Roll-ups Market Size, Share, and Trends Analysis Report

CAGR :

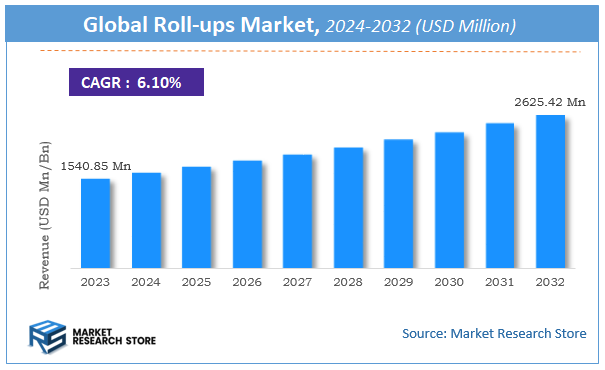

| Market Size 2023 (Base Year) | USD 1540.85 Million |

| Market Size 2032 (Forecast Year) | USD 2625.42 Million |

| CAGR | 6.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Roll-ups Market Insights

According to Market Research Store, the global roll-ups market size was valued at around USD 1540.85 million in 2023 and is estimated to reach USD 2625.42 million by 2032, to register a CAGR of approximately 6.1% in terms of revenue during the forecast period 2024-2032.

The roll-ups report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Roll-ups Market: Overview

A roll-up is a business strategy where multiple smaller companies within the same industry are acquired and merged into a single larger entity. This approach is commonly used by private equity firms to capitalize on fragmented markets, achieve economies of scale, and create a more competitive organization. Roll-ups allow the new, combined entity to streamline operations, reduce costs, increase bargaining power, and expand market presence. They are especially effective in industries with numerous small players, such as healthcare services, logistics, IT, and niche manufacturing. By unifying similar businesses, the consolidated company can often command a higher market valuation and attract investor interest for future sale or public offering.

Key Highlights

- The roll-ups market is anticipated to grow at a CAGR of 6.1% during the forecast period.

- The global roll-ups market was estimated to be worth approximately USD 1540.85 million in 2023 and is projected to reach a value of USD 2625.42 million by 2032.

- The growth of the roll-ups market is being driven by investor interest in operational efficiency and growth potential.

- Based on the type of roll-ups, the fruit roll-ups segment is growing at a high rate and is projected to dominate the market.

- On the basis of packaging type, the single serve packs segment is projected to swipe the largest market share.

- In terms of distribution channel, the supermarkets & hypermarkets segment is expected to dominate the market.

- Based on the end user, the children segment is expected to dominate the market.

- In terms of ingredient type, the all-natural ingredients segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Roll-ups Market: Dynamics

Key Growth Drivers:

- Rising Demand for Portable and Convenient Food Options: Consumers are increasingly seeking quick, on-the-go snack alternatives, making roll-ups a popular choice due to their portability and ease of consumption.

- Expansion of Retail and E-Commerce Channels: The growing reach of retail chains and online grocery platforms is helping roll-up products gain wider visibility and availability, boosting overall sales.

- Growing Preference for Healthy and Functional Snacks: Many roll-up brands are incorporating natural ingredients, fruit content, and added nutrients to align with consumer demand for healthier snacking options.

- Innovative Flavor Varieties and Packaging: Continuous product innovation in terms of taste, ingredients, and attractive packaging is driving consumer interest and encouraging repeat purchases.

- Increasing Popularity Among Children: Roll-ups are widely favored by children due to their sweet taste and fun, rollable format, contributing significantly to market growth.

Restraints:

- High Sugar Content in Some Variants: Health-conscious consumers may avoid certain roll-up products due to concerns over excessive sugar, artificial flavors, or preservatives.

- Short Shelf Life of Natural Variants: Roll-ups made with organic or fresh ingredients often have limited shelf life, posing distribution and storage challenges.

- Regulatory Hurdles for Food Additives: Stricter food safety regulations and ingredient restrictions in some regions can slow down product development or entry into new markets.

Opportunities:

- Rising Trend of Plant-Based and Organic Products: Developing roll-ups that are vegan, organic, or gluten-free opens up opportunities to attract health-focused and environmentally conscious consumers.

- Untapped Markets in Emerging Economies: Expanding into developing regions with growing urban populations and changing dietary habits presents new avenues for growth.

- Brand Collaborations and Licensing Deals: Collaborations with popular cartoon characters or entertainment franchises can enhance product appeal, especially among younger demographics.

- Customization and Premium Product Lines: Offering personalized packaging, exotic flavors, or premium ingredients can help brands target niche segments and increase margins.

Challenges:

- Intense Market Competition: The roll-ups market faces stiff competition from other snack categories, including bars, chips, and fruit snacks, making brand differentiation crucial.

- Volatility in Raw Material Prices: Fluctuations in the prices of fruits, sweeteners, and packaging materials can affect production costs and profit margins.

- Changing Consumer Preferences: Shifts toward protein-rich or low-carb diets may reduce demand for traditional roll-up snacks unless products are reformulated accordingly.

- Supply Chain Disruptions: Issues like transportation delays, labor shortages, or raw material scarcity can disrupt manufacturing and delivery timelines.

Roll-ups Market: Report Scope

This report thoroughly analyzes the Roll-ups Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Roll-ups Market |

| Market Size in 2023 | USD 1540.85 Million |

| Market Forecast in 2032 | USD 2625.42 Million |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 198 |

| Key Companies Covered | Altria Group Inc, British American Tobacco, Imperial Brands, Japan Tobacco Inc, PHILIP MORRIS INTERNATIONAL |

| Segments Covered | By Type of Roll-ups, By Packaging Type, By Distribution Channel, By End User, By Ingredient Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Roll-ups Market: Segmentation Insights

The global roll-ups market is divided by type of roll-ups, packaging type, distribution channel, end user, ingredient type, and region.

Segmentation Insights by Type of Roll-ups

Based on type of roll-ups, the global roll-ups market is divided into fruit roll-ups, vegetable roll-ups, protein roll-ups, nut-based roll-ups, and herbal roll-ups.

In the roll-ups market, Fruit Roll-ups emerge as the most dominant segment due to their widespread consumer appeal, long-established market presence, and extensive product variety. These snacks are especially popular among children and health-conscious adults looking for a sweet yet convenient snack option. Fruit roll-ups are widely available in supermarkets and convenience stores and are often marketed as both indulgent treats and healthier alternatives to candies, depending on sugar content and ingredient sourcing. Innovations in natural and organic fruit-based products have also helped maintain strong demand in this segment.

Protein Roll-ups follow as the second most dominant segment, driven by the growing fitness and health awareness among consumers. These roll-ups often incorporate ingredients like whey, soy, or plant-based protein and are targeted at gym-goers, athletes, and individuals seeking to supplement their protein intake. They are increasingly used as meal replacements or post-workout snacks and are gaining popularity in both developed and emerging markets due to the rising demand for functional foods.

Nut-based Roll-ups rank next, combining the nutritional benefits of nuts with the portability and flavor appeal of roll-up formats. These products are rich in healthy fats, protein, and fiber, making them an attractive option for consumers seeking sustained energy and better satiety. Although not as ubiquitous as fruit or protein roll-ups, nut-based variants are carving a niche in the premium snack segment and among those with dietary restrictions or preferences like keto or paleo diets.

Vegetable Roll-ups occupy the fourth position. While they cater to health-conscious consumers looking to boost vegetable intake in a convenient format, they often face resistance due to taste preferences. However, innovations in flavor blending and the inclusion of popular vegetables like spinach, kale, or beetroot are helping them gain traction, particularly in niche health-food stores and urban wellness markets.

Herbal Roll-ups are the least dominant segment, largely due to limited consumer familiarity and narrow market targeting. These roll-ups typically include herbs like mint, basil, or turmeric and are positioned for their functional health benefits such as digestion support or anti-inflammatory properties. Despite their potential, the market for herbal roll-ups remains small and underdeveloped, often restricted to specialized health stores or Ayurvedic and holistic wellness niches.

Segmentation Insights by Packaging Type

On the basis of packaging type, the global roll-ups market is bifurcated into single serve packs, family packs, bulk packaging, resealable bags, and glass/jar packaging.

In the roll-ups market, Single Serve Packs represent the most dominant packaging type due to their convenience, portability, and strong appeal to on-the-go consumers. These packs are especially popular in lunchboxes, vending machines, and impulse-buy sections in retail stores. They cater to individual consumption, promote portion control, and are favored by both parents for children and adults seeking convenient snacking options. Their widespread availability across supermarkets and convenience stores contributes significantly to their leading position in the market.

Resealable Bags are the second most dominant packaging type, appreciated for their practicality and ability to maintain product freshness after opening. These packages are often used for premium or health-conscious roll-ups, including protein, nut-based, or organic fruit variants. Resealable options appeal to consumers who prefer multi-serving packs with the flexibility of resealing, making them suitable for both home use and outdoor activities without compromising product quality.

Family Packs follow closely behind, targeting households and larger group consumption. These packages offer better value per unit and are commonly preferred by families or shared environments like schools and offices. Though they don’t offer the same level of portability as single-serve packs, their cost-efficiency and suitability for stocking at home contribute to their strong presence in the market.

Bulk Packaging holds a more niche but steady place, mostly used in wholesale, institutional, or foodservice sectors. This type of packaging is common in school canteens, cafeterias, and health-conscious catering services. While it is not as visible in retail settings, bulk packaging is vital for high-volume consumption and offers the lowest cost per unit, making it attractive for large-scale users.

Glass/Jar Packaging is the least dominant segment due to higher costs, fragility, and limited portability. It is typically reserved for artisanal or gourmet roll-up products, especially herbal or homemade-style variants that emphasize freshness and natural ingredients. This packaging type is more common in premium health food stores and gift-oriented product lines, rather than in everyday snacking scenarios.

Segmentation Insights by Distribution Channel

Based on distribution channel, the global roll-ups market is divided into online retail, supermarkets & hypermarkets, convenience stores, health food stores, and specialty shops.

In the roll-ups market, Supermarkets & Hypermarkets serve as the most dominant distribution channel, owing to their broad reach, extensive product variety, and consumer trust. These outlets offer wide shelf space, allowing brands to showcase multiple flavors, types, and packaging formats of roll-ups. Their role as one-stop destinations for family and household grocery shopping makes them the go-to channel for both new and established brands aiming for maximum visibility and foot traffic. Promotional deals and in-store sampling further bolster their dominance.

Convenience Stores hold the second position due to their strategic locations and the impulsive nature of roll-up purchases. These stores cater especially to on-the-go consumers looking for quick snacks, often favoring single-serve and grab-and-go packaging. Convenience stores play a vital role in brand visibility, especially for fruit and protein roll-ups that appeal to commuters, students, and busy professionals.

Online Retail is rapidly growing and ranks third, driven by the increasing adoption of e-commerce platforms and consumer preference for home delivery. This channel offers convenience, access to niche and specialty brands, and the ability to compare products and reviews easily. Online platforms are particularly important for health-focused and premium roll-up products, such as organic or protein-rich variants, which may not be widely available in brick-and-mortar stores.

Health Food Stores cater to a more selective but growing audience of health-conscious consumers, offering roll-ups made with natural, organic, or functional ingredients. These stores often emphasize ingredient transparency, clean labeling, and sustainability. While their market share is smaller compared to supermarkets, they are important for positioning higher-end or specialty roll-up products and serve as a launchpad for emerging brands.

Specialty Shops, including gourmet and artisanal outlets, represent the least dominant distribution channel. They typically carry unique, handcrafted, or herbal roll-ups that appeal to niche markets. Due to their limited geographic footprint and premium pricing, these stores cater to a narrower audience. However, they contribute to brand prestige and consumer perception of product quality, particularly for premium or novelty roll-up types.

Segmentation Insights by End User

On the basis of end user, the global roll-ups market is bifurcated into children, adults, health-conscious consumers, seniors, and fitness enthusiasts.

In the roll-ups market, Children constitute the most dominant end-user segment, as roll-ups—particularly fruit-flavored ones—are widely marketed and consumed as convenient, fun, and sweet snacks suitable for school lunches or after-school treats. Bright packaging, appealing flavors, and cartoon-themed branding further drive demand in this demographic. Parents also gravitate toward fortified or natural fruit roll-up options for their children, reinforcing the dominance of this segment.

Health-conscious Consumers form the second most significant end-user group, with growing interest in clean-label snacks, natural ingredients, and low-sugar alternatives. These consumers drive demand for vegetable, herbal, and organic fruit roll-ups. Brands catering to this segment often emphasize nutritional benefits, superfoods, and functional ingredients. The health-conscious demographic spans both younger adults and middle-aged individuals seeking better dietary choices, contributing to strong growth in this segment.

Fitness Enthusiasts follow closely, primarily drawn to protein-based roll-ups and those fortified with nutrients like fiber, amino acids, or superfoods. These consumers often use roll-ups as part of a pre- or post-workout routine, preferring products that offer sustained energy or muscle recovery support. While this segment is more niche than children or general health-conscious consumers, it’s rapidly growing, especially in urban and fitness-centric markets.

Adults, in general, represent a broad but less targeted category. They consume roll-ups for convenience and taste, but their preferences are diverse—ranging from indulgent treats to healthier snacking alternatives. While many adults fall under the health-conscious or fitness enthusiast umbrellas, mainstream adult consumers who are neither particularly health-focused nor seeking performance nutrition contribute moderately to overall market consumption.

Seniors are the least dominant end-user segment in the roll-ups market. Though there is potential for growth with products tailored for digestive health, low sugar, or easy chewability, the current product landscape does not heavily target this demographic. Seniors typically prioritize functional benefits, low sugar content, and softer textures, but due to a lack of specialized marketing and product design, this segment remains underdeveloped.

Segmentation Insights by Ingredient Type

On the basis of ingredient type, the global roll-ups market is bifurcated into organic ingredients, non-GMO ingredients, gluten-free ingredients, all-natural ingredients, and preservative-free ingredients.

In the roll-ups market, All-natural Ingredients stand out as the most dominant ingredient type, driven by widespread consumer demand for clean-label products and transparency. Roll-ups made with all-natural ingredients—typically free from artificial colors, flavors, and additives—appeal to both mainstream and health-conscious buyers. This segment benefits from strong crossover appeal across children’s snacks, adult health foods, and fitness products, making it a key focus for brands looking to maintain broad market relevance.

Organic Ingredients follow as the second most dominant segment. These roll-ups are typically made from certified organic fruits, vegetables, or other plant-based components and are free from synthetic pesticides, fertilizers, and genetically modified substances. The rising awareness of environmental sustainability and health among consumers has significantly boosted the demand for organic snacks. Although priced higher, organic roll-ups enjoy strong support from premium retailers, online platforms, and health food stores.

Non-GMO Ingredients hold the third position. This segment overlaps significantly with both the organic and all-natural markets but maintains its own relevance, especially in regions where genetically modified organisms are a concern. Consumers seeking transparency and ethical sourcing practices tend to favor non-GMO-labeled products. Brands often highlight this feature to build trust and distinguish themselves in competitive health-oriented markets.

Gluten-free Ingredients occupy a specialized yet growing segment, particularly among individuals with gluten intolerance, celiac disease, or those who voluntarily follow gluten-free diets. While many fruit and vegetable roll-ups are naturally gluten-free, specific labeling and certification help cater to this segment more effectively. Gluten-free roll-ups are becoming more mainstream as consumers associate gluten-free products with better digestion and cleaner eating.

Preservative-free Ingredients are the least dominant but gaining traction, especially among consumers looking to avoid artificial shelf-life extenders. The challenge for this segment lies in maintaining freshness and stability without using preservatives, which may limit shelf life and increase production costs. However, as cold-chain logistics and clean-label formulations improve, preservative-free roll-ups are expected to gain more market share over time.

Roll-ups Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific is the most dominant region in the roll-ups market, driven by its robust manufacturing sector, rapid urbanization, and growing demand for packaged consumer goods. Countries like China, India, and Japan lead the adoption of roll-up packaging across food, beverage, and pharmaceutical industries. The region benefits from low production costs, technological advancements in packaging, and expanding e-commerce activities, all of which contribute to its leading position in the global market.

North America follows closely behind, supported by a mature packaging industry and a strong focus on convenience and sustainability. The United States dominates the regional market, with high consumer demand for on-the-go food products and eco-friendly packaging solutions. The presence of major market players, along with technological innovation and adherence to environmental standards, strengthens the region’s role in the global roll-ups market.

Europe holds a significant share of the market, largely influenced by its stringent environmental regulations and commitment to sustainable packaging. Countries like Germany, France, and the United Kingdom are at the forefront of adopting recyclable and biodegradable materials. The region’s consumer base is highly conscious of environmental impact, and the industry responds with continuous innovation in roll-up packaging formats.

Latin America shows steady growth, primarily led by Brazil and Mexico, where increasing urbanization and a rising middle class fuel the demand for packaged food and beverages. Retail expansion and growing awareness of sustainable practices are supporting market development, although growth is somewhat moderated by economic fluctuations in certain parts of the region.

Middle East and Africa represent the least dominant region in the global roll-ups market but display growing potential. Investments in modern retail infrastructure and packaging technologies, particularly in the Gulf countries, are beginning to stimulate market activity. However, limited industrial base and slower regulatory development compared to other regions contribute to its lower standing in the global market hierarchy.

Roll-ups Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the roll-ups market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global roll-ups market include:

- Altria Group Inc

- British American Tobacco

- Imperial Brands

- Japan Tobacco Inc

- PHILIP MORRIS INTERNATIONAL

The global roll-ups market is segmented as follows:

By Type of Roll-ups

- Fruit Roll-ups

- Vegetable Roll-ups

- Protein Roll-ups

- Nut-based Roll-ups

- Herbal Roll-ups

By Packaging Type

- Single Serve Packs

- Family Packs

- Bulk Packaging

- Resealable Bags

- Glass/Jar Packaging

By Distribution Channel

- Online Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Health Food Stores

- Specialty Shops

By End User

- Children

- Adults

- Health-conscious Consumers

- Seniors

- Fitness Enthusiasts

By Ingredient Type

- Organic Ingredients

- Non-GMO Ingredients

- Gluten-free Ingredients

- All-natural Ingredients

- Preservative-free Ingredients

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Roll-ups

Request Sample

Roll-ups