Security Analytics and SIEM Platforms Market Size, Share, and Trends Analysis Report

CAGR :

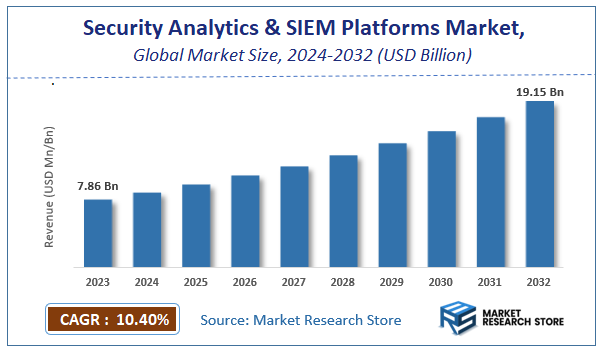

| Market Size 2023 (Base Year) | USD 7.86 Billion |

| Market Size 2032 (Forecast Year) | USD 19.15 Billion |

| CAGR | 10.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Security Analytics and SIEM Platforms Market Insights

According to Market Research Store, the global security analytics and SIEM platforms market size was valued at around USD 7.86 billion in 2023 and is estimated to reach USD 19.15 billion by 2032, to register a CAGR of approximately 10.4% in terms of revenue during the forecast period 2024-2032.

The security analytics and SIEM platforms report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Security Analytics and SIEM Platforms Market: Overview

Security analytics and SIEM platforms are cybersecurity tools designed to detect, analyze, and respond to security threats and incidents within an organization's IT environment. These platforms collect and aggregate data from across various sources—such as firewalls, endpoints, servers, and network devices—and apply advanced analytics, including behavioral analysis, machine learning, and threat intelligence, to identify patterns or anomalies that could signal malicious activity.

Security analytics focuses on identifying potential threats using historical and real-time data analysis, helping security teams to understand attack vectors and vulnerabilities. SIEM platforms, on the other hand, provide a centralized system for real-time monitoring, log management, correlation of security events, and alerting. Together, they offer a comprehensive security solution that not only detects threats but also supports incident response, forensic investigations, and regulatory compliance efforts.

Key Highlights

- The security analytics and SIEM platforms market is anticipated to grow at a CAGR of 10.4% during the forecast period.

- The global security analytics and SIEM platforms market was estimated to be worth approximately USD 7.86 billion in 2023 and is projected to reach a value of USD 19.15 billion by 2032.

- The growth of the security analytics and SIEM platforms market is being driven by rising cyber threats and the need for real-time threat detection.

- Based on the deployment, the cloud segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the SMEs segment is projected to swipe the largest market share.

- In terms of application, the web security analytics segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Security Analytics and SIEM Platforms Market: Dynamics

Key Growth Drivers:

- Escalating Frequency and Sophistication of Cyber Threats: The ever-increasing number and complexity of cyberattacks, including ransomware, advanced persistent threats (APTs), and supply chain attacks, are driving organizations to invest in robust security analytics and SIEM platforms for enhanced threat detection and response capabilities.

- Growing Regulatory Compliance Requirements: Stringent data privacy regulations and compliance mandates (such as GDPR, HIPAA, PCI DSS) require organizations to implement comprehensive security monitoring and logging capabilities, which SIEM platforms are well-suited to provide.

- Increasing Data Volumes and Complexity: The exponential growth in data generated by modern IT environments (including cloud, on-premises, and IoT devices) necessitates advanced analytics capabilities to sift through the noise, identify anomalies, and detect potential security incidents. SIEM platforms with integrated security analytics are crucial for managing this data deluge.

- Shortage of Skilled Cybersecurity Professionals: The global shortage of cybersecurity analysts makes it challenging for organizations to manually monitor and analyze security events. Security analytics and SIEM platforms help automate threat detection, prioritize alerts, and streamline incident response workflows, augmenting the capabilities of security teams.

- Shift Towards Proactive Threat Detection and Hunting: Organizations are increasingly adopting a proactive security posture, focusing on threat hunting and early detection of potential breaches before they cause significant damage. Security analytics capabilities within SIEM platforms enable security teams to identify subtle indicators of compromise.

- Integration with Other Security Tools: The ability of modern SIEM platforms to integrate with a wide range of other security tools (such as endpoint detection and response (EDR), threat intelligence platforms, and network security controls) provides a holistic view of the security landscape and enhances threat detection accuracy.

Restraints:

- High Implementation and Maintenance Costs: The initial investment in a comprehensive SIEM platform, along with the ongoing costs of configuration, customization, maintenance, and staffing, can be significant, especially for small and medium-sized enterprises (SMEs).

- Complexity of Deployment and Configuration: Deploying and properly configuring a SIEM platform to effectively collect, normalize, and analyze data from diverse sources can be a complex and time-consuming process, often requiring specialized expertise.

- Alert Fatigue and Data Overload: Poorly configured or unoptimized SIEM platforms can generate a large volume of low-priority alerts, leading to alert fatigue among security analysts and potentially causing them to miss critical incidents. Managing the sheer volume of data ingested by SIEM platforms can also be challenging.

- Integration Challenges with Heterogeneous Environments: Organizations often have complex and heterogeneous IT environments with a mix of legacy systems, cloud services, and various security tools. Integrating the SIEM platform seamlessly with all these disparate systems can be a significant hurdle.

- Lack of Skilled Personnel for Operation and Management: Effectively operating and managing a SIEM platform requires specialized skills in areas such as log analysis, rule creation, threat intelligence integration, and incident response. The shortage of such skilled personnel can hinder the full utilization of the platform's capabilities.

- Concerns about Data Privacy and Security of SIEM Data: SIEM platforms collect and store sensitive security logs and event data. Ensuring the privacy and security of this data itself is crucial and can be a concern for organizations, especially in light of data breach risks.

Opportunities:

- Adoption of Cloud-Based SIEM Solutions: Cloud-native SIEM platforms offer scalability, flexibility, and reduced infrastructure management overhead, making them an attractive option for organizations of all sizes. The increasing adoption of cloud services is driving the demand for cloud-based SIEM solutions.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): Incorporating AI and ML capabilities into security analytics and SIEM platforms can significantly enhance threat detection accuracy, reduce false positives, automate incident investigation, and provide more insightful threat intelligence.

- Growing Demand for Managed Security Services Providers (MSSPs): Organizations facing a shortage of in-house security expertise are increasingly turning to MSSPs for outsourced security monitoring and management, including SIEM services. This presents a significant opportunity for MSSPs offering security analytics and SIEM capabilities.

- Focus on User and Entity Behavior Analytics (UEBA): Integrating UEBA capabilities into SIEM platforms provides deeper insights into user and entity behavior patterns, enabling the detection of insider threats and compromised accounts that might be missed by traditional rule-based approaches.

- Development of Industry-Specific SIEM Solutions: Tailoring SIEM platforms and analytics rules to specific industry verticals (e.g., finance, healthcare) can address the unique security challenges and regulatory requirements of those sectors, creating niche market opportunities.

- Threat Intelligence Platform (TIP) Integration: Enhanced integration between SIEM platforms and TIPs allows for the enrichment of security alerts with contextual threat intelligence, improving the speed and accuracy of threat detection and response.

Challenges:

- Keeping Pace with the Evolving Threat Landscape: The constantly evolving tactics, techniques, and procedures (TTPs) of cyber adversaries require continuous updates and adaptations of SIEM rules and analytics models to maintain effective threat detection.

- Dealing with the Increasing Volume and Velocity of Data: The sheer volume and speed at which security data is generated pose significant challenges for SIEM platforms in terms of data ingestion, processing, and analysis.

- Reducing False Positives and Improving Alert Prioritization: Minimizing false positives and effectively prioritizing genuine security alerts remain a significant challenge for SIEM platforms to ensure that security teams focus on the most critical incidents.

- Demonstrating Return on Investment (ROI): Quantifying the ROI of a SIEM platform can be challenging, especially in terms of avoided breaches and reduced business impact. Organizations need to clearly understand the value proposition to justify the investment.

- Maintaining Data Integrity and Compliance: Ensuring the integrity and compliance of the data collected and stored by SIEM platforms is crucial, especially in regulated industries.

- Adapting to New Technologies and Architectures: The emergence of new technologies like serverless computing, microservices, and distributed architectures requires SIEM platforms to adapt their data collection and analysis capabilities to these evolving environments.

Security Analytics and SIEM Platforms Market: Report Scope

This report thoroughly analyzes the Security Analytics and SIEM Platforms Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Security Analytics and SIEM Platforms Market |

| Market Size in 2023 | USD 7.86 Billion |

| Market Forecast in 2032 | USD 19.15 Billion |

| Growth Rate | CAGR of 10.4% |

| Number of Pages | 144 |

| Key Companies Covered | Alert Logic, AlienVault, Assuria, BAE Systems, BlackStratus, CorreLog, Cygilant, Dell, Exabeam, Fortinet, IBM, Logentries, Logpoint, LogRhythm, Logsign, Zoho, McAfee, Micro Focus, RSA, Securonix |

| Segments Covered | By Deployment, By End-User, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Security Analytics and SIEM Platforms Market: Segmentation Insights

The global security analytics and SIEM platforms market is divided by deployment, end-user, application, and region.

Segmentation Insights by Deployment

Based on deployment, the global security analytics and SIEM platforms market is divided into cloud and on-premises.

Cloud-based Security Analytics and SIEM Platforms dominate the market as organizations increasingly adopt cloud infrastructure to enhance cybersecurity agility and reduce capital expenditure. Cloud deployment offers the advantage of real-time threat detection, remote accessibility, and seamless integration with other cloud-based services. It also allows for automated updates and easier scalability, which is essential for businesses managing large volumes of security data from distributed environments. The growing trend of remote work, BYOD (bring your own device), and the rise of cloud-native applications are further accelerating the shift toward cloud-based security solutions. Small to mid-sized enterprises, in particular, prefer cloud deployment due to its lower upfront costs and reduced maintenance burden.

On-Premises Security Analytics and SIEM Platforms, while still significant, are gradually losing market share to cloud alternatives. This deployment model is typically preferred by large enterprises and government agencies with stringent data privacy, regulatory, or compliance requirements. On-premises platforms offer greater control over data and system configurations, which is crucial for organizations operating in highly regulated industries such as finance, defense, and healthcare. However, the higher cost of infrastructure, longer implementation timelines, and the need for dedicated IT teams to manage the systems are some of the limitations that are slowing down growth in this segment.

Segmentation Insights by End-User

On the basis of end-user, the global security analytics and SIEM platforms market is bifurcated into SMEs, large enterprises, and government organization.

SMEs are increasingly dominating the security analytics and SIEM platforms market as they recognize the critical need to secure their digital assets amid a rising number of cyber threats. Traditionally viewed as less equipped to invest in advanced security infrastructure, SMEs are now rapidly shifting toward affordable, cloud-based SIEM and security analytics platforms. These solutions offer scalability, automated threat detection, and minimal need for in-house IT expertise, making them ideal for smaller businesses with limited cybersecurity resources. The rise of remote work, digital transformation, and the adoption of SaaS applications have expanded attack surfaces, pushing SMEs to prioritize real-time threat visibility and compliance management. Furthermore, managed security service providers (MSSPs) and SIEM-as-a-service offerings have made it easier for SMEs to deploy sophisticated security tools without heavy upfront investments, thus accelerating adoption across various industries.

Large Enterprises although historically dominant, are experiencing relatively slower growth in comparison. These organizations require comprehensive security analytics and SIEM platforms to monitor, detect, and respond to threats in real time. The complexity of their networks demands scalable and highly integrated solutions, which are often supported by dedicated cybersecurity teams and budgets. The need for compliance with stringent regulatory frameworks such as GDPR, HIPAA, and PCI-DSS further drives the adoption of robust SIEM platforms in this segment. Moreover, large enterprises increasingly prefer hybrid or multi-cloud environments, making advanced, cloud-compatible SIEM tools essential for seamless threat visibility across all endpoints.

Government Organizations represent a significant segment due to the critical nature of public sector data and infrastructure. These entities face constant threats from cyber espionage, nation-state actors, and internal vulnerabilities. Security analytics and SIEM solutions are vital for safeguarding national security assets, citizen information, and essential public services. Governments are investing heavily in modernizing their cybersecurity frameworks, often incorporating centralized monitoring and incident response capabilities provided by advanced SIEM platforms. However, procurement processes and budget constraints can sometimes slow the pace of adoption in this segment.

Segmentation Insights by Application

On the basis of application, the global security analytics and SIEM platforms market is bifurcated into web security analytics, network security analytics, endpoint security analytics, and application security analytics.

Web Security Analytics dominates the market as organizations across sectors are increasingly relying on web portals, cloud-based services, and digital platforms for operations, customer engagement, and e-commerce. This growing digital footprint has made the web environment a primary target for cybercriminals using tactics such as phishing, SQL injection, cross-site scripting, and session hijacking. As a result, enterprises are prioritizing web security analytics platforms that provide deep visibility into user behavior, real-time threat detection, and automated incident responses. These solutions help in identifying abnormal traffic patterns, preventing data exfiltration, and ensuring compliance with regulations like GDPR and PCI-DSS. The surge in digital transformation initiatives and the shift toward cloud-hosted environments further propel the demand for advanced web security analytics tools that offer scalability, accuracy, and continuous monitoring.

Network Security Analytics, although significant, trails behind as it focuses more on internal traffic analysis and perimeter defense. While still critical for threat detection and prevention, network-focused tools are increasingly being integrated with broader web and endpoint analytics platforms to offer holistic protection, especially in hybrid and cloud environments.

Endpoint Security Analytics is gaining traction with the growing number of devices and remote work setups, but it remains a secondary focus for many small and medium-sized enterprises that first prioritize securing their web-facing assets. However, its role in detecting malware, insider threats, and device-level vulnerabilities makes it an essential component in layered security strategies.

Application Security Analytics is the most emerging segment and is expected to grow steadily as more organizations adopt DevSecOps models. It is particularly relevant for securing custom-built software and third-party applications, but currently holds a smaller share due to limited awareness and slower implementation cycles.

Security Analytics and SIEM Platforms Market: Regional Insights

- North America is expected to dominate the global market.

North America dominates the Security Analytics and SIEM Platforms Market. This leadership position is due to the region’s early adoption of advanced cybersecurity technologies and its well-developed cybersecurity infrastructure. Governments and enterprises across the United States and Canada have enforced strict data protection laws, leading to heightened demand for platforms that offer real-time security monitoring and analytics. The region also benefits from the presence of leading technology companies and solution providers that continuously innovate to respond to evolving cyber threats.

Asia-Pacific is emerging as the fastest-growing region in the Security Analytics and SIEM Platforms Market. Rapid digital transformation, the proliferation of connected devices, and the expansion of online services have increased vulnerability to cyberattacks across countries such as China, India, Japan, and South Korea. Organizations are increasingly adopting security analytics tools and SIEM platforms to enhance their detection and response capabilities. Growing investment in cybersecurity infrastructure and workforce development is also supporting the market’s expansion in this region.

Europe maintains a strong position in the global market due to its strict data privacy regulations and compliance frameworks, most notably the General Data Protection Regulation (GDPR). Countries like Germany, the United Kingdom, and France are leading the adoption of SIEM platforms, particularly in sectors such as finance, healthcare, and public administration. European enterprises are increasingly integrating advanced security analytics tools to monitor suspicious activities and meet regulatory standards.

Latin America is witnessing gradual growth in the Security Analytics and SIEM Platforms Market. While adoption has been relatively slower than in other regions, increasing cyberattacks and regulatory efforts are prompting businesses to strengthen their cybersecurity posture. Brazil and Mexico, in particular, are seeing rising adoption of SIEM platforms as part of broader digital transformation and security modernization initiatives. The region is also benefiting from collaborations between governments and private sectors to enhance cyber readiness.

Middle East & Africa are experiencing increasing adoption of security analytics and SIEM platforms, driven by growing concerns over cyber threats targeting critical infrastructure and national security. Gulf countries, such as the United Arab Emirates and Saudi Arabia, are leading in implementation, fueled by national strategies and digital initiatives. Enterprises in sectors like energy, finance, and government services are deploying SIEM solutions to bolster threat detection and response capabilities. The region's cybersecurity maturity is improving, encouraging greater investment in advanced solutions.

Security Analytics and SIEM Platforms Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the security analytics and SIEM platforms market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global security analytics and SIEM platforms market include:

- Alert Logic

- AlienVault

- Assuria

- BAE Systems

- BlackStratus

- CorreLog

- Cygilant

- Dell

- Exabeam

- Fortinet

- IBM

- Logentries

- Logpoint

- LogRhythm

- Logsign

- Zoho

- McAfee

- Micro Focus

- RSA

- Securonix

The global security analytics and SIEM platforms market is segmented as follows:

By Deployment

- Cloud

- On-Premises

By End-User

- SMEs

- Large Enterprises

- Government Organization

By Application

- Web Security Analytics

- Network Security Analytics

- Endpoint Security Analytics

- Application Security Analytics

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Security Analytics and SIEM Platforms

Request Sample

Security Analytics and SIEM Platforms