Recycled Thermoplastic Market Size, Share, and Trends Analysis Report

CAGR :

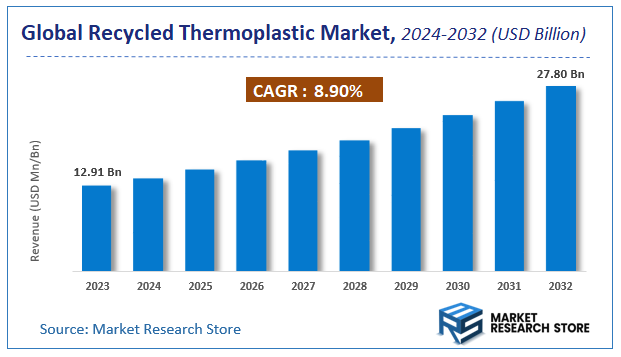

| Market Size 2023 (Base Year) | USD 12.91 Billion |

| Market Size 2032 (Forecast Year) | USD 27.80 Billion |

| CAGR | 8.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Recycled Thermoplastic Market Insights

According to Market Research Store, the global recycled thermoplastic market size was valued at around USD 12.91 billion in 2023 and is estimated to reach USD 27.80 billion by 2032, to register a CAGR of approximately 8.9% in terms of revenue during the forecast period 2024-2032.

The recycled thermoplastic report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Recycled Thermoplastic Market: Overview

Recycled thermoplastic refers to plastic materials that have been reclaimed from post-consumer or post-industrial waste streams, reprocessed, and reused to manufacture new products. Thermoplastics—such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS)—are particularly well-suited for recycling because they can be melted and remolded multiple times without significantly degrading their molecular structure. The recycling process typically involves collection, sorting, cleaning, shredding, melting, and pelletizing, after which the recycled material can be used alone or blended with virgin plastic.

The growth of recycled thermoplastic usage is driven by increasing global emphasis on sustainability, circular economy practices, and regulatory measures aimed at reducing plastic pollution and carbon emissions. Industries such as automotive, packaging, construction, and consumer goods are incorporating recycled thermoplastics to reduce raw material costs and environmental impact. Technological advancements in sorting systems, additives, and chemical recycling are improving the quality and versatility of recycled thermoplastics, enabling their use in higher-value applications. As demand for eco-friendly materials continues to rise, recycled thermoplastics are playing an increasingly important role in supporting green manufacturing and waste reduction initiatives worldwide.

Key Highlights

- The recycled thermoplastic market is anticipated to grow at a CAGR of 8.9% during the forecast period.

- The global recycled thermoplastic market was estimated to be worth approximately USD 12.91 billion in 2023 and is projected to reach a value of USD 27.80 billion by 2032.

- The growth of the recycled thermoplastic market is being driven by stringent environmental regulations and mandates being implemented by governments globally.

- Based on the form, the flakes segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the extrusion segment is projected to swipe the largest market share.

- In terms of product, the polyethylene segment is expected to dominate the market.

- Based on the application, the packaging segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Recycled Thermoplastic Market: Dynamics

Key Growth Drivers:

- Rising Environmental Concerns and Plastic Waste Crisis: The escalating global plastic waste problem, with its detrimental impact on landfills, oceans, and ecosystems, is the primary driver. Increased awareness among consumers, governments, and corporations is fueling the demand for sustainable alternatives like recycled thermoplastics to reduce environmental footprint.

- Stringent Government Regulations and Policies: Governments worldwide are implementing stricter regulations regarding plastic waste management, promoting recycling initiatives, and mandating the use of recycled content in various products. Examples include bans on single-use plastics, extended producer responsibility (EPR) schemes, and targets for recycled content in packaging and other goods.

- Growing Demand for Sustainable Materials Across Industries: Key industries such as packaging, automotive, construction, consumer goods, and electrical & electronics are increasingly adopting recycled thermoplastics to meet their sustainability goals, improve their corporate image, and comply with evolving regulatory and consumer demands.

- Cost-Effectiveness Compared to Virgin Plastics: While initial processing costs exist, recycled thermoplastics can often be more cost-effective than virgin plastics, especially when virgin plastic prices fluctuate due to volatile crude oil prices. This economic advantage provides a strong incentive for manufacturers to integrate recycled content.

- Technological Advancements in Recycling Processes: Innovations in recycling technologies, including advanced sorting techniques (e.g., AI-powered optical sorting), purification methods, and particularly chemical recycling (which breaks plastics down to their molecular building blocks), are significantly improving the quality, purity, and performance of recycled thermoplastics, making them comparable to virgin materials and expanding their application range.

- Consumer Preference for Eco-Friendly Products: A growing segment of consumers is actively seeking and willing to pay a premium for products made from recycled or sustainable materials. This shift in consumer behavior is pressuring brands to incorporate recycled thermoplastics into their product lines to cater to this demand.

- Circular Economy Initiatives: The global shift towards a circular economy model, which emphasizes resource efficiency, waste reduction, and material reuse, is a fundamental driver. Recycled thermoplastics are central to achieving circularity in the plastics industry by keeping valuable materials in circulation.

Restraints:

- Quality and Consistency of Recycled Materials: Ensuring consistent quality, purity, and performance properties of recycled thermoplastics can be challenging due to variations in feedstock sources, contamination, and degradation during the recycling process. This can limit their use in high-performance or food-contact applications.

- Limited Availability of High-Quality Plastic Waste: The availability of clean, sorted, and high-quality post-consumer and post-industrial plastic waste suitable for recycling remains a significant challenge. Inadequate collection infrastructure and inefficient sorting processes contribute to this scarcity.

- Competition from Virgin Plastics (Especially When Prices are Low): When the price of virgin plastics (which are directly linked to crude oil prices) drops significantly, they can become more economically attractive than recycled alternatives, undermining the cost advantage of recycled thermoplastics and slowing down market growth.

- Technical Challenges in Recycling Complex Plastics: Multi-layered packaging, composite plastics, and plastics containing various additives (like flame retardants, dyes, fillers) are difficult and costly to recycle mechanically, often leading to downcycling or disposal. Advanced recycling technologies are emerging but are not yet widely scaled.

- Lack of Standardized Regulations Across Regions: The absence of uniform and harmonized regulations for plastic waste management, recycling, and recycled content mandates across different countries and regions creates complexities for global manufacturers and can hinder cross-border trade of recycled materials.

- High Initial Investment in Recycling Infrastructure: Setting up advanced recycling facilities, especially for chemical recycling or specialized sorting, requires substantial capital investment. This can be a barrier to entry and expansion for many players.

- Consumer Acceptance and Perception for Certain Applications: While general awareness is growing, some consumers may still have reservations about the safety or performance of recycled plastics in specific applications, particularly food packaging or medical devices, requiring further education and clear labeling.

Opportunities:

- Advanced Recycling Technologies (Chemical Recycling): The rapid development and scaling of chemical recycling technologies (e.g., pyrolysis, gasification, depolymerization) offer a significant opportunity to process mixed and contaminated plastic waste, producing high-quality recycled monomers or virgin-like polymers, thus expanding the feedstock base and application possibilities.

- Development of "Design for Recyclability" Initiatives: Collaboration between polymer producers, product designers, and recyclers to create products that are inherently easier to recycle at their end-of-life (e.g., using mono-materials, easily removable labels, compatible additives) presents a massive opportunity to improve the overall circularity of plastics.

- Expansion into High-Value Applications: As the quality of recycled thermoplastics improves, there's an opportunity to penetrate higher-value applications traditionally dominated by virgin plastics, such as automotive components (e.g., interiors, under-the-hood parts), electrical & electronics casings, and even certain medical devices, where performance requirements are stringent.

- Growth in Emerging Economies with Increasing Waste Volumes: Rapid industrialization and urbanization in emerging economies (e.g., India, Southeast Asia) are generating massive volumes of plastic waste. Investing in recycling infrastructure and promoting the use of recycled thermoplastics in these regions presents significant growth potential.

- Strategic Partnerships and Collaborations Across the Value Chain: Opportunities exist for stronger collaborations between plastic manufacturers, brand owners, waste management companies, and recycling technology providers to create integrated, closed-loop systems for plastic recycling, ensuring a stable supply of recycled materials.

- Digitalization and Traceability Solutions: Implementing blockchain and other digital technologies to track the origin, quality, and journey of recycled plastics can enhance transparency, build trust, and verify sustainability claims, adding significant value to the recycled thermoplastic market.

- Specialized Recycled Grades for Niche Markets: Developing and marketing specialized recycled thermoplastic grades with tailored properties for specific niche markets (e.g., recycled engineering plastics for specialized industrial uses, flame-retardant recycled ABS) can cater to unmet demands and create higher-margin products.

Challenges:

- Contamination and Degradation During Recycling: The presence of contaminants (other plastics, labels, food residue) and the degradation of polymer chains during mechanical recycling can limit the quality and performance of recycled thermoplastics, making it challenging to achieve "closed-loop" recycling for many applications.

- Economic Viability of Collecting and Sorting Mixed Waste: The high cost and logistical complexity of collecting, sorting, and cleaning mixed plastic waste streams efficiently and economically remain a significant challenge, especially for low-value or highly contaminated plastics.

- Scaling Up Advanced Recycling Technologies: While promising, many advanced (chemical) recycling technologies are still in their nascent stages or pilot scale. Scaling them up to commercial production volumes economically and sustainably presents significant engineering and financial challenges.

- Energy Consumption and Carbon Footprint of Recycling Processes: Although generally lower than virgin plastic production, some recycling processes, particularly mechanical recycling involving washing, shredding, and re-pelletizing, can still be energy-intensive. Reducing the overall carbon footprint of recycling processes is a continuous challenge.

- Ensuring Consistent Supply for Large-Scale Manufacturing: Large manufacturers require a consistent and reliable supply of high-quality recycled thermoplastics. Establishing robust supply chains that can meet this demand, given the variability of waste streams, is a persistent challenge.

- Lack of Harmonized Standards and Certification: The absence of widely accepted global standards for recycled content, quality assurance, and certification can create confusion, hinder market transparency, and make it difficult for buyers to trust the quality of recycled materials.

- Consumer Education and Behavioral Change: While awareness is growing, a significant challenge remains in educating consumers about proper waste segregation and encouraging participation in recycling programs to ensure a cleaner and more consistent feedstock for the recycling industry.

Recycled Thermoplastic Market: Report Scope

This report thoroughly analyzes the Recycled Thermoplastic Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Recycled Thermoplastic Market |

| Market Size in 2023 | USD 12.91 Billion |

| Market Forecast in 2032 | USD 27.80 Billion |

| Growth Rate | CAGR of 8.9% |

| Number of Pages | 175 |

| Key Companies Covered | KW Plastics, Plastipak Holdings Inc., PARC Corporation, Clear Path Recycling, B. Schoenberg and Co., Custom Polymers Inc., RJM International Inc., Suez SA, Merlin Plastics Alberta Inc., Ricova International Inc., JP Industrial, Revital Polymers, MRC, Replas |

| Segments Covered | By Form, By Technology, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recycled Thermoplastic Market: Segmentation Insights

The global recycled thermoplastic market is divided by form, technology, product, application, and region.

Segmentation Insights by Form

Based on form, the global recycled thermoplastic market is divided into flakes, pellets, and granules.

Flakes dominate the Recycled Thermoplastic Market due to their widespread availability, cost-efficiency, and versatility in downstream applications. Flakes are primarily obtained through the mechanical recycling process of post-consumer and post-industrial plastic waste, particularly polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP). They serve as an intermediate material for manufacturing packaging products, fibers, and construction materials. Flakes are widely used in industries such as textiles, packaging, and automotive, where they are further processed into resins, sheets, or filaments. Their popularity stems from the relatively low processing cost, ease of transportation, and compatibility with existing plastic processing infrastructure, making them an attractive option for manufacturers seeking sustainable raw materials.

Pellets are another significant form of recycled thermoplastics, valued for their uniform shape, high purity, and ease of use in extrusion and injection molding applications. They are typically derived from cleaned and sorted flakes that undergo reprocessing and compounding to achieve consistent quality. Pellets are preferred in applications requiring higher mechanical properties and dimensional precision, such as automotive components, consumer goods, and electronic housings. The pellet form allows for more consistent melting behavior and better process control, which is critical in high-performance and precision-focused manufacturing environments. Their use is expanding as demand for high-quality recycled content rises in regulatory and environmentally conscious markets.

Granules are primarily utilized in applications where material properties can vary slightly without impacting performance, such as in low-end packaging, disposable items, and non-critical consumer products. They are often produced from mixed or lower-grade plastic streams and are less refined than pellets. Granules serve as a cost-effective option for small and medium-sized manufacturers seeking to incorporate recycled material without stringent technical requirements. Although less consistent than pellets, granules provide a valuable outlet for mixed recycled plastics and contribute to reducing landfill and incineration volumes. Their usage is growing in regions with aggressive waste reduction initiatives and in product lines that prioritize affordability and sustainability over performance.

Segmentation Insights by Technology

On the basis of technology, the global recycled thermoplastic market is bifurcated into extrusion, injection molding, blow molding, and others (thermoforming 3d printing).

Extrusion is the dominant technology in the Recycled Thermoplastic Market due to its efficiency, scalability, and suitability for a broad range of applications. This process involves melting recycled thermoplastic materials and forcing them through a die to create continuous shapes such as sheets, films, pipes, and profiles. It is widely used in industries like packaging, construction, and agriculture where large volumes of uniform plastic products are needed. Recycled flakes, pellets, or granules can be easily processed using extrusion methods, making it a cost-effective choice for manufacturers. Its adaptability to various recycled polymers—such as polyethylene (PE), polypropylene (PP), and polystyrene (PS)—adds to its dominance, especially as industries seek more sustainable alternatives to virgin materials.

Injection Molding holds significant importance in producing high-precision and high-strength components from recycled thermoplastics. This technology involves injecting molten plastic into molds to form complex shapes used in the automotive, consumer goods, and electronics sectors. Although it requires stricter material quality and consistency compared to extrusion, improvements in sorting and refining recycled plastics have made injection molding increasingly viable. Recycled thermoplastic pellets are particularly well-suited for this process due to their uniform melt behavior. As the demand grows for sustainable and performance-driven materials, recycled plastics used in injection molding continue to gain traction in premium applications.

Blow Molding is primarily employed in the production of hollow plastic products such as bottles, containers, and tanks using recycled thermoplastics. It is especially prominent in packaging applications where recycled polyethylene terephthalate (rPET) and high-density polyethylene (rHDPE) are used extensively. This technology allows manufacturers to reuse significant amounts of post-consumer plastic waste while maintaining functional and structural performance in packaging. The demand for environmentally friendly packaging has bolstered the relevance of blow molding in the recycled thermoplastics space, especially among consumer brands prioritizing circular economy goals. Its ability to accommodate a wide range of recycled plastic grades also adds to its market share.

Segmentation Insights by Product

On the basis of product, the global recycled thermoplastic market is bifurcated into polyethylene, polyethylene terephthalate, polypropylene, polystyrene, polyvinyl chloride, and others.

Polyethylene is the dominant product segment in the Recycled Thermoplastic Market due to its high volume of consumption, widespread applications, and excellent recyclability. It is primarily recycled in two forms: high-density polyethylene (HDPE) and low-density polyethylene (LDPE), both of which are extensively used in packaging films, containers, plastic bags, pipes, and agricultural products. Recycled polyethylene retains a considerable portion of its original strength and flexibility, making it suitable for manufacturing durable and lightweight goods. Its versatility and wide post-consumer availability make it a preferred material for closed-loop recycling systems, driving its leadership in the recycled thermoplastics sector.

Polyethylene Terephthalate (PET) is another critical product segment, widely recycled for use in bottles, fibers, and food packaging. Recycled PET (rPET) is valued for its clarity, strength, and barrier properties, and is commonly used in textiles (as polyester fibers), thermoformed trays, and new beverage containers. With increased pressure on reducing single-use plastic waste, PET recycling systems are becoming more sophisticated, enabling high-quality recovery and reuse. The demand for rPET is particularly high among packaging and fashion industries, which seek to meet sustainability targets without compromising material performance.

Polypropylene (PP) is gaining momentum in the recycled thermoplastics market due to its mechanical strength, chemical resistance, and thermal stability. It is commonly recovered from consumer packaging, automotive components, and household products. Recycled polypropylene is used in applications such as storage containers, automotive battery casings, and industrial parts. Although its recycling rate historically lagged behind PET and PE, advancements in sorting technology and growing demand from the automotive and consumer goods industries are pushing recycled PP into a more competitive position within the market.

Polystyrene (PS) is recycled less frequently due to its lightweight and brittle nature, which complicates collection and processing. However, with increasing focus on expanded polystyrene (EPS) recycling and improved reprocessing technologies, recycled PS is being used in insulation materials, packaging inserts, and molded products. Chemical recycling methods are also emerging to improve yield and purity, enabling greater market participation from this segment. Despite challenges, PS remains a notable part of the recycled thermoplastics mix due to its presence in consumer and commercial waste streams.

Polyvinyl Chloride (PVC) poses significant recycling challenges due to the presence of additives and its complex chemical structure. However, recycled PVC is still used in applications such as window frames, piping, and flooring, where consistent mechanical properties are more critical than aesthetic performance. Industrial recycling of PVC waste from construction and demolition is helping to sustain demand. Innovations in separation and dechlorination technologies are expected to gradually improve the recyclability and market share of PVC.

Segmentation Insights by Application

On the basis of application, the global recycled thermoplastic market is bifurcated into packaging, automotive, consumer goods, medical, building & construction, electrical and electronics, and others.

Packaging is the dominant application segment in the Recycled Thermoplastic Market, driven by high consumption volume, short product lifecycle, and intense global pressure to reduce single-use plastic waste. Recycled thermoplastics such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are widely used in manufacturing flexible films, rigid containers, trays, and bottles. Brands across food and beverage, personal care, and household product categories are integrating recycled content into their packaging to meet environmental goals and regulatory standards. The ease of processing, cost-effectiveness, and adaptability of recycled materials in extrusion and thermoforming processes further reinforce the segment’s leadership in the market.

Automotive is a rapidly expanding segment for recycled thermoplastics, particularly as automakers focus on sustainability and lightweighting strategies. Recycled polypropylene, polyethylene, and thermoplastic blends are used in non-critical interior parts, under-the-hood components, and battery housings. These materials help reduce vehicle weight, enhance fuel efficiency, and lower manufacturing costs. Additionally, post-industrial and post-consumer plastic waste is being reprocessed to meet performance standards for impact resistance and durability in automotive applications, which further boosts the segment’s growth potential.

Consumer Goods make up a significant portion of the market, using recycled thermoplastics for products such as furniture, toys, containers, kitchenware, and appliances. The appeal lies in the ability of recycled plastics to meet functional and aesthetic requirements while contributing to eco-conscious consumer trends. The flexibility of recycled thermoplastics in molding and coloring processes allows manufacturers to create a wide array of customized items. This segment also benefits from increasing awareness and demand for circular products among environmentally responsible consumers.

Medical applications for recycled thermoplastics are currently limited but growing in areas where safety, hygiene, and performance standards allow. Non-critical medical components, disposable instruments, and packaging for medical supplies may incorporate recycled materials. The use of recycled thermoplastics in this segment is subject to strict regulatory scrutiny, but advancements in material purification and sorting technologies are gradually enabling the inclusion of recycled content in select products. This is especially true for non-implantable, single-use items.

Building & Construction utilizes recycled thermoplastics in the production of durable and cost-effective products such as piping, insulation boards, roofing sheets, and wall panels. Materials like recycled PVC, HDPE, and polystyrene offer resistance to weathering, moisture, and corrosion, making them suitable for both structural and decorative applications. Additionally, the segment benefits from large-scale waste recovery programs associated with demolition and renovation activities. Recycled thermoplastics provide a sustainable solution for construction materials with long service life and reduced environmental footprint.

Electrical and Electronics is an emerging application area for recycled thermoplastics, particularly in non-conductive casings, wiring insulation, and housings for small appliances. Materials such as recycled ABS, PC, and PP are favored due to their excellent mechanical and thermal properties. As electronics manufacturers respond to e-waste regulations and extended producer responsibility (EPR) policies, recycled thermoplastics offer a pathway to reduce raw material usage and environmental impact. The compatibility of recycled materials with precision molding and their compliance with industry safety standards help support this segment’s expansion.

Recycled Thermoplastic Market: Regional Insights

- North America is expected to dominate the global market

North America dominate the recycled thermoplastic market, driven by robust recycling infrastructure, stringent environmental regulations, and increasing demand for sustainable materials across automotive, packaging, construction, and consumer goods sectors. The United States is the region’s key contributor, with major initiatives supporting closed-loop recycling systems and circular economy models. Large volumes of polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are collected and reprocessed for use in applications such as automotive components, decking, plastic lumber, rigid packaging, and industrial containers. Advanced sorting technologies, mechanical recycling methods, and chemical recycling pilot projects have helped enhance material purity and mechanical properties. Companies such as KW Plastics, Greenpath Recovery, and Avangard Innovative are key players investing in high-efficiency recycling processes. The region also benefits from growing consumer demand for post-consumer recycled (PCR) content in products and favorable government incentives, which continue to position North America at the forefront of the global recycled thermoplastic market.

Asia-Pacific is the fastest-growing region in the recycled thermoplastic market, driven by high plastic consumption, expanding manufacturing industries, and increasing focus on environmental protection. China, India, Japan, and Southeast Asian countries are major contributors. China, while previously the largest global importer of recyclable plastics, has now shifted toward domestic recycling after implementing its National Sword policy, encouraging local capacity building. India’s unorganized but extensive recycling ecosystem processes large volumes of PE and PP for secondary uses in packaging, piping, and construction products. Japan and South Korea have well-regulated recycling frameworks, emphasizing clean separation and reuse in high-value applications. However, the region still faces challenges related to contamination levels, inconsistent collection systems, and dependence on informal recycling sectors, particularly in developing nations. While Asia-Pacific is growing in volume, North America continues to dominate in terms of material traceability, product quality, and regulatory integration.

Europe holds a significant position in the recycled thermoplastic market, supported by the European Union’s Circular Economy Action Plan and directives targeting recycled content in packaging and automotive parts. Countries like Germany, the Netherlands, France, and Italy have strong municipal recycling systems and well-developed mechanical recycling facilities. Recycled PET and PP are widely used in food-grade packaging, textiles, and consumer electronics. Extended Producer Responsibility (EPR) schemes and plastic tax initiatives have further accelerated demand for high-quality recycled thermoplastics. Europe also leads in technological innovation, particularly in chemical recycling and depolymerization of complex thermoplastics. Despite this, North America retains market leadership due to greater integration of recycled thermoplastics across industrial supply chains and higher adoption rates in sectors such as automotive and construction.

Latin America shows emerging growth in the recycled thermoplastic market, with Brazil, Mexico, and Argentina being key countries. The region’s recycling industry is largely driven by economic necessity and supported by an active informal sector. Recycled materials are primarily used in non-food packaging, furniture, agricultural films, and construction applications. While local initiatives for improving collection and material recovery exist, inconsistent regulations and lack of processing capacity limit market scalability. Government efforts and public-private partnerships are helping to improve infrastructure and raise awareness, but North America continues to lead with more advanced regulatory frameworks and higher-grade recycling technologies.

Middle East & Africa region is at a nascent stage in the recycled thermoplastic market. In countries such as South Africa, the UAE, and Egypt, recycling programs are gradually expanding, particularly in urban centers. South Africa has a relatively organized plastic recycling industry, with recycled thermoplastics being used in packaging and construction products. However, much of the region still struggles with inadequate collection infrastructure, low consumer awareness, and limited investment in processing technologies. Reliance on imports for high-quality recycled material is common. In contrast, North America benefits from widespread institutional support, mature processing systems, and greater market integration for recycled thermoplastic products.

Recycled Thermoplastic Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the recycled thermoplastic market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global recycled thermoplastic market include:

- KW Plastics

- Plastipak Holdings Inc.

- PARC Corporation

- Clear Path Recycling

- B. Schoenberg and Co.

- Custom Polymers Inc.

- RJM International Inc.

- Suez SA

- Merlin Plastics Alberta Inc.

- Ricova International Inc.

- JP Industrial

- Revital Polymers

- MRC

- Replas

The global recycled thermoplastic market is segmented as follows:

By Form

- Flakes

- Pellets

- Granules

By Technology

- Extrusion

- Injection Molding

- Blow Molding

- Others (Thermoforming

- 3D Printing)

By Product

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polystyrene

- Polyvinyl Chloride

- Others

By Application

- Packaging

- Automotive

- Consumer Goods

- Medical

- Building & Construction

- Electrical and Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Recycled Thermoplastic

Request Sample

Recycled Thermoplastic