Styrene-Acrylic Copolymer Market Size, Share, and Trends Analysis Report

CAGR :

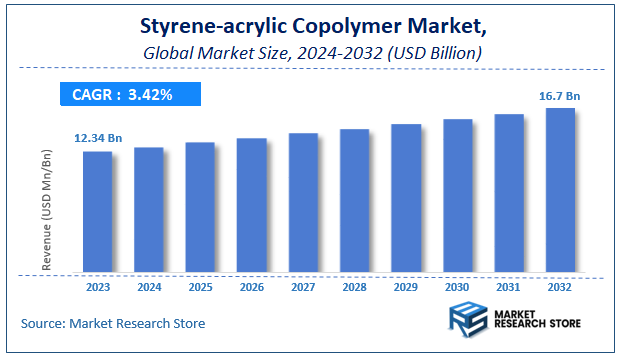

| Market Size 2023 (Base Year) | USD 12.34 Billion |

| Market Size 2032 (Forecast Year) | USD 16.7 Billion |

| CAGR | 3.42% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Styrene-acrylic Copolymer Market Insights:

According to Market Research Store, the global styrene-acrylic copolymer market size was valued at around USD 12.34 billion in 2023 and is estimated to reach USD 16.7 billion by 2032, to register a CAGR of approximately 3.42% in terms of revenue during the forecast period 2024-2032.

The styrene-acrylic copolymer report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Styrene-Acrylic Copolymer Market: Overview

Styrene-acrylic copolymer is a type of synthetic polymer composed of styrene and various acrylic monomers, such as acrylic acid, methyl methacrylate, or butyl acrylate. These copolymers are valued for their excellent adhesion, water resistance, UV stability, and flexibility, making them widely used in paints, coatings, adhesives, sealants, and construction materials. They form stable emulsions in water and are commonly used as binders in water-based formulations. Styrene provides hardness and gloss, while the acrylic component enhances weatherability and resistance to yellowing and degradation. Due to their customizable properties, styrene-acrylic copolymers are suitable for both indoor and outdoor applications across industries including automotive, packaging, textile, and building & construction.

Key Highlights

- The styrene-acrylic copolymer market is anticipated to grow at a CAGR of 3.42% during the forecast period.

- The global styrene-acrylic copolymer market was estimated to be worth approximately USD 12.34 billion in 2023 and is projected to reach a value of USD 16.7 billion by 2032.

- The growth of the styrene-acrylic copolymer market is being driven by increasing demand in construction, automotive, and packaging sectors.

- Based on the type, the pure styrene-acrylic copolymers segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the coatings segment is projected to swipe the largest market share.

- In terms of end-user, the building & construction segment is expected to dominate the market.

- Based on the formulation type, the waterborne formulations segment is expected to dominate the market.

- In terms of functionality, the binder segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Styrene-Acrylic Copolymer Market: Dynamics

Key Growth Drivers:

- Rising Demand from the Paints and Coatings Industry: Styrene-acrylic copolymers are widely used in architectural and industrial coatings due to their excellent weatherability, gloss retention, and cost-effectiveness, driving market growth.

- Growth in Construction and Infrastructure Development: Increasing construction activities, particularly in emerging economies, are fueling the demand for decorative paints and coatings, thereby boosting the need for styrene-acrylic copolymers.

- Shift Toward Water-Based and Low-VOC Formulations: Environmental regulations and consumer preference for eco-friendly products are pushing the adoption of waterborne coatings, where styrene-acrylic copolymers serve as key components.

- Expanding Packaging and Adhesives Applications: The versatility and adhesive properties of styrene-acrylic copolymers make them suitable for use in packaging materials, labels, and tapes, supporting market expansion.

Restraints:

- Volatility in Raw Material Prices: Fluctuations in the prices of petrochemical-derived raw materials like styrene and acrylic monomers can significantly impact production costs and profit margins.

- Availability of Substitute Products: The presence of alternative polymers, such as vinyl acetate-based and pure acrylic emulsions, can limit market growth by offering competitive performance and pricing.

- Environmental Concerns Associated with Styrene: Although widely used, styrene is considered a potential health and environmental hazard, which may lead to stricter regulations and hinder market penetration.

Opportunities:

- Product Innovation and Customization: Ongoing R&D is enabling the development of high-performance, specialized copolymer grades tailored for specific applications like elastomeric coatings and textile finishes.

- Growth in Emerging Economies: Countries in Asia-Pacific, Latin America, and Africa are witnessing rising demand for paints, coatings, and adhesives due to urbanization and industrialization, presenting strong growth prospects.

- Increased Use in Construction Chemicals: The growing trend toward energy-efficient and long-lasting buildings is encouraging the use of performance-enhancing construction chemicals, where styrene-acrylic copolymers play a role.

- Adoption in Nonwoven and Textile Industries: These copolymers are increasingly used in textile coatings and nonwoven applications due to their durability and flexibility, opening new market avenues.

Challenges:

- Stringent Environmental and Safety Regulations: Compliance with evolving global regulations regarding the use and disposal of styrene-based products adds complexity and cost to manufacturing processes.

- Intense Market Competition: Numerous players in the market, both global and regional, intensify price competition and reduce margins, especially in commoditized segments.

- Technical Barriers in High-Performance Applications: Meeting the performance requirements for specialized applications such as automotive or marine coatings can be challenging, limiting the copolymers' adoption in certain sectors.

- Limited Awareness in Certain End-Use Industries: In some industries, end-users remain unaware of the benefits and capabilities of styrene-acrylic copolymers, limiting market expansion opportunities.

Styrene-acrylic Copolymer Market: Report Scope

This report thoroughly analyzes the Styrene-acrylic Copolymer Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Styrene-acrylic Copolymer Market |

| Market Size in 2023 | USD 12.34 Billion |

| Market Forecast in 2032 | USD 16.7 Billion |

| Growth Rate | CAGR of 3.42% |

| Number of Pages | 198 |

| Key Companies Covered | DOW, Celanese, Acquos, Pexi Chem, H.B. Fuller, Lubrizol, Wacker, Xyntra, Hanwha, INDULO, INEOS Styrolution, Arkema, DSM, Chemrez Technologies, DIC Corporation, Linyi Kaiao Chemical, Mallard Creek Polymer, Anhui Sinograce Chemical, Shanghai BaoLiJia Chemical, Jiangsu Sunrise Chemical, Hebei Xingguang Technology, Guangdong Yinyang Resin, Beijing Donglian Chem |

| Segments Covered | By Type, By Application, By End-User, By Formulation Type, By Functionality, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Styrene-Acrylic Copolymer Market: Segmentation Insights

The global styrene-acrylic copolymer market is divided by type, application, end-user, formulation type, functionality, and region.

Segmentation Insights by Type

Based on type, the global styrene-acrylic copolymer market is divided into Pure styrene-acrylic copolymers, modified styrene-acrylic copolymers, and acrylic-styrene block copolymers.

In the styrene-acrylic copolymer market, the pure styrene-acrylic copolymers segment holds the most dominant position. These copolymers are widely used across multiple industries, particularly in coatings, adhesives, and construction materials, due to their excellent balance of water resistance, durability, and cost-effectiveness. Their superior film-forming properties, UV resistance, and flexibility make them a preferred choice for applications in architectural coatings and waterproofing membranes, especially in construction and paints and coatings industries. Moreover, the easy availability of raw materials and relatively simple manufacturing process contribute to their widespread adoption.

Following this, the modified styrene-acrylic copolymers segment ranks second in market share. These are chemically enhanced formulations that offer improved performance characteristics such as better adhesion to difficult substrates, enhanced chemical resistance, or improved elasticity. Industries that require more specialized or high-performance properties, such as packaging, industrial coatings, or automotive applications, often turn to modified variants. Their ability to be tailored to specific end-use requirements makes them valuable in niche applications, although their market share is relatively smaller due to higher production complexity and cost.

The acrylic-styrene block copolymers segment is the least dominant among the three. These copolymers, structured in block sequences rather than random arrangements, are known for their strength, flexibility, and phase separation properties, making them suitable for applications that require rubber-like elasticity or impact resistance, such as in specialty adhesives and thermoplastic elastomers. However, their relatively limited range of applications, higher production cost, and niche demand restrict their broader market adoption, keeping this segment smaller in comparison to the others.

Segmentation Insights by Application

On the basis of application, the global styrene-acrylic copolymer market is bifurcated into coatings, adhesives & sealants, textiles, construction, and electronics.

In the styrene-acrylic copolymer market, the coatings segment stands out as the most dominant application area. This is largely due to the exceptional properties of styrene-acrylic copolymers such as high weather resistance, UV stability, gloss retention, and film-forming capability, which make them ideal for use in architectural, industrial, and automotive coatings. Their ability to be formulated into both interior and exterior paints—especially water-based paints—has fueled their widespread use in the global coatings industry, where performance, durability, and environmental friendliness are critical.

The adhesives & sealants segment follows as the second most significant application. Styrene-acrylic copolymers are favored in this sector for their excellent adhesion to various substrates, water resistance, and flexibility. These attributes make them ideal for pressure-sensitive adhesives, packaging adhesives, construction sealants, and general-purpose bonding applications. Their compatibility with other additives and ability to meet diverse bonding requirements further boosts their adoption in this segment.

Next is the construction segment, where styrene-acrylic copolymers are used in applications like cement modification, waterproofing membranes, crack fillers, and surface coatings. These copolymers enhance the mechanical strength, flexibility, and water resistance of construction materials. While the segment sees strong demand in infrastructure and residential development, its use is more specialized compared to coatings and adhesives, which limits its market share to a degree.

The textiles segment ranks fourth, where these copolymers serve as binders in textile coatings and finishes. They provide properties like softness, durability, and wash resistance to fabrics. However, compared to other applications, the volume of styrene-acrylic copolymers used in textiles is relatively lower, owing to the limited number of processes and product types that require them.

Lastly, the electronics segment holds the smallest share of the market. Though styrene-acrylic copolymers offer beneficial properties like dielectric strength and thermal stability, their use in electronics is relatively niche. Applications are mostly confined to specialty coatings and encapsulants, where specific performance characteristics are needed. High-performance materials such as silicones or epoxies often replace them in more demanding electronic applications, keeping this segment comparatively limited.

Segmentation Insights by End-User

Based on end-user, the global styrene-acrylic copolymer market is divided into building & construction, automotive, consumer goods, healthcare, and packaging.

In the styrene-acrylic copolymer market, the building & construction sector is the most dominant end-user. This prominence is driven by the material’s extensive use in coatings, waterproofing membranes, sealants, cement modifiers, and insulation materials. Its excellent weather resistance, water repellency, adhesion, and durability make it ideal for architectural and infrastructure projects. The demand for cost-effective and high-performance materials in construction, especially for green buildings and urban infrastructure, continues to drive the use of styrene-acrylic copolymers in this sector.

The automotive industry follows closely, utilizing styrene-acrylic copolymers primarily in coatings and adhesives for vehicle bodies, interiors, and components. These copolymers offer advantages such as UV resistance, gloss retention, and strong adhesion, which are essential in maintaining the aesthetic and structural integrity of automotive surfaces. Their use contributes to lightweight construction and improved fuel efficiency, making them increasingly popular in modern vehicle manufacturing.

Next in line is the consumer goods segment, which leverages these copolymers in products like decorative paints, personal care packaging, and household adhesives. Their non-toxic, flexible, and durable nature makes them suitable for a wide array of applications, from furniture coatings to do-it-yourself adhesive products. While this segment has broad application diversity, it holds a smaller share compared to construction and automotive due to generally lower volume requirements per product.

The healthcare segment ranks fourth and involves applications such as medical adhesives, hygienic coatings, and disposable products. The biocompatibility, low odor, and high purity of certain styrene-acrylic copolymer formulations make them appropriate for use in healthcare environments. However, stringent regulatory requirements and competition from specialized medical-grade polymers limit the broader adoption of styrene-acrylic copolymers in this field.

Finally, the packaging segment represents the least dominant end-user. While the copolymers are used in packaging adhesives, coatings, and barrier films, especially for flexible packaging, their market share is relatively small compared to other end-users. This is due to competition from other polymers like polyethylene, polypropylene, and PET, which are more commonly used in mainstream packaging applications due to their cost-efficiency and processability.

Segmentation Insights by Formulation Type

On the basis of formulation type, the global styrene-acrylic copolymer market is bifurcated into waterborne formulations, solvent-borne formulations, and powder coatings.

In the styrene-acrylic copolymer market, waterborne formulations are the most dominant formulation type. These are widely favored due to their environmentally friendly profile, low VOC (volatile organic compounds) emissions, and compliance with increasingly stringent environmental regulations. Waterborne styrene-acrylic copolymers are extensively used in paints, coatings, and adhesives, especially in the building & construction, consumer goods, and automotive industries. Their excellent film-forming ability, durability, and ease of cleanup contribute to their broad acceptance and growing market share across both developed and emerging economies.

Solvent-borne formulations follow as the second most prominent segment. These formulations offer advantages such as faster drying times, superior performance in extreme weather conditions, and excellent adhesion to difficult substrates. They are often used where water resistance and durability are critical, including in industrial coatings and certain automotive applications. However, concerns about VOC emissions, health hazards, and stricter environmental regulations have gradually constrained their growth compared to waterborne alternatives.

Powder coatings represent the least dominant formulation type within the styrene-acrylic copolymer market. Although powder coatings offer benefits such as high durability, zero solvent emissions, and recyclability, their adoption is limited due to the relatively lower compatibility of styrene-acrylic copolymers with powder coating processes. These coatings require specific equipment and conditions (like electrostatic application and curing ovens), which are less commonly used in traditional sectors that rely on styrene-acrylics. As a result, this formulation type maintains a smaller, more specialized market share.

Segmentation Insights by Functionality

On the basis of functionality, the global styrene-acrylic copolymer market is bifurcated into binder, emulsifier, adhesive, and film-forming agent.

In the styrene-acrylic copolymer market, binder is the most dominant functionality. These copolymers are extensively used as binders in paints, coatings, and construction products due to their excellent adhesion to various substrates, resistance to UV and moisture, and ability to form durable, flexible films. Their role as a binder is critical in enhancing the mechanical properties, longevity, and performance of products in sectors such as construction, automotive, and decorative coatings. The versatility and compatibility of styrene-acrylic copolymers with different additives and pigments further solidify their dominance in this category.

The film-forming agent functionality ranks second. Styrene-acrylic copolymers are well-known for their superior film formation at ambient temperatures, producing clear, tough, and elastic films that are resistant to water, chemicals, and environmental stress. This functionality is crucial in applications like surface coatings, water-based paints, and sealants, where protective and aesthetic film layers are required. Their low-temperature film-forming ability is particularly advantageous in waterborne formulations.

Adhesive functionality comes next. In this role, styrene-acrylic copolymers are used to develop pressure-sensitive adhesives, laminating adhesives, and construction sealants. They provide strong initial tack, cohesive strength, and long-term bonding capabilities. While important, this function holds a relatively smaller share compared to binders and film-forming agents, largely because it is more specialized and often supplemented with other resin systems depending on the application.

Lastly, the emulsifier functionality is the least dominant in this market. Although styrene-acrylic copolymers can act as stabilizers or emulsifying agents in certain formulations—especially in polymer emulsions or latex systems—their role is usually secondary. Other specialized surfactants and emulsifiers are typically preferred for this purpose, which limits the demand for styrene-acrylics in this specific function.

Styrene-Acrylic Copolymer Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific is the most dominant region in the styrene-acrylic copolymer market. The region benefits from its vast industrial base, particularly in countries such as China, India, and Japan, where demand for water-based adhesives, paints, and coatings continues to rise due to rapid urbanization and infrastructure development. Favorable government policies supporting low-emission products and the availability of cost-effective raw materials further enhance the region’s competitiveness. The increasing shift towards eco-friendly construction and industrial solutions strengthens the region's leadership in this market.

North America holds a strong position in the market, driven by the widespread adoption of environmentally sustainable materials and a mature construction sector. The U.S. leads regional demand due to the growing use of water-based coating solutions in architectural and industrial applications. Stringent environmental regulations and continuous investment in technological innovation encourage the development of advanced styrene-acrylic copolymer formulations, supporting steady market expansion.

Europe accounts for a substantial share of the global market, supported by strict environmental norms and a well-developed industrial framework. Countries such as Germany, France, and the U.K. are prominent consumers due to their demand for durable and high-performance coatings in sectors like automotive, infrastructure, and manufacturing. The region emphasizes sustainability and energy efficiency, which drives the shift towards low-VOC, water-based copolymer products.

Latin America shows moderate market activity, with Brazil and Mexico emerging as leading contributors. Rising investments in infrastructure, combined with increased urban population and growing consumer awareness about environmentally friendly materials, are gradually fueling demand. However, the region faces challenges including economic instability and regulatory inconsistency, which can impact long-term market momentum.

Middle East and Africa represent the least dominant regions but offer emerging growth opportunities. Expanding construction activities in Gulf countries and urbanization in parts of Africa are slowly driving demand for sustainable coatings and adhesives. Limited domestic production and dependency on imports currently hinder faster development, though improvements in industrial capacity and economic diversification efforts are creating potential for future market expansion.

Styrene-Acrylic Copolymer Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the styrene-acrylic copolymer market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global styrene-acrylic copolymer market include:

- DOW

- Celanese

- Acquos

- Pexi Chem

- H.B. Fuller

- Lubrizol

- Wacker

- Xyntra

- Hanwha

- INDULO

- INEOS Styrolution

- Arkema

- DSM

- Chemrez Technologies

- DIC Corporation

- Linyi Kaiao Chemical

- Mallard Creek Polymer

- Anhui Sinograce Chemical

- Shanghai BaoLiJia Chemical

- Jiangsu Sunrise Chemical

- Hebei Xingguang Technology

- Guangdong Yinyang Resin

- Beijing Donglian Chem

The global styrene-acrylic copolymer market is segmented as follows:

By Type

- Pure Styrene-acrylic Copolymers

- Modified Styrene-acrylic Copolymers

- Acrylic-Styrene Block Copolymers

By Application

- Coatings

- Adhesives and Sealants

- Textiles

- Construction

- Electronics

By End-User

- Building and Construction

- Automotive

- Consumer Goods

- Healthcare

- Packaging

By Formulation Type

- Waterborne Formulations

- Solvent-borne Formulations

- Powder Coatings

By Functionality

- Binder

- Emulsifier

- Adhesive

- Film-forming Agent

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Styrene-Acrylic Copolymer

Request Sample

Styrene-Acrylic Copolymer