Survey Tool Market Size, Share, and Trends Analysis Report

CAGR :

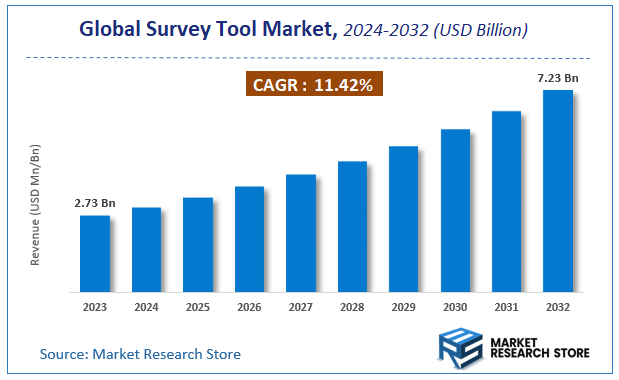

| Market Size 2023 (Base Year) | USD 2.73 Billion |

| Market Size 2032 (Forecast Year) | USD 7.23 Billion |

| CAGR | 11.42% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Survey Tool Market Insights

According to Market Research Store, the global survey tool market size was valued at around USD 2.73 billion in 2023 and is estimated to reach USD 7.23 billion by 2032, to register a CAGR of approximately 11.42% in terms of revenue during the forecast period 2024-2032.

The survey tool report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Survey Tool Market: Overview

A survey tool is a digital application or software platform designed to create, distribute, collect, and analyze surveys for a variety of purposes, including market research, customer feedback, employee engagement, academic studies, and public opinion polling. These tools enable users to build customizable questionnaires using various question types such as multiple choice, open-ended, Likert scale, and rating systems. Many survey tools offer advanced features like skip logic, branching, data validation, automated reporting, real-time analytics, and integration with CRM, email marketing, and data analysis platforms. Popular survey tools include platforms like SurveyMonkey, Google Forms, Qualtrics, Typeform, and Microsoft Forms. Their accessibility, ease of use, and ability to reach a wide audience through online and mobile channels have significantly replaced traditional paper-based surveys.

Key Highlights

- The survey tool market is anticipated to grow at a CAGR of 11.42% during the forecast period.

- The global survey tool market was estimated to be worth approximately USD 2.73 billion in 2023 and is projected to reach a value of USD 7.23 billion by 2032.

- The growth of the survey tool market is being driven by increasing need for data-driven decision-making across industries such as healthcare, education, retail, government, and corporate sectors.

- Based on the type, the online survey tools segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the market research segment is projected to swipe the largest market share.

- In terms of deployment mode, the cloud-based segment is expected to dominate the market.

- Based on the enterprise size, the large enterprises segment is expected to dominate the market.

- In terms of end-user, the BFSI segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Survey Tool Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Customer Feedback and Experience Management: Businesses are increasingly relying on survey tools to gather real-time customer insights to enhance products, services, and customer experience.

- Rising Popularity of Online and Mobile Surveys: The widespread use of smartphones and internet access has made it easier to distribute and collect survey responses via digital platforms.

- Adoption of Data-Driven Decision Making: Organizations are turning to survey tools to collect actionable data that supports strategic and operational decision-making.

- Growth in Remote Work and Virtual Collaboration: With more teams working remotely, survey tools are being used to assess employee engagement, satisfaction, and feedback in distributed workforces.

- Integration with CRM and Marketing Automation Platforms: Survey tools are increasingly being integrated with customer relationship management and marketing platforms to streamline feedback loops and personalization.

Restraints:

- Concerns About Data Privacy and Security: Users are cautious about sharing personal or sensitive information, which may limit the effectiveness of surveys, especially if tools lack robust data protection.

- Survey Fatigue Among Respondents: Excessive or poorly designed surveys can lead to low response rates and unengaged participants, affecting data quality.

- Limited Accessibility and Inclusivity: Some survey tools may not be fully optimized for users with disabilities or for use in low-bandwidth regions, limiting their reach.

Opportunities:

- AI and Machine Learning for Survey Analysis: Integration of AI/ML can enhance real-time sentiment analysis, predictive insights, and automated reporting, adding value to survey data.

- Expansion in Emerging Markets: Growing digital penetration in developing regions presents opportunities for survey tools tailored to local languages and mobile-first platforms.

- Voice and Conversational Surveys: Adoption of voice-enabled and chatbot-based surveys can provide more engaging and user-friendly ways to collect feedback.

- Customizable and Industry-Specific Templates: Offering ready-to-use, industry-focused survey templates can attract more users looking for targeted solutions.

Challenges:

- High Competition and Market Saturation: The survey tool market is crowded with numerous players offering similar features, making differentiation and customer retention a challenge.

- Keeping Up with Regulatory Compliance: Ensuring ongoing compliance with international data protection laws like GDPR, CCPA, and others can be complex and resource-intensive.

- Ensuring Data Accuracy and Integrity: Biases in survey design or dishonest responses can compromise the reliability and usefulness of collected data.

- User Training and Adoption Issues: Not all organizations have the expertise to design effective surveys or interpret results, leading to underutilization of the tool’s capabilities.

Survey Tool Market: Report Scope

This report thoroughly analyzes the Survey Tool Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Survey Tool Market |

| Market Size in 2023 | USD 2.73 Billion |

| Market Forecast in 2032 | USD 7.23 Billion |

| Growth Rate | CAGR of 11.42% |

| Number of Pages | 189 |

| Key Companies Covered | SurveyGizmo, SurveyMonkey, QuestionPro, Zoho, Typeform, Survey Planet, SoGoSurvey, Constant Contact, Crowdsignal, Client Heartbeat, Google, Qualtrics, Nicereply, Nextiva, SurveyLegend, CheckMarket, Outgrow |

| Segments Covered | By Type, By Application, By Deployment Mode, By Enterprise Size, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Survey Tool Market: Segmentation Insights

The global survey tool market is divided by type, application, deployment mode, enterprise size, end-user, and region.

Segmentation Insights by Type

Based on type, the global survey tool market is divided into online survey tools and offline survey tools.

In the survey tool market, online survey tools represent the most dominant segment by type. This dominance is largely driven by the growing adoption of cloud-based solutions, increased internet penetration, and the need for real-time data collection and analytics across businesses, educational institutions, and government organizations. Online survey tools are widely preferred due to their ease of distribution via email, social media, and websites, along with features such as automated reporting, customizable templates, integration with other digital platforms (like CRM or marketing software), and mobile compatibility. These tools enable organizations to reach a broader and more diverse audience quickly, which is essential for modern market research and customer feedback strategies.

In contrast, offline survey tools constitute a smaller but still relevant segment of the market. These tools are primarily used in environments where internet connectivity is limited or non-existent, such as remote or rural areas, field research settings, and on-premise customer interaction points. Offline survey tools allow data to be collected on devices like tablets or laptops and later synced to central databases when internet access is available. Although not as widely adopted as their online counterparts, offline tools remain important in sectors like public health, agriculture, and development research, where on-ground data collection is critical. However, their limited scalability and lack of real-time analytics capabilities contribute to their comparatively lower market share.

Segmentation Insights by Application

On the basis of application, the global survey tool market is bifurcated into market research, customer feedback, employee feedback, academic research, and others.

In the survey tool market, market research stands out as the most dominant application segment. Organizations across industries rely heavily on survey tools to gather consumer insights, track market trends, and evaluate product or service performance. The ability of survey platforms to reach large and diverse respondent groups, analyze responses in real-time, and segment data for targeted insights has made them indispensable for market research professionals. The increasing focus on data-driven decision-making and competitive analysis further fuels the demand for these tools in this segment.

Customer feedback follows closely, as businesses strive to enhance customer satisfaction, improve products and services, and foster brand loyalty. Online survey tools offer quick turnaround times and user-friendly interfaces, making them ideal for collecting feedback through post-purchase emails, website pop-ups, and mobile apps. With customer experience now a key differentiator in many industries, companies are investing heavily in feedback systems to stay ahead.

Employee feedback is another important application area, especially with the growing emphasis on employee engagement, workplace culture, and remote work environments. HR departments use survey tools to conduct pulse surveys, performance reviews, and organizational health checks. These insights help in improving retention rates, productivity, and internal communication strategies.

Academic research utilizes survey tools primarily in universities and research institutions for data collection on human behavior, social sciences, and educational outcomes. These tools support structured data collection and offer flexibility in survey design, making them suitable for both qualitative and quantitative studies. Although significant, this segment is comparatively smaller due to limited budgets and narrower user bases.

Segmentation Insights by Deployment Mode

Based on deployment mode, the global survey tool market is divided into cloud-based and on-premises.

In the survey tool market, cloud-based deployment is the most dominant segment by deployment mode. This dominance is fueled by its scalability, accessibility, and cost-efficiency. Cloud-based survey tools allow users to design, distribute, and analyze surveys from any location with internet access, which is particularly valuable for organizations with distributed teams or global operations. These platforms often come with automatic updates, robust data security, real-time analytics, and easy integration with other software ecosystems like CRM, marketing automation, or HR systems. Their subscription-based pricing models also make them attractive to businesses of all sizes, from startups to large enterprises.

On-premises deployment, on the other hand, serves a smaller share of the market. It is typically preferred by organizations with strict data privacy regulations, such as government agencies, healthcare providers, or financial institutions, where full control over data storage and security is essential. These solutions require dedicated IT infrastructure and support, which leads to higher upfront costs and longer implementation times. Although offering a higher level of customization and internal control, on-premises tools are less flexible and less frequently updated compared to their cloud-based counterparts, which limits their appeal in the broader commercial landscape.

Segmentation Insights by Enterprise Size

On the basis of enterprise size, the global survey tool market is bifurcated into small & medium enterprises and large enterprises.

In the survey tool market, large enterprises constitute the most dominant segment by enterprise size. These organizations often have complex, large-scale operations that require comprehensive survey tools to gather insights from diverse stakeholders including customers, employees, and partners across multiple geographies. Large enterprises typically have bigger budgets and more specialized requirements, prompting them to invest in feature-rich, scalable platforms with advanced analytics, integration capabilities, multi-language support, and enhanced security protocols. They also utilize survey tools across multiple departments—such as marketing, HR, R&D, and customer support—making them consistent and high-value users of survey technologies.

Small and medium enterprises (SMEs) represent a significant but less dominant segment. While SMEs may not need the same depth or breadth of features as larger organizations, they increasingly rely on affordable and easy-to-use survey tools for quick feedback, customer satisfaction tracking, and employee engagement. The availability of low-cost or freemium cloud-based platforms has lowered the entry barrier for SMEs, allowing them to compete more effectively in data-driven decision-making. However, their adoption rates are slightly lower due to budget constraints, limited in-house technical expertise, and smaller-scale research needs compared to large enterprises.

Segmentation Insights by End-User

On the basis of end-user, the global survey tool market is bifurcated into BFSI, healthcare, retail, education, government, and others.

In the survey tool market, the BFSI (Banking, Financial Services, and Insurance) sector is one of the most dominant end-users. Financial institutions frequently rely on survey tools for customer satisfaction surveys, market research, risk assessment, and internal audits. With a strong focus on customer experience, regulatory compliance, and service quality, BFSI organizations utilize surveys to gather feedback from clients, assess financial products, and improve their offerings. The sector’s heavy emphasis on data-driven decision-making and customer insights further fuels the demand for robust survey platforms that provide advanced analytics and real-time reporting.

Healthcare is another significant end-user segment. Healthcare providers, pharmaceutical companies, and research institutions use survey tools for patient satisfaction surveys, employee feedback, clinical trials, and market research. The need for accurate, timely data in patient care, medical product testing, and employee engagement makes survey tools indispensable in this sector. With the increasing importance of patient-centered care and compliance with regulatory standards, healthcare organizations are adopting survey tools for both internal assessments and patient-facing surveys.

Retail also plays a crucial role in the survey tool market. Retailers use survey platforms to collect customer feedback on products, services, and in-store experiences. These tools are essential for tracking consumer sentiment, measuring brand loyalty, and improving customer experience. Retailers can gather valuable insights through post-purchase surveys, loyalty programs, and product satisfaction feedback. With the growing trend of omnichannel shopping, survey tools are increasingly used to assess consumer behavior across both online and brick-and-mortar stores.

Education is an emerging but important sector for survey tools. Educational institutions use surveys to gauge student satisfaction, measure teaching effectiveness, gather feedback on courses and programs, and assess alumni engagement. The flexibility of survey tools allows schools and universities to conduct research, analyze learning outcomes, and improve institutional strategies. Furthermore, surveys are often used in academic research projects, which contributes to their adoption in this sector.

Government organizations also utilize survey tools for public opinion polling, citizen engagement, employee satisfaction, and policy assessments. Governments use surveys to gather data for public health studies, social research, and to better understand the needs and concerns of their citizens. Given the increasing focus on transparency and public engagement, government agencies at local, state, and federal levels are turning to survey tools for efficient data collection and analysis.

Survey Tool Market: Regional Insights

- North America is expected to dominates the global market

The North America region is the most dominant in the global survey tool market. Its leadership is driven by a mature digital infrastructure and a high level of technological adoption across enterprises. Companies in the United States and Canada increasingly rely on survey tools for employee engagement, customer feedback, and market research. The presence of numerous established players and continuous innovation in software functionality and analytics further strengthens the region's position at the top of the market.

Europe maintains a strong presence in the survey software market, supported by strict data protection regulations and a culture that values structured feedback mechanisms. Organizations across sectors such as healthcare, education, and public services utilize survey tools to enhance operational efficiency and stakeholder engagement. Customization and compliance are key selling points in this region, which demands robust and secure platforms to handle sensitive data responsibly.

Asia Pacific is emerging as a fast-growing region due to the accelerating digital transformation in countries like China, India, and Southeast Asia. Businesses and educational institutions are increasingly deploying survey solutions to gather insights from large and diverse populations. With rising mobile and internet penetration, the region presents considerable growth potential, especially among SMEs and startups seeking cost-effective and scalable survey options.

Latin America is steadily expanding in the survey tool market, with increased adoption driven by the need for customer feedback and quality improvement across industries like hospitality and retail. Survey platforms that offer language localization and user-friendly interfaces are particularly popular. While infrastructure development is still in progress in some areas, growing interest from small and medium businesses is gradually shaping a stronger market foundation.

Middle East and Africa represent the least dominant but growing segment of the global survey software market. The growth here is fueled by government and private sector investments in digital tools for healthcare, education, and public administration. Survey tools are being used to improve service delivery and gather citizen feedback. While adoption is still at an early stage compared to other regions, increasing digital literacy and internet access are paving the way for future market expansion.

Survey Tool Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the survey tool market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global survey tool market include:

- SurveyGizmo

- SurveyMonkey

- QuestionPro

- Zoho

- Typeform

- Survey Planet

- SoGoSurvey

- Constant Contact

- Crowdsignal

- Client Heartbeat

- Qualtrics

- Nicereply

- Nextiva

- SurveyLegend

- CheckMarket

- Outgrow

The global survey tool market is segmented as follows:

By Type

- Online Survey Tools

- Offline Survey Tools

By Application

- Market Research

- Customer Feedback

- Employee Feedback

- Academic Research

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Healthcare

- Retail

- Education

- Government

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Survey Tool

Request Sample

Survey Tool