Requirements Management Tools Market Size, Share, and Trends Analysis Report

CAGR :

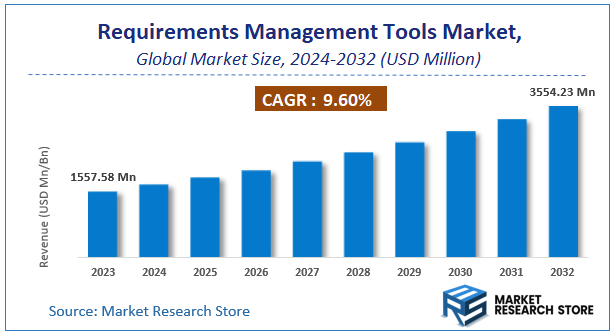

| Market Size 2023 (Base Year) | USD 1557.58 Million |

| Market Size 2032 (Forecast Year) | USD 3554.23 Million |

| CAGR | 9.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Requirements Management Tools Market Insights

According to Market Research Store, the global requirements management tools market size was valued at around USD 1557.58 million in 2023 and is estimated to reach USD 3554.23 million by 2032, to register a CAGR of approximately 9.6% in terms of revenue during the forecast period 2024-2032.

The requirements management tools report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Requirements Management Tools Market: Overview

The Requirements Management Tools Market focuses on software solutions designed to help organizations capture, analyze, track, and manage project requirements throughout the development lifecycle. These tools are essential for ensuring that projects meet stakeholder needs, comply with regulations, and are delivered on time and within budget. They are widely used in industries such as software development, engineering, healthcare, and aerospace, where complex projects require meticulous planning and documentation. Key features of these tools include requirement traceability, collaboration, version control, and integration with other project management and development tools.

The market is driven by the increasing complexity of projects, the need for efficient collaboration among distributed teams, and the growing emphasis on regulatory compliance and quality assurance. The rise of agile and DevOps methodologies has further fueled demand for flexible and scalable requirements management solutions. Additionally, advancements in cloud-based platforms and AI-driven analytics have enhanced the capabilities of these tools, making them more accessible and user-friendly. However, challenges such as high implementation costs and the need for skilled personnel may hinder market growth.

Key Highlights

- The requirements management tools market is anticipated to grow at a CAGR of 9.6% during the forecast period.

- The global requirements management tools market was estimated to be worth approximately USD 1557.58 million in 2023 and is projected to reach a value of USD 3554.23 million by 2032.

- The growth of the requirements management tools market is being driven by the increasing complexity of software and product development, the need for improved collaboration and traceability, and the growing emphasis on regulatory compliance.

- Based on the type of tool, the cloud-based tools segment is growing at a high rate and is projected to dominate the market.

- On the basis of industry vertical, the information technology segment is projected to swipe the largest market share.

- In terms of size of organization, the large enterprises segment is expected to dominate the market.

- Based on the deployment model, the software as a service (SAAS) segment is expected to dominate the market.

- Based on the functionality, the collaboration features segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Requirements Management Tools Market: Dynamics

Key Drivers

- Increasing Project Complexity: Modern projects are increasingly complex, requiring robust tools to manage vast amounts of requirements.

- Need for Traceability: Traceability between requirements, design, development, and testing is crucial for ensuring project quality and compliance.

- Agile Development Methodologies: Agile methodologies emphasize iterative development and frequent changes, requiring flexible requirements management tools.

- Regulatory Compliance: Industries like aerospace, automotive, and healthcare require strict adherence to regulatory standards, driving the need for compliant tools.

- Improved Collaboration: Requirements management tools facilitate collaboration among stakeholders, enhancing communication and reducing errors.

Restraints

- High Implementation Costs: Implementing and customizing requirements management tools can be expensive, especially for smaller organizations.

- Integration Challenges: Integrating these tools with existing development and testing environments can be complex.

- Resistance to Change: Some organizations may resist adopting new tools due to concerns about disruption or learning curves.

- Lack of Standardization: The absence of industry-wide standards can hinder interoperability between different tools.

- Complexity of Use: Some tools can be complex and require extensive training, limiting adoption.

Opportunities

- Cloud-Based Solutions: Cloud-based requirements management tools offer accessibility, scalability, and cost-effectiveness.

- AI and Machine Learning Integration: Implementing AI and machine learning can improve requirements analysis, validation, and change management.

- Integration with DevOps Tools: Seamless integration with DevOps tools can enhance collaboration and automation throughout the development lifecycle.

- Focus on User Experience (UX): Developing intuitive and user-friendly interfaces can improve adoption and usability.

- Specialized Tools for Niche Industries: Developing specialized tools tailored to specific industries, such as medical devices or automotive, can create niche markets.

Challenges

- Ensuring Data Security and Privacy: Protecting sensitive project data is crucial, especially in regulated industries.

- Managing Requirements Volatility: Handling frequent changes and updates to requirements is a continuous challenge.

- Maintaining Traceability Across Complex Projects: Ensuring complete traceability across complex projects with numerous stakeholders is essential.

- Addressing User Adoption and Training: Providing adequate training and support to ensure user adoption is critical.

- Keeping Up with Technological Advancements: Adapting to rapid advancements in software development and engineering practices is essential.

Requirements Management Tools Market: Report Scope

This report thoroughly analyzes the Requirements Management Tools Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Requirements Management Tools Market |

| Market Size in 2023 | USD 1557.58 Million |

| Market Forecast in 2032 | USD 3554.23 Million |

| Growth Rate | CAGR of 9.6% |

| Number of Pages | 177 |

| Key Companies Covered | Micro Focus, Broadcom, Intland Software GmbH, Perforce, IBM, PTC Integrity, Jama Software, Atlassian, Kovair Software Inc., microTool GmbH, Siemens, Process Street, Visure, Visual Trace Spec, SpiraTeam, osseno |

| Segments Covered | By Type of Tool, By Industry Vertical, By Size of Organization, By Deployment Model, By Functionality, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Requirements Management Tools Market: Segmentation Insights

The global requirements management tools market is divided by type of tool, industry vertical, size of organization, deployment model, functionality, and region.

Segmentation Insights by Type of Tool

Based on type of tool, the global requirements management tools market is divided into cloud-based tools, on-premise tools, and hybrid tools.

Cloud-based Tools segment dominates the market, driven by the increasing adoption of Software-as-a-Service (SaaS) solutions in enterprises of all sizes. Cloud-based requirements management tools offer scalability, remote accessibility, and seamless integration with other cloud services, making them highly preferred among businesses with distributed teams. The growing trend toward digital transformation, along with reduced infrastructure costs and automatic updates, further fuels the adoption of cloud solutions. However, concerns over data security and compliance regulations in highly regulated industries may pose challenges for some enterprises.

On-Premise Tools segment holds a substantial market share, particularly among industries requiring strict data security, such as defense, healthcare, and financial services. These tools allow companies to maintain full control over their data, ensuring compliance with regulatory requirements and minimizing cybersecurity risks. Large enterprises with dedicated IT teams often prefer on-premise solutions for their customization capabilities and integration with existing legacy systems. However, higher upfront costs and the need for ongoing maintenance and IT support can limit adoption in smaller organizations.

Hybrid Tools segment is gaining traction as organizations seek a balance between the flexibility of cloud solutions and the security of on-premise systems. Hybrid requirements management tools enable companies to store sensitive data on-premise while leveraging cloud-based features for collaboration and remote access. This approach is particularly beneficial for enterprises operating in sectors with mixed regulatory environments or transitioning from legacy systems to modern infrastructure. The demand for hybrid solutions is expected to grow as businesses prioritize security while still benefiting from cloud-driven efficiency.

Segmentation Insights by Industry Vertical

On the basis of industry vertical, the global requirements management tools market is bifurcated into information technology, healthcare, aerospace and defense, banking and financial services, manufacturing, and telecommunications.

Information Technology segment dominates the market, driven by the high demand for agile development and software project lifecycle management. IT companies use requirements management tools to streamline software development processes, enhance team collaboration, and track project progress efficiently. With the increasing adoption of DevOps, Agile, and Continuous Integration/Continuous Deployment (CI/CD) methodologies, IT firms rely on these tools to ensure alignment between business requirements and software development. The rapid growth of cloud computing, artificial intelligence, and cybersecurity further contributes to this segment’s dominance.

Healthcare segment is experiencing significant growth due to the rising need for regulatory compliance and documentation management in medical software development, medical device manufacturing, and pharmaceutical research. Strict regulatory frameworks such as HIPAA, FDA, and GDPR require healthcare organizations to manage detailed requirements to ensure compliance, patient safety, and product reliability. Requirements management tools help healthcare companies streamline development workflows, improve traceability, and maintain audit trails, driving their adoption in this sector.

Aerospace and Defense segment holds a substantial market share, as this industry deals with highly complex projects requiring strict regulatory adherence and extensive documentation. Aerospace and defense organizations use requirements management tools for system engineering, risk management, and compliance with standards such as DO-178C, ISO 9001, and ITAR. The growing emphasis on digital engineering and model-based systems engineering (MBSE) is further accelerating demand in this sector.

Banking and Financial Services segment is expanding as financial institutions adopt requirements management tools to ensure compliance with evolving regulatory frameworks such as Basel III, PCI-DSS, and AML regulations. Banks and fintech firms use these tools to manage software development, cybersecurity initiatives, and risk assessment projects while ensuring adherence to regulatory requirements. The increasing shift toward digital banking, blockchain, and AI-driven financial services fuels the adoption of structured requirements management solutions.

Manufacturing segment is witnessing steady growth, driven by the rising adoption of Industry 4.0, smart factories, and digital twin technologies. Manufacturers use requirements management tools to track product development lifecycles, maintain quality standards, and ensure compliance with industry regulations such as ISO 13485 and Six Sigma. The demand for efficient supply chain management and product innovation further supports market expansion in this sector.

Telecommunications segment is growing, fueled by the deployment of 5G networks, IoT infrastructure, and cloud-based communication services. Telecom companies rely on requirements management tools to streamline large-scale network deployments, manage service upgrades, and comply with regulatory standards. The increasing complexity of telecom ecosystems, including mobile applications, fiber-optic networks, and cybersecurity protocols, is driving demand for structured requirements management solutions.

Segmentation Insights by Size of Organization

On the basis of size of organization, the global requirements management tools market is bifurcated into small enterprises, medium-sized enterprises, and large enterprises.

Large Enterprises segment dominates the market, as these organizations handle complex projects that require advanced requirements management solutions to ensure efficiency, compliance, and collaboration across global teams. Large enterprises in industries such as IT, aerospace and defense, and banking rely on these tools to manage large-scale software development, regulatory compliance, and risk mitigation. These companies prioritize features such as real-time collaboration, traceability, and integration with other enterprise software, driving the demand for high-end, customizable solutions. Additionally, large enterprises have the financial capability to invest in premium solutions, including on-premise and hybrid deployments, further solidifying their dominance.

Medium-Sized Enterprises segment is witnessing significant growth as companies in this category increasingly adopt digital transformation strategies. These organizations require scalable and cost-effective solutions that offer robust project management, collaboration, and regulatory compliance capabilities. Cloud-based requirements management tools are particularly popular among medium-sized enterprises due to their affordability, flexibility, and ease of implementation. Industries such as manufacturing, healthcare, and telecommunications are driving the adoption of these tools as they seek to improve product development processes and maintain regulatory standards.

Small Enterprises segment is gradually expanding, supported by the growing availability of affordable and user-friendly cloud-based requirements management tools. Startups and small businesses in sectors such as IT and software development are leveraging these tools to streamline workflows, enhance team collaboration, and manage project requirements efficiently. However, budget constraints and limited awareness of advanced requirements management solutions can pose challenges to widespread adoption in this segment. The increasing availability of subscription-based, pay-as-you-go models is expected to drive further adoption among small enterprises.

Segmentation Insights by Deployment Model

On the basis of deployment model, the global requirements management tools market is bifurcated into software as a service (SAAS), platform as a service (PAAS), and infrastructure as a service (IAAS).

Software as a Service (SaaS) segment dominates the market due to the growing demand for cloud-based, cost-effective, and scalable requirements management solutions. SaaS-based tools enable organizations to access requirements management functionalities without the need for extensive infrastructure investments. These solutions offer real-time collaboration, automated updates, and integration with other cloud applications, making them highly preferred among small and medium-sized enterprises. Additionally, SaaS deployment allows companies to scale their usage based on project needs, making it an ideal choice for industries such as IT, healthcare, and manufacturing. The increasing adoption of Agile and DevOps methodologies further fuels the demand for SaaS-based requirements management tools.

Platform as a Service (PaaS) segment is experiencing steady growth, driven by the need for customizable and flexible development environments. PaaS-based requirements management tools provide enterprises with the ability to develop, test, and deploy custom applications while integrating them with existing workflows. Organizations in industries such as banking, aerospace, and telecommunications prefer PaaS solutions for their ability to offer enhanced security, compliance, and customization options. Businesses seeking greater control over their application development lifecycle and system integrations are increasingly turning to PaaS-based solutions to optimize requirements management processes.

Infrastructure as a Service (IaaS) segment is expanding as enterprises with complex IT environments require greater control over computing resources. IaaS-based deployment of requirements management tools allows organizations to manage their infrastructure while leveraging cloud benefits such as scalability, cost efficiency, and data security. Industries with strict data sovereignty and security requirements, such as defense, government, and financial services, often prefer IaaS models for hosting their requirements management tools. The ability to integrate with private cloud environments and maintain high-performance computing capabilities makes IaaS an attractive option for large enterprises handling mission-critical projects.

Segmentation Insights by Functionality

On the basis of functionality, the global requirements management tools market is bifurcated into collaboration features, document management, traceability, change management, and integration capabilities.

Collaboration Features segment dominates the market as businesses prioritize real-time communication and teamwork across distributed teams. With the increasing adoption of Agile and DevOps methodologies, organizations require robust collaboration tools to streamline discussions, track project progress, and ensure all stakeholders are aligned. Features such as role-based access, threaded discussions, and shared workspaces enhance team productivity, making collaboration functionalities essential in IT, healthcare, and manufacturing sectors. The rise of remote work and cloud-based operations further accelerates demand for strong collaboration tools within requirements management platforms.

Document Management segment holds a substantial share, as enterprises require structured storage, retrieval, and version control for project-related documents. Industries such as aerospace, defense, and pharmaceuticals rely on comprehensive document management capabilities to maintain regulatory compliance, audit trails, and security protocols. Advanced document management features, including automated tagging, digital signatures, and centralized repositories, support efficient information handling across complex projects. The increasing focus on digital transformation and paperless operations further boosts adoption in this segment.

Traceability segment is expanding rapidly, driven by stringent compliance requirements and the need for clear requirement tracking throughout the project lifecycle. Traceability functionalities ensure that every requirement is linked to design specifications, test cases, and project milestones, allowing organizations to monitor progress and meet quality standards. Industries such as automotive, medical devices, and financial services prioritize traceability to comply with regulatory standards such as ISO 26262, FDA 21 CFR Part 11, and GDPR. The demand for auditability and risk management continues to drive this segment’s growth.

Change Management segment is gaining traction as enterprises seek structured approaches to handling evolving requirements. Change management functionalities allow teams to track modifications, assess the impact of changes, and maintain historical records for better decision-making. This capability is crucial in dynamic industries like IT, telecommunications, and banking, where evolving regulations and customer demands require continuous adjustments. Advanced features such as automated notifications, approval workflows, and rollback options enhance efficiency in managing project changes.

Integration Capabilities segment is becoming increasingly important as organizations demand seamless interoperability with existing software ecosystems. Requirements management tools that integrate with project management platforms, testing tools, and enterprise resource planning (ERP) systems enable businesses to enhance productivity and streamline workflows. Industries such as manufacturing and cloud computing benefit from integration capabilities that support data synchronization and process automation. As enterprises continue to adopt best-of-breed software solutions, the need for strong integration functionalities is expected to grow.

Requirements Management Tools Market: Regional Insights

- North America is expected to dominate the global market.

North America dominates the Requirements Management Tools Market due to the high concentration of technology companies, widespread adoption of agile software development, and stringent regulatory compliance requirements in industries such as healthcare and finance. The United States leads the region, with major enterprises and government agencies utilizing advanced requirements management solutions to streamline product development and ensure compliance. Canada is also witnessing steady growth, driven by increasing digital transformation initiatives and the adoption of cloud-based tools.

Europe holds a significant market share, supported by strong demand for requirements management solutions in automotive, aerospace, and IT industries. Germany, the UK, and France are key contributors. Germany leads the region with widespread adoption in the automotive sector, where precise requirements tracking is crucial for regulatory compliance and safety standards. The UK is seeing increased adoption in finance and healthcare industries to manage compliance and risk. France is focusing on integrating AI-driven requirements management solutions to enhance software development efficiency and product lifecycle management. The European Union's data protection and cybersecurity regulations are also driving demand for advanced requirements tracking tools.

Asia Pacific is the fastest-growing region in the Requirements Management Tools Market, driven by rapid digitalization, growing software development outsourcing, and increased adoption of agile methodologies. China, Japan, India, and South Korea are key markets. China leads the region with strong demand from IT and manufacturing sectors, where requirements management tools help improve product development efficiency. Japan is focusing on AI-powered tools for precision engineering and software development in automotive and robotics. India is experiencing a surge in demand due to its expanding IT outsourcing sector, with software firms increasingly adopting cloud-based requirements management solutions. South Korea is leveraging advanced project management tools in electronics, automotive, and AI-driven software development.

Latin America is witnessing steady market growth, with Brazil and Mexico leading the region. Brazil’s expanding IT sector and growing investment in software development are driving demand for requirements management tools. Mexico is seeing increased adoption in the manufacturing and aerospace industries, where structured requirements management is critical. However, economic fluctuations and lower adoption of enterprise software solutions in some areas may limit market expansion.

The Middle East & Africa is gradually adopting requirements management tools, particularly in the UAE, Saudi Arabia, and South Africa. The UAE and Saudi Arabia are investing in digital transformation initiatives, leading to increased demand for enterprise software solutions in finance, construction, and IT. South Africa is seeing rising adoption in the healthcare and engineering sectors to improve compliance and project tracking. However, limited awareness and slower adoption in some regions may restrain growth.

Requirements Management Tools Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the requirements management tools market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global requirements management tools market include:

- Micro Focus

- Broadcom

- Intland Software GmbH

- Perforce

- IBM

- PTC Integrity

- Jama Software

- Atlassian

- Kovair Software Inc.

- microTool GmbH

- Siemens

- Process Street

- Visure

- Visual Trace Spec

- SpiraTeam

- osseno

The global requirements management tools market is segmented as follows:

By Type of Tool

- Cloud-based Tools

- On-Premise Tools

- Hybrid Tools

By Industry Vertical

- Information Technology

- Healthcare

- Aerospace and Defense

- Banking and Financial Services

- Manufacturing

- Telecommunications

By Size of Organization

- Small Enterprises

- Medium-sized Enterprises

- Large Enterprises

By Deployment Model

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

By Functionality

- Collaboration Features

- Document Management

- Traceability

- Change Management

- Integration Capabilities

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Requirements Management Tools

Request Sample

Requirements Management Tools