars, light commercial vehicles, and heavy commercial vehicles.

Passenger Cars represent the dominant segment in the rear & front drive shaft market, driven by the massive volume of car production globally and the increasing integration of efficient driveline systems in modern vehicles. Drive shafts in passenger cars play a vital role in transferring engine power to the wheels, especially in rear-wheel drive and all-wheel drive configurations. The rapid growth in personal vehicle ownership, especially in emerging economies, coupled with a rising demand for fuel efficiency and low-maintenance driveline components, has reinforced the adoption of drive shafts in this segment. Furthermore, technological advancements such as lightweight materials (e.g., carbon fiber and aluminum) are increasingly being incorporated into passenger car drive shafts to reduce weight and improve fuel economy. The consistent rollout of new vehicle models and the trend toward electric and hybrid passenger vehicles also contribute to sustained demand for advanced and efficient drive shaft solutions.

Light Commercial Vehicles (LCVs) are the second-largest segment, covering vans, small trucks, and pickup trucks that require reliable drive shaft systems for carrying moderate payloads over varying distances. LCVs typically rely on sturdy drive shafts that can handle frequent stops, medium-range torque requirements, and variable road conditions. Growth in the e-commerce and logistics sectors, particularly in urban areas, has boosted demand for LCVs, thereby increasing the need for high-performance, durable drive shafts. Manufacturers are also focusing on improving the efficiency and lifespan of these components to meet commercial users' expectations for low downtime and high durability.

Heavy Commercial Vehicles (HCVs), including large trucks, buses, and construction vehicles, use more robust and complex drive shaft systems to support high torque loads, long-distance travel, and heavy-duty applications. While this segment has a lower volume compared to passenger cars, it requires high-strength materials and precision engineering to ensure performance under strenuous conditions. The growing need for infrastructure development, freight movement, and industrial logistics continues to drive steady demand for HCVs, and by extension, drive shaft systems tailored for durability, power transmission, and operational longevity.

Segmentation Insights by Material

On the basis of material, the global rear & front drive shaft market is bifurcated into steel, aluminum, and carbon fiber.

Steel is the most commonly used material in drive shafts and dominates the rear & front drive shaft market because of its superior structural strength, reliability, and affordability. It is widely adopted across all vehicle types—from passenger cars to heavy commercial vehicles—owing to its ability to handle high torque loads, withstand harsh operating conditions, and offer long service life. Steel drive shafts are particularly favored in markets where durability, load-bearing capacity, and cost efficiency are critical factors. Additionally, the manufacturing processes for steel drive shafts are well-established, making them a practical and widely available solution. Despite being heavier than alternatives like aluminum or carbon fiber, steel remains the go-to material due to its performance consistency, especially in commercial and utility vehicles that demand robust driveline components.

Aluminum drive shafts are gaining traction, particularly in passenger cars and light commercial vehicles, due to their lighter weight and ability to enhance fuel efficiency. Aluminum offers a favorable balance between strength and weight, making it an appealing option for automakers focused on reducing vehicle mass to improve performance and meet emissions regulations. These shafts are also more resistant to corrosion compared to steel, which contributes to their increasing use in certain automotive segments. However, they are not as strong as steel and may not be suitable for high-torque or heavy-duty applications without reinforcement, which slightly limits their widespread adoption in the commercial vehicle sector.

Carbon Fiber drive shafts represent the most advanced and lightweight option, mainly used in high-performance sports cars, luxury vehicles, and racing applications. Their superior strength-to-weight ratio significantly reduces rotational mass, resulting in faster acceleration, better fuel economy, and reduced vibration. Carbon fiber also provides excellent resistance to fatigue and corrosion. However, the high production cost and complex manufacturing processes restrict their use to premium vehicle segments. As demand for electric vehicles and high-efficiency systems grows, the use of carbon fiber is expected to increase, but its adoption will likely remain limited to niche, high-value applications in the near term.

Segmentation Insights by Sales Channel

On the basis of sales channel, the global rear & front drive shaft market is bifurcated into OEM and aftermarket.

OEM rear & front drive shaft dominate the market as they are integrated during the vehicle manufacturing process and are designed to meet exact specifications required by automotive brands. These components offer superior compatibility, reliability, and performance, making them the preferred choice for both automakers and consumers who prioritize original quality and long-term durability. OEM drive shafts are typically manufactured under strict quality control standards, ensuring optimal fit and functionality with the vehicle’s drivetrain. The increasing global production of vehicles, particularly in the passenger car and light commercial vehicle segments, further supports the growth of OEM sales. Additionally, automakers are focusing on integrating lightweight materials and advanced drive shaft technologies at the factory level to improve fuel efficiency and driving dynamics, contributing to the OEM segment's continued dominance.

Aftermarket drive shafts cater to vehicle owners seeking replacement parts or performance upgrades after the original component has worn out or failed. This segment is driven by the aging vehicle population, increased vehicle customization trends, and demand for cost-effective repair solutions. Aftermarket suppliers offer a wide variety of options, including performance-enhancing or budget-friendly alternatives, making them attractive to a diverse customer base ranging from individual car owners to repair shops. While aftermarket components may vary in terms of quality and fitment, the segment continues to grow due to expanding automotive repair and maintenance needs globally. However, aftermarket sales are more fragmented and may not always match the precision and warranty support provided by OEM solutions.

Rear & Front Drive Shaft Market: Regional Insights

- North America is expected to dominate the global market.

North America are the dominant regions in the Rear & Front Drive Shaft Market, The demand for drive shafts in this region is driven by high vehicle production and a focus on enhancing vehicle performance and fuel efficiency. Key manufacturers like Dana, Neapco, and Meritor have established strong manufacturing bases in the region, supporting the just-in-time requirements of automakers. Additionally, innovations in drive shaft technologies aimed at improving vehicle efficiency are contributing to the market's growth. The U.S., in particular, remains a dominant market for both rear and front drive shafts, due to its robust automotive industry.

Europe also presents a strong demand for rear and front drive shafts, with countries such as Germany, France, and the UK being major contributors. Europe's automotive market is known for high standards in vehicle performance and efficiency, which is driving the adoption of advanced drive shaft technologies. The region’s focus on reducing emissions and improving fuel efficiency is leading to innovations in lightweight drive shaft materials and designs. Additionally, the presence of leading automotive manufacturers, such as Volkswagen, BMW, and Daimler, plays a key role in the growth of the market in this region. Europe's stringent environmental regulations further encourage the development of more efficient drive shaft solutions.

Asia-Pacific is the largest and fastest-growing region in the Rear & Front Drive Shaft Market. Countries like China, Japan, and India are key drivers of this growth, owing to rapid urbanization, increasing disposable incomes, and a booming automotive manufacturing base. Asia-Pacific is home to some of the world’s largest automotive manufacturers, such as Toyota, Honda, and Hyundai, which are significant consumers of rear and front drive shafts. The demand for these components is fueled by the expanding automotive production and a growing middle class that is increasingly purchasing personal vehicles. The region’s automotive manufacturing capacity, coupled with increasing exports, is expected to continue driving growth in the market for rear and front drive shafts.

Latin America is an emerging market for rear and front drive shafts, experiencing growth due to increasing vehicle production and an expanding automotive industry. Countries like Brazil and Mexico are seeing rising demand for automotive components as local manufacturing capabilities improve. The market is growing as consumer demand for vehicles increases and local automotive production ramps up. Manufacturers are looking to tap into this market with both cost-effective and high-performance drive shaft solutions. Latin America presents opportunities for growth, particularly as the automotive market becomes more sophisticated and competitive.

Middle East & Africa is a developing market with significant growth potential. While the region is still in the early stages of market development, increasing disposable incomes and rising vehicle ownership are driving demand for rear and front drive shafts. The Middle East, particularly countries like the UAE and Saudi Arabia, has seen a rise in luxury car ownership, which is contributing to the demand for high-performance drive shafts. However, the region faces challenges related to limited local manufacturing capabilities and a reliance on imports, which could slow growth in the short term. Despite these challenges, the market is expected to expand as automotive demand increases and manufacturing capabilities improve in select countries.

Rear & Front Drive Shaft Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rear & front drive shaft market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rear & front drive shaft market include:

- GKN

- NTN

- SDS

- Dana

- Nexteer

- Hyundai-Wia

- IFA Rotorion

- Meritor

- AAM

- Neapco

- JTEKT

- Yuandong

- Wanxiang

The global rear & front drive shaft market is segmented as follows:

By Product Type

- Single Piece Drive Shaft

- Two Piece Drive Shaft

- Slip-in-Tube Drive Shaft

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Material

- Steel

- Aluminum

- Carbon Fiber

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rear & Front Drive Shaft

Request Sample

Rear & Front Drive Shaft