Roll-Your-Own-Tobacco Products (RYO) Market Size, Share, and Trends Analysis Report

CAGR :

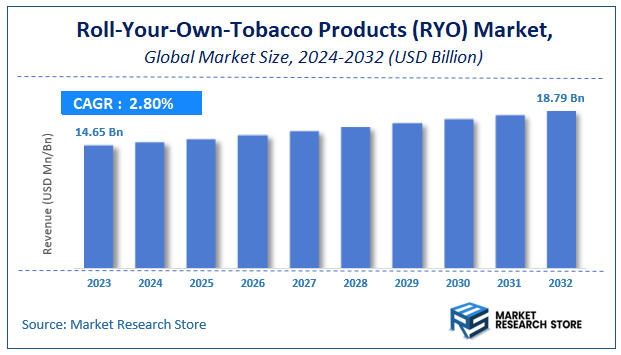

| Market Size 2023 (Base Year) | USD 14.65 Billion |

| Market Size 2032 (Forecast Year) | USD 18.79 Billion |

| CAGR | 2.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Roll-Your-Own-Tobacco Products (RYO) Market Insights

According to Market Research Store, the global roll-your-own-tobacco products (RYO) market size was valued at around USD 14.65 billion in 2023 and is estimated to reach USD 18.79 billion by 2032, to register a CAGR of approximately 2.8% in terms of revenue during the forecast period 2024-2032.

The roll-your-own-tobacco products (RYO) report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Roll-Your-Own-Tobacco Products (RYO) Market: Overview

Roll-your-own-tobacco products (RYO) refer to loose tobacco that consumers roll themselves into cigarettes using rolling papers, filters, and sometimes injectors. These products offer customization options for smokers, enabling them to choose tobacco types, flavors, and rolling methods. RYO products are often seen as a more affordable and natural alternative to factory-made cigarettes, attracting budget-conscious and health-conscious individuals.

The roll-your-own-tobacco products (RYO) tobacco market has been growing steadily, driven by factors such as rising taxes on pre-made cigarettes, a growing demand for organic or additive-free tobacco, and an increasing interest in personalized smoking experiences. Europe dominates this market due to its long tradition of hand-rolled cigarettes and a well-established consumer base. Additionally, the availability of various tobacco flavors such as mint and berries has helped attract younger smokers, contributing to market growth.

Key Highlights

- The roll-your-own-tobacco products (RYO) market is anticipated to grow at a CAGR of 2.8% during the forecast period.

- The global roll-your-own-tobacco products (RYO) market was estimated to be worth approximately USD 14.65 billion in 2023 and is projected to reach a value of USD 18.79 billion by 2032.

- The growth of the roll-your-own-tobacco products (RYO) market is being driven by its economic advantage, offering a more budget-friendly alternative to manufactured cigarettes, particularly in areas with high tobacco taxes or during periods of economic pressure.

- Based on the product, the RYO tobacco segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the offline segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Roll-Your-Own-Tobacco Products (RYO) Market: Dynamics

Key Growth Drivers

- Price Sensitivity and Cost Savings: roll-your-own-tobacco products (RYO) tobacco is often significantly cheaper than manufactured cigarettes, making it an attractive option for price-conscious consumers seeking to reduce their smoking expenses, especially in regions with high cigarette taxes.

- Perceived Control Over Tobacco Quality and Quantity: Some smokers believe that RYO allows them to control the type and amount of tobacco they use, potentially leading to a perceived "purer" or more customized smoking experience.

- Cultural and Traditional Smoking Habits: In certain regions and among specific demographics, rolling one's own cigarettes is a long-standing cultural practice.

- Availability in Smaller or Local Retail Outlets: RYO tobacco and accessories might be more readily available in smaller convenience stores or local tobacconists compared to specific manufactured cigarette brands.

- Tax Differentials and Loopholes: In some jurisdictions, RYO tobacco may be taxed at a lower rate than manufactured cigarettes, further driving its price advantage.

- Preference for Specific Tobacco Blends or Flavors: RYO allows smokers to experiment with different tobacco blends and flavors that might not be widely available in manufactured cigarette form.

- "Backlash" Against Manufactured Cigarette Regulations: Increasingly stringent regulations on manufactured cigarettes (e.g., plain packaging, flavor bans) might push some smokers towards RYO as a way to circumvent these restrictions.

- DIY Culture and Personalization: A broader trend towards DIY and personalization in various consumer goods might extend to tobacco consumption for some individuals.

Restraints

- Inconvenience and Time Required for Rolling: Rolling cigarettes manually is less convenient and more time-consuming than simply purchasing a pack of manufactured cigarettes.

- Negative Perception and Social Stigma: Smoking in general carries a significant social stigma, and RYO might be perceived by some as an outdated or less sophisticated way of smoking.

- Health Concerns and Lack of Perceived Harm Reduction: Despite potential perceptions of purity, RYO tobacco carries the same health risks as manufactured cigarettes, and there is no scientific evidence to suggest it is a safer alternative.

- Increasing Regulations and Taxation on RYO Tobacco: Governments are increasingly closing tax loopholes and applying similar or higher tax rates to RYO tobacco to discourage smoking and equalize the market.

- Declining Smoking Prevalence: Overall smoking rates are declining in many developed countries, which naturally impacts the demand for all tobacco products, including RYO.

- Availability and Marketing Restrictions: Regulations on the advertising and display of tobacco products, including RYO, can limit consumer awareness and accessibility.

- Messiness and Storage Issues: Handling loose tobacco and rolling accessories can be messier than dealing with pre-packaged cigarettes, and proper storage is required to maintain tobacco quality.

- Age Restrictions and Prevention of Underage Smoking: Strict regulations on the sale of all tobacco products, including RYO, aim to prevent underage smoking.

Opportunities

- Development of User-Friendly Rolling Accessories: Innovations in rolling machines, pre-cut papers, and filter tips that simplify the rolling process could attract new users or make it more convenient for existing ones.

- Marketing Towards Price-Sensitive Consumers: Highlighting the cost savings associated with RYO tobacco can be an effective marketing strategy, particularly during economic downturns.

- Offering Diverse Tobacco Blends and Flavors: Providing a wider variety of tobacco blends and flavor options can cater to niche preferences and potentially attract smokers seeking alternatives to regulated manufactured cigarettes.

- Online Retail and Subscription Services: E-commerce platforms could offer convenient access to RYO tobacco and accessories, potentially reaching a wider customer base (where legally permitted).

- Focus on "Natural" or "Organic" Tobacco Options: Marketing RYO tobacco as a more "natural" or "organic" alternative (even if health risks remain) could appeal to certain consumer segments.

- Partnerships with Tobacco Accessories Brands: Collaborating with rolling paper and filter manufacturers to offer bundled products or promotional deals.

- Education and Tutorials on Rolling Techniques: Providing resources and guidance on how to roll cigarettes effectively could lower the barrier to entry for new users.

- Adapting to Regional Preferences and Regulations: Tailoring product offerings and marketing strategies to comply with specific regional regulations and cater to local smoking habits.

Challenges

- Navigating Complex and Divergent Regulatory Landscapes: Tobacco regulations vary significantly across countries and regions, creating challenges for manufacturers and retailers.

- Combating Negative Perceptions and Public Health Campaigns: Addressing the strong anti-smoking sentiment and public health campaigns that discourage all forms of tobacco use.

- Preventing Illicit Trade and Smuggling: The price differentials between manufactured cigarettes and RYO can incentivize illicit trade and smuggling, undermining legitimate sales.

- Maintaining Profitability Under Increasing Taxation: As governments increase taxes on RYO tobacco, manufacturers and retailers face the challenge of maintaining profitability while remaining price-competitive.

- Adapting to Potential Flavor Bans and Other Restrictions: Future regulations, such as flavor bans that might extend to RYO tobacco, could significantly impact product appeal.

- Ensuring Compliance with Age Verification and Sales Restrictions: Implementing robust systems to prevent sales to underage individuals is crucial for responsible retailing.

- Competing with the Convenience and Branding of Manufactured Cigarettes: Overcoming the established convenience and strong branding of major cigarette manufacturers.

- Monitoring and Responding to Evolving Consumer Preferences: Understanding and adapting to changing smoking habits and preferences among tobacco consumers.

Roll-Your-Own-Tobacco Products (RYO) Market: Report Scope

This report thoroughly analyzes the Roll-Your-Own-Tobacco Products (RYO) Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Roll-Your-Own-Tobacco Products (RYO) Market |

| Market Size in 2023 | USD 14.65 Billion |

| Market Forecast in 2032 | USD 18.79 Billion |

| Growth Rate | CAGR of 2.8% |

| Number of Pages | 179 |

| Key Companies Covered | Imperial Brands, British American Tobacco, Scandinavian Tobacco Group A/S, Altria Group Inc., Philip Morris International, HBI International, Curved PapersInc., Karma Filter Tips, Shine Brands, Japan Tobacco International |

| Segments Covered | By Product, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Roll-Your-Own-Tobacco Products (RYO) Market: Segmentation Insights

The global roll-your-own-tobacco products (RYO) market is divided by product, distribution channel, and region.

Segmentation Insights by Product

Based on product, the global roll-your-own-tobacco products (RYO) market is divided into RYO tobacco, rolling paper & cigarette tubes, injector, and filter & paper tip.

RYO Tobacco segment dominates the roll-your-own-tobacco products (RYO) market, making it the most significant product type in the industry. With an increasing number of consumers opting for personalized smoking experiences and cost-effective alternatives to pre-rolled cigarettes, RYO tobacco remains the central component in the market. Its versatility and affordability have made it the preferred choice, accounting for the majority of the market share. As smoking habits evolve and consumers look for more control over their smoking products, RYO tobacco continues to lead the market.

Rolling Paper & Cigarette Tubes segment plays a crucial complementary role in the roll-your-own-tobacco products (RYO) market. This segment has seen sustained growth, driven by the increasing demand for products that allow consumers to roll their own cigarettes. The wide variety of available paper types, such as hemp, rice, and traditional paper, adds to the appeal, enhancing the market's accessibility. Despite not dominating as much as RYO tobacco itself, this product category is essential for completing the DIY cigarette-making process, which contributes significantly to the market dynamics.

Injector segment has witnessed growth as consumers seek more convenient and efficient ways to roll their own cigarettes. While this segment is not the dominant force like roll-your-own-tobacco products (RYO), its rising popularity among regular users who want consistency and speed in their cigarette preparation has made it an important part of the market. The injector’s convenience and ease of use contribute to the growing appeal of RYO tobacco, driving demand for this category.

Filter & Paper Tip segment, while not as dominant as roll-your-own-tobacco products (RYO), plays a supporting but essential role in enhancing the smoking experience. With increasing health consciousness and demand for smoother smoking alternatives, the filter and paper tip products are seeing growth, especially among consumers who seek a cleaner and more filtered smoke. This segment is growing steadily, complementing the RYO tobacco market, but does not currently lead the market in terms of volume.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global roll-your-own-tobacco products (RYO) market is bifurcated into offline and online.

Offline distribution channel remains the dominant force in the roll-your-own-tobacco products (RYO) market. Traditional brick-and-mortar stores, such as tobacco shops, convenience stores, and supermarkets, continue to play a major role in product sales, providing immediate access for customers. Many consumers prefer in-person shopping for RYO products, especially for products like RYO tobacco and rolling papers, as it offers the chance to inspect the products firsthand and make immediate purchases. The offline channel also benefits from the loyal customer base who prefer the experience of in-store shopping, particularly in regions where there is high foot traffic in physical retail outlets.

Online distribution channel has been steadily growing, with e-commerce platforms offering the convenience of doorstep delivery and a broader selection of RYO products. The online market caters to a tech-savvy demographic that values convenience and the ability to compare prices easily. Though it currently does not dominate the market in volume compared to offline channels, online sales are on the rise, especially in regions with younger, more digitally inclined consumers. The growth of online sales is also aided by discreet packaging and home delivery services, which appeal to those who prefer privacy. The trend is expected to continue growing as consumers increasingly shift towards online shopping for its ease and accessibility.

Roll-Your-Own-Tobacco Products (RYO) Market: Regional Insights

- North American is expected to dominate the global market.

North American is dominates the roll-your-own-tobacco products (RYO) market, driven by cost-conscious consumers who prefer the more affordable and customizable smoking experience RYO products offer compared to traditional factory-made cigarettes. The market also benefits from the widespread availability of rolling papers, tobacco, and accessories. Despite increasing regulatory pressures from the FDA, particularly around nicotine level restrictions, demand remains robust, particularly among price-sensitive smokers. Canada also contributes to the market, with consumers favoring RYO products for similar reasons, although the strict regulatory environment, such as plain packaging laws, limits growth.

Europe, the roll-your-own-tobacco products (RYO) market is led by Germany, which is the largest market in the region, followed by countries like France and the United Kingdom. The preference for RYO products is driven by their affordability compared to pre-manufactured cigarettes, along with the opportunity for a more customizable smoking experience. Despite strong demand, the market faces challenges from stringent regulations, including advertising restrictions and higher taxes on tobacco products, which may slow market growth. However, the deep-rooted smoking culture and continued consumer interest in cost-effective alternatives sustain the market in the region.

Asia-Pacific region is experiencing rapid growth in the roll-your-own-tobacco products (RYO) market, particularly in China, India, and Indonesia. The rise in disposable incomes, urbanization, and the increasing shift toward more affordable and customizable smoking options contribute to this growth. China is the largest market in the region, with many smokers seeking RYO products as an alternative to expensive, factory-made cigarettes. India and Indonesia are also seeing increasing adoption, driven by large populations and the growing affordability of tobacco products. Despite this, rising regulatory pressures and health campaigns could slow down the market expansion.

Latin America, countries like Brazil and Mexico are seeing steady growth in the adoption of RYO tobacco products. The cost-effectiveness of RYO products is a significant factor in these markets, with consumers opting for cheaper alternatives to traditional cigarettes. Brazil has the largest share of the market, driven by rising disposable incomes and the increasing preference for customizable tobacco products. Mexico also shows growth, particularly among cost-conscious smokers. However, the region faces challenges such as economic instability and inconsistent regulatory environments across different countries.

Middle East & Africa region presents a smaller but emerging market for roll-your-own-tobacco products (RYO). South Africa is the leading market in the region, where RYO products are gaining popularity as more affordable alternatives to traditional cigarettes. The UAE also shows some demand, but adoption is slower compared to other regions due to stricter regulations and cultural attitudes toward tobacco consumption. The region faces several challenges, including regulatory barriers and less developed infrastructure for distributing RYO products, though urbanization and younger, price-sensitive smokers could drive future growth.

Roll-Your-Own-Tobacco Products (RYO) Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the roll-your-own-tobacco products (RYO) market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global roll-your-own-tobacco products (RYO) market include:

- Imperial Brands

- British American Tobacco

- Scandinavian Tobacco Group A/S

- Altria Group Inc.

- Philip Morris International

- HBI International

- Curved PapersInc.

- Karma Filter Tips

- Shine Brands

- Japan Tobacco International

The global roll-your-own-tobacco products (RYO) market is segmented as follows:

By Product

- RYO Tobacco

- Rolling Paper & Cigarette Tubes

- Injector

- Filter & Paper Tip

By Distribution Channel

- Offline

- Online

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Roll-Your-Own-Tobacco Products (RYO)

Request Sample

Roll-Your-Own-Tobacco Products (RYO)