SGOT Test Market Size, Share, and Trends Analysis Report

CAGR :

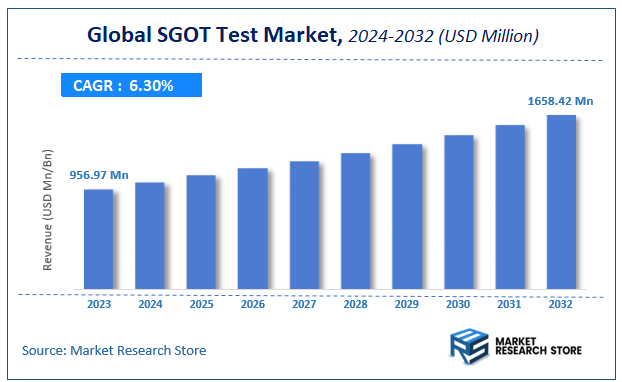

| Market Size 2023 (Base Year) | USD 956.97 Million |

| Market Size 2032 (Forecast Year) | USD 1658.42 Million |

| CAGR | 6.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

SGOT Test Market Insights

According to Market Research Store, the global SGOT test market size was valued at around USD 956.97 million in 2023 and is estimated to reach USD 1658.42 million by 2032, to register a CAGR of approximately 6.3% in terms of revenue during the forecast period 2024-2032.

The SGOT test report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

.Global SGOT Test Market: Overview

The SGOT test, also known as the AST (Aspartate Aminotransferase) test, is a blood test used to evaluate liver function by measuring the level of the enzyme SGOT/AST in the bloodstream. This enzyme is found primarily in the liver and heart, but also in smaller amounts in muscles, kidneys, and the brain. Under normal conditions, SGOT levels in the blood are low. However, when liver or muscle cells are damaged due to conditions like hepatitis, cirrhosis, heart attack, or muscle injury, SGOT is released into the bloodstream, causing elevated levels.

The SGOT test is commonly ordered alongside the SGPT (ALT – Alanine Aminotransferase) test to assess liver health more comprehensively. While elevated SGOT levels may indicate liver damage, the SGOT/SGPT ratio can help distinguish liver conditions from heart or muscle-related disorders. It's important to interpret SGOT results in the context of other liver function tests, patient symptoms, and medical history. The test is simple, quick, and typically involves drawing a small blood sample from a vein. It plays a crucial role in diagnosing, monitoring, and managing liver and systemic health conditions.

Key Highlights

- The SGOT test market is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The global SGOT test market was estimated to be worth approximately USD 956.97 million in 2023 and is projected to reach a value of USD 1658.42 million by 2032.

- The growth of the SGOT test market is being driven by the increasing global prevalence of liver-related disorders and other conditions that impact organs where SGOT is found.

- Based on the demographic, the age group segment is growing at a high rate and is projected to dominate the market.

- On the basis of psychographic, the lifestyle segment is projected to swipe the largest market share.

- In terms of behavioral, the usage rate segment is expected to dominate the market.

- Based on the health condition, the general health segment is expected to dominate the market.

- Based on the service utilization, the testing locations segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

SGOT Test Market: Dynamics

Key Growth Drivers:

- Rising Incidence of Liver Diseases: The global increase in liver conditions such as non-alcoholic fatty liver disease (NAFLD/MASLD), alcoholic liver disease (ALD), hepatitis (viral and other forms), and cirrhosis is the primary driver. As these diseases become more prevalent, the demand for diagnostic tests like SGOT for screening, diagnosis, and monitoring escalates.

- Increasing Awareness of Preventive Healthcare and Regular Health Check-ups: There's a growing trend towards proactive health management, with individuals and healthcare systems emphasizing preventive health check-ups. The SGOT test is a standard component of routine health screenings and liver function panels, fueling its demand even in asymptomatic individuals.

- Growing Geriatric Population: The aging global population is more susceptible to chronic diseases, including liver disorders, cardiovascular issues, and other conditions that can affect SGOT levels. This demographic shift contributes significantly to the demand for diagnostic tests.

- Advancements in Diagnostic Technologies: Continuous innovation in laboratory automation, analytical instruments, and diagnostic reagents is making SGOT testing faster, more accurate, and more efficient. This technological progress enhances testing capabilities and accessibility.

- Ease of Test Procedure and Accessibility: The SGOT test is a simple, minimally invasive blood test that can be performed in various settings, including hospitals, clinics, and diagnostic laboratories. Its widespread availability and affordability contribute to its high volume.

- Pharmaceutical and Clinical Research Needs: The pharmaceutical industry and clinical researchers frequently use SGOT levels to monitor drug-induced liver injury in clinical trials and for post-market surveillance of medications, especially those known to be hepatotoxic.

- Rising Incidence of Lifestyle Diseases: Conditions like obesity, diabetes, and metabolic syndrome are significant risk factors for liver diseases (particularly NAFLD/MASLD). As these lifestyle diseases continue to rise globally, so does the need for SGOT testing to assess liver health.

Restraints:

- Non-Specificity of SGOT Levels: A significant restraint is that elevated SGOT levels are not always specific to liver damage. They can also be elevated due to damage to other organs like the heart (e.g., heart attack), skeletal muscles (e.g., strenuous exercise, muscle injury), or kidneys. This non-specificity often necessitates further, more targeted tests (like SGPT/ALT, GGT, ALP, bilirubin) for an accurate diagnosis, adding to healthcare costs and potential patient anxiety.

- Variability in Normal Ranges and Interpretation: Normal SGOT ranges can vary slightly between different laboratories due to differences in testing methodologies and equipment. This variability can sometimes lead to confusion or misinterpretation of results without proper clinical correlation.

- Cost Sensitivity in Developing Regions: While relatively inexpensive, the cumulative cost of repeated SGOT tests, especially when part of broader liver panels, can be a barrier for individuals in low-income settings or healthcare systems with limited budgets.

- Lack of Public Awareness on Liver Health Beyond Alcoholism: While awareness of liver disease linked to alcohol is high, public understanding of other causes of liver damage (e.g., fatty liver disease due to lifestyle, viral hepatitis in asymptomatic individuals) is often lower, leading to delayed testing and diagnosis in some cases.

- Competition from More Liver-Specific Tests (e.g., SGPT): SGPT (ALT) is often considered a more specific indicator of liver damage than SGOT. In many cases, SGPT levels are prioritized for initial screening, which can somewhat limit the standalone demand for SGOT tests if not part of a panel.

- Pre-analytical and Analytical Variables: Factors like strenuous exercise before the test, certain medications, or even the time of day can influence SGOT levels, potentially leading to inaccurate results and requiring repeat testing.

Opportunities:

- Integration with Comprehensive Liver Health Panels: The market opportunity lies in promoting SGOT tests as part of comprehensive liver function panels (LFTs) and full-body health check-ups. This provides a more holistic view of liver health and leads to more accurate diagnoses.

- Development of Point-of-Care (POC) Testing: Creating accurate, rapid, and easy-to-use point-of-care SGOT testing devices for clinics, pharmacies, or even home use could significantly expand accessibility and facilitate early detection, especially in remote areas.

- Leveraging AI and Data Analytics for Diagnostics: AI and machine learning can be used to analyze SGOT results in conjunction with other patient data (e.g., medical history, lifestyle factors, other blood parameters) to provide more precise risk assessments and personalized diagnostic pathways, improving diagnostic accuracy.

- Targeted Screening Programs: Implementing widespread screening programs for at-risk populations (e.g., individuals with obesity, diabetes, heavy alcohol consumption, or family history of liver disease) can significantly increase test volumes and lead to earlier detection and intervention.

- Partnerships with Healthcare Providers and Wellness Programs: Collaborating with hospitals, clinics, corporate wellness programs, and insurance providers to offer routine liver health screenings that include SGOT tests can expand market reach and integrate testing into broader health initiatives.

- Research into Novel Biomarkers for Specificity: While SGOT is non-specific, ongoing research into combining SGOT results with emerging, more specific biomarkers for various liver conditions could create new diagnostic algorithms and panels, enhancing its clinical utility.

- Telemedicine and Remote Consultation Integration: With the rise of telemedicine, the ability for patients to get SGOT tests done and then discuss the results with a healthcare provider remotely can improve patient convenience and follow-up adherence.

Challenges:

- Standardization and Quality Control Across Labs: Ensuring consistent accuracy and reliable results across a multitude of diagnostic laboratories, especially with varying equipment and methodologies, remains a continuous challenge for the market.

- Educating Clinicians and Patients on Result Interpretation: Given SGOT's non-specificity, a significant challenge is to educate both healthcare providers and patients on the proper interpretation of results, emphasizing that an elevated SGOT doesn't automatically mean liver disease and often requires further investigation.

- Competition from Advanced Liver Fibrosis Biomarkers: As non-invasive tests for liver fibrosis (e.g., FibroScan, enhanced liver fibrosis (ELF) test, or various biomarker panels) become more common, SGOT might face competition as a primary diagnostic tool for advanced liver disease.

- Managing High Test Volumes and Lab Efficiency: The high volume of SGOT tests performed necessitates efficient laboratory operations, including automation and robust IT systems for sample processing, analysis, and result delivery, which can be a logistical challenge for smaller labs.

- Reimbursement Policies: Favorable reimbursement policies from government and private insurance providers are crucial for sustained market growth. Unfavorable or complex reimbursement structures can limit test adoption, particularly for routine screenings.

- Ethical Considerations of Mass Screening: While beneficial, widespread screening programs might raise ethical questions regarding potential over-diagnosis, unnecessary follow-up tests, and the psychological impact of abnormal results that may not always signify severe disease.

- Development of Truly Non-Invasive Alternatives: The ultimate long-term challenge could come from the development of completely non-invasive methods (e.g., breath analysis, advanced imaging, or highly specific blood tests that require no venipuncture) that could potentially offer similar or superior diagnostic value without a blood draw.

SGOT Test Market: Report Scope

This report thoroughly analyzes the SGOT Test Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | SGOT Test Market |

| Market Size in 2023 | USD 956.97 Million |

| Market Forecast in 2032 | USD 1658.42 Million |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 186 |

| Key Companies Covered | Alpha Laboratories, Biobase Group, ELITechGroup, Horiba Medical., Laboratory Corporation of America Holdings, Randox Laboratories Ltd, Thermo Fisher Scientific Inc., Abbott Laboratories, Roche Diagnostics |

| Segments Covered | By Demographic, By Psychographic, By Behavioral, By Health Condition, By Service Utilization, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

SGOT Test Market: Segmentation Insights

The global SGOT test market is divided by demographic, psychographic, behavioral, health condition, service utilization, and region.

Segmentation Insights by Demographic

Based on demographic, the global SGOT test market is divided into age group, gender, and income level.

Age Group dominates the SGOT Test Market by demographic segmentation, as liver function disorders and related screenings are significantly more prevalent among middle-aged and older populations. Individuals aged 40 and above are more prone to chronic conditions such as hepatitis, liver fibrosis, cirrhosis, and alcohol-induced liver damage, which require routine monitoring through SGOT tests. Additionally, age-related comorbidities like diabetes and cardiovascular diseases also necessitate liver function evaluations, making this age group a primary target for diagnostic labs and healthcare providers. As global life expectancy increases and awareness about preventive healthcare rises, this demographic continues to generate substantial demand for SGOT testing, especially in regions with aging populations and well-developed healthcare infrastructure.

Gender influences SGOT test utilization, although demand patterns vary based on disease prevalence and biological factors. Men are statistically more likely to undergo SGOT testing due to higher risks of liver dysfunction caused by alcohol use, fatty liver disease, and occupational exposure to toxins. However, women also represent a significant segment, particularly during pregnancy when elevated liver enzymes may indicate conditions such as intrahepatic cholestasis or preeclampsia. Diagnostic protocols are increasingly being tailored to gender-specific health trends, and gender-sensitive public health initiatives are further promoting test awareness and access among both men and women.

Income Level impacts both access to and frequency of SGOT testing. Higher-income individuals typically utilize private diagnostic services and participate in regular health screening programs that include liver enzyme testing. Their greater awareness and insurance coverage facilitate early detection and ongoing monitoring. In contrast, low- and middle-income populations may only undergo SGOT testing when symptoms are severe or through government-sponsored screening initiatives. The expansion of affordable diagnostic options and public health subsidies in emerging markets is gradually improving accessibility, allowing for broader test adoption across all income levels. As healthcare systems become more inclusive, the income-based disparity in SGOT test utilization is expected to narrow.

Segmentation Insights by Psychographic

On the basis of psychographic, the global SGOT test market is bifurcated into lifestyle, personality traits, and values and beliefs.

Lifestyle is a dominant psychographic factor in the SGOT Test Market, as individuals with health-conscious lifestyles are more proactive in monitoring their liver function through regular SGOT testing. This segment includes people who engage in preventive healthcare, follow structured fitness and dietary routines, and prioritize early diagnosis of potential health issues. Additionally, lifestyles involving high alcohol consumption, sedentary behavior, or use of medications affecting liver health contribute to increased testing demand, as these individuals are at higher risk for liver dysfunction and related conditions. As awareness campaigns and personalized wellness programs grow, lifestyle-oriented segmentation continues to shape demand trends in both developed and developing healthcare systems.

Personality Traits play a nuanced role in SGOT testing behavior. Individuals with conscientious and health-aware traits are more likely to schedule regular health check-ups, follow medical advice, and comply with liver monitoring recommendations. Conversely, those with risk-taking or neglectful personality profiles may delay testing until symptoms become severe. Healthcare providers increasingly recognize the importance of aligning communication and outreach strategies with patient personality types to improve screening participation, adherence, and health outcomes, especially in preventive testing contexts.

Values and Beliefs significantly influence SGOT test uptake, especially in populations where trust in modern medicine, preventive care, and early diagnosis are strong. Individuals who value evidence-based healthcare are more likely to seek liver function testing even in asymptomatic stages. On the other hand, cultural beliefs, religious considerations, or mistrust in formal healthcare systems may hinder participation in routine diagnostics in some communities. Tailoring health education to local belief systems and reinforcing the importance of liver health within those frameworks is crucial to expanding the reach and effectiveness of SGOT testing programs globally.

Segmentation Insights by Behavioral

On the basis of behavioral, the global SGOT test market is bifurcated into usage rate, brand loyalty, and purchase motivations.

Usage Rate is the dominant behavioral segment in the SGOT Test Market, significantly shaping demand patterns and diagnostic service delivery. High-usage individuals, such as those with chronic liver conditions, patients on hepatotoxic medications, alcohol users, and individuals with metabolic disorders, require regular SGOT testing to monitor liver enzyme fluctuations and track treatment efficacy. This segment contributes the highest test volumes, often relying on recurring or scheduled diagnostics. Medium-usage groups include health-conscious individuals undergoing periodic full-body checkups or those with moderate health risks. Low-usage segments primarily include patients tested occasionally, usually based on symptomatic triggers. Diagnostic service providers and laboratories prioritize high-usage customers by offering subscription models, automated alerts for test schedules, and personalized health dashboards to maintain engagement and improve health outcomes.

Brand Loyalty is a steadily growing segment, particularly in urban markets where consumers can choose among multiple diagnostic providers. Loyalty often stems from positive past experiences with accurate reporting, minimal turnaround times, ease of booking, and adherence to privacy standards. Users tend to stick with brands that maintain service reliability, convenience, and personalized health record management. High brand loyalty also reduces switching behavior, helping service providers retain a stable customer base. Loyalty programs, membership benefits, and integrated digital health platforms further enhance retention among frequent test users.

Purchase Motivations vary but are critical to understanding consumer decision-making in the SGOT test landscape. Motivations include physician referrals for specific liver-related symptoms, routine preventive health screenings, insurance-mandated tests, corporate wellness initiatives, and health checkups before surgeries. Additionally, awareness of the importance of early detection of liver issues drives voluntary SGOT testing, especially among proactive individuals and those with lifestyle-related risks. The influence of digital health platforms, health tracking apps, and public health campaigns also amplifies the role of purchase motivation, encouraging individuals to consider SGOT testing as part of comprehensive wellness monitoring.

Segmentation Insights by Health Condition

On the basis of health condition, the global SGOT test market is bifurcated into general health, chronic diseases, and family health history.

General Health is the dominant segment in the SGOT Test Market, driven by a rising emphasis on preventive healthcare and routine wellness monitoring. Individuals in this category undergo SGOT tests as part of annual physical exams or corporate health screenings, even in the absence of specific symptoms. The test serves as an early warning indicator for liver function abnormalities, making it a standard component in general diagnostic panels offered by hospitals, clinics, and diagnostic labs. The growing popularity of full-body health packages and wellness subscriptions, combined with increased awareness of liver health, has made SGOT testing more accessible and routine. Additionally, digital health platforms and at-home test kits have simplified the testing process, encouraging proactive health management among individuals of all age groups.

Chronic Diseases represent a critical high-need segment where SGOT testing is used regularly to manage and monitor conditions such as hepatitis, liver cirrhosis, diabetes, obesity, and cardiovascular diseases. Patients in this category typically require ongoing liver enzyme monitoring to assess the effectiveness of prescribed treatments and adjust medications accordingly. SGOT is also used to detect drug-induced liver injuries in patients on long-term pharmacological therapies. Hospitals and specialized liver clinics frequently rely on SGOT test trends to evaluate disease progression. As the global burden of chronic liver and metabolic conditions continues to grow, this segment remains a consistent driver of demand in the SGOT testing landscape.

Family Health History is an emerging and awareness-driven segment that includes individuals who seek SGOT testing due to hereditary risk factors or a family history of liver-related illnesses. This group often includes asymptomatic users who proactively monitor their liver function based on preventive advice from physicians or genetic counselors. Although smaller in comparison to the other segments, the increasing availability of personalized health assessments and genomic risk profiling has spurred interest in preventive diagnostics among those with familial predispositions. As public health education improves and more individuals gain access to personalized screening tools, this segment is expected to grow steadily.

Segmentation Insights by Service Utilization

On the basis of service utilization, the global SGOT test market is bifurcated into testing locations, type of service, and insurance coverage.

Testing Locations dominate the SGOT Test Market, as they encompass the primary venues where patients access diagnostic services, including hospitals, standalone diagnostic laboratories, clinics, and at-home collection services. Among these, hospitals and diagnostic labs hold the largest market share due to their accessibility, credibility, and well-established infrastructure. Urban and semi-urban populations primarily rely on these centers for routine and physician-recommended tests, often driven by referrals or preventive health screenings. Hospitals provide a comprehensive environment with immediate medical consultation and follow-up, while diagnostic labs offer convenience through online booking, faster turnaround, and home sample collection. The recent expansion of mobile phlebotomy and telehealth integration has further strengthened testing location dominance by ensuring reach in both densely populated and remote areas. As awareness of liver health continues to grow and diagnostic services become more decentralized, testing locations remain the most widely utilized channel for SGOT testing.

Type of Service includes both standalone SGOT tests and comprehensive diagnostic packages that bundle SGOT with other liver enzymes like SGPT, bilirubin, and ALP. While standalone testing is typically used for specific liver function evaluations following symptoms or treatment monitoring, bundled services are increasingly preferred for general health screening. Preventive health packages, offered through both public and private healthcare providers, commonly include SGOT due to its role in detecting early-stage liver conditions. Corporate wellness programs and annual checkups further drive the popularity of combined service offerings. The bundling trend allows for cost-effective, broad-spectrum diagnostics that provide a fuller clinical picture, contributing to better health outcomes.

Insurance Coverage significantly influences the uptake of SGOT tests, especially among individuals managing chronic diseases or seeking routine health assessments. While not all insurance plans cover standalone SGOT testing, many include it as part of annual health checkups or disease monitoring protocols. Employer-sponsored health plans and government healthcare schemes in some regions offer full or partial reimbursement, making testing more affordable and accessible. The increasing push for preventive care in health insurance portfolios is expanding coverage for diagnostic services, thereby encouraging more frequent SGOT testing. As policies evolve to incorporate wellness and chronic disease management, insurance-backed utilization of SGOT tests is expected to rise steadily.

SGOT Test Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the SGOT test market owing to advanced healthcare infrastructure, high diagnostic awareness, and an increasing prevalence of liver-related and cardiovascular disorders. The United States and Canada have widespread access to routine blood screening facilities, making liver enzyme testing a common part of diagnostic panels. The region’s strong presence of major diagnostic companies, such as Abbott Laboratories and Quest Diagnostics, supports the easy availability of high-sensitivity SGOT test kits. Furthermore, high expenditure on preventive healthcare and rising adoption of personalized medicine have accelerated test frequency in both outpatient and inpatient settings. Favorable reimbursement policies and continued research into liver biomarkers contribute to the market’s expansion across the region.

Europe holds a significant share of the SGOT test market, driven by the growing burden of chronic liver diseases, non-alcoholic fatty liver disease (NAFLD), and alcohol-related disorders. Countries such as Germany, the UK, France, and Italy have established guidelines for routine liver function testing, particularly for patients on long-term medications or with metabolic syndromes. The region benefits from national healthcare systems that enable widespread access to diagnostic services. Public health initiatives focusing on early disease detection, coupled with stringent regulatory frameworks for test accuracy and quality control, support the high demand for SGOT testing in both public hospitals and private clinics.

Asia-Pacific is emerging as a rapidly growing region in the SGOT test market, largely due to increasing incidences of hepatitis infections, rising alcohol consumption, and expanding awareness of liver health. Countries like China, India, Japan, and South Korea are witnessing a significant rise in diagnostic testing volumes due to large population bases and government-backed health screening programs. In India and China, urbanization and lifestyle changes have led to higher rates of fatty liver disease and diabetes, prompting physicians to include SGOT testing in basic health assessments. Moreover, the growing adoption of automated clinical chemistry analyzers in laboratories is boosting the accessibility and affordability of liver function tests across both urban and semi-urban areas.

Latin America represents a developing but steadily growing SGOT test market, particularly in countries such as Brazil, Mexico, Argentina, and Chile. The region is seeing an increase in liver disease burden due to rising alcohol abuse, obesity, and viral hepatitis. Public and private healthcare sectors are investing in diagnostic infrastructure to improve early detection and disease management. While accessibility to advanced diagnostics may vary, government programs and international health initiatives are working to improve awareness and screening in underserved populations. Increased partnerships with global diagnostic companies are also making SGOT test kits more available and affordable in this region.

Middle East and Africa are gradually expanding their SGOT test market presence, supported by improvements in healthcare infrastructure and increasing awareness of chronic disease prevention. In the Middle East, countries such as Saudi Arabia, the UAE, and Qatar have prioritized health screening as part of their national healthcare agendas. These nations have well-equipped laboratories and high per capita healthcare spending, which facilitate the routine use of SGOT and other liver function tests. In Africa, access remains uneven, but rising rates of infectious diseases, along with donor-supported programs, are encouraging the integration of liver enzyme testing into broader diagnostic protocols. Mobile health initiatives and public-private collaborations are key to expanding test availability in rural and underserved areas.

SGOT Test Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the SGOT test market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global SGOT test market include:

- Alpha Laboratories

- Biobase Group

- ELITechGroup

- Horiba Medical.

- Laboratory Corporation of America Holdings

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Roche Diagnostics

The global SGOT test market is segmented as follows:

By Demographic

- Age Group

- Gender

- Income Level

By Psychographic

- Lifestyle

- Personality Traits

- Values and Beliefs

By Behavioral

- Usage Rate

- Brand Loyalty

- Purchase Motivations

By Health Condition

- General Health

- Chronic Diseases

- Family Health History

By Service Utilization

- Testing Locations

- Type of Service

- Insurance Coverage

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

SGOT Test

Request Sample

SGOT Test