Technical Films Market Size, Share, and Trends Analysis Report

CAGR :

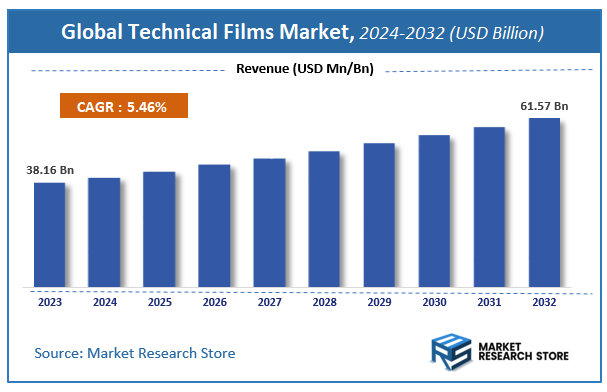

| Market Size 2023 (Base Year) | USD 38.16 Billion |

| Market Size 2032 (Forecast Year) | USD 61.57 Billion |

| CAGR | 5.46% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Technical Films Market Insights

According to Market Research Store, the global technical films market size was valued at around USD 38.16 billion in 2023 and is estimated to reach USD 61.57 billion by 2032, to register a CAGR of approximately 5.46% in terms of revenue during the forecast period 2024-2032.

The technical films report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Technical Films Market: Overview

Technical films are specialized plastic films engineered with advanced material properties to meet the requirements of specific industrial, commercial, or consumer applications. Unlike conventional films used for basic packaging, technical films possess functional characteristics such as high barrier protection, chemical resistance, UV stability, conductivity, flame retardancy, or biodegradability. These films are typically composed of polymers like polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyamide (PA), polylactic acid (PLA), and others. They are widely used in industries such as electronics, automotive, aerospace, medical, construction, agriculture, and food packaging.

Key Highlights

- The technical films market is anticipated to grow at a CAGR of 5.46% during the forecast period.

- The global technical films market was estimated to be worth approximately USD 38.16 billion in 2023 and is projected to reach a value of USD 61.57 billion by 2032.

- The growth of the technical films market is being driven by increasing demand for high-performance materials in end-use sectors.

- Based on the films type, the barrier films segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the polyethylene (PE) segment is projected to swipe the largest market share.

- In terms of thickness type, the 25–50 microns segment is expected to dominate the market.

- Based on the end use industry, the food and beverage segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Technical Films Market: Dynamics

Key Growth Drivers:

- Rising Demand in Packaging Industry: The growing need for durable, flexible, and high-barrier packaging materials in food, pharmaceutical, and personal care industries is driving the adoption of technical films due to their protective and performance-enhancing properties.

- Technological Advancements in Film Manufacturing: Innovations in multi-layer film technology, biodegradable materials, and nanocomposites are expanding application possibilities, boosting demand for high-performance technical films across various industries.

- Growth in Electronics and Automotive Sectors: Increasing use of technical films in electronics (e.g., insulation, displays) and automotive (e.g., interior films, protective layers) is fueling market growth, driven by miniaturization and smart device integration.

- Environmental Regulations and Sustainable Materials: Stringent regulations on single-use plastics are pushing industries to switch to recyclable or biodegradable technical films, creating strong demand for eco-friendly solutions.

Restraints:

- High Production Costs: The use of advanced raw materials, complex manufacturing processes, and R&D investments makes technical films more expensive than conventional alternatives, limiting affordability for small-scale users.

- Raw Material Price Volatility: Fluctuations in the prices of petroleum-based polymers and specialty additives can affect the cost-effectiveness and stability of the supply chain for manufacturers and end-users.

Opportunities:

- Rising Adoption of Biodegradable and Recyclable Films: The shift toward sustainability is creating lucrative opportunities for manufacturers to develop and market environment-friendly technical films in compliance with global green mandates.

- Expansion in Emerging Markets: Rapid industrial growth, urbanization, and increasing disposable income in regions like Asia Pacific, Latin America, and Africa offer significant potential for market penetration and expansion of technical films.

- Smart Films and Functional Applications: The integration of functionalities such as conductivity, antimicrobial properties, and UV shielding is opening new opportunities in sectors like healthcare, electronics, and energy.

Challenges:

- Complexity in Recycling Multi-layer Films: Many technical films are made with multiple layers and materials that are difficult to separate and recycle, posing environmental concerns and regulatory challenges.

- Lack of Standardization Across Regions: Variability in industry standards, regulations, and product requirements across different countries complicates production, certification, and international trade for manufacturers.

Technical Films Market: Report Scope

This report thoroughly analyzes the Technical Films Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Technical Films Market |

| Market Size in 2023 | USD 38.16 Billion |

| Market Forecast in 2032 | USD 61.57 Billion |

| Growth Rate | CAGR of 5.46% |

| Number of Pages | 180 |

| Key Companies Covered | The Mondi Group plc, Bischof + Klein SE & Co. KG, Klöckner Pentaplast Group, Selenis Portugal S.A., Polifilms GmbH, Futamura Chemical Co. Ltd, Vizelpas, Bioplast, HYPAC Packaging Pte Ltd, Perlen Packaging AG, HAFLIGER Films Spa, Idealplast Srl, Cassioli Srl, Kuhne Anlagenbau GmbH, DowDuPont, Kaneka, SKC Kolon, Ube, Taimide Tech, MGC, I.S.T Corp, Rayitek, Treofan, Polifilm GmbH, Borealis AG |

| Segments Covered | By Films Type, By Material, By Thickness Type, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Technical Films Market: Segmentation Insights

The global technical films market is divided by films type, material, thickness type, end use industry, and region.

Segmentation Insights by Films Type

Based on films type, the global technical films market is divided into stretch films, shrink films, barrier films, conductive films, safety & security films, anti-fog films, and other technical films.

In the technical films market, barrier films represent the most dominant segment. These films are highly valued across industries, particularly in food packaging, pharmaceuticals, and electronics, due to their superior ability to protect against moisture, gases, and contaminants. Their role in extending shelf life, maintaining product integrity, and complying with stringent safety regulations has made them essential in packaging applications. The rising demand for high-performance packaging, especially in ready-to-eat and perishable goods, continues to drive the growth of barrier films globally.

Following barrier films, stretch films hold a significant market share, widely used for pallet wrapping, logistics, and storage due to their excellent elasticity and load-holding capabilities. These films provide stability during transportation and are favored in retail and industrial packaging for their cost-effectiveness and ease of application. Their dominance is reinforced by the expanding e-commerce and warehousing sectors that require reliable packaging solutions for bulk and varied shipments.

Shrink films come next and are extensively used in product bundling and retail packaging. Upon heat application, these films shrink tightly around items, offering tamper evidence and visual appeal. Industries such as beverages, personal care, and food service use shrink films to enhance product protection and marketability. Their demand is increasing due to the need for secure and compact packaging in consumer goods.

Conductive films are a growing niche, especially in electronics and semiconductor industries. These films are used for electromagnetic interference (EMI) shielding, static dissipation, and protection of sensitive electronic components. As the demand for smaller, more advanced electronics grows, so does the need for films that offer electrical conductivity and insulation in a lightweight form.

Safety & security films are primarily used in construction, automotive, and commercial spaces. These films are designed to prevent shattering, reduce injury risk, and enhance window and glass security. Although they occupy a smaller share compared to packaging films, increasing concerns about safety and property protection are gradually pushing demand, especially in urban infrastructure.

Anti-fog films are used in food packaging and optical applications to prevent condensation, thus maintaining product visibility and quality. They are particularly crucial in refrigerated and cold storage conditions. While the market size is relatively smaller, the segment is gaining attention due to its role in ensuring food appeal and reducing spoilage.

Segmentation Insights by Material

On the basis of material, the global technical films market is bifurcated into polyethylene (PE), polyethylene terephthalate (PET), polyamide (PA), polypropylene (pp), polyvinyl chloride (PVC), ethylene vinyl alcohol (EVOH), polyurethane (PU), aluminum, polycarbonate (PC), and others.

In the technical films market, polyethylene (PE) is the most dominant material segment due to its versatility, affordability, and excellent mechanical properties. It is widely used in stretch and shrink films, agricultural films, and protective packaging. PE films offer good moisture resistance and flexibility, making them ideal for a broad range of industrial and consumer applications, especially in food packaging, construction, and medical industries. Its dominance is supported by high global availability and ease of processing.

Polypropylene (PP) follows closely as a highly favored material due to its excellent chemical resistance, clarity, and high melting point. PP films are used extensively in food packaging, labeling, and textiles. They are also lightweight and provide a good barrier to moisture, making them suitable for both rigid and flexible packaging formats. Their widespread use in both commodity and specialty applications keeps them among the top materials in the market.

Polyethylene terephthalate (PET) is another significant segment, valued for its excellent strength, dimensional stability, and barrier properties against oxygen and aroma. PET films are commonly used in electronics, labels, insulation, and high-performance food packaging. They are particularly important in applications requiring transparency and heat resistance, such as microwaveable or ovenable containers.

Polyamide (PA) films, also known as nylon films, are known for their outstanding toughness, puncture resistance, and barrier properties. They are used in vacuum packaging, medical packaging, and industrial applications. Although costlier than PE or PP, PA films are preferred in environments where durability and protection are critical, such as meat packaging or sterile medical environments.

Polyvinyl chloride (PVC) films are used in applications that require clarity, formability, and strength, such as blister packaging, shrink sleeves, and pharmaceutical films. However, environmental concerns regarding PVC’s recyclability and health risks from chlorine-based materials have somewhat limited its market share in recent years, pushing manufacturers toward more sustainable alternatives.

Ethylene vinyl alcohol (EVOH) films offer exceptional gas barrier properties, making them ideal for multi-layer structures in food and medical packaging. Though expensive and less mechanically robust on their own, EVOH is often co-extruded with other materials to enhance product shelf life without compromising film flexibility.

Polyurethane (PU) films are primarily used in high-performance applications such as automotive interiors, textile coatings, and medical devices. They are valued for their elasticity, abrasion resistance, and comfort. While not as widely used as PE or PP, PU films occupy a solid place in the premium segment of the market.

Aluminum films, often used as a metallized layer in barrier packaging, provide superior protection against light, moisture, and gases. These films are widely used in pharmaceutical, food, and electronics sectors. Despite being heavier and less flexible, aluminum’s barrier capabilities make it indispensable in high-protection packaging.

Polycarbonate (PC) films are transparent, impact-resistant, and heat-tolerant, making them suitable for electrical insulation, displays, and ID cards. Their high cost limits their use to specialty applications, but their performance makes them essential in electronics and security-sensitive industries.

Segmentation Insights by Thickness Type

Based on thickness type, the global technical films market is divided into up to 25 microns, 25-50 microns, 50-100 microns, 100-150 microns, and above 150 microns.

In the technical films market, the 25–50 microns thickness range is the most dominant segment. Films in this category strike a balance between strength, flexibility, and cost-efficiency, making them ideal for a wide range of packaging, labeling, and industrial applications. This thickness range is commonly used in food packaging, personal care, and medical products due to its ability to offer adequate barrier properties while maintaining processability and printability.

The 50–100 microns segment follows, widely used in more demanding applications that require enhanced mechanical strength, puncture resistance, and durability. These films are popular in automotive, construction, and heavy-duty industrial uses, where robustness is a priority. They also serve well in protective packaging for electronics and appliances, offering a combination of flexibility and toughness.

Up to 25 microns thickness films are primarily used in applications where ultra-thin films are sufficient, such as lightweight packaging, laminations, and disposable items. Their minimal material usage makes them cost-effective and environmentally favorable in certain low-barrier applications. However, due to their limited strength and barrier capabilities, they are generally confined to less demanding environments.

The 100–150 microns segment caters to applications that need higher durability and structural integrity, such as specialty laminates, insulation films, and medical-grade packaging. These films provide enhanced tear and abrasion resistance and are often used in multilayer film structures for added protection and performance.

Films with a thickness of above 150 microns represent a niche but essential segment. These are used in technical applications requiring maximum protection and strength, such as solar panel back sheets, protective window films, and certain types of industrial laminates. While they occupy the smallest market share, their role is crucial in high-end, high-risk applications where superior performance is non-negotiable.

Segmentation Insights by End Use Industry

On the basis of end use industry, the global technical films market is bifurcated into food & beverage, cosmetic & personal care, chemical, agriculture, building & construction, pharmaceutical, electrical & electronic, automobile, and others.

In the technical films market, the food and beverage industry is the most dominant end-use segment. This sector relies heavily on technical films for packaging that extends shelf life, maintains freshness, and protects against moisture, oxygen, and contamination. Barrier films, shrink films, and anti-fog films are widely used in packaging formats like pouches, wraps, and lidding films. The increasing demand for convenience foods, ready-to-eat meals, and hygienic packaging solutions continues to drive this segment’s growth globally.

The pharmaceutical industry holds a significant share due to the strict regulatory and safety requirements for drug packaging. Technical films in this sector are used for blister packs, sachets, and sterilizable packaging, offering superior moisture and oxygen barrier properties. Their ability to provide tamper-evident and contamination-resistant features is critical in maintaining drug efficacy and safety, especially with the growth in over-the-counter (OTC) and prescription drug consumption.

Electrical and electronic applications represent another major segment, where technical films are used for insulation, EMI shielding, component protection, and flexible circuitry. As demand for compact, lightweight, and high-performance electronic devices continues to rise, so does the need for films with advanced thermal, dielectric, and conductive properties.

The automobile industry also plays a crucial role in the demand for technical films. These films are used in interior components, protective coatings, paint protection films, and thermal insulation layers. With the growing trend toward lightweight materials and electric vehicles, automotive manufacturers are increasingly adopting advanced films to enhance efficiency and aesthetics.

The building and construction industry utilizes technical films in waterproofing membranes, vapor barriers, window films, and insulation layers. These films contribute to energy efficiency, durability, and safety in both residential and commercial buildings. The push for green building standards and infrastructure development in emerging economies supports this segment’s growth.

Cosmetic and personal care industries use technical films primarily in packaging formats that ensure product hygiene, visual appeal, and prolonged shelf life. Applications include sachets, flexible tubes, and sample pouches, especially for creams, lotions, and hygiene products. The demand for premium, travel-friendly packaging has further boosted this segment.

In the chemical industry, technical films are used for safe containment and transportation of hazardous and sensitive materials. These films need to offer high resistance to chemicals, punctures, and environmental stress, and are typically used in industrial bags, liners, and protective packaging.

The agriculture segment uses technical films for mulching, greenhouse covers, silage wraps, and irrigation films. These films help in moisture retention, temperature control, and weed suppression. With a growing focus on agricultural productivity and sustainable farming, the demand for specialty films in this sector is gradually increasing.

Technical Films Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific (APAC) region is the most dominant market for technical films, driven by rapid industrialization, expanding packaging and electronics sectors, and growing demand for flexible and high-performance materials. Countries like China, India, Japan, and South Korea are at the forefront of consumption and production. China, in particular, leads the regional market due to its robust manufacturing infrastructure and strong presence of key end-use industries such as automotive, electronics, construction, and food packaging. Moreover, rising environmental awareness and government initiatives promoting biodegradable and recyclable films are further fueling market growth in this region.

Europe follows as a major market for technical films, characterized by its mature packaging, automotive, and healthcare industries. The region places a high emphasis on sustainability and circular economy practices, leading to the increasing adoption of bio-based and recyclable films. Countries such as Germany, France, Italy, and the UK are key contributors, focusing heavily on R&D and innovation in advanced polymer technologies. Stringent EU regulations on packaging waste and food safety are also accelerating the shift toward high-performance, multifunctional films that comply with environmental and safety standards.

North America holds a significant share of the global technical films market, supported by well-established industries such as electronics, aerospace, pharmaceuticals, and industrial manufacturing. The United States is the primary contributor, driven by strong demand for specialty films in sectors requiring thermal insulation, chemical resistance, and high-barrier protection. The region is also witnessing a growing preference for eco-friendly materials and advanced packaging solutions, prompting manufacturers to invest in product development and sustainable production practices.

Latin America represents a moderately growing technical films market, with growth being driven by the food and beverage, agriculture, and pharmaceutical sectors. Brazil and Mexico are the leading markets within the region, where the rising demand for shelf-stable food products and improved healthcare infrastructure is encouraging the use of advanced film technologies. Although the market is relatively smaller than APAC or Europe, increasing urbanization and industrial activity are creating new growth opportunities for technical film manufacturers.

Middle East and Africa (MEA) is the least dominant region in the technical films market, primarily due to slower industrial development and limited technological advancements. However, the market is gradually gaining traction, especially in sectors such as construction, packaging, and agriculture. The demand for high-barrier and UV-resistant films is rising in countries like the UAE, Saudi Arabia, and South Africa. Despite current limitations in local production and infrastructure, the region holds long-term growth potential due to increasing investment in industrial diversification and infrastructure projects.

Technical Films Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the technical films market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global technical films market include:

- The Mondi Group plc

- Bischof + Klein SE & Co. KG

- Klöckner Pentaplast Group

- Selenis Portugal S.A.

- Polifilms GmbH

- Futamura Chemical Co. Ltd

- Vizelpas

- Bioplast

- HYPAC Packaging Pte Ltd

- Perlen Packaging AG

- HAFLIGER Films Spa

- Idealplast Srl

- Cassioli Srl

- Kuhne Anlagenbau GmbH

- DowDuPont

- Kaneka

- SKC Kolon

- Ube

- Taimide Tech

- MGC

- I.S.T Corp

- Rayitek

- Treofan

- Polifilm GmbH

- Borealis AG

The global technical films market is segmented as follows:

By Films Type

- Stretch Films

- Shrink Films

- Barrier Films

- Conductive Films

- Safety & Security Films

- Anti-Fog Films

- Other Technical Films

By Material

- Polyethylene (PE)

- Polyethylene terephthalate (PET)

- Polyamide (PA)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Ethylene vinyl alcohol (EVOH)

- Polyurethane (PU)

- Aluminum

- Polycarbonate (PC)

- Others

By Thickness Type

- Up to 25 microns

- 25-50 microns

- 50-100 microns

- 100-150 microns

- above 150 microns

By End Use Industry

- Food & Beverage

- Cosmetic & Personal Care

- Chemical

- Agriculture

- Building & Construction

- Pharmaceutical

- Electrical & Electronic

- Automobile

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Technical Films

Request Sample

Technical Films