Rhenium Alloy Market Size, Share, and Trends Analysis Report

CAGR :

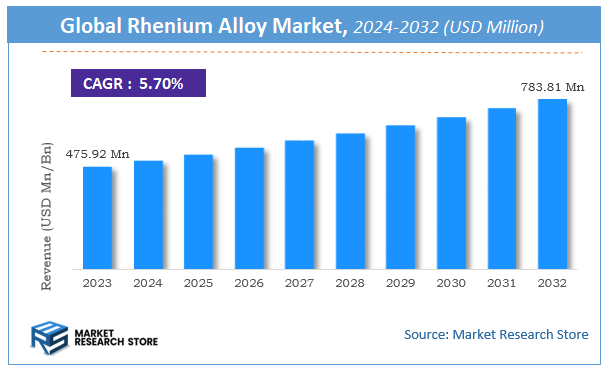

| Market Size 2023 (Base Year) | USD 475.92 Million |

| Market Size 2032 (Forecast Year) | USD 783.81 Million |

| CAGR | 5.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rhenium Alloy Market Insights

According to Market Research Store, the global rhenium alloy market size was valued at around USD 475.92 million in 2023 and is estimated to reach USD 783.81 million by 2032, to register a CAGR of approximately 5.7% in terms of revenue during the forecast period 2024-2032.

The rhenium alloy report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rhenium Alloy Market: Overview

Rhenium alloy refers to a metal composite that includes rhenium—a rare, dense, and high-melting-point metal—combined with other metals such as tungsten, molybdenum, or platinum to enhance material properties for extreme environments. Rhenium is primarily used in small but critical amounts due to its exceptional resistance to heat, corrosion, and wear. Rhenium alloys are commonly found in high-temperature applications, including aerospace turbine engines, rocket propulsion systems, electrical contacts, and X-ray or nuclear components, where mechanical strength and stability under thermal stress are essential.

The growth of the rhenium alloy market is driven by increasing demand for advanced materials in aerospace, defense, and high-performance industrial sectors. In particular, the rising production of jet engines and gas turbines has significantly fueled demand for rhenium-containing superalloys, which improve efficiency and durability at high operating temperatures. Additionally, the electronics and medical industries utilize rhenium alloys in filaments, thermocouples, and imaging equipment due to their precision and reliability. However, due to the metal's scarcity and high cost, usage is typically limited to specialized, high-value applications where performance cannot be compromised. Ongoing research into rhenium recycling and resource-efficient alloying is expected to support sustainable growth in this niche but strategically important market.

Key Highlights

- The rhenium alloy market is anticipated to grow at a CAGR of 5.7% during the forecast period.

- The global rhenium alloy market was estimated to be worth approximately USD 475.92 million in 2023 and is projected to reach a value of USD 783.81 million by 2032.

- The growth of the rhenium alloy market is being driven by the increasing global demand for high-performance materials in extreme high-temperature applications, particularly within the aerospace and defense industries.

- Based on the industry application, the aerospace segment is growing at a high rate and is projected to dominate the market.

- On the basis of alloy type, the rhenium-heavy alloys segment is projected to swipe the largest market share.

- In terms of form factor, the bars and rods segment is expected to dominate the market.

- Based on the end-user demographics, the manufacturers (OEMS) segment is expected to dominate the market.

- Based on the purity level, the low purity rhenium alloys (less than 90%) segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Rhenium Alloy Market: Dynamics

Key Growth Drivers:

- Growing Aerospace and Defense Industry: This is the most significant driver, with over 70% of global rhenium demand coming from this sector. Rhenium is a critical alloying element in nickel-based superalloys used for manufacturing high-temperature components like turbine blades and vanes in jet engines and industrial gas turbines. The continuous demand for more fuel-efficient, powerful, and durable aircraft (commercial and military), coupled with ongoing fleet upgrades and expansion, directly fuels the market.

- Increasing Demand for High-Performance Materials: Beyond aerospace, there's a broader industrial need for materials that can withstand extreme temperatures, corrosive environments, and high stress. Rhenium alloys are sought after for their superior mechanical and thermal properties, making them ideal for applications in power generation, chemical processing, and other demanding industrial settings.

- Technological Advancements in Superalloys: Continuous research and development in metallurgy lead to new generations of superalloys that incorporate rhenium to achieve even higher performance metrics (e.g., improved creep strength, better thermal stability). These innovations allow engines to operate at higher temperatures, leading to greater fuel efficiency and extended component life.

- Emergence of New Medical Applications: Recent FDA approvals for molybdenum-rhenium (MoRe) alloys in medical devices like spinal implants and cardiovascular stents are creating a significant new demand sector. Rhenium's biocompatibility, mechanical strength, fatigue resistance, and lack of allergic reactions are proving superior to traditional implant materials. This area has the potential to substantially disrupt the market.

- Additive Manufacturing (3D Printing) Adoption: The increasing use of additive manufacturing in the aerospace and other industries presents an opportunity for rhenium alloys. These alloys are well-suited for 3D printing complex, customized parts with improved performance and reduced material waste, driving demand for rhenium powders and specialized alloys.

- Demand for Catalytic Applications: Platinum-rhenium catalysts are widely used in the petrochemical industry for catalytic reforming, a process to produce high-octane, lead-free gasoline. The chemical industry also utilizes rhenium catalysts for other reactions due to their resistance to chemical poisoning.

Restraints:

- Extreme Scarcity and Limited Supply: Rhenium is one of the rarest elements in the Earth's crust, with an average abundance of only 1 part per billion. It is primarily obtained as a byproduct of molybdenum and copper mining. This inherent scarcity and dependence on the production of other metals severely limit its supply, making the market vulnerable to disruptions.

- High Cost and Price Volatility: Due to its rarity and complex extraction process, rhenium is one of the most expensive metals. Its price is highly volatile, influenced by supply constraints, geopolitical factors impacting mining regions, and demand fluctuations. This high cost can make it challenging for wider adoption in less critical applications or for industries with tighter budget constraints.

- Geographic Concentration of Production: The global supply of rhenium is highly concentrated, with a few countries (e.g., Chile, Poland, Kazakhstan) and companies dominating primary production. This concentration creates supply chain vulnerabilities and makes the market susceptible to regional economic, environmental, or political instability.

- Substitution Possibilities (Limited but Present): While rhenium is irreplaceable in many high-performance superalloys without compromising critical properties, research is ongoing to develop lower-rhenium or even rhenium-free alloys for certain components. Successful development of substitutes could eventually pose a long-term restraint, though this is currently a minor factor for core applications.

- Complex Extraction and Purification Processes: The process of isolating and purifying rhenium from its host ores is technically challenging and costly, requiring specialized infrastructure and expertise. This complexity contributes to its high price and limited number of primary producers.

Opportunities:

- Growth in Emerging Aerospace Markets: As countries like China and India rapidly expand their domestic aerospace and defense manufacturing capabilities, they present significant new markets for rhenium alloys, driving demand for both commercial and military aircraft components.

- Increased R&D in New Alloys and Applications: Continuous investment in R&D to explore novel applications for rhenium, particularly in areas beyond aerospace (e.g., advanced electronics, energy storage, specialized medical devices, green hydrogen refining), can open up entirely new market segments.

- Enhanced Recycling and Recovery: Given its high value and scarcity, there is a substantial opportunity to develop and implement more efficient and cost-effective recycling processes for rhenium from spent catalysts and end-of-life superalloys. Increased recycling can mitigate supply risks and improve sustainability.

- Development of Lower-Rhenium Content Alloys: While a potential restraint, the successful development of superalloys that use less rhenium while maintaining or improving performance could broaden their applicability and improve cost-effectiveness, leading to wider adoption in various industrial sectors.

- Strategic Stockpiling by Governments: Recognizing rhenium's strategic importance, governments may increase strategic stockpiling to ensure national security and uninterrupted supply for critical defense and aerospace industries, providing a stable demand floor.

- Investment in Primary Production Diversification: Efforts to identify and develop new primary rhenium deposits or to improve extraction efficiency from existing sources could help diversify the supply chain and reduce reliance on a few key producers.

Challenges:

- Maintaining Supply Security and Stability: The inherent rarity, byproduct nature, and concentrated production of rhenium pose a constant challenge to ensure a stable and secure supply chain for industries that rely on it for critical components. Geopolitical shifts or disruptions in copper/molybdenum mining can severely impact availability.

- Managing Price Volatility: The unpredictable and often high price of rhenium makes long-term planning and cost management challenging for manufacturers of rhenium-containing products. Hedging strategies or long-term supply agreements are often necessary but add complexity.

- Strict Quality Control for High-Performance Applications: Rhenium alloys are used in extremely demanding environments where component failure can have catastrophic consequences (e.g., jet engines). Maintaining incredibly stringent quality control, purity, and consistency in alloy composition and manufacturing is a continuous and critical challenge.

- Environmental Regulations for Mining and Processing: The extraction and processing of molybdenum and copper (from which rhenium is a byproduct) are subject to increasingly stringent environmental regulations. Compliance with these regulations can increase operational costs and affect supply.

- Competition for Skilled Talent: The specialized nature of metallurgy, material science, and high-temperature alloy manufacturing requires a highly skilled workforce. Attracting and retaining talent with expertise in these niche areas is a continuous challenge for the industry.

- Substitution Risk in Non-Critical Applications: While core applications are secure, the high cost of rhenium means that for less critical or more cost-sensitive applications, there is always a risk of substitution with alternative materials if performance can be adequately met by cheaper options.

Rhenium Alloy Market: Report Scope

This report thoroughly analyzes the Rhenium Alloy Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rhenium Alloy Market |

| Market Size in 2023 | USD 475.92 Million |

| Market Forecast in 2032 | USD 783.81 Million |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 179 |

| Key Companies Covered | Rhenium Alloys, Rheniumet Ltd, Advanced Technology & Materials, Jiangxi Copper |

| Segments Covered | By Industry Application, By Alloy Type, By Form Factor, By End-User Demographics, By Purity Level, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rhenium Alloy Market: Segmentation Insights

The global rhenium alloy market is divided by industry application, alloy type, form factor, end-user demographics, purity level, and region.

Segmentation Insights by Industry Application

Based on industry application, the global rhenium alloy market is divided into aerospace, electrical contacts, superalloys, chemical processing, and oil and gas.

Aerospace dominates the Rhenium Alloy Market due to the critical role of rhenium in enhancing the performance of jet engines, rocket nozzles, and propulsion systems that operate under extremely high temperatures and mechanical stress. Rhenium is commonly used in nickel-based superalloys, which make up a significant portion of aerospace turbine engine components, including turbine blades, combustor liners, and afterburners. Its addition significantly improves creep resistance, high-temperature strength, and fatigue life. As the global demand for fuel-efficient and high-thrust aircraft continues to grow—particularly in commercial aviation, defense, and space exploration—rhenium alloys become increasingly vital. The trend toward more efficient, lightweight aircraft with reduced environmental impact further strengthens the demand for high-performance rhenium-based materials in this sector.

Electrical Contacts are another significant application area where rhenium alloys are used in environments that require high reliability under extreme electrical loads. Rhenium-tungsten and rhenium-molybdenum alloys are favored in electrical contacts due to their high melting points, excellent conductivity, arc resistance, and resistance to wear during repeated cycles. These properties make them especially valuable in vacuum interrupters, electrical relays, and high-voltage switching devices used in power distribution networks, rail systems, and industrial automation. The increasing shift toward renewable energy integration and grid modernization—combined with growing infrastructure investments in developing economies—is fueling the need for more durable, long-life electrical components incorporating rhenium alloys.

Superalloys, particularly those used in high-performance gas turbines and jet engines, are a key growth driver for the rhenium alloy market. Rhenium is one of the most effective elements for improving high-temperature performance and corrosion resistance in nickel-based superalloys. These alloys are crucial for both aerospace propulsion and land-based power generation. Rhenium-containing superalloys enhance mechanical integrity at temperatures exceeding 1,000°C, making them indispensable for turbine blades, vanes, and exhaust components. As governments and private sectors invest in next-generation energy infrastructure and more advanced aerospace propulsion systems, the demand for high-rhenium-content superalloys continues to rise, especially for single-crystal turbine components that require superior creep resistance and thermal fatigue performance.

Chemical Processing industries utilize rhenium alloys in highly corrosive and high-temperature environments such as catalytic reforming units, reactor linings, and components for acid and alkali handling. Rhenium’s exceptional resistance to oxidation and chemical degradation under stress makes it ideal for reactors and containment systems used in petrochemical, fertilizer, and specialty chemical production. In particular, its resistance to sulfuric acid and hydrogen sulfide corrosion enhances safety and equipment life in these sectors. As chemical processing plants increasingly operate under harsher conditions and higher efficiency requirements, the use of rhenium alloys in reactor vessels, crucibles, and tubing is expected to expand steadily.

Oil and Gas applications of rhenium alloys focus on components that must endure extreme temperatures, high pressure, and abrasive conditions found in drilling and extraction environments. Rhenium-enhanced molybdenum and tungsten alloys are used in tools such as drill bits, downhole sensors, wear-resistant sleeves, and high-strength fasteners. These parts are subjected to significant thermal and mechanical loads, particularly in deep well drilling, hydraulic fracturing, and offshore operations. Rhenium helps extend the service life of these components, reduce maintenance cycles, and improve operational efficiency. As exploration moves toward deeper, more challenging reserves, and with the rise of enhanced oil recovery techniques, the demand for rhenium-based materials in advanced drilling technologies is poised to grow.

Segmentation Insights by Alloy Type

On the basis of alloy type, the global rhenium alloy market is bifurcated into rhenium-heavy alloys, rhenium-nickel alloys, rhenium-molybdenum alloys, rhenium-iridium alloys, and rhenium-copper alloys.

Rhenium-Heavy Alloys dominate the Rhenium Alloy Market due to their widespread usage in aerospace propulsion systems, defense-grade armaments, nuclear technologies, and advanced medical devices. These alloys typically contain a high concentration of rhenium, often combined with tungsten or molybdenum, creating a material capable of withstanding extremely high temperatures, corrosive environments, and intense mechanical stress. Their superior density and resistance to deformation under pressure make them ideal for critical components such as rocket nozzles, control surfaces in spacecraft, and jet engine combustion chambers. In nuclear applications, they serve as radiation shielding and containment barriers due to their high atomic number and structural integrity under prolonged exposure. Additionally, in medical sectors, they are used in precision instruments and imaging equipment where dimensional stability and thermal resistance are vital. The accelerating investments in hypersonic defense programs, interplanetary missions, and deep-space exploration are further reinforcing the dominance of rhenium-heavy alloys, especially across North America and emerging space nations like China and India.

Rhenium-Nickel Alloys are a cornerstone in the superalloy sector, especially in aviation and power generation industries, where they are essential for manufacturing single-crystal turbine blades and critical engine parts. Rhenium enhances the high-temperature creep strength and phase stability of nickel-based alloys, allowing turbine components to function at temperatures approaching or exceeding 1,100°C. This not only boosts engine efficiency but also extends component life cycles, reducing maintenance and operational costs in aerospace and industrial gas turbines. These alloys are especially crucial for meeting stringent environmental regulations by improving fuel combustion efficiency and lowering emissions. The growing demand for more durable and efficient aero engines in commercial and military aviation continues to make rhenium-nickel alloys highly valuable in the development of next-generation turbine technologies.

Rhenium-Molybdenum Alloys are notable for their balanced combination of ductility, oxidation resistance, and high-temperature performance, making them suitable for critical electronic and industrial components. These alloys are widely applied in furnace heating elements, semiconductor process chambers, x-ray equipment, and vacuum contacts. Molybdenum provides a strong structural base with high melting points, while rhenium contributes increased tensile strength and resistance to embrittlement under thermal cycling. As precision electronics manufacturing and semiconductor fabrication processes demand cleaner, more durable high-temperature materials, rhenium-molybdenum alloys continue to gain prominence. Their ease of machining and good weldability further support their adoption in complex geometrical parts used in process-intensive sectors such as photovoltaics, microelectronics, and analytical instrumentation.

Rhenium-Iridium Alloys represent a highly specialized segment used in extreme thermal and corrosive environments where material failure is not an option. These alloys exhibit remarkable inertness and dimensional stability even under rapid thermal fluctuations and high oxidative stress. They are primarily found in aerospace components such as satellite thruster chambers, nuclear thermocouples, and spaceborne scientific instruments, where longevity and absolute reliability are mission-critical. Iridium’s noble metal characteristics, when combined with rhenium’s ductility, create an alloy capable of resisting embrittlement, microcracking, and deformation even in plasma-exposed applications. Despite their high cost, they remain essential in applications where failure would result in catastrophic loss or prohibitively high downtime costs.

Rhenium-Copper Alloys serve niche but increasingly important roles in thermal management systems, electrical contacts, and heat dissipation solutions. While copper provides high thermal and electrical conductivity, the addition of rhenium improves the alloy’s mechanical strength, thermal fatigue resistance, and wear tolerance under elevated temperatures. These alloys are used in aerospace avionics, circuit breakers, industrial arc welding equipment, and advanced computing systems that require effective and stable heat transfer mechanisms. They are also gaining relevance in electric mobility and next-generation energy systems where high-efficiency thermal control is essential. As industries seek to develop more compact and efficient thermal and electronic systems, rhenium-copper alloys offer a compelling combination of conductivity and resilience for precision-engineered applications.

Segmentation Insights by Form Factor

On the basis of form factor, the global rhenium alloy market is bifurcated into bars and rods, sheets and plates, powders, rings, and wire.

Bars and Rods dominate the Rhenium Alloy Market due to their structural versatility, high strength, and suitability for a broad range of high-temperature and high-stress applications. These solid cylindrical or prismatic forms are especially prevalent in aerospace, defense, and industrial thermal equipment, where dimensional precision and mechanical durability are crucial. Rhenium alloy bars and rods are commonly machined into engine components, jet nozzles, and structural parts that endure extreme operational conditions, including intense heat, corrosive gases, and high mechanical loads. Their ease of fabrication and compatibility with welding and drilling make them ideal for custom configurations in prototype and production environments. In military and space applications, these forms are preferred for thrust chamber inserts, thermal barriers, and satellite propulsion assemblies due to their ability to maintain mechanical integrity over extended mission durations. With increasing investments in next-generation propulsion and hypersonic technologies, demand for rhenium alloy bars and rods continues to outpace other form factors, reinforcing their dominant market position.

Sheets and Plates play a significant role in industries requiring heat shielding, chemical resistance, and dimensional coverage. These flat rhenium alloy products are commonly used in applications like furnace linings, radiation barriers, and vacuum system components. Their form factor allows them to be cut, welded, or bent into customized shapes, providing an effective solution for lining or shielding components exposed to high thermal loads or corrosive environments. In the chemical processing and semiconductor sectors, rhenium alloy sheets and plates offer long-lasting protection for reactors, etching chambers, and crucibles, where conventional metals fail due to degradation or warping. Their relatively large surface area and resistance to oxidation make them essential for applications where both thermal management and structural support are required.

Powders offer exceptional utility in advanced manufacturing processes, particularly in additive manufacturing, sintering, and surface coating applications. Rhenium alloy powders are integral to producing high-performance parts with complex geometries using methods such as selective laser melting, electron beam melting, and hot isostatic pressing. These powders are often used to fabricate aerospace turbine blades, intricate heat exchangers, and medical device components that require precision, minimal material waste, and strong performance under thermal cycling. Additionally, powders are employed in thermal spray coatings to enhance the surface properties of components, providing erosion resistance, oxidation resistance, and extended service life. As 3D printing technology matures, the demand for rhenium alloy powders is steadily growing across sectors focused on innovation, sustainability, and design flexibility.

Rings are a specialized yet vital form used in precision-engineered components such as rotary seals, gaskets, and high-temperature joints. Their symmetrical, circular design ensures even stress distribution, reducing the risk of failure under thermal expansion or mechanical pressure. Rhenium alloy rings are widely used in gas turbines, satellite engine mounts, and vacuum systems where sealing integrity and thermal resilience are non-negotiable. Their resistance to deformation, corrosion, and fatigue makes them ideal for rotating or reciprocating systems subjected to fluctuating loads. Despite being a niche segment, the high-performance reliability of rhenium alloy rings makes them indispensable in aerospace propulsion systems and chemical reactors.

Wire is essential in fine-scale, high-precision applications such as thermocouples, electronic circuits, and specialized medical equipment. Rhenium alloy wire is valued for its high tensile strength, excellent conductivity, and resistance to oxidation and creep at elevated temperatures. It is extensively used in high-temperature sensors, welding electrodes, x-ray systems, and semiconductor devices. The wire’s ability to retain mechanical properties at micro-scale diameters makes it ideal for compact electronics and MEMS (microelectromechanical systems). As industries increasingly shift toward miniaturization and high-frequency operation, rhenium alloy wire finds growing utility in environments where precision, reliability, and thermal performance are essential.

Segmentation Insights by End-User Demographics

On the basis of end-user demographics, the global rhenium alloy market is bifurcated into manufacturers (OEMS), research institutions, aerospace engineers, defense contractors, and automotive industries.

Manufacturers (OEMs) represent a dominant end-user demographic in the Rhenium Alloy Market due to their central role in integrating these alloys into finished components across aerospace, defense, and high-temperature industrial applications. Original Equipment Manufacturers utilize rhenium alloys to produce turbine blades, combustion liners, and electronic parts that require unmatched thermal and structural performance. These manufacturers demand consistent alloy quality, machinability, and high-temperature resilience, making rhenium a preferred material in designing components for jet engines, space vehicles, and industrial gas turbines. Their emphasis on performance-driven innovation and material longevity positions OEMs as key drivers of technological adoption and material specification in this market.

Research Institutions contribute significantly to the development and advancement of rhenium alloy applications, although they represent a smaller market share compared to OEMs. These institutions focus on exploring the fundamental properties of rhenium alloys, such as their creep resistance, oxidation behavior, and compatibility with additive manufacturing processes. Universities, laboratories, and national research bodies often work on prototype-level projects in aerospace, nuclear technology, and advanced electronics, helping to push the boundaries of rhenium’s potential applications. Their findings frequently lead to the development of next-generation materials or improved processing techniques that are later adopted by commercial and military sectors.

Aerospace Engineers form a critical user group, often collaborating closely with both OEMs and material scientists to specify and implement rhenium alloys in propulsion and thermal management systems. These professionals are responsible for ensuring that engine components, structural elements, and control surfaces meet exacting performance and safety standards under extreme operating conditions. Rhenium alloys are especially favored by aerospace engineers for their resistance to creep, fatigue, and oxidation at temperatures exceeding 1,200°C. As aerospace technology advances toward reusable launch systems, hypersonic aircraft, and extended-duration satellite missions, the reliance on materials like rhenium becomes increasingly important in design validation and mission success.

Defense Contractors are prominent end-users of rhenium alloys due to the material’s application in high-performance, mission-critical military systems. These include missile nozzles, armor-piercing components, and thermal shielding elements used in advanced weapons platforms and defense-grade aerospace systems. Defense contractors prioritize reliability, survivability, and operational efficiency in extreme conditions, aligning well with the capabilities of rhenium-based materials. With increasing global investments in next-generation defense technologies, including hypersonic vehicles and directed-energy systems, defense contractors are expected to expand their usage of rhenium alloys in specialized components.

Automotive Industries are an emerging segment in the Rhenium Alloy Market, driven by the development of electric vehicles, turbocharged engines, and fuel cell technologies that require advanced materials for heat control and durability. Although rhenium use in automotive applications is currently limited compared to aerospace and defense, it is gradually being adopted in catalytic converters, high-performance spark plugs, and components exposed to high thermal cycling. As automotive manufacturers seek lighter, more durable, and thermally efficient materials for electric drivetrains and emissions control systems, rhenium alloys offer a promising solution for niche, high-demand areas within vehicle platforms.

Segmentation Insights by Purity Level

On the basis of purity level, the global rhenium alloy market is bifurcated into low purity rhenium alloys (less than 90%), medium purity rhenium alloys (90% - 95%), high purity rhenium alloys (greater than 95%), and ultra-high purity rhenium alloys (greater than 99%).

Low Purity Rhenium Alloys (less than 90%) dominate the market segment due to their cost-effectiveness and suitability for a wide range of industrial applications where extreme performance parameters are not mandatory. These alloys, containing a lower percentage of rhenium mixed with other base metals such as nickel, molybdenum, or copper, provide adequate thermal resistance, corrosion protection, and mechanical strength for less critical components. Their affordability makes them attractive to large-scale manufacturers who require bulk materials for producing heat shields, industrial wear parts, and thermal management components that operate under moderate temperatures and stresses. Low purity alloys are frequently used in heavy machinery, chemical processing plants, and energy generation equipment, where long service life and reliable performance at a reasonable cost are prioritized over ultra-high purity characteristics. Despite their lower rhenium content, these alloys maintain important material properties such as oxidation resistance and creep strength sufficient for many commercial applications.

Medium Purity Rhenium Alloys (90% – 95%) are utilized where a balance between cost and higher performance is needed. These alloys are common in mid-tier aerospace components, industrial heating elements, and chemical reactors requiring moderate creep resistance and thermal stability. They offer enhanced corrosion resistance and mechanical strength compared to low purity alloys, making them preferable for applications with elevated thermal and mechanical demands. Medium purity grades are often chosen in industries aiming to improve product longevity without incurring the premium costs of ultra-high purity materials, thus serving as a bridge between budget constraints and performance expectations.

High Purity Rhenium Alloys (greater than 95%) are extensively used in demanding environments such as aerospace propulsion systems, defense applications, and high-precision manufacturing equipment. Their superior purity ensures exceptional thermal stability, oxidation resistance, and mechanical integrity, which are critical for components exposed to extreme temperatures and corrosive atmospheres. These alloys are subject to strict quality standards to guarantee consistency, making them ideal for mission-critical applications where reliability is paramount. High purity rhenium alloys support innovation in jet engine technology, space exploration, and advanced industrial processes, contributing to enhanced efficiency and safety.

Ultra-High Purity Rhenium Alloys (greater than 99%) cater to the most specialized and sensitive applications, including semiconductor fabrication, nuclear reactors, and space-grade instrumentation. Their ultra-low impurity levels prevent material degradation under extreme conditions such as high radiation, intense heat, and corrosive environments. These alloys enable the manufacture of components requiring precise dimensional stability and long-term durability, such as plasma-facing materials in fusion reactors or components in satellite propulsion systems. Despite their high cost, ultra-high purity rhenium alloys are indispensable where failure risks are unacceptable, and performance requirements exceed those of conventional materials. The growth of cutting-edge technologies continues to drive demand in this segment, especially in advanced research and development sectors.

Rhenium Alloy Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the rhenium alloy market due to its advanced aerospace, defense, and petrochemical industries, which are the primary end-users of rhenium-based materials. The United States, in particular, holds a significant share driven by high demand for high-performance superalloys used in jet engines, gas turbines, and rocket engines, where rhenium alloys enhance temperature resistance and mechanical strength. The presence of major aerospace manufacturers such as Boeing, Lockheed Martin, and Raytheon fuels this demand. Furthermore, North America benefits from well-established research and development infrastructure focused on metallurgical innovations and alloy performance improvements. The region’s strict quality standards and certification processes ensure continuous advancement in rhenium alloy applications. Additionally, the increasing focus on cleaner energy and efficient industrial processes is propelling the use of rhenium in catalytic converters and chemical processing equipment. The market is supported by stable supply chains and growing investments in aerospace modernization programs and defense contracts.

Europe holds a substantial share of the rhenium alloy market, with Germany, France, and the United Kingdom leading the region. Europe's aerospace sector, led by Airbus and several defense contractors, demands high-quality rhenium alloys for turbine blades and engine components that operate under extreme thermal stress. The region also has a strong chemical and petrochemical industry that utilizes rhenium-based catalysts to improve process efficiency and reduce emissions. Europe’s stringent environmental regulations encourage the adoption of advanced alloys for cleaner industrial operations. The presence of metallurgical research centers and collaborations between universities and manufacturers accelerates the development of high-performance rhenium alloys. Additionally, Europe imports rhenium raw materials from stable sources and has developed recycling initiatives to reclaim rhenium from used catalysts and alloys, supporting sustainable growth.

Asia-Pacific is the fastest-growing market for rhenium alloys, driven by rapid industrialization, expanding aerospace manufacturing, and increasing investments in energy and petrochemical sectors. Countries such as China, Japan, South Korea, and India are investing heavily in advanced materials to enhance the performance and durability of jet engines, gas turbines, and refining catalysts. China’s emergence as a global aerospace player and its growing defense expenditure are key growth factors. Additionally, the rise of chemical manufacturing hubs in South Korea and India is driving demand for rhenium-based catalysts and alloys. The Asia-Pacific region benefits from expanding manufacturing capabilities and increasing collaborations with global aerospace and chemical companies. However, challenges such as raw material supply constraints, price volatility, and the need for skilled metallurgical expertise remain. Nonetheless, government initiatives to support high-tech industries and sustainable energy development are expected to boost rhenium alloy demand significantly.

Latin America represents a smaller but growing segment of the rhenium alloy market, with Brazil and Mexico being the primary contributors. The region’s aerospace industry is expanding, with increasing production of aircraft components that require advanced alloys. Additionally, Latin America’s petrochemical sector is adopting rhenium-based catalysts to improve refining processes and reduce environmental impact. The market growth is supported by government incentives for industrial modernization and foreign direct investments in manufacturing and chemical processing. However, infrastructure challenges, limited local production of rhenium, and dependency on imports constrain rapid market expansion. Efforts to improve supply chain logistics and enhance metallurgical expertise are underway to capture more market opportunities.

Middle East and Africa hold emerging opportunities in the rhenium alloy market, largely driven by the robust oil and gas industry in the Middle East and growing aerospace activities in certain African countries like South Africa. The Middle East’s large refining and petrochemical sectors utilize rhenium alloys and catalysts to enhance efficiency and comply with stringent environmental regulations. Investments in upgrading refinery technologies and expanding petrochemical capacities are boosting demand. Africa’s market is nascent but shows potential due to increasing industrialization and efforts to develop local aerospace and energy sectors. Challenges such as geopolitical instability, limited access to raw materials, and underdeveloped metallurgical infrastructure affect market penetration. However, strategic partnerships and increasing interest in advanced materials provide growth prospects in these regions.

Rhenium Alloy Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rhenium alloy market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rhenium alloy market include:

- Rhenium Alloys

- Rheniumet Ltd

- Advanced Technology & Materials

- Jiangxi Copper

The global rhenium alloy market is segmented as follows:

By Industry Application

- Aerospace

- Electrical Contacts

- Superalloys

- Chemical Processing

- Oil and Gas

By Alloy Type

- Rhenium-Heavy Alloys

- Rhenium-Nickel Alloys

- Rhenium-Molybdenum Alloys

- Rhenium-Iridium Alloys

- Rhenium-Copper Alloys

By Form Factor

- Bars and Rods

- Sheets and Plates

- Powders

- Rings

- Wire

By End-User Demographics

- Manufacturers (OEMs)

- Research Institutions

- Aerospace Engineers

- Defense Contractors

- Automotive Industries

By Purity Level

- Low Purity Rhenium Alloys (less than 90%)

- Medium Purity Rhenium Alloys (90% - 95%)

- High Purity Rhenium Alloys (greater than 95%)

- Ultra-High Purity Rhenium Alloys (greater than 99%)

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rhenium Alloy

Request Sample

Rhenium Alloy