Rotary Electrohydraulic Actuator Market Size, Share, and Trends Analysis Report

CAGR :

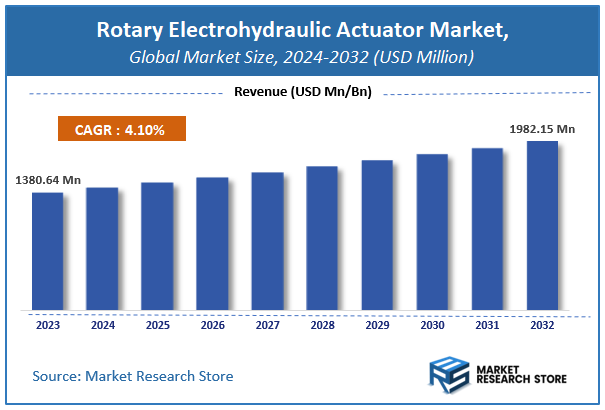

| Market Size 2023 (Base Year) | USD 1380.64 Million |

| Market Size 2032 (Forecast Year) | USD 1982.15 Million |

| CAGR | 4.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rotary Electrohydraulic Actuator Market Insights

According to Market Research Store, the global rotary electrohydraulic actuator market size was valued at around USD 1380.64 million in 2023 and is estimated to reach USD 1982.15 million by 2032, to register a CAGR of approximately 4.1% in terms of revenue during the forecast period 2024-2032.

The rotary electrohydraulic actuator report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rotary Electrohydraulic Actuator Market: Overview

A rotary electrohydraulic actuator is a device that converts electrical signals into hydraulic power to produce rotary motion. It integrates electrical, hydraulic, and mechanical components to deliver precise control and high torque output. These actuators are widely used in industrial automation, aerospace, marine, and oil & gas sectors due to their ability to provide smooth, powerful, and energy-efficient motion control. They are favored in applications requiring high force, durability, and precision, such as valve operation, robotic systems, and heavy machinery.

Key Highlights

- The rotary electrohydraulic actuator market is anticipated to grow at a CAGR of 4.1% during the forecast period.

- The global rotary electrohydraulic actuator market was estimated to be worth approximately USD 1380.64 million in 2023 and is projected to reach a value of USD 1982.15 million by 2032.

- The growth of the rotary electrohydraulic actuator market is being driven by increasing demand for automation and energy-efficient solutions across industries.

- Based on the type, the double-acting actuators segment is growing at a high rate and is projected to dominate the market.

- On the basis of size, the medium size segment is projected to swipe the largest market share.

- In terms of mechanism, the rotary actuators segment is expected to dominate the market.

- Based on the application, the oil and gas segment is expected to dominate the market.

- On the basis of end-user, the energy and power segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Rotary Electrohydraulic Actuator Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Automation – The rising adoption of automation in industrial, aerospace, and defense applications is driving the need for precise motion control solutions like rotary electrohydraulic actuators.

- Advancements in Electrohydraulic Technologies – Innovations in hydraulic and electronic control systems are improving efficiency, reliability, and response time, making these actuators more attractive.

- Expansion of Industrial Robotics – Growth in robotics and automated machinery across sectors like manufacturing, energy, and oil & gas is increasing demand for high-performance actuation systems.

- Infrastructure Development – Rising investments in smart infrastructure, construction, and renewable energy projects are fueling the need for advanced motion control solutions.

Restraints:

- High Initial Cost – The advanced technology and integration requirements of electrohydraulic actuators result in high upfront investment, limiting adoption among small enterprises.

- Maintenance Complexity – These actuators require regular maintenance due to their hydraulic components, leading to higher operational costs and downtime concerns.

- Availability of Alternative Technologies – Growing competition from electric and pneumatic actuators, which offer simpler operation and lower maintenance, poses a challenge to market growth.

Opportunities:

- Integration with Industry 4.0 and IoT – The adoption of smart actuators with real-time monitoring and predictive maintenance capabilities can enhance efficiency and drive market growth.

- Growing Aerospace & Defense Applications – Increasing demand for precise motion control in aircraft, military vehicles, and naval systems presents lucrative opportunities for market expansion.

- Rising Investments in Renewable Energy – The deployment of wind turbines and hydroelectric power plants requires advanced actuation solutions, creating new growth avenues.

Challenges:

- Supply Chain Disruptions – Fluctuations in raw material availability and geopolitical uncertainties can impact production and supply.

- Skilled Workforce Shortage – The complexity of electrohydraulic systems requires highly skilled personnel for installation and maintenance, posing a workforce challenge.

- Environmental Concerns – Hydraulic fluid leakage and disposal issues can lead to regulatory challenges and sustainability concerns, impacting market growth.

Rotary Electrohydraulic Actuator Market: Report Scope

This report thoroughly analyzes the Rotary Electrohydraulic Actuator Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rotary Electrohydraulic Actuator Market |

| Market Size in 2023 | USD 1380.64 Million |

| Market Forecast in 2032 | USD 1982.15 Million |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 162 |

| Key Companies Covered | Rotork, Rexa, HOERBIGER, Emerson, KOSO, Schuck, Voith, Moog, Zhongde, Tefulong, Reineke, SAMSON, Woodward, AVTEC, RPMTECH, Rotex |

| Segments Covered | By Type, By Size, By Mechanism, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rotary Electrohydraulic Actuator Market: Segmentation Insights

The global rotary electrohydraulic actuator market is divided by type, size, mechanism, application, end-user, and region.

Segmentation Insights by Type

Based on type, the global rotary electrohydraulic actuator market is divided into single-acting actuators, double-acting actuators, and modular actuators.

The double-acting actuators segment holds the dominant position in the rotary electrohydraulic actuator market. These actuators utilize hydraulic pressure in both directions, allowing for precise control over rotational movement, making them ideal for applications that require high force and consistent torque output. Their ability to operate in harsh environments, such as offshore oil and gas platforms, power plants, and heavy machinery, has led to their widespread adoption. Additionally, their durability and ability to maintain performance under extreme conditions make them a preferred choice in industries that require high reliability and efficiency.

The single-acting actuators segment follows, offering a more energy-efficient alternative for applications that require movement in only one direction, with a return mechanism relying on a spring or external force. These actuators are commonly used in industries such as water treatment, chemical processing, and certain manufacturing processes where space constraints and cost-effectiveness are important considerations. While they may not offer the same level of force and precision as double-acting actuators, their simpler design and lower maintenance requirements make them a viable option for various applications.

The modular actuators segment is the least dominant in the market, primarily due to their specialized applications and higher costs. These actuators are designed for flexibility, allowing components to be configured based on specific operational requirements. Industries that require customized solutions, such as aerospace and high-end industrial automation, benefit from their adaptability. However, their limited standardization and relatively higher integration costs compared to single-acting and double-acting actuators have restricted their adoption to niche applications. Despite this, as industries continue to demand more versatile and intelligent actuation systems, modular actuators may see increased adoption in the future.

Segmentation Insights by Size

On the basis of size, the global rotary electrohydraulic actuator market is bifurcated into compact size, medium size, and large size.

The medium-size segment is the most dominant in the rotary electrohydraulic actuator market. These actuators strike a balance between power, efficiency, and versatility, making them suitable for a wide range of industrial applications. They are commonly used in oil and gas, power generation, water treatment, and manufacturing industries, where moderate torque and precision control are required. Their ability to fit into standard operational setups while offering high reliability and performance makes them the preferred choice for many industrial applications.

The compact-size segment follows closely, driven by the increasing demand for space-efficient automation solutions. These actuators are ideal for applications where installation space is limited, such as in robotics, medical devices, and small-scale industrial machinery. Despite their smaller size, they deliver sufficient torque for various precision-driven applications. The rise in demand for compact and lightweight industrial equipment has further fueled the adoption of these actuators, especially in sectors where miniaturization and efficiency are key considerations.

The large-size segment holds the smallest market share, mainly due to its specialized applications and higher costs. These actuators are designed for heavy-duty operations, often found in industries such as shipbuilding, aerospace, and large-scale energy projects. Their ability to handle extreme loads and provide high torque makes them indispensable in such environments. However, their higher initial investment, installation complexity, and maintenance costs limit their widespread adoption compared to medium and compact-size actuators. Nonetheless, as industries requiring heavy-duty automation continue to grow, the demand for large-size rotary electrohydraulic actuators may see gradual expansion.

Segmentation Insights by Mechanism

Based on mechanism, the global rotary electrohydraulic actuator market is divided into rotary actuators, linear actuators, and servo actuators.

The rotary actuators segment dominates the rotary electrohydraulic actuator market, as these actuators are specifically designed for rotational motion, making them ideal for applications requiring controlled torque and angular displacement. They are widely used in industries such as oil and gas, power generation, and manufacturing, where precise control of valve operations and mechanical movements is crucial. Their ability to provide high torque output, durability in extreme environments, and compatibility with automated control systems makes them the preferred choice for many industrial applications.

The linear actuators segment follows, as these actuators convert hydraulic energy into straight-line motion. They are essential in industries such as construction, automotive, and heavy machinery, where linear force and precise positioning are required. While they offer high load capacity and reliability, their use in applications requiring rotational movement is limited, placing them behind rotary actuators in terms of market share. However, their importance in sectors that require lifting, pressing, and pushing operations ensures steady demand.

The servo actuators segment is the least dominant, primarily due to their specialized applications and higher costs. These actuators provide precise motion control with feedback mechanisms, making them ideal for high-precision applications such as robotics, aerospace, and high-end automation systems. While they offer superior accuracy and adaptability, their complexity and higher price point restrict their widespread adoption compared to rotary and linear actuators. However, as industries increasingly integrate smart automation solutions, the demand for servo actuators is expected to grow in niche applications.

Segmentation Insights by Application

On the basis of application, the global rotary electrohydraulic actuator market is bifurcated into industrial automation, aerospace and defense, marine, oil and gas, and automotive.

The oil and gas segment is the most dominant application in the rotary electrohydraulic actuator market. These actuators are crucial for controlling valves in drilling, pipeline, and refining operations, where high torque and precise motion control are essential. Their ability to function reliably in harsh environments, such as offshore rigs and high-pressure gas pipelines, makes them indispensable in the industry. With the increasing need for automation in oil extraction and transportation, the demand for rotary electrohydraulic actuators in this sector continues to grow.

The industrial automation segment follows closely, driven by the rising adoption of automated machinery and robotics in manufacturing, processing, and material handling industries. These actuators play a key role in enhancing efficiency, precision, and safety in automated production lines. As industries move towards Industry 4.0, integrating smart actuators with IoT and AI-based systems, the demand for these actuators in industrial automation is expected to expand further.

The marine segment holds a significant market share as well, with actuators being widely used in ship steering systems, deck machinery, and subsea equipment. The ability of electrohydraulic actuators to operate in extreme marine conditions, such as high humidity, saltwater exposure, and heavy mechanical loads, makes them an ideal choice for this industry. As global trade and naval defense investments increase, the marine sector continues to drive demand for these actuators.

The aerospace and defense segment is another important application, particularly in aircraft control systems, missile launch mechanisms, and military vehicle automation. These actuators provide precise motion control in demanding environments, ensuring reliable operation in extreme temperatures and high-vibration conditions. However, due to the highly specialized nature of aerospace and defense applications, the market size is smaller compared to industrial automation and oil & gas.

The automotive segment is the least dominant in the market, mainly because automotive applications typically rely more on electric and pneumatic actuators rather than electrohydraulic ones. However, rotary electrohydraulic actuators are still used in specialized areas such as heavy-duty vehicles, autonomous driving systems, and advanced steering mechanisms. As the automotive industry continues to evolve with electric and autonomous vehicle technologies, the demand for highly precise and efficient actuators may lead to gradual growth in this segment.

Segmentation Insights by End-User

On the basis of end-user, the global rotary electrohydraulic actuator market is bifurcated into manufacturing, energy and power, construction, mining, and food & beverage.

The energy and power segment is the most dominant end-user in the rotary electrohydraulic actuator market. These actuators are widely used in power plants, renewable energy systems, and electrical grid automation for controlling high-pressure valves, turbines, and circuit breakers. Their ability to handle extreme operating conditions, such as high temperatures and pressures, makes them essential in energy production and distribution. With the growing demand for efficient power generation and grid modernization, the adoption of these actuators in the energy & power sector continues to rise.

The manufacturing segment follows closely, driven by the increasing adoption of automation in industries such as automotive, electronics, and metal processing. Rotary electrohydraulic actuators enhance precision, efficiency, and safety in automated assembly lines, robotic arms, and material handling systems. As industries shift towards smart manufacturing and Industry 4.0, integrating actuators with IoT and AI technologies, this segment is expected to witness significant growth.

The mining sector holds a significant market share, as rotary electrohydraulic actuators are used in heavy machinery, drilling equipment, and material transport systems. These actuators provide high torque and durability, allowing for efficient operation in extreme conditions such as underground mining and open-pit excavation. The demand for automation in mining operations, aimed at improving safety and productivity, is fueling the growth of actuators in this segment.

The construction segment also plays a notable role in the market, as electrohydraulic actuators are used in heavy construction equipment, such as excavators, cranes, and road pavers. These actuators provide precise motion control for lifting, positioning, and excavation tasks, improving efficiency and reducing manual labor. As infrastructure development and smart city projects continue to expand, the demand for actuators in construction machinery is expected to grow.

The food & beverage segment is the least dominant, primarily due to the industry's preference for electric and pneumatic actuators over electrohydraulic ones. However, rotary electrohydraulic actuators are still used in specialized applications, such as automated bottling lines, food processing machinery, and industrial ovens, where high torque and precision are required. With increasing automation in food production and packaging, the demand for actuators in this sector may gradually rise, although it remains a smaller portion of the overall market.

Rotary Electrohydraulic Actuator Market: Regional Insights

- North America is expected to dominates the global market

North America leads the rotary electrohydraulic actuator market, driven by its advanced industrial infrastructure and widespread adoption of automation technologies. The region's robust automotive, aerospace, and energy sectors have significantly contributed to the increased demand for electrohydraulic actuators. Technological innovations and a strong focus on efficiency and sustainability further bolster market growth in this region.

Europe follows as a strong contender, with substantial demand stemming from the automotive and industrial sectors. Countries like Germany, France, and the United Kingdom, known for their technological advancements and presence of key industry players, contribute significantly to the region's market share. The emphasis on energy-efficient systems and the push for renewable energy projects also play pivotal roles in driving the market.

Asia-Pacific is witnessing rapid adoption of electrohydraulic actuators, particularly in emerging economies such as China and India. Rapid industrialization, infrastructure development, and government initiatives promoting smart manufacturing are fueling demand. The region's expanding oil and gas exploration activities and growing emphasis on automation further accelerate market growth.

Middle East and Africa, while comparatively smaller markets, are poised for steady growth. Investments in oil and gas projects, alongside infrastructure development, drive demand for durable and efficient actuators capable of performing in extreme environments. The region's extensive oil and gas reserves and ongoing investments in industrial automation present significant potential for market expansion.

Latin America exhibits moderate growth, primarily driven by industrial activities and renewable energy initiatives in countries like Brazil and Mexico. Developments in the oil and gas sector, coupled with infrastructure projects, contribute to the demand for electrohydraulic actuators. Despite economic challenges, the region's focus on enhancing operational efficiency in various industries supports market growth.

Rotary Electrohydraulic Actuator Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rotary electrohydraulic actuator market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rotary electrohydraulic actuator market include:

- Rotork

- Rexa

- HOERBIGER

- Emerson

- KOSO

- Schuck

- Voith

- Moog

- Zhongde

- Tefulong

- Reineke

- SAMSON

- Woodward

- AVTEC

- RPMTECH

- Rotex

The global rotary electrohydraulic actuator market is segmented as follows:

By Type

- Single-acting Actuators

- Double-acting Actuators

- Modular Actuators

By Size

- Compact Size

- Medium Size

- Large Size

By Mechanism

- Rotary Actuators

- Linear Actuators

- Servo Actuators

By Application

- Industrial Automation

- Aerospace and Defense

- Marine

- Oil and Gas

- Automotive

By End-User

- Manufacturing

- Energy and Power

- Construction

- Mining

- Food and Beverage

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rotary Electrohydraulic Actuator

Request Sample

Rotary Electrohydraulic Actuator