Starch Sodium Octenyl Succinate Market Size, Share, and Trends Analysis Report

CAGR :

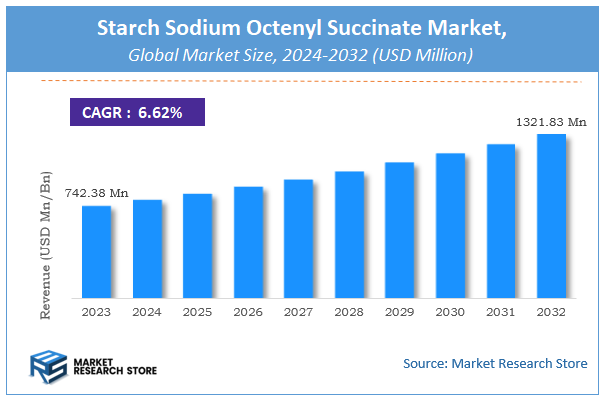

| Market Size 2023 (Base Year) | USD 742.38 Million |

| Market Size 2032 (Forecast Year) | USD 1321.83 Million |

| CAGR | 6.62% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Starch Sodium Octenyl Succinate Market Insights

According to Market Research Store, the global starch sodium octenyl succinate market size was valued at around USD 742.38 million in 2023 and is estimated to reach USD 1321.83 million by 2032, to register a CAGR of approximately 6.62% in terms of revenue during the forecast period 2024-2032.

The starch sodium octenyl succinate report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Starch Sodium Octenyl Succinate Market: Overview

Starch sodium octenyl succinate is a chemically modified starch produced by treating starch—typically derived from corn, potato, or tapioca—with octenyl succinic anhydride (OSA) and neutralizing it with sodium. This modification introduces both hydrophilic and hydrophobic properties, making the starch amphiphilic. As a result, it functions effectively as an emulsifier, stabilizer, and encapsulating agent in various applications, particularly in food, pharmaceuticals, and cosmetics. It is commonly used to stabilize oil-in-water emulsions and to encapsulate flavors, vitamins, or bioactive compounds in powdered form, enhancing solubility and shelf life.

The growth in usage of starch sodium octenyl succinate is driven by increasing demand for clean-label and plant-based ingredients, particularly in food and beverage formulations such as instant soups, salad dressings, and powdered drink mixes. Its ability to improve the dispersibility of lipophilic compounds in water-based systems also supports its application in nutritional supplements and personal care products. Moreover, regulatory approvals for use in food (e.g., as E1450 in the EU) and its biodegradability make it an attractive alternative to synthetic emulsifiers. As industries move toward more natural and multifunctional ingredients, starch sodium octenyl succinate continues to gain relevance across multiple sectors.

Key Highlights

- The starch sodium octenyl succinate market is anticipated to grow at a CAGR of 6.62% during the forecast period.

- The global starch sodium octenyl succinate market was estimated to be worth approximately USD 742.38 million in 2023 and is projected to reach a value of USD 1321.83 million by 2032.

- The growth of the starch sodium octenyl succinate market is being driven by the increasing global demand for functional food ingredients that enhance product quality, stability, and texture, while also aligning with consumer preferences for clean-label and natural products.

- Based on the product form, the powdered form segment is growing at a high rate and is projected to dominate the market.

- On the basis of functionality, the emulsifier segment is projected to swipe the largest market share.

- In terms of source, the natural sources segment is expected to dominate the market.

- Based on the application, the food and beverages segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Starch Sodium Octenyl Succinate Market: Dynamics

Key Growth Drivers:

- Growing Demand for Processed and Convenience Foods: With increasing urbanization, changing lifestyles, and busier schedules, the demand for processed and convenience foods (e.g., ready-to-eat meals, sauces, dressings, bakery products, dairy alternatives) is steadily rising. SSOS is a crucial ingredient in these products, providing stability, texture, and extended shelf life, thereby directly driving its market growth.

- Rising Consumer Preference for Clean Label and Natural Ingredients: There is a significant global trend towards "clean label" products, where consumers prefer ingredients perceived as natural, minimally processed, and free from artificial additives. As a starch derivative from natural sources (like corn, tapioca, potato), SSOS often fits the clean-label criteria, making it a preferred choice over synthetic emulsifiers and stabilizers.

- Versatile Functional Properties in Food & Beverage Industry: SSOS offers superior emulsification capabilities, which are vital for stabilizing oil-in-water emulsions in products like salad dressings, low-fat spreads, and beverages. It also acts as an effective thickener, improving texture and mouthfeel in sauces, yogurts, and desserts, contributing to a better consumer experience.

- Expansion in Pharmaceutical Applications: SSOS is increasingly used as an excipient in pharmaceutical formulations, acting as a binder, disintegrant, or emulsifier in drug delivery systems. The growth in the pharmaceutical industry, driven by new drug development and demand for various dosage forms, fuels the demand for SSOS.

- Growth of the Cosmetics and Personal Care Industry: SSOS finds application in various cosmetic formulations as an absorbent, emulsion stabilizer, and viscosity controlling agent. Its use in products like antiperspirants, foundations, and hair care products, coupled with the expanding cosmetics market, contributes to its demand.

- Technological Advancements in Starch Modification: Continuous research and development in starch modification techniques are leading to improved production efficiency and enhanced functionalities of SSOS. This includes developing grades with higher stability at extreme temperatures or tailored properties for specific applications, broadening its utility.

- Sustainability and Biodegradability: As a plant-based ingredient, SSOS is generally considered biodegradable and aligns with the growing emphasis on sustainable sourcing and environmentally friendly practices in ingredient manufacturing, appealing to environmentally conscious companies and consumers.

Restraints:

- Stringent Regulatory Guidelines and Approvals: The use of SSOS as a food additive (E1450) is subject to strict regulatory guidelines and approval processes by food safety authorities like the FDA (U.S.) and EFSA (Europe). These regulations can vary by region, and any changes or re-evaluations can impact market adoption and production costs.

- Competition from Alternative Emulsifiers and Stabilizers: The market faces intense competition from a wide array of other natural and synthetic emulsifiers and stabilizers, such as gums (xanthan gum, guar gum), lecithins, proteins, and other modified starches. These alternatives might offer different functionalities, price points, or consumer perceptions.

- Availability and Price Volatility of Raw Materials: The primary raw materials for SSOS are native starches (corn, tapioca, potato). Fluctuations in the supply and price of these agricultural commodities due to weather conditions, crop yields, and global demand can directly impact the production cost and profitability of SSOS manufacturers.

- Consumer Perception of "Modified Starch": Despite being generally recognized as safe, the term "modified starch" might still raise some concerns among a segment of consumers who prefer ingredients that are entirely "unprocessed" or "natural," even if the modification is minimal and safe. This can be a marketing challenge.

- Technical Complexity in Production: The chemical modification process to produce SSOS requires specialized equipment, technical expertise, and stringent quality control to ensure consistent product quality and safety, which can be a barrier for new entrants or smaller manufacturers.

- Limited Awareness and Technical Knowledge in Some Regions: In certain developing markets, there might be a lack of awareness among food manufacturers and formulators regarding the specific functional benefits and optimal applications of SSOS compared to more traditional or readily available ingredients.

Opportunities:

- New Application Development Beyond Core Industries: Opportunities exist to explore and expand the use of SSOS into novel applications, such as nutraceuticals (e.g., encapsulation of active ingredients), animal feed, paper & pulp industry (as a sizing agent), and biodegradable films, leveraging its unique functional properties.

- Customized Solutions for Specific Formulations: As industries seek highly specialized ingredients, there's an opportunity to develop customized grades of SSOS with tailored properties (e.g., specific viscosity profiles, improved emulsification stability under certain pH conditions, enhanced heat resistance) to meet the precise requirements of unique product formulations.

- Clean Label and Organic Certified SSOS: The increasing demand for organic and truly clean-label ingredients provides an opportunity for manufacturers to produce SSOS from organic-certified starches and ensure that the modification process adheres to strict organic or clean-label guidelines.

- Strategic Partnerships and Collaborations: Collaborations between SSOS manufacturers, food companies, pharmaceutical companies, and research institutions can drive innovation, co-develop new applications, and streamline market adoption of novel SSOS formulations.

- Geographical Expansion in Emerging Markets: Rapidly growing food processing industries and increasing consumer awareness in emerging economies (e.g., Southeast Asia, Latin America, Africa) present significant untapped markets for SSOS, particularly as their regulatory frameworks for food additives evolve.

- Encapsulation and Delivery Systems: SSOS's excellent emulsifying properties make it ideal for encapsulation of sensitive ingredients (e.g., flavors, vitamins, essential oils, probiotics) to protect them from degradation, control their release, and improve their stability in various products. This is a high-growth area.

- Improvements in Sustainable Sourcing and Production: Investing in sustainable sourcing of native starches and optimizing production processes to reduce water, energy consumption, and waste generation can enhance the market appeal of SSOS and align with broader corporate sustainability goals.

Challenges:

- Maintaining Purity and Avoiding Contamination: Given its use in sensitive applications like food, pharmaceuticals, and cosmetics, ensuring the highest level of purity and preventing any form of contamination during the entire production, storage, and transportation process of SSOS is a critical and continuous challenge.

- Managing Perceptions Around "Modified" Ingredients: Despite safety approvals, the ongoing consumer preference for "natural" and "unmodified" ingredients means manufacturers must continually educate the market and effectively communicate the safety, necessity, and benefits of SSOS to overcome potential negative perceptions.

- Balancing Cost and Performance: While SSOS offers superior performance in many applications, its cost compared to some conventional alternatives can be higher. The challenge is to continuously optimize production processes and demonstrate the long-term value and benefits (e.g., shelf life extension, improved texture) to justify its price point.

- Adherence to Evolving Food Safety Standards: Food safety regulations are constantly evolving globally. SSOS manufacturers must stay abreast of these changes, conduct rigorous testing, and ensure full compliance with all relevant food safety and quality standards, which can be a complex and resource-intensive task.

- Intellectual Property and Product Differentiation: As the market grows, competition can intensify. Protecting intellectual property related to specialized SSOS grades or unique applications and differentiating products based on superior performance, sustainability, or customer service becomes crucial.

- Supply Chain Resilience: Ensuring a robust and resilient supply chain for both raw starches and the final SSOS product, especially in the face of global disruptions (e.g., climate events, geopolitical issues), is a significant operational challenge to meet consistent customer demand.

- Technical Support and Application Expertise: Providing comprehensive technical support and application expertise to customers (e.g., formulators in food, pharma, cosmetics) to help them effectively integrate SSOS into their diverse products and overcome formulation challenges is vital for customer retention and market growth.

Starch Sodium Octenyl Succinate Market: Report Scope

This report thoroughly analyzes the Starch Sodium Octenyl Succinate Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Starch Sodium Octenyl Succinate Market |

| Market Size in 2023 | USD 742.38 Million |

| Market Forecast in 2032 | USD 1321.83 Million |

| Growth Rate | CAGR of 6.62% |

| Number of Pages | 167 |

| Key Companies Covered | GUANGZHOU HISOYA BIOLOGICAL SCIENCE AND TECHNOLOGY CO. LTD,, Noshly Pty Ltd, Ningbo Samreal Chemical Co. Ltd., Ingredion, Zhejiang NHU, A&Z Food Additives, Guangzhou Fofiber Biological Industry, Texture Maker, Yishui Dadi Corn Development, Zhejiang Zhongtong Technology, Foshan Huawu Huafeng Starch, Europe Starch |

| Segments Covered | By Product Form, By Functionality, By Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Starch Sodium Octenyl Succinate Market: Segmentation Insights

The global starch sodium octenyl succinate market is divided by product form, functionality, source, application, and region.

Segmentation Insights by Product Form

Based on product form, the global starch sodium octenyl succinate market is divided into powdered form and liquid form.

Powdered Form is the dominant segment in the Starch Sodium Octenyl Succinate Market due to its superior ease of handling, long shelf life, and compatibility with various manufacturing processes. In powdered form, starch sodium octenyl succinate (SSOS) is widely used as an emulsifier and stabilizer in food applications such as flavor encapsulation, beverage emulsions, and spray-dried products. Its dry nature allows for better storage, transport, and integration into dry mix systems without the risk of microbial growth. Additionally, it offers flexibility in dosing and blending, making it a preferred choice in sectors like nutraceuticals, infant formula production, and cosmetic powders. The powdered variant is also easier to rehydrate and disperse in aqueous systems, enhancing its versatility across diverse industrial uses.

Liquid Form of starch sodium octenyl succinate is primarily used in specific applications that require immediate solubility or integration into liquid matrices, such as oil-in-water emulsions and cosmetic formulations. This form is valued for its ability to reduce processing time and provide rapid emulsification, especially in ready-to-use personal care products and certain food preparations. While it offers convenience in continuous processing environments, the liquid form is more sensitive to microbial contamination and typically has a shorter shelf life compared to its powdered counterpart. Despite these limitations, its application in specific niches where liquid dispersions are preferred ensures steady demand and supports innovation in product formulations.

Segmentation Insights by Functionality

On the basis of functionality, the global starch sodium octenyl succinate market is bifurcated into emulsifier, stabilizer, and thickening agent.

Emulsifier is the dominant functionality segment in the Starch Sodium Octenyl Succinate Market, widely utilized across food, beverage, pharmaceutical, and personal care industries. Its amphiphilic molecular structure allows it to effectively stabilize oil-in-water emulsions by reducing interfacial tension and preventing phase separation. This makes it highly valuable in the production of flavor emulsions, nutritional beverages, and encapsulated oils, where long-term stability and improved shelf life are essential. Additionally, its compatibility with spray drying and its clean-label profile enhance its demand in infant nutrition, dietary supplements, and functional food applications. The emulsifying capabilities of SSOS also support innovation in clean and natural ingredient formulations.

Stabilizer is another key functionality where starch sodium octenyl succinate plays a crucial role, particularly in products requiring consistency and resistance to separation or sedimentation. In dairy alternatives, sauces, and dressings, SSOS ensures homogeneity and enhances mouthfeel without contributing unwanted flavors or odors. Its film-forming and viscosity-enhancing properties help protect sensitive compounds such as vitamins, probiotics, or essential oils in encapsulated systems. This stabilizing function is also significant in cosmetic and pharmaceutical formulations where uniform texture and stability are necessary over extended shelf life.

Thickening Agent functionality is primarily utilized in formulations that require controlled viscosity and enhanced texture. While not the primary role of SSOS, its ability to provide moderate thickening contributes to the smooth consistency in products like soups, baby food, and cream-based formulations. Its thickening behavior, when combined with its emulsifying and stabilizing properties, offers multifunctionality that reduces the need for additional additives. This is especially important in clean-label formulations aiming to simplify ingredient lists without sacrificing performance.

Segmentation Insights by Source

On the basis of source, the global starch sodium octenyl succinate market is bifurcated into natural sources and synthetic sources.

Natural Sources dominate the Starch Sodium Octenyl Succinate Market due to growing demand for clean-label, plant-based ingredients in food, pharmaceutical, and personal care industries. Derived primarily from naturally occurring starches such as corn, tapioca, or potato, SSOS from natural sources aligns with consumer preferences for non-GMO and organic-certified products. These starches undergo a safe chemical modification using octenyl succinic anhydride, preserving their natural origin while enhancing emulsifying and stabilizing properties. Industries favor natural sources for regulatory compliance and marketing benefits, especially in infant nutrition, health supplements, and natural cosmetics, where origin and traceability play a critical role. The wide availability, renewability, and biodegradability of natural starch sources further support the dominance of this segment.

Synthetic Sources involve the use of industrially modified starches that may originate from non-traditional or petroleum-derived pathways, often engineered to achieve specific performance characteristics beyond those of natural counterparts. Although less common, synthetic-source SSOS may offer advantages in terms of uniformity, stability, or functionality under extreme processing conditions. These variants are occasionally utilized in specialized applications such as industrial emulsions, non-food formulations, or where high-performance criteria outweigh the need for natural origin. However, the limited consumer acceptance of synthetic additives, coupled with increasing regulatory scrutiny, restricts the growth of this segment in food and health-related industries.

Segmentation Insights by Application

On the basis of application, the global starch sodium octenyl succinate market is bifurcated into food and beverages, cosmetics and personal care, pharmaceuticals, and industrial applications.

Food and Beverages is the dominant application segment in the Starch Sodium Octenyl Succinate Market, primarily due to its widespread use as an emulsifier, stabilizer, and encapsulation agent. SSOS plays a crucial role in the formulation of beverages, dressings, sauces, dairy alternatives, and flavor systems. Its ability to encapsulate oils and flavors enhances the stability and shelf life of sensitive ingredients like vitamins, omega-3 fatty acids, and essential oils. In powdered beverage mixes and spray-dried products, SSOS improves solubility and prevents ingredient separation. Moreover, its clean-label compatibility and approval for use in infant formulas and nutritional supplements make it highly preferred in health-conscious and regulated food sectors.

Cosmetics and Personal Care applications of SSOS are growing steadily due to its multifunctionality in emulsion stability, skin-feel improvement, and formulation consistency. It is used in creams, lotions, foundations, and sunscreens, where it helps create smooth, uniform textures and enhances the dispersion of active ingredients. Its film-forming properties aid in moisture retention and skin protection, while its natural origin aligns with the demand for plant-based, non-irritating cosmetic ingredients. SSOS is especially valued for its lightweight, non-greasy finish and compatibility with sensitive skin formulations.

Pharmaceuticals use starch sodium octenyl succinate in applications where controlled release, bioavailability enhancement, and protection of active pharmaceutical ingredients (APIs) are required. It serves as a carrier in microencapsulation systems and improves the stability and dispersion of hydrophobic drugs in aqueous solutions. Its emulsifying and stabilizing properties contribute to the formulation of oral suspensions, powders for reconstitution, and nutraceutical blends. SSOS’s non-toxic profile and compatibility with a wide range of APIs make it suitable for both over-the-counter and prescription drug formulations.

Industrial Applications include use in non-food sectors such as adhesives, paper coatings, textile treatments, and encapsulated chemicals. In these areas, SSOS functions as a binder, stabilizer, or dispersing agent, enhancing product performance and shelf stability. Its biodegradability and compatibility with water-based systems make it attractive for eco-friendly formulations in coatings and packaging solutions. Although this segment represents a smaller share of the overall market, it offers niche opportunities in sustainable industrial manufacturing and green chemistry applications.

Starch Sodium Octenyl Succinate Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the starch sodium octenyl succinate market due to its advanced food processing industry, strong presence of multinational cosmetic and pharmaceutical companies, and high regulatory standards supporting the use of modified starches. In the United States and Canada, starch sodium octenyl succinate (SSOS) is extensively used as an emulsifier, stabilizer, and fat replacer in products such as salad dressings, flavored beverages, instant puddings, and dairy desserts. It is also widely applied in encapsulating flavors, vitamins, and lipophilic nutrients through spray-drying techniques in both the food and nutraceutical sectors. In the cosmetics industry, SSOS serves as a thickener and emollient in creams and lotions, while pharmaceutical companies use it as a film-forming and binding agent in tablet formulations. The region's highly developed supply chain, strict FDA and USP compliance standards, and demand for clean-label and functional ingredients further strengthen North America’s leadership in both consumption and innovation. Major players such as Ingredion, Tate & Lyle, and Cargill operate large-scale facilities that produce food- and pharma-grade SSOS, often derived from corn starch, supporting domestic demand and exports.

Asia-Pacific is experiencing rapid growth in the SSOS market due to rising processed food consumption, increasing use of cosmetic emulsifiers, and expanding pharmaceutical manufacturing. Countries like China, India, Japan, and South Korea are major contributors. In China and India, SSOS is increasingly utilized in ready-to-eat foods, powdered drink mixes, and encapsulated flavors for the domestic food industry. India, in particular, shows significant use of modified starches in ayurvedic and allopathic tablet production. Japan and South Korea prioritize the use of high-purity starch derivatives in functional foods and high-end cosmetics, supported by advanced manufacturing processes. However, while production volumes are growing, North America remains dominant in terms of process standardization, purity levels, and global trade influence.

Europe holds a significant share in the SSOS market, with its mature food, pharmaceutical, and cosmetics industries. Countries such as Germany, France, the UK, and the Netherlands lead in the adoption of SSOS in emulsified sauces, powdered supplements, infant formula, and encapsulated flavors. The European Food Safety Authority (EFSA) permits its use under the E1450 designation, and demand is driven by consumer preferences for stable, long-shelf-life emulsions and functional ingredient carriers. In the cosmetics sector, SSOS is favored for its ability to enhance skin-feel and stability in water-in-oil emulsions. While European companies are prominent in research and applications, North America continues to outpace Europe in production scale, supply chain integration, and regulatory support.

Latin America shows growing interest in starch sodium octenyl succinate, particularly in Brazil, Mexico, and Argentina. The compound is increasingly used in food processing and powdered beverage formulations, which are popular across the region. Local food manufacturers utilize SSOS to improve the solubility and shelf life of instant products and flavor systems. However, adoption in the pharmaceutical and cosmetic sectors remains limited due to lower production capacities and reliance on imports. Despite regional growth potential, North America leads in technological sophistication, diversified application base, and consistent regulatory oversight.

Middle East & Africa region is still in the early stages of SSOS market development. In countries like South Africa, Saudi Arabia, and the UAE, starch sodium octenyl succinate finds limited but increasing use in processed foods, powdered milk, and encapsulated seasonings. Market growth is supported by rising consumer demand for convenience foods and packaged health supplements. However, local production capacity is minimal, and most SSOS-based formulations are imported from North America and Europe. Industrial-scale use in cosmetics and pharmaceuticals is largely underdeveloped. North America maintains a strong advantage through its robust manufacturing infrastructure, quality control, and multi-sectoral demand.

Starch Sodium Octenyl Succinate Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the starch sodium octenyl succinate market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global starch sodium octenyl succinate market include:

- GUANGZHOU HISOYA BIOLOGICAL SCIENCE AND TECHNOLOGY CO. LTD

- Noshly Pty Ltd

- Ningbo Samreal Chemical Co. Ltd.

- Ingredion

- Zhejiang NHU

- A&Z Food Additives

- Guangzhou Fofiber Biological Industry

- Texture Maker

- Yishui Dadi Corn Development

- Zhejiang Zhongtong Technology

- Foshan Huawu Huafeng Starch

- Europe Starch

The global starch sodium octenyl succinate market is segmented as follows:

By Product Form

- Powdered Form

- Liquid Form

By Functionality

- Emulsifier

- Stabilizer

- Thickening Agent

By Source

- Natural Sources

- Synthetic Sources

By Application

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

- Industrial Applications

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Who are the leading players functioning in the global Starch Sodium Octenyl Succinate market growth?

Table Of Content

Inquiry For Buying

Starch Sodium Octenyl Succinate

Request Sample

Starch Sodium Octenyl Succinate